BTC Market Pulse: Week 40

Bitcoin traded above the cost basis of short-term holders this past week, with price fluctuations centered around $111k. Spot market momentum softened as the 14-day RSI eased and net selling pressure declined, reflected in stronger Spot CVD.

Overview

Trading volumes rose meaningfully, highlighting elevated participation despite weakening momentum. This combination suggests that while demand is still present, price strength is beginning to show signs of fatigue, leaving the market vulnerable to shifts in sentiment.

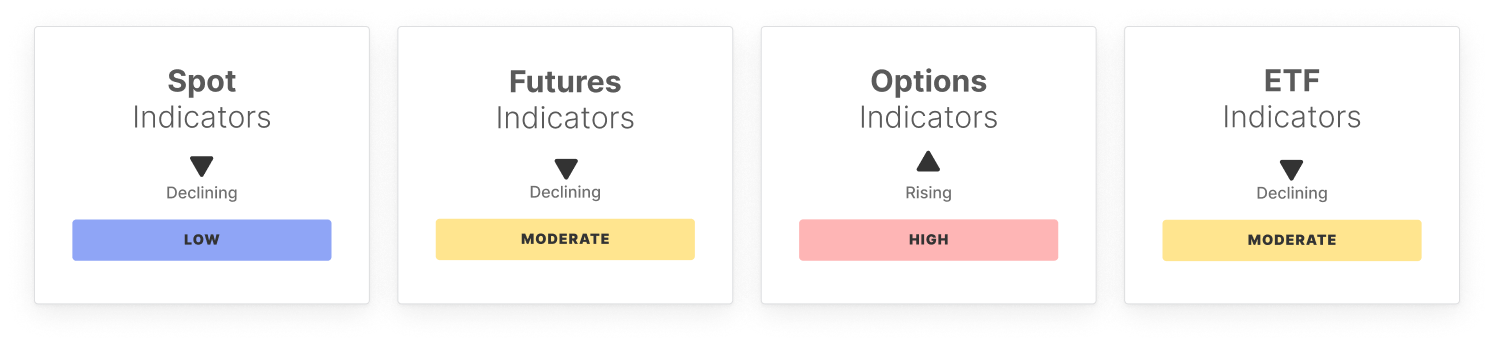

Derivatives signaled a more cautious tone. Futures open interest and funding both declined, pointing to reduced leverage and lower risk appetite among traders. Positioning leaned defensive, with fewer signs of aggressive long exposure. In contrast, the options market showed stronger engagement, with demand skewed toward downside protection as traders sought insurance against potential drawdowns. Volatility spreads remained firm, reflecting heightened expectations for price swings, though not yet accompanied by strong directional conviction. Liquidity conditions stayed stable, helping balance speculative activity with underlying market steadiness, but the tilt toward protection highlights lingering caution beneath the surface.

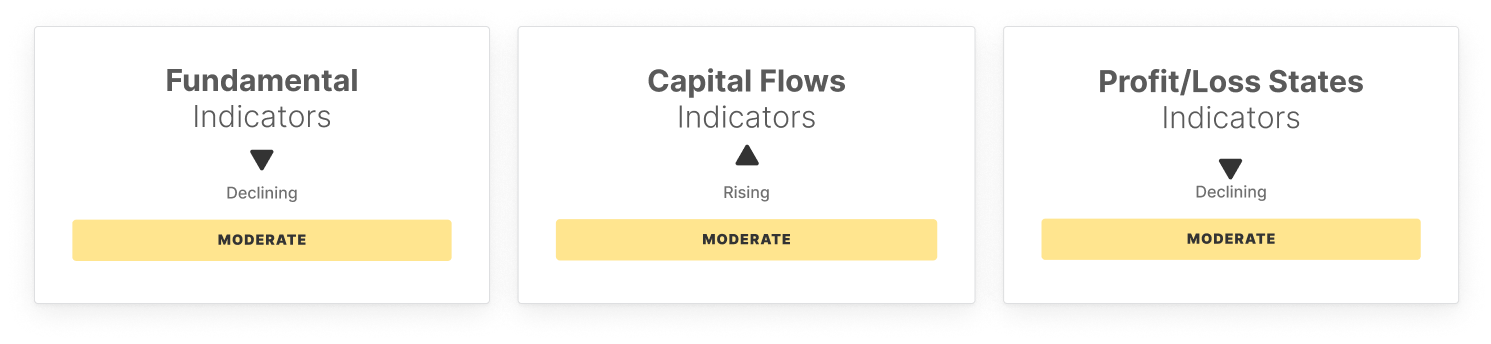

On-chain profitability slipped, with the market shifting from profit- dominant to loss-dominant states. This indicates rising stress, echoed in fundamentals: active addresses declined and transaction fee volume fell, both pointing to quieter activity on-chain. Capital flows also reflected caution, with realized cap inflows easing and long-term holder activity outweighing short-term engagement.

In sum, the market appears to be in transition. Momentum and risk appetite have cooled, even as liquidity and participation remain stable. Heightened spot activity highlights continued interest, yet softer derivatives positioning and weaker on-chain fundamentals suggest a consolidating structure. Unless new demand materializes, external catalysts may be required to shift the balance and drive the next decisive move.

Off-Chain Indicators

On-Chain Indicators

🔗 Access the full report PDF

Make sure you read it!

Smart market intelligence, straight to your inbox.

Subscribe now- For on-chain metrics, dashboards, and alerts, visit Glassnode Studio

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solar radiation reveals previously undetected software flaw in Airbus aircraft fleet

- Airbus issues emergency directive to update A320 fleet software/hardware after solar radiation-linked flight-control incident caused JetBlue's emergency landing. - EU Aviation Safety Agency mandates fixes for 6,000 aircraft, risking Thanksgiving travel chaos as airlines face weeks-long groundings for repairs. - Solar interference vulnerability, previously flagged by FAA in 2018, highlights growing software reliability challenges in modern avionics systems. - Analysts call issue "manageable" but warn of s

Khabib's NFTs Ignite Discussion: Honoring Culture or Taking Advantage?

- Khabib Nurmagomedov's $4.4M NFT collection, rooted in Dagestani heritage, sparked controversy over cultural symbolism and legacy claims. - The project sold 29,000 tokens rapidly but faced scrutiny for post-launch transparency gaps and parallels to failed celebrity NFT ventures. - NFT market recovery (2025 cap: $3.3B) highlights risks like "rug pulls" and volatility, despite celebrity-driven momentum. - Concurrent trends include crowdfunding innovations and sustainability-focused markets like OCC recyclin

Ethereum Updates Today: Fusaka Upgrade on Ethereum Triggers Structural Deflation Through L2 Collaboration

- Ethereum's Fusaka upgrade (Dec 3, 2025) introduces EIP-7918, linking L2 data costs to mainnet gas prices, boosting ETH burn rates and accelerating deflationary trajectory. - PeerDAS and BPO forks reduce validator demands while enabling scalable 100k TPS growth through modular upgrades, avoiding disruptive hard forks. - Analysts predict 40-60% lower L2 fees for DeFi/gaming, with institutional ETH accumulation and a 5% price rebound signaling confidence in post-upgrade value capture. - The upgrade creates

Bitcoin News Update: Stablecoin Growth Drives Cathie Wood's Updated Bullish Outlook on Bitcoin, Not Market Weakness

- ARK's Cathie Wood maintains $1.5M Bitcoin long-term target despite 30% price drop, adjusting 2030 forecast to $1.2M due to stablecoin competition. - She attributes market volatility to macroeconomic pressures, not crypto fundamentals, and highlights Bitcoin's historical liquidity-driven rebounds. - UK's "no gain, no loss" DeFi tax framework and firms like Hyperscale Data ($70.5M BTC treasury) reflect evolving regulatory and strategic dynamics. - Bitfarms' exit from Bitcoin mining to AI HPC by 2027 unders