Morning Brief | Crypto market stabilizes and rebounds; Last week, global listed companies made a net purchase of $40.88 million BTC

A summary of important market events on September 29.

Compiled by: Zhou, ChainCatcher

Key Information:

- The open interest of options linked to BlackRock's IBIT has surpassed Deribit, now approaching $38 billion

- Williams: Weakening labor market prompted my support for rate cuts, real neutral rate estimated at 0.75%

- Data: Last week, global listed companies made a net purchase of $40.88 million in BTC, Strategy increased holdings by 196 bitcoins in a single week, Metaplanet did not purchase bitcoin last week

- The total market cap of stablecoins on Solana has reached $13.8 billion, hitting a new all-time high

- Data: Aster's fees exceeded $25 million in the past 24 hours, ranking first among perpetual DEXs

- QCP: Crypto market stabilizes and rebounds, BTC needs to break 115K to confirm upward trend

What important events happened in the past 24 hours?

Data: BTC total contract open interest grew 6.41% in 24h

According to ChainCatcher, Coinglass data shows that BTC total contract open interest grew by 6.41% in the past 24 hours, with the current total open interest at $82.903 billion. Of this, Binance holds $14.382 billion, OKX holds $4.286 billion, and Bybit holds $9.833 billion.

Williams: Weakening labor market prompted my support for rate cuts, real neutral rate estimated at 0.75%

According to ChainCatcher and Golden Ten Data, Federal Reserve's Williams said on Monday that initial signs of weakness in the labor market prompted him to support a rate cut at the most recent Fed meeting. He believes "it makes sense to slightly lower rates" and stated that "moderately easing some tightening measures" will help boost the job market and exert some downward pressure on still-high inflation. In addition, his model estimates the real neutral rate at 0.75%, but he emphasized that policy is data-driven.

The open interest of options linked to BlackRock's IBIT has surpassed Deribit, now approaching $38 billion

According to ChainCatcher, the open interest value of options linked to the Nasdaq-listed BlackRock iShares Bitcoin Trust (IBIT) has approached $38 billion, surpassing Deribit's $32 billion in open interest. This means IBIT has overtaken Coinbase's Deribit platform to have the largest bitcoin options trading volume.

Deribit, founded in 2016, has long dominated the bitcoin options market, while IBIT options only launched last November and have been listed for less than a year.

Contract exchange Flying Tulip raises $200 million at a $1 billion valuation, with Brevan Howard Digital and others participating

According to ChainCatcher, Andre Cronje's newly developed contract exchange Flying Tulip has raised $200 million at a $1 billion valuation, with participation from Brevan Howard Digital, CoinFund, DWF Labs, FalconX, Hypersphere, Lemniscap, Nascent, Republic Digital, Selini, Sigil Fund, Susquehanna Crypto, Tioga Capital, and Virtuals Protocol. Flying Tulip currently plans to publicly offer its FT token.

Citi Bank introduces blockchain technology into cross-border payment services

According to ChainCatcher and Solid Intel, Citi Bank announced it will integrate its blockchain platform Citi Token Services with the US dollar clearing system to provide 24/7 instant cross-border payment services for institutional clients in the US and UK.

Due to approval of new general listing standards, US SEC requires LTC, XRP, SOL, ADA, and DOGE ETF issuers to withdraw 19b-4 applications

According to ChainCatcher, crypto journalist Eleanor Terrett posted on X that the US SEC has required ETF issuers for LTC, XRP, SOL, ADA, and DOGE to withdraw their 19b-4 applications because the general listing standard has been approved, replacing the 19b-4 application. Withdrawals may begin as early as this week.

Data: Ethereum network gas fee rises to 15 gwei

According to ChainCatcher, possibly due to the "Falcon Finance airdrop claim event," Ethereum network gas fees have risen to 15 gwei.

Data: Last week, global listed companies made a net purchase of $40.88 million in BTC, Strategy increased holdings by 196 bitcoins in a single week, Metaplanet did not purchase bitcoin last week

According to ChainCatcher and SoSoValue data, as of September 29, 2025 (Eastern Time), global listed companies (excluding mining companies) made a total net purchase of $40.88 million in bitcoin last week.

Strategy (formerly MicroStrategy) invested $22.1 million last week, purchasing 196 bitcoins at $113,048 each, bringing its total holdings to 640,031 bitcoins.

Japanese listed company Metaplanet suspended bitcoin purchases last week.

In addition, three other companies made new bitcoin purchases last week.

Mitsubishi UFJ: If non-farm payroll report is weak, the dollar may fall further

According to ChainCatcher and Golden Ten Data, Mitsubishi UFJ analyst Lee Hardman noted in a report that if Friday's US non-farm payroll report shows continued weak job growth in September, the dollar may fall further. He said another poor non-farm payroll report would support market expectations for another Fed rate cut in October.

Federal Reserve Governor: Stablecoins should be included in regulatory protection and increase payment options

According to ChainCatcher and Golden Ten Data, Federal Reserve Governor Waller stated that stablecoins should be included in regulatory protection and increase payment options.

The total market cap of stablecoins on Solana has reached $13.8 billion, hitting a new all-time high

According to ChainCatcher, SolanaFloor posted on X that the total market cap of stablecoins on Solana has risen to $13.8 billion, a new all-time high.

QCP: Crypto market stabilizes and rebounds, BTC needs to break 115K to confirm upward trend

According to ChainCatcher, QCP's briefing stated that after a sharp correction last week, the crypto market has begun to stabilize, with bitcoin and ethereum rebounding to $112,000 and $4,100, respectively. Despite large-scale ETF redemptions, the market has shown strong resilience.

Optimism has returned to the perpetual contract market, with leveraged longs re-entering the market. Perpetual contract open interest rose from $42.8 billion to $43.6 billion, and BTC perpetual contract funding rates remain positive. Analysts pointed out that while market conditions support the upcoming "Uptober" trend, bitcoin still needs to break $115,000 to confirm a new upward trend. The options market shows traders are gradually rebuilding confidence, with put skew gradually returning to normal levels.

Data: Short-term bitcoin holders are incurring losses, market may enter a reset phase

According to ChainCatcher, Glassnode posted data on social media showing that the NUPL (Net Unrealized Profit/Loss) indicator for short-term bitcoin holders has entered the loss zone, indicating that recent buyers are under pressure. Historically, capitulation events among short-term holders often mark the market entering a reset phase, usually laying the foundation for a new round of asset accumulation.

Matrixport: Greed and Fear Index is near the lower end of the range, traders should still watch bitcoin's retest of key long-term moving averages

According to ChainCatcher, Matrixport released a chart today stating, "Our Greed and Fear Index is near the lower end of the range. Historically, this level often corresponds to a tradable bottom. Ideally, moving averages should trend smoothly upward, meaning a smoother and more graspable rebound. However, the current market shows bitcoin's trend is more technical. The current price is hovering at the lower end of the range, providing some tactical long opportunities, but traders should still watch bitcoin's retest of key long-term moving averages."

Data: Aster's fees exceeded $25 million in the past 24 hours, ranking first among perpetual DEXs

According to ChainCatcher and The Block, decentralized perpetual contract exchange Aster currently tops DefiLlama's fee income rankings, surpassing Hyperliquid and other perpetual decentralized exchanges (DEXs).

According to DefiLlama data, Aster recorded over $25 million in fee income in the past 24 hours, leading other protocols. Its competitor Hyperliquid generated $3.17 million in fees in the past day, ranking fifth. Data also shows that Aster's spot trading volume in the past day was $199.96 million, ranking 13th among perpetual contract DEXs. In terms of trading volume, Hyperliquid outperformed Aster with $477.3 million. Aster also did not appear on the daily revenue leaderboard of this data aggregation platform.

CZ shares reflections on one year after release: Witnessing improved US regulation and BTC, ETH, and BNB hitting all-time highs

According to ChainCatcher, Binance co-founder CZ posted on X sharing his reflections on the one-year anniversary of his release. He wrote: "A year ago, I was released from prison and finally left the US. A year later, I see the American people electing a crypto-friendly president, influencing policies worldwide, seeing BNB reach an all-time high, seeing BTC reach an all-time high, seeing ETH reach an all-time high, seeing the return of utility tokens, and seeing increased on-chain trading volume."

Aster CEO: First startup project was P2P lending, began developing perpetual contract DEX after dYdX emerged

According to ChainCatcher, Aster CEO Leonard said in an interview with Trends founder Mable (@Mable_Jiang):

"I initially worked as a tech specialist at an investment bank in Hong Kong, mainly handling high-frequency trading. After five years, I started to try entrepreneurship. At that time, the narrative was Internet+, and my first startup was a P2P lending project. The project and the entire sector eventually failed, but I learned a lot from it.

I first entered crypto by participating in the Ethereum ICO. After making money, I thought I was a genius, but then lost it all in the next three trades. However, I became interested in blockchain technology and developed a lending platform project in IBM Blockchain's Hyperledger ecosystem. Clearly, we chose the wrong ecosystem; we should have gone big on Ethereum. Later, I also developed NFT and token solutions for a gaming platform, but it was too early and also failed."

Data: 7,865.74 bitcoins flowed out of crypto exchanges last week

According to ChainCatcher, in the past week, major crypto exchanges saw a net outflow of 7,865.74 bitcoins, with Coinbase Pro seeing an outflow of 8,928.34, Binance an outflow of 5,298.6, and Bitfinex an inflow of 5,346.46 bitcoins.

Meme Hot List

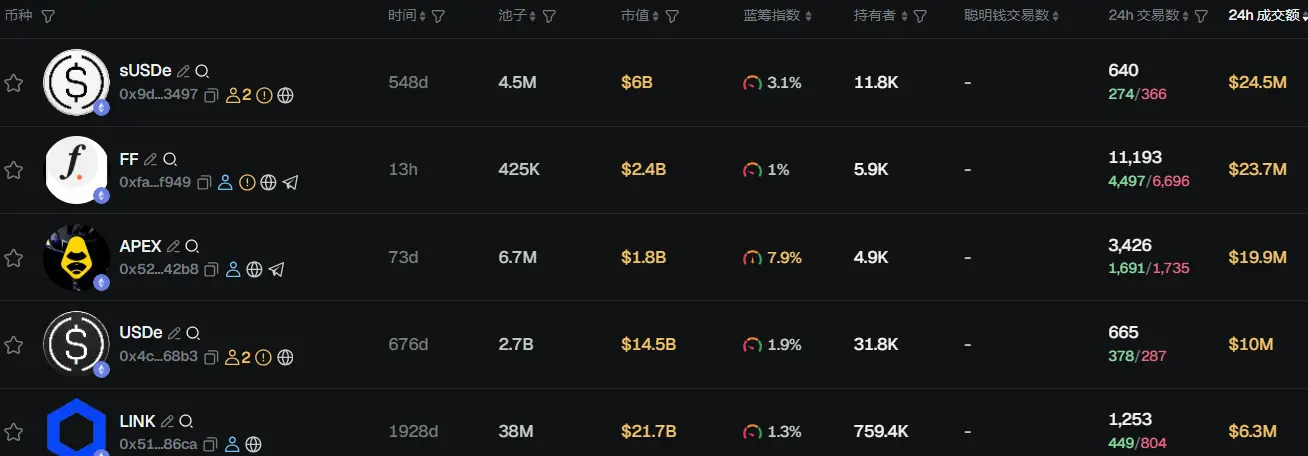

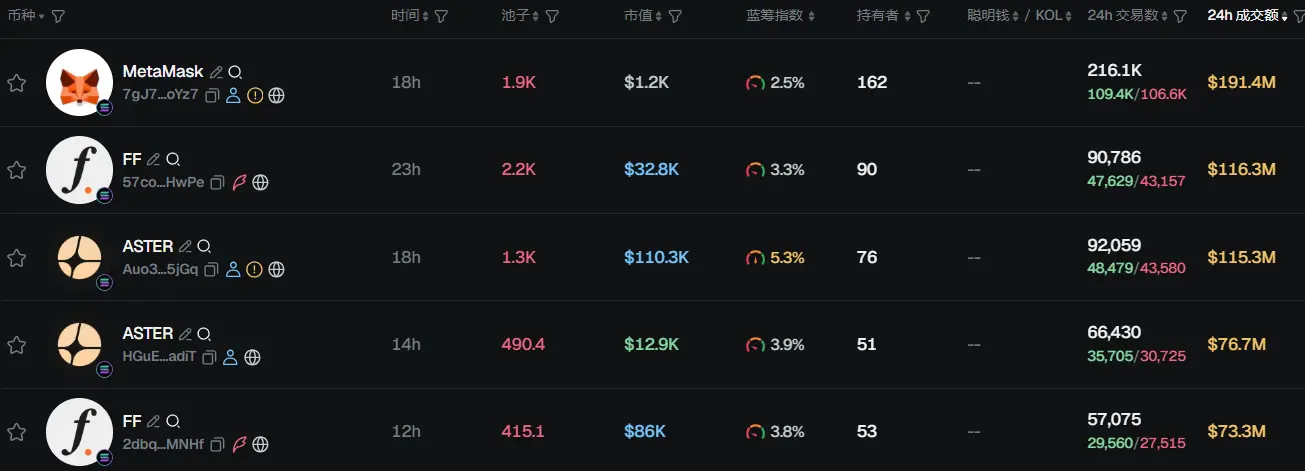

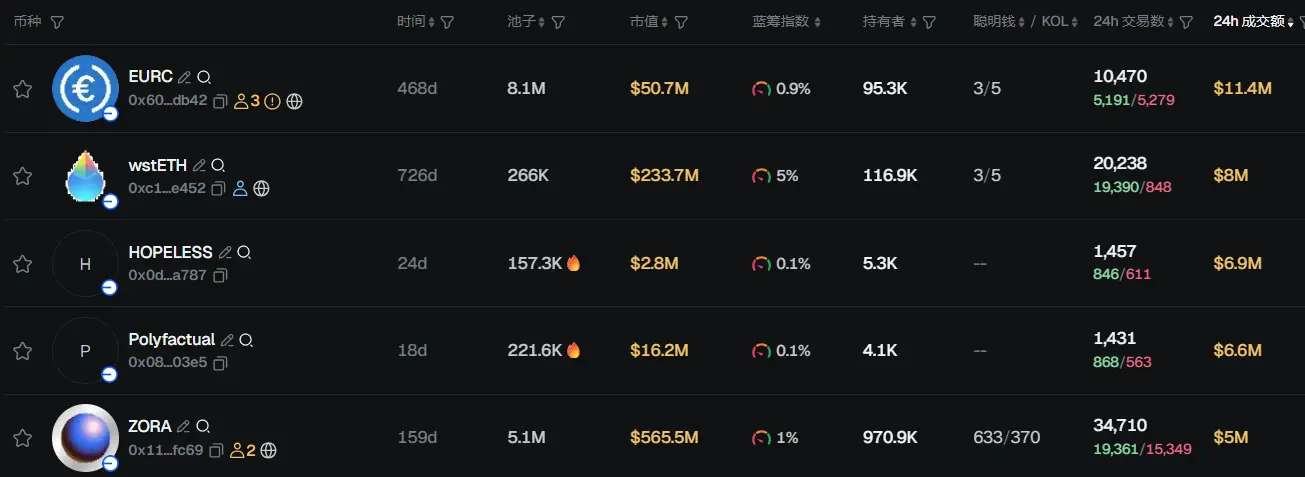

According to data from meme token tracking and analysis platform GMGN, as of 08:45 on September 30,

The top five trending ETH tokens in the past 24h are: sUSDe, FF, APEX, USDe, LINK

The top five trending Solana tokens in the past 24h are: MetaMask, FF, ASTER, ASTER, FF

The top five trending Base tokens in the past 24h are: EURC, wstETH, HOPELESS, Polyfactual, ZORA

What are some great articles worth reading in the past 24 hours?

An overview of Canton Network: A public blockchain with institutional-grade privacy and compliance

Canton was born at a turning point for institutional on-chain adoption and accelerated RWA tokenization. The fully public and decentralized nature of public chains has long been misaligned with financial institutions' needs for privacy, compliance, and governance. Canton achieves sub-transaction-level selective transparency and rights-obligations workflows with "public permissioned + Daml," combined with the "network of networks" architecture of Participant/CSP/vCSP, retaining real-time settlement and atomic composability, while making it easier to reduce capital occupation under Basel standards, enabling institutions to protect privacy while complying with regulations.

Notably, Canton Network's developer Digital Asset announced in June the completion of a $135 million strategic financing round led by DRW Venture Capital and Tradeweb Markets, with participation from BNP Paribas, Circle Ventures, Citadel Securities, DTCC, Virtu Financial, Paxos, and other well-known traditional finance and crypto companies. Currently, tokenized assets on Canton exceed $6 trillion, larger than the GDP of most countries. The network also processes over $280 billion in US Treasury repo transactions daily. In addition, its token, Canton Coin, has no VC/foundation allocation, is distributed entirely based on contribution, and incentivizes early super validators with a balanced mechanism of fee burning and reward minting.

Powell is about to step down, who will be the next "money printer chief"?

In May 2026, Federal Reserve Chairman Powell's term will officially end. But the Trump administration's planning has already begun—Trump and Treasury Secretary Bessent are trying to gain substantive control over monetary policy by securing key voting rights on the Federal Reserve Board (FRB) before the first half of 2026. The Trump camp has already secured three seats by having Stephen Miran replace Adriana Kugler, and board member Lisa Cook faces pressure to resign due to alleged mortgage fraud, leaving them just one seat short of a majority on the seven-member board.

From the proposal of the "shadow chairman" concept to the quiet maneuvering for board seats, this struggle for control of the Federal Reserve is reshaping the future landscape of cryptocurrency. According to prediction platforms Polymarket and Kalshi, several candidates open to cryptocurrency are vying for this key position, and market expectations for the next Fed chair are clearly divided: Kevin Hassett, Kevin Warsh, and Christopher Waller are the three leading candidates, with much higher odds; other candidates such as Bowman and Bessent have odds of ≤1%. Notably, Elon Musk also appears on Polymarket's odds list, currently ranking last.

Is Circle developing a "regret pill"? Reversible stablecoin transactions spark heated debate in the crypto community

Circle President Heath Tarbert recently told the Financial Times that the company is researching mechanisms to roll back transactions in cases of fraud and hacking, while still maintaining settlement finality. He noted: "We are thinking... whether it is possible to have reversibility of transactions, but at the same time we still want to have settlement finality."

Simply put, if you are scammed or hacked, in theory you could get your money back.

This reversible transaction mechanism will not be implemented directly on the Arc blockchain that Circle is developing, but rather by adding a "reverse payment" layer on top, similar to how credit card refunds work. Arc is an enterprise-grade blockchain designed by Circle for financial institutions and is expected to launch fully by the end of 2025.

Animoca Brands research report: The new era of exchanges, how to go mainstream?

Centralized exchanges (CEX) have played a key role in the development of the crypto industry. They provide the core infrastructure for trading and discovering cryptocurrencies and are the cornerstone of the entire crypto space. As the earliest participants with a clear business model, CEXs quickly evolved into massive institutions employing hundreds or thousands of people. Their efforts to expand user scale have greatly promoted the popularity of cryptocurrencies among the general public.

The form of crypto exchanges has evolved through several stages. Initially, it was just an electronic upgrade of over-the-counter (OTC) trading. With the boom of Web3 projects and altcoins, exchanges seized the surge in trading demand and transformed into professional-grade platforms. They later added lending and hedging functions to meet the needs of professional traders.

However, the growth of CEXs now faces both challenges and opportunities. On one hand, the native crypto population is nearing saturation, slowing user acquisition in recent years. At the same time, innovations in decentralized trading are diverting users, such as meme coin issuance platforms and advanced DEXs like Hyperliquid, which offer experiences close to CEXs but with greater transparency. This forces exchanges to integrate self-custody wallets and DEX trading to retain native users.

Click to learn about job openings at ChainCatcher

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

No wonder Buffett finally bet on Google

Google holds the entire chain in its own hands. It does not rely on Nvidia and possesses efficient, low-cost computational sovereignty.

HYPE Price Prediction December 2025: Can Hyperliquid Absorb Its Largest Supply Shock?

XRP Price Stuck Below Key Resistance, While Hidden Bullish Structure Hints at a Move To $3

Bitcoin Price Prediction: Recovery Targets $92K–$101K as Market Stabilizes