Bitget Daily Digest(September 30)|The TOKEN2049 Singapore 2025 conference is about to kick off, with several key token unlocks scheduled in the coming days.

Today’s Preview

- The TOKEN2049 Singapore 2025 conference will take place from October 1 to 2, 2025, in Singapore. As one of the world's largest crypto events, it will bring together decision-makers from the Web3 ecosystem to discuss industry developments.

- Sui (SUI) will unlock 44 million tokens on October 1, 2025, at 08:00 (UTC+8), valued at approximately $143-182 million, representing 1.23% of the circulating supply.

- Kamino (KMNO) will unlock 229 million tokens on September 30, 2025, at 20:00 (UTC+8), valued at approximately $19.54 million, representing 6.37% of the circulating supply.

Macro & Hot Topics

- Several important token unlocks are scheduled in the coming days: Optimism will unlock approximately 31.34 million tokens on September 30, Big Time about 333 million, Kamino about 229 million, Sui about 44 million, EigenCloud about 36.82 million, and Ethena about 40.63 million.

- FTX will conduct its third bankruptcy distribution on September 30, paying an additional $1.6 billion to creditors.

Market Trends

1、BTC is consolidating around $112,000, while ETH rebounded to $4,200 after hitting support at $3,800-3,900. Market sentiment remains cautiously neutral, with $38.77 million in liquidations over the past 4 hours, primarily short positions.

2、U.S. stock indices closed higher on Monday: Dow up 0.15%, Nasdaq up 0.48%, S&P 500 up 0.26%. AI tech stocks rebounded, but gains were capped by concerns over tariffs and a potential government shutdown.

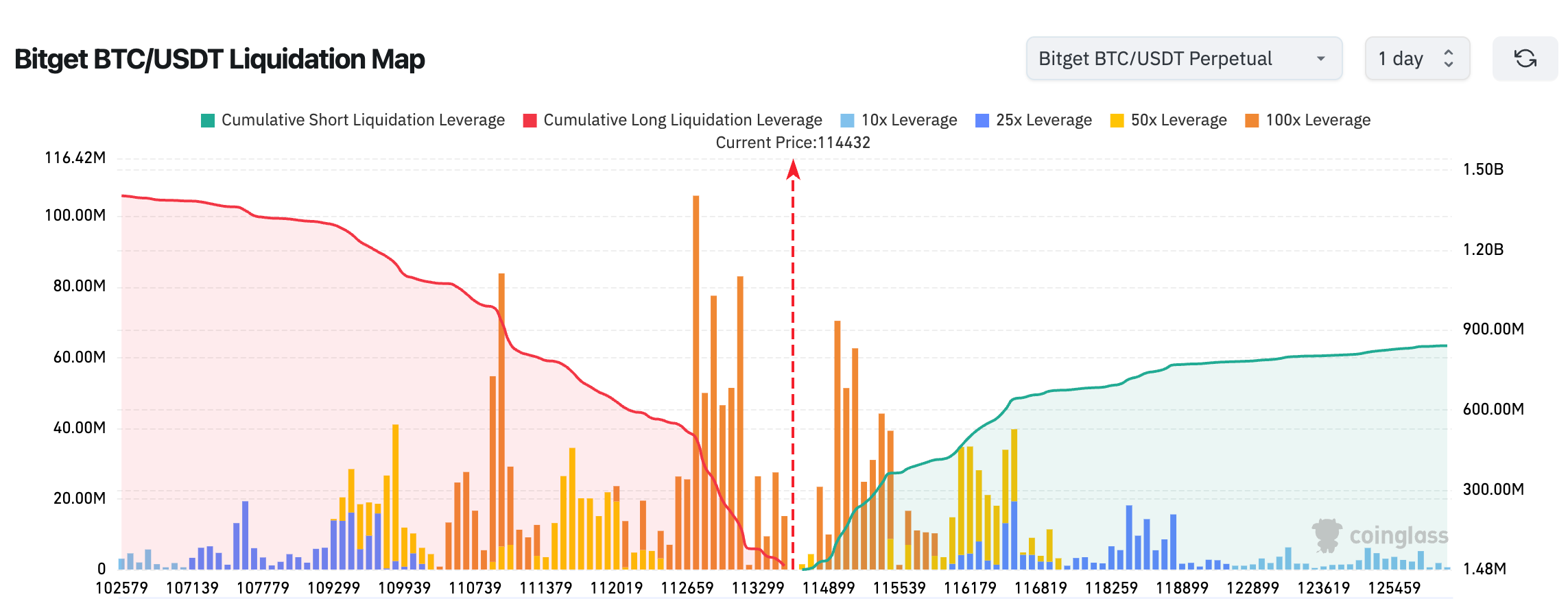

3、Bitget BTC/USDT is currently priced at 114,442, with dense long liquidations nearby. 100x leverage longs face significant risk, and there may be further downside liquidation pressure in the short term; beware of a potential long stampede.

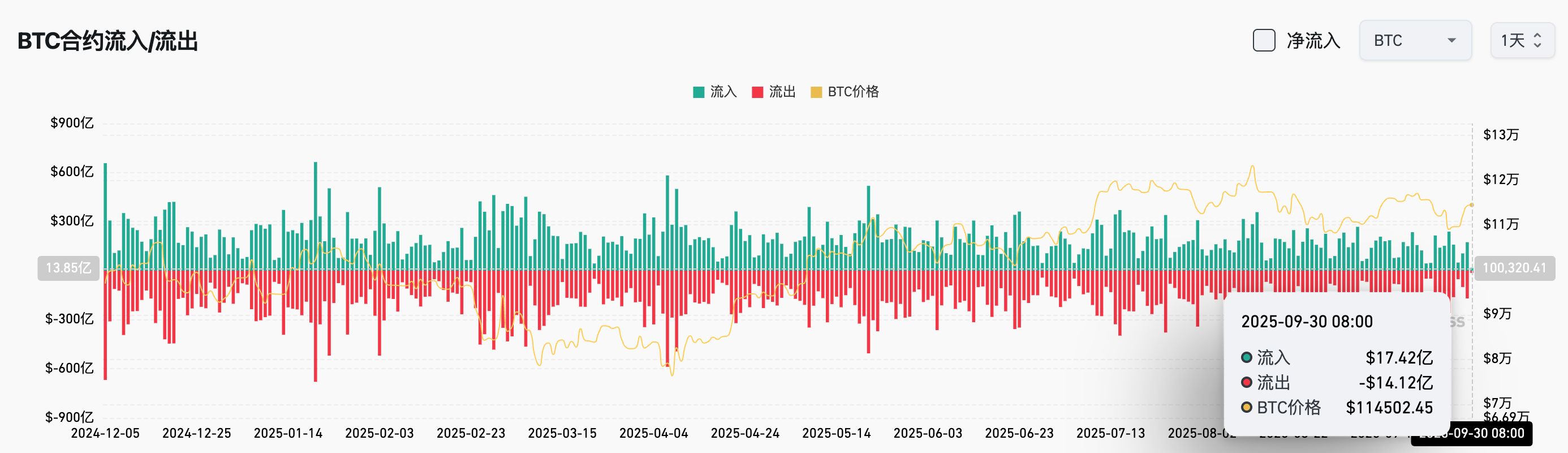

4、In the past 24 hours, BTC spot inflows totaled $209 million, outflows $183 million, resulting in a net inflow of $26 million.

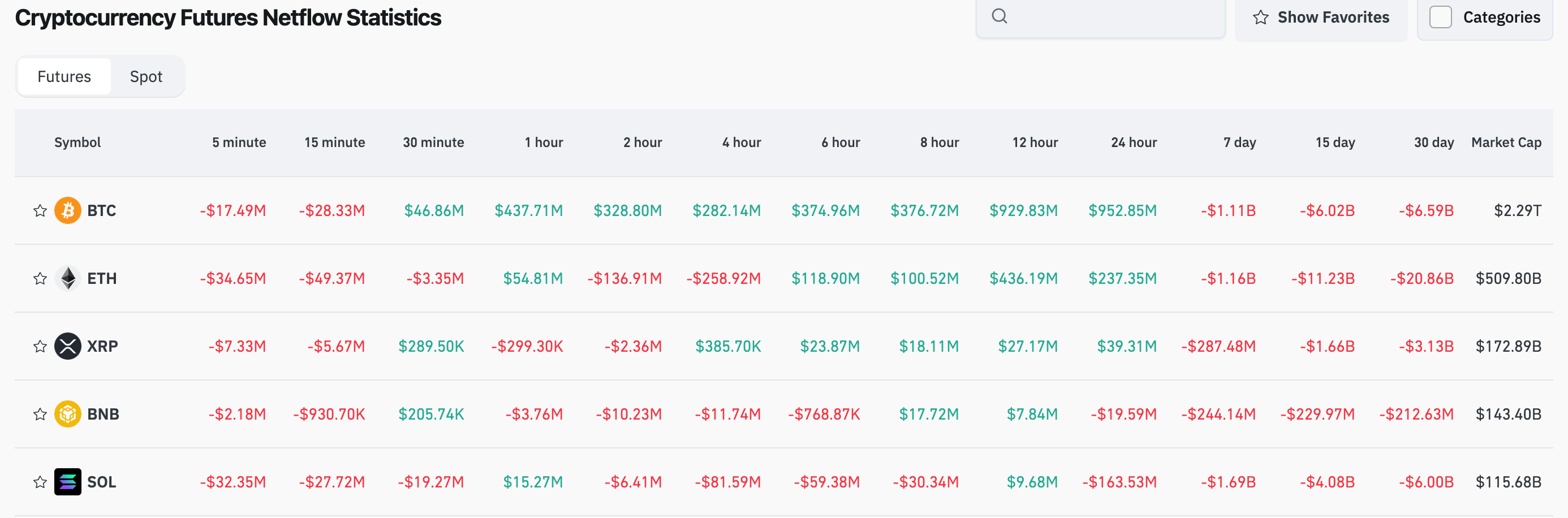

5、Over the past 24 hours, contracts for BTC, ETH, XRP, BNB, SOL, and others led in net outflows, potentially presenting trading opportunities.

News Updates

- SWIFT is collaborating with over 30 global banks to build a blockchain-based ledger aimed at enabling 24/7 cross-border payments, while jointly developing stablecoins and on-chain messaging systems with Linea.

- Adrienne Harris, head of the New York State Department of Financial Services (NYDFS), will step down in October; this change may impact the regulation of U.S. dollar stablecoins.

- Starknet plans a major upgrade, shortening the mainnet Bitcoin staking withdrawal period to 7 days to enhance user staking liquidity.

Project Developments

- The SEC will rule on 16 cryptocurrency ETF applications in October.

- SWIFT announces collaboration with over 30 banks to advance blockchain-based cross-border payment solutions.

- Andre Cronje's new DeFi protocol Flying Tulip has completed a $200 million private funding round.

- Optimism will unlock approximately 31.34 million tokens on September 30.

- Kamino will unlock approximately 229 million tokens on September 30.

Disclaimer: This report is generated by AI, with human verification only for information accuracy, and does not constitute any investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto recovery: Dead Cat Bounce or the start of a Buy-the-Dip?

BitMine buys $70M ETH while Tom Lee revises Bitcoin prediction

Bitcoin mispricing deepens as BTC trades below $100K, but not for long: Bitwise

Solana on-chain flows flag notable supply shift as SOL trades near key support