After Plasma and Falcon, how can one participate in USD.AI, the highly anticipated "next-generation miracle mining project"?

This year, Framework has led investments in two stablecoin projects: one is Plasma, which has surpassed 10 billion, and the other is USD.AI.

Original Title: "After Plasma and Falcon, Will USD.AI Become the Next Generation 'God Mining' Project?"

Original Author: Azuma, Odaily

Following the consecutive TGEs of Plasma and Falcon in a short period, both opening with FDVs in the tens of billions and billions of dollars respectively, capital has begun searching for the next potential high-yield "god mining" project. With eye-catching labels such as "AI + Stablecoin," "YZi Labs Investment," "Plasma Partner," and "500 million quota, hard to get a spot," USD.AI has become the top choice for many users.

The Combination of AI and Stablecoins

USD.AI positions itself as a synthetic USD stablecoin protocol, aiming to provide funding for physical infrastructure in artificial intelligence and other emerging fields.

On August 14, USD.AI announced the completion of a $13 million Series A funding round, led by Framework Ventures, with participation from Bullish, Dragonfly, Arbitrum, and others. Later, on August 26, YZi Labs also announced an investment in USD.AI (specific amount undisclosed for now). Then, on August 28, USD.AI announced a partnership with Plasma and will be one of the initial deployments on Plasma's mainnet launch day.

According to USD.AI, the main funding channels for the current emerging AI industry are still traditional financial yield products, such as loans, bonds, and convertible preferred shares. However, there is a clear gap between this financing model and market demand. Therefore, the protocol aims to build a financial layer tailored to the AI cycle to bridge this demand gap.

Specifically, USD.AI allows entities with financing needs to use hardware itself as collateral for loans, restructures related risks into standardized investable assets, and earns yields from them—in simple terms, it accepts AI companies' graphics processing unit (GPU) hardware as collateral, issues loans to them, and distributes the loan yields to deposit staking users.

The operation of the USD.AI protocol relies on three roles—first, Depositors, who can deposit funds to obtain the stablecoin USDai, then stake it as sUSDai to earn protocol yields; second, Borrowers, usually small and medium-sized AI companies that cannot meet their loan needs through traditional financing channels; third, Curators, a relatively special role mainly responsible for providing first-loss capital, earning corresponding premiums, and achieving risk isolation between capital and operating entities through tokenization.

As mentioned above, USD.AI currently offers two forms of stablecoin products. The first is the fully collateralized USD-pegged stablecoin USDai (currently trading at a premium), which supports redemption at any time. The second is the staked version sUSDai, which shares protocol yields (current staking yield is 13.22%). The price of sUSDai increases as yields accumulate, and there is a 30-day un-staking period.

Points Program—Choose One of Two Rights

USD.AI launched its points (Allo™) program at the very beginning, with points to be used for subsequent rights distribution. The potential value expectation of these points is also the main reason the protocol currently attracts users.

However, it should be made clear that the rights corresponding to USD.AI points can only be chosen between two options—if you choose to use USDai to earn points, you get one type of right (total allocation of 70% of tokens), which requires KYC and capital subscription; if you choose to use sUSDai to earn points, you get airdrop rights (total allocation of 30% of tokens), which requires neither KYC nor capital subscription.

USD.AI has clearly stated that a single address cannot obtain both types of rights at the same time. The user's total allocation will be determined by their final points contribution and assigned to one of the options. If you want both, you must use two separate wallets to participate in the points activity.

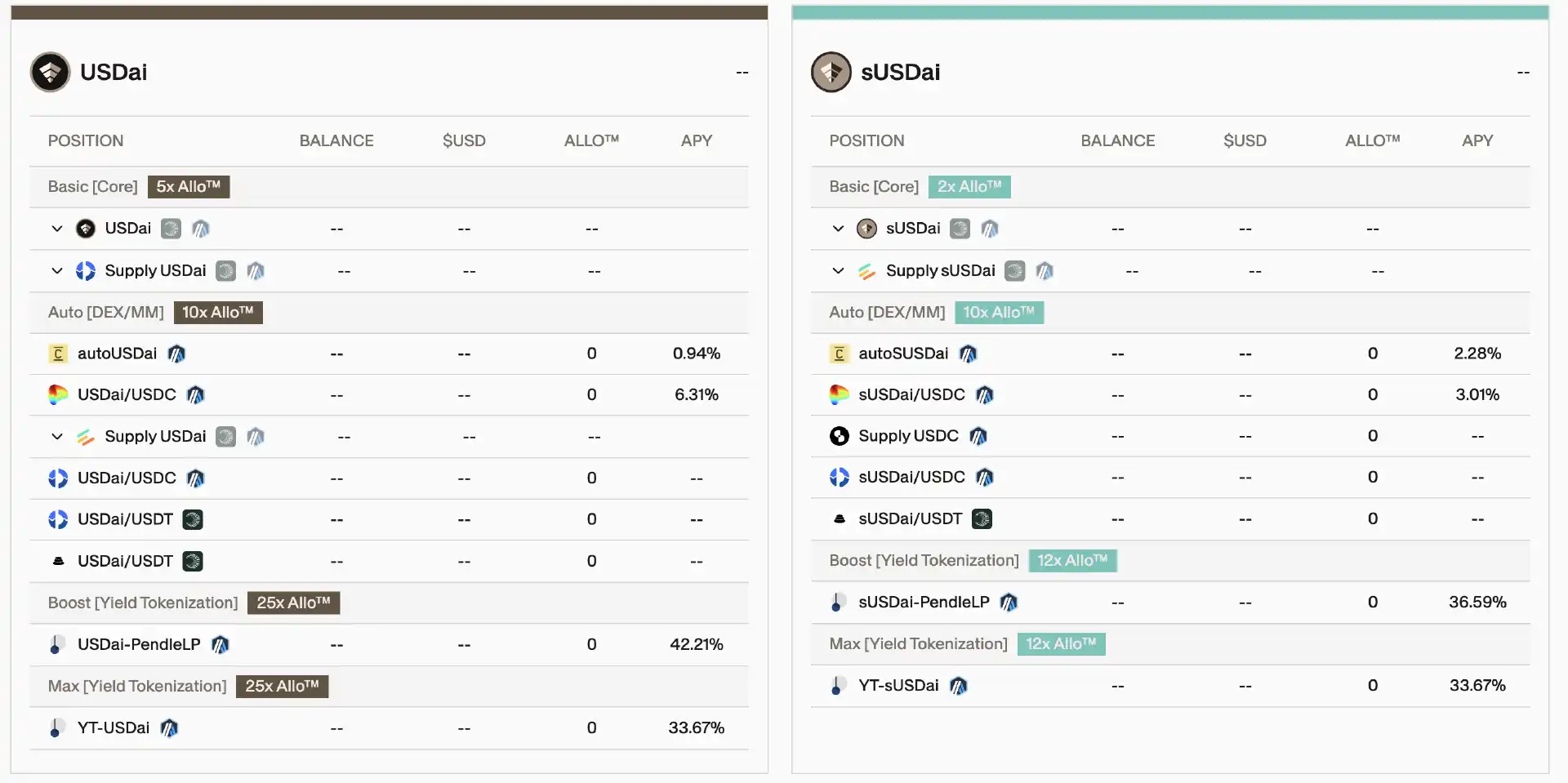

As shown below, users can earn points through USDai and sUSDai via the following channels (including corresponding yields and point multipliers). The left side (USDai) corresponds to the first type of right, and the right side (sUSDai) corresponds to the second type of right.

It is easy to see that, whether USDai or sUSDai, currently providing LP on Pendle or buying YT are the highest point multiplier methods (note that only the SY part of LP counts for points), and providing LP also comes with considerable annualized yields (42.21%, 36.59%). However, don't rush in blindly now—since the minting cap for USD.AI has been reached, you can only buy USDai at a premium on the secondary market (about $1.03), so entering now comes with significant slippage. It might be better to wait for the next increase in the minting cap.

Is It Really Worth Mining?

As the popularity of USD.AI continues to rise, some FUD voices have also emerged around the protocol, and the market's view seems to be noticeably divided.

Supporters believe that USD.AI combines the two hottest narratives of "stablecoin" and "AI". Even without considering fundamentals, it is an excellent speculation target. In addition, USD.AI's lead investor Framework has had excellent recent performance (also the lead investor of Plasma), and with the Binance listing expectation brought by YZi Labs, this further raises the ceiling for USD.AI's imagination. Also, the fact that USD.AI's deposit cap was quickly snapped up several times after being raised is reminiscent of Plasma.

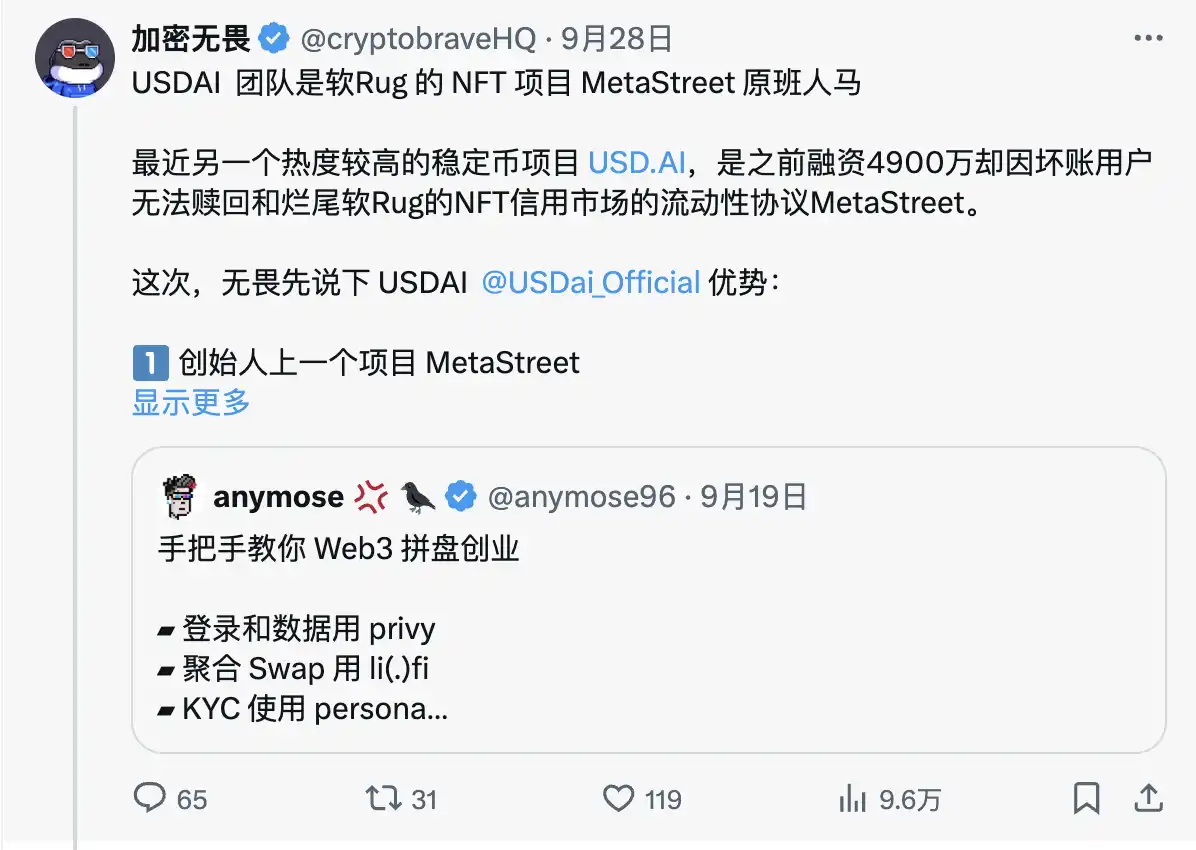

On the other hand, skeptics believe that the lending model introduced by USD.AI has not yet been fully validated by the market. Using AI companies that cannot obtain sufficient financing through traditional channels as the main borrowers is actually a debuff, and whether this mechanism can remain effective in the long term is still unknown. In addition, KOL "加密无畏 (@cryptobraveHQ)" revealed that the USD.AI team may be the original team behind the previously rugged NFT project MetaStreet, which could mean a dark history...

As for my personal operation, after USD.AI went live in late August, I deposited some funds into Pendle USDai LP, but kept the position relatively small. Later, I plan to switch accounts and buy some sUSDai YT when the price drops further.

For users still interested in participating in USD.AI, I personally recommend operating around Pendle within your risk tolerance (even if just for the basic LP yield, the APY is attractive enough), but I really don't recommend entering at a premium right now—unless you believe the yield during this period before the next quota opening can cover nearly 3% slippage. As for which right to choose, that's up to personal preference.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto: Fundraising Explodes by +150% in One Year

Bitcoin Drops $8B In Open Interest : Capitulation Phase ?

Coinpedia Digest: This Week’s Crypto News Highlights | 29th November, 2025