Written by: Prathik Desai

Translated by: TechFlow

Seven years ago, Apple completed what could be considered its greatest financial maneuver. In April 2017, Apple finished building its $5 billion, 360-acre Apple Park headquarters in Cupertino, California, known as the "Spaceship." A year later, in May 2018, Apple announced a $100 billion stock buyback plan. The amount was 20 times its headquarters investment, sending a message to the world: Apple's other "product"—its stock—was as important as the iPhone, if not more so.

This was the largest buyback plan Apple had ever announced at the time and was part of a decade-long buyback spree in which Apple spent over $725 billion repurchasing its own shares. Six years later, in May 2024, Apple broke its own record again, announcing a $110 billion buyback plan. This move not only demonstrated Apple’s scarcity in device manufacturing but also its management of equity scarcity.

The crypto industry is now adopting this strategy at an even faster and larger scale.

The two major revenue engines in crypto—perpetual contract exchange Hyperliquid and memecoin issuance platform Pump.fun—are using almost all of their fee income to buy back their own tokens.

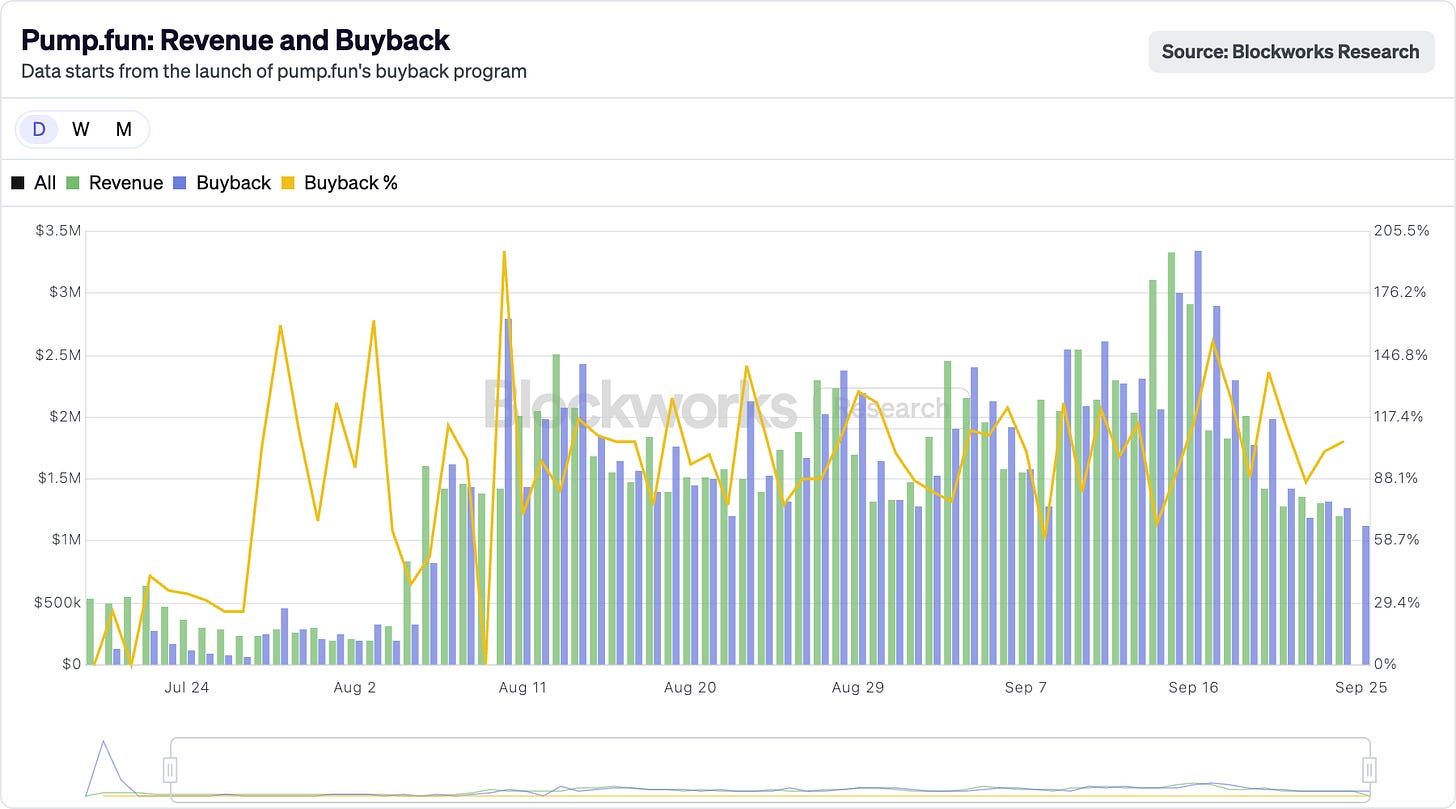

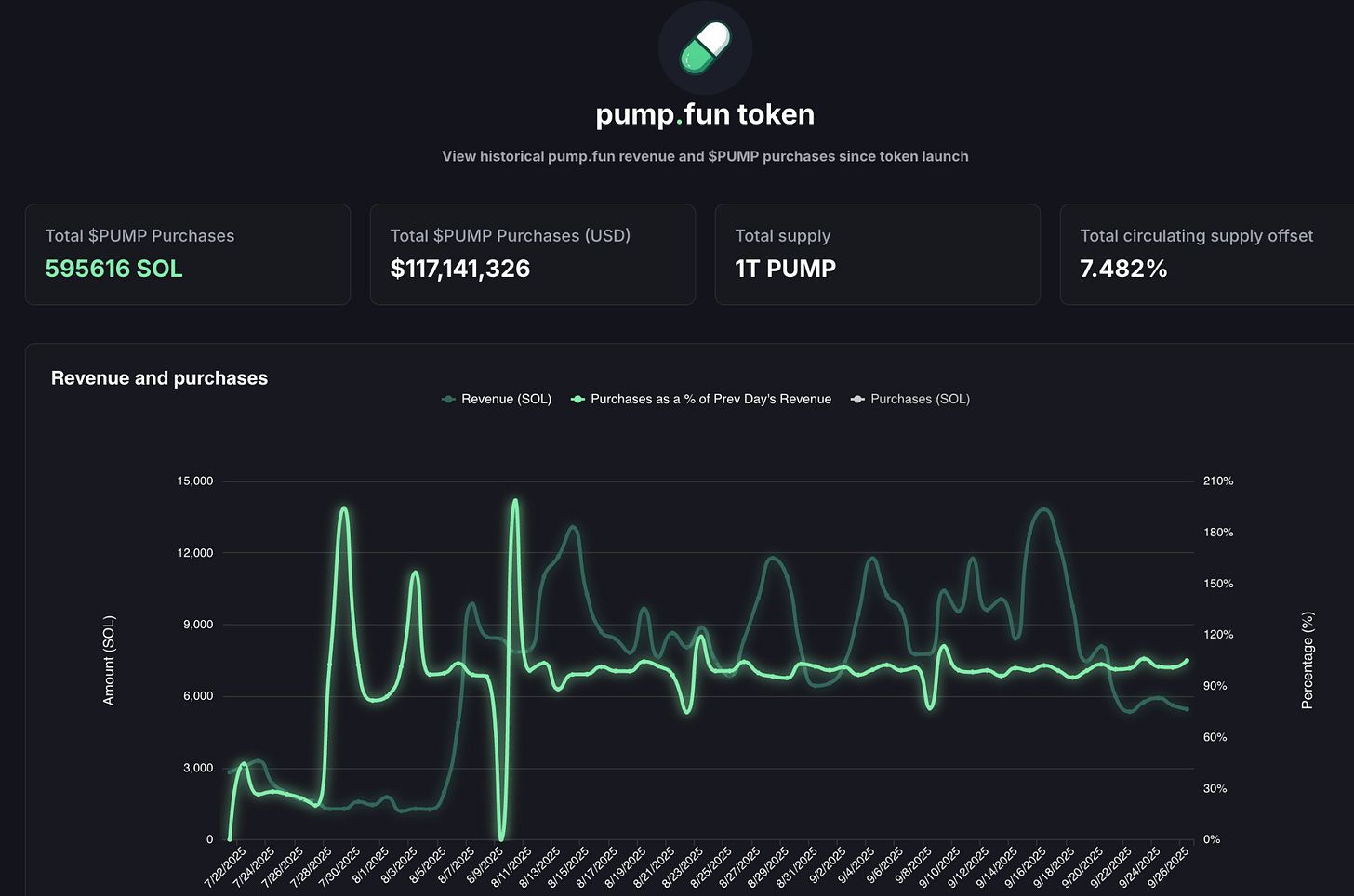

In August this year, Hyperliquid hit a record-high fee income of $106 million, with over 90% used to buy back HYPE tokens on the open market. Meanwhile, on a certain day in September, Pump.fun briefly surpassed Hyperliquid in daily revenue, reaching $3.38 million in a single day. And all of this income had only one destination—to buy back PUMP tokens. In fact, this buyback behavior has continued for two months.

@BlockworksResearch

This behavior makes tokens start to function like shareholder proxies. In the crypto industry, this is a rare phenomenon, as tokens are usually dumped on investors whenever possible.

This strategy attempts to replicate the long-term success of Wall Street’s “dividend aristocrats”—such as Apple, Procter & Gamble, and Coca-Cola—who spend huge sums rewarding shareholders through stable cash dividends or stock buybacks. For example, in 2024, Apple spent $104 billion on stock buybacks, about 3% to 4% of its market cap at the time. In comparison, Hyperliquid’s buybacks offset 9% of its token supply.

Even by equity standards, these numbers are exceptionally large. In the crypto industry, this is unprecedented.

Hyperliquid’s strategy is simple and direct.

It has built a decentralized exchange focused on perpetual contracts, offering a user experience comparable to centralized exchanges (like Binance), but running entirely on-chain. Zero fees, high leverage, and a Layer 1 ecosystem centered around perpetual contracts. By mid-2025, the platform’s monthly trading volume had exceeded $400 billion, capturing about 70% of the decentralized finance (DeFi) perpetual market.

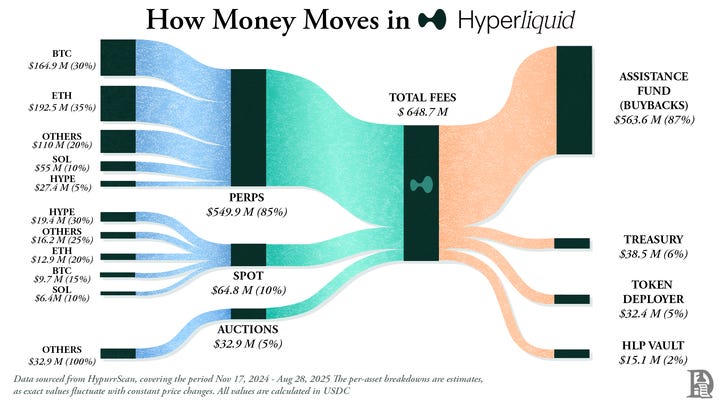

What makes Hyperliquid unique is how it uses its revenue.

Every day, Hyperliquid puts over 90% of its income into an account called the “Assistance Fund,” which is used directly to buy HYPE tokens on the open market.

@decentralised.co

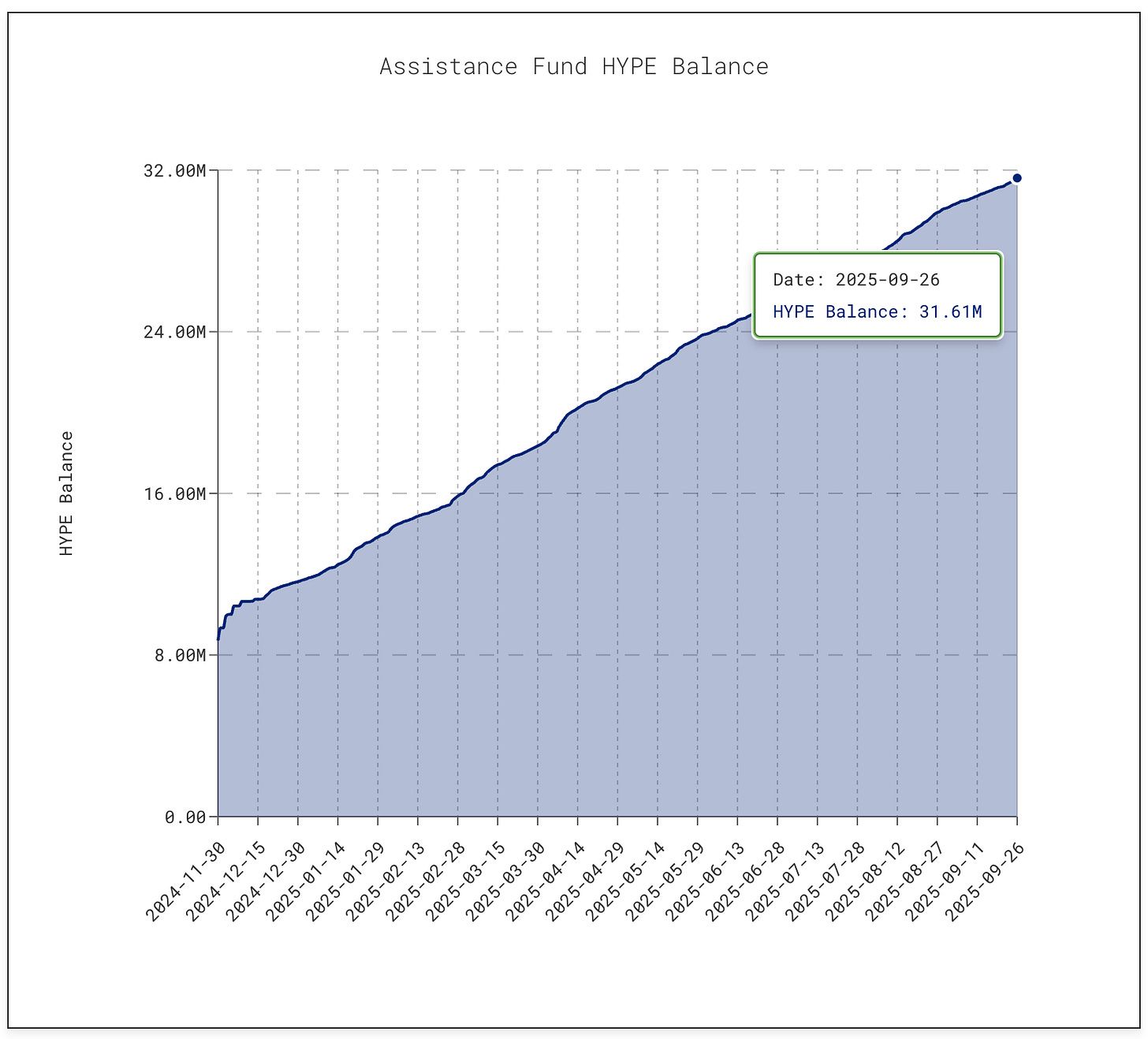

As of this writing, the fund has cumulatively bought back over 31.61 million HYPE tokens, worth about $1.4 billion. This number is 10 times higher than the 3 million tokens in January this year.

@asxn.xyz

This buyback frenzy has absorbed about 9% of the circulating supply, pushing the HYPE token price to a peak of $60 per token in mid-September.

Meanwhile, Pump.fun has reduced its token supply by about 7.5% through buybacks.

@pump.fun

The platform has turned the memecoin craze into a fee-based business model. Anyone can issue a token on the platform, set a bonding curve, and let the market speculate freely. What started as a joke tool has now become a factory for speculative assets.

But there is instability within.

Pump.fun’s income is closely tied to the popularity of memecoin issuance, so it fluctuates cyclically. In July this year, its income dropped to $17.11 million, the lowest since April 2024. The subsequent buybacks also decreased. However, by August, its monthly income had jumped to over $41.05 million.

Nevertheless, questions about sustainability remain. When the memecoin craze cools down (which has already happened and will happen again in the future), the intensity of token burning will also weaken. In addition, Pump.fun faces a $5.5 billion lawsuit accusing its entire operating model of being akin to unlicensed gambling.

The core driving force currently supporting Hyperliquid and Pump.fun is their willingness to return profits to the community.

In some years, Apple has returned nearly 90% of its profits to shareholders through buybacks and dividends, but these are usually phased decisions, announced in batches. Hyperliquid and Pump.fun, on the other hand, return almost 100% of their income to token holders nearly every day.

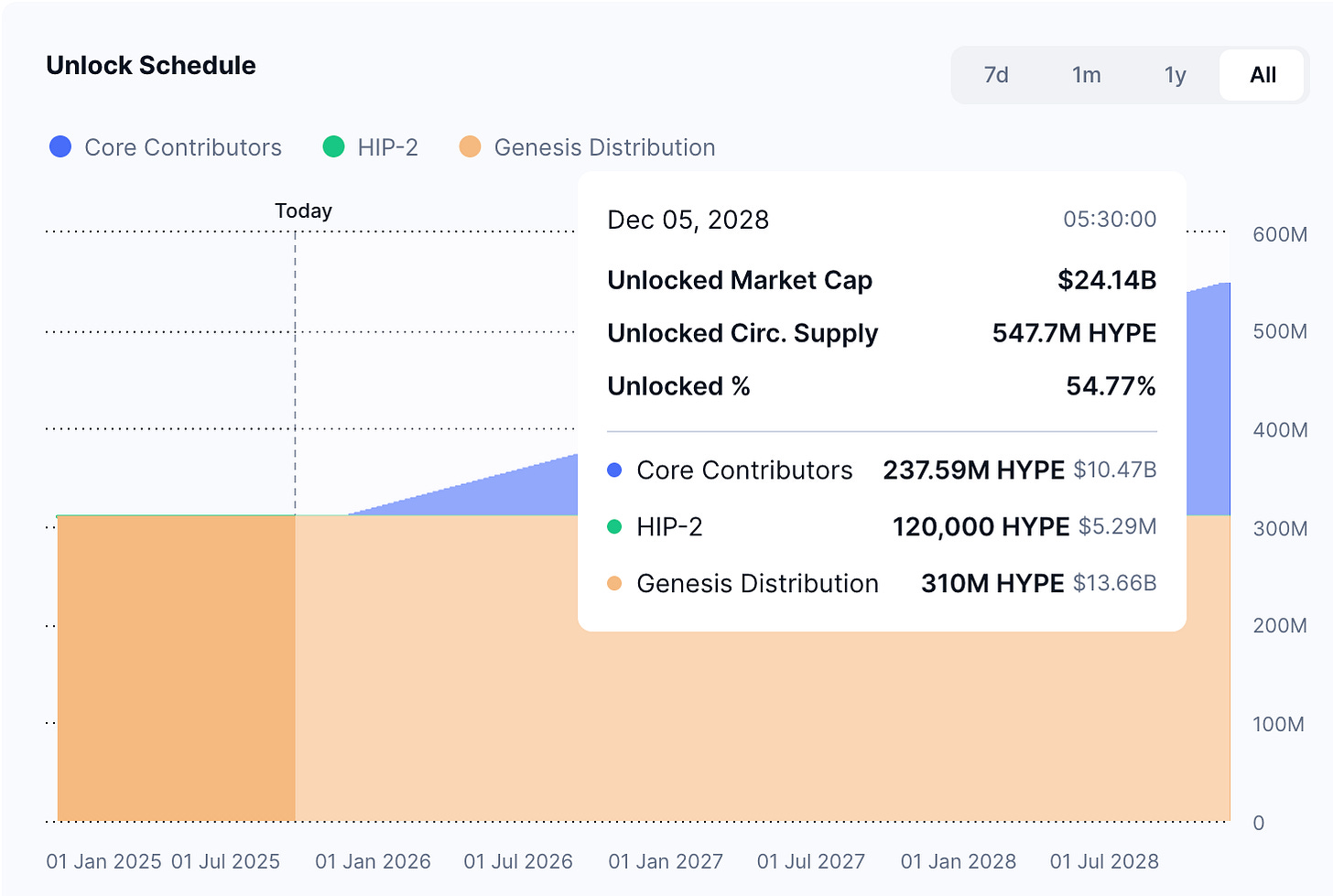

Of course, the two are not exactly the same. Dividends are real cash—taxable but relatively reliable; buybacks, at best, support the price. If income drops or unlocks are too large, the effect of buybacks will be greatly reduced. Hyperliquid faces upcoming token unlock pressure, while Pump.fun worries about losing its memecoin user base. Compared to Johnson & Johnson’s 63 years of steady dividend growth or Apple’s continuous buybacks, these crypto projects are more like high-wire acts.

But perhaps that’s okay.

The crypto industry is still in its growth phase, with a long way to go before stability. For now, it has found “speed.” Buybacks have the elements to drive speed: flexibility, tax efficiency, and deflationary effects. This strategy fits perfectly with a market driven by speculation. So far, this approach has turned two very different projects into top revenue machines.

We don’t yet know if this model can remain sustainable in the long run. But one thing is certain: for the first time, this approach makes crypto tokens behave less like casino chips and more like shares in companies that can return value at a pace comparable to Apple.

There’s a bigger lesson here. Apple understood long before the crypto industry that it was not just selling iPhones, but also “selling” stock. Since 2012, Apple has spent nearly $1 trillion on buybacks, an amount greater than the GDP of most countries, reducing its outstanding shares by over 40%.

Although Apple’s market cap still exceeds $3.8 trillion, part of the reason is that Apple treats its equity as a product—something to be marketed, polished, and kept scarce. Apple doesn’t need to issue more shares to raise funds because its balance sheet is already strong enough. In this model, stock becomes the product, and shareholders become the customers.

The same model is now extending to crypto.

Hyperliquid and Pump.fun are mastering this technique by turning business income into buy pressure on their own equity, rather than investing funds into the business or storing them away.

This also changes how investors view assets.

iPhone sales are certainly important, but bullish Apple investors know there’s another driver for its stock: scarcity. Similarly, for HYPE and PUMP, traders are beginning to view these tokens in the same way. What they see is an asset backed by a promise—that over 95% of every token expenditure or transaction is likely to be converted into market buybacks and burns.

Apple also demonstrates the other side of this strategy.

The intensity of buybacks depends on the underlying cash flow. What happens if income drops? If iPhone and MacBook sales slow, Apple’s historical balance sheet allows it to issue debt to fulfill buyback arrangements. Hyperliquid and Pump.fun do not have this leeway. If trading volume dries up, buybacks will stop. Unlike Apple, they cannot turn to dividends, services, or new products—these protocols have yet to find their own backup plan.

For the crypto industry, this also brings the risk of dilution.

Apple doesn’t have to worry about 200 million new shares flooding the market overnight. Hyperliquid, on the other hand, must face this issue. Starting this November, about $12 billion worth of HYPE tokens will begin unlocking for insiders, a number far exceeding the daily buyback scale.

@coinmarketcap

Apple can control its outstanding shares, while crypto protocols must deal with unlock schedules set years in advance.

Even so, investors still see the story and want to participate. Apple’s buyback strategy is obvious, especially to those familiar with its decades-long history. By turning equity into a financial product, Apple has successfully cultivated shareholder loyalty. Hyperliquid and Pump.fun are trying to blaze a new trail for the crypto industry—only they’re doing it faster, louder, and with greater risk.