Pi Network Risks Fresh Low as 138 Million Tokens Head for Unlock in October

Pi Network faces a critical October as 138 million tokens unlock, fueling bearish sentiment and raising risks of a breakdown toward fresh lows.

Pi Network (PI) faces renewed pressure as 138.21 million PI tokens, valued at $37 million, are set to be unlocked in October.

The altcoin has been trading sideways since September 23 and now risks retesting its all-time low if demand continues to falter.

PI Under Pressure as Sentiment Turns Bearish

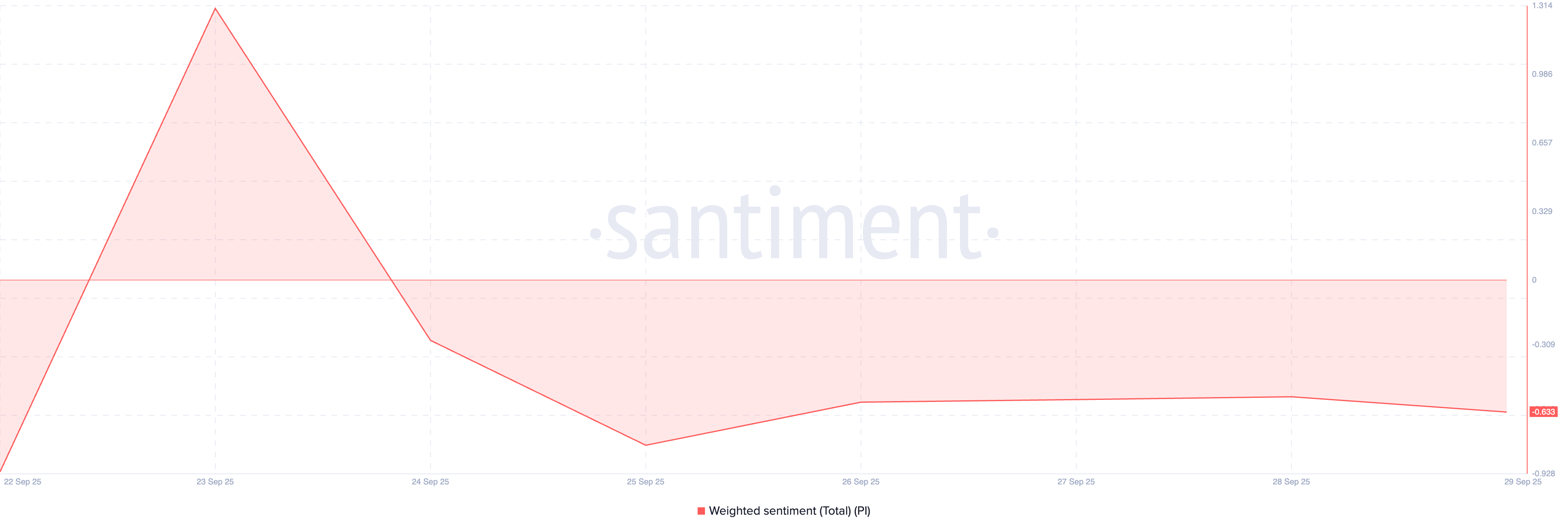

October’s unlock comes at a time when investor confidence is already shaky. On-chain data shows PI’s weighted sentiment slipped below zero on September 24 and has remained under that line ever since. According to Santiment, this is at -0.63 at the time of writing.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

PI Weighted Sentiment. Source:

Santiment

PI Weighted Sentiment. Source:

Santiment

Weighted sentiment combines the volume of social mentions of an asset with the ratio of positive to negative commentary. It helps measure whether online discussions around a token are leaning more bullish or bearish.

When weighted sentiment is above zero, it indicates more positive comments and discussions about the cryptocurrency than negative ones, suggesting a favorable public perception.

On the other hand, a negative reading indicates more criticism than support, reflecting bearish sentiment.

With PI’s weighted sentiment holding firmly below zero for over a week, it highlights that sentiment among market participants has worsened and may trigger further price dips.

Further, readings from the PI’s Super Trend Indicator support this bearish outlook. It continues to act as a dynamic resistance above PI’s price at $0.3279.

PI Super Trend. Source:

TradingView

PI Super Trend. Source:

TradingView

This indicator helps traders identify the market’s direction by placing a line above or below the price chart based on the asset’s volatility.

As with PI, when an asset’s price trades below the Super Trend line, it signals a bearish market where selling pressure is dominant. This leaves PI vulnerable to more declines.

Will Bears Drive It to $0.18 or Bulls Force a Rebound?

The lack of demand for PI and the upcoming supply influx mean the altcoin could either remain trapped in sideways consolidation or face a sharp breakdown. If demand weakens further, PI could break below its immediate support at $0.2573 and plunge toward its all-time low at $0.1842.

PI Price Action. Source:

TradingView

PI Price Action. Source:

TradingView

However, if traders step in to absorb the incoming supply, PI could stabilize and attempt a rebound. It could break above $0.2917 and push toward $0.3987 in that case.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DappRadar, another tear of the era

"High value, low payment" is a problem that Web3 tool products have yet to solve.

Bitcoin falls below the 90,000 mark—where is the market headed?

A quick overview of market outlook analyses from traders and industry experts.

Powell faces the ultimate test: At least three dissenters at the December meeting, Federal Reserve consensus collapses!

The "Fed mouthpiece" reported that internal divisions within the Federal Reserve have intensified amid a data vacuum, with three board members appointed by Trump strongly supporting a dovish stance, while the hawkish camp has recently expanded.

Weekly Hot Picks: Data Disappearance Doesn’t Stop the Fed’s Hawkish Stance! Global Multi-Asset Markets Face “Backstabbing”

The U.S. government shutdown has ended, but the release of key data remains chaotic. The Federal Reserve has sent frequent hawkish signals, causing significant declines in gold, silver, stocks, and currencies on Friday. The U.S. has launched Operation "Southern Spear". Buffett delivered his farewell letter, and the "Big Short" exited abruptly. What exciting market events did you miss this week?