Date: Wed, Oct 01, 2025 | 06:55 AM GMT

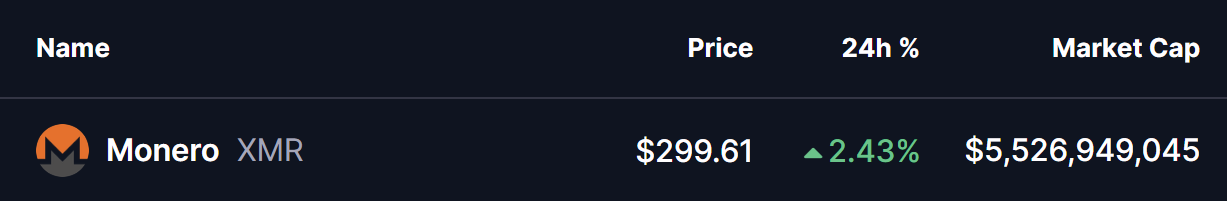

The cryptocurrency market is showing mixed sentiment today, with Bitcoin (BTC) trading in green while Ethereum (ETH) faces pressure, slipping 1% lower. Despite the uneven tone across majors, some altcoins are quietly flashing strength — and Monero (XMR) is among them.

XMR is posting modest gains, but more importantly, its chart is shaping up a potential bullish reversal pattern that could set the stage for a larger move ahead.

Source: Coinmarketcap

Source: Coinmarketcap

Bump-and-Run Reversal (BARR) Pattern

On the daily chart, XMR’s price action is mirroring the Bump-and-Run Reversal (BARR) pattern — a rare but powerful technical formation that often signals the end of a bearish phase and the start of an extended uptrend.

The Lead-in Phase began after XMR was rejected from its downtrend line near $415, driving prices lower and ultimately forming the Bump Phase bottom around $232. From that low, XMR staged a strong recovery, pushing through the downtrend resistance breakout before pulling back for a classic throwback retest.

Monero (XMR) Daily Chart/Coinsprobe (Source: Tradingview)

Monero (XMR) Daily Chart/Coinsprobe (Source: Tradingview)

At the time of writing, the token is trading at $299, holding steady above the 200-day moving average at $286.53 — a crucial support level that adds weight to the bullish case.

What’s Next for XMR?

If the BARR pattern continues to unfold, maintaining support at the 200-day MA could fuel XMR into its Uphill Run Phase. The projected technical target for this move sits at $394, representing a potential 31% upside from current levels.

Failure to hold above the moving average could delay the rally, but as long as the broader structure remains intact, the bias leans toward further upside momentum.

For now, Monero’s structure looks promising, and traders are keeping a close eye to see if this reversal setup confirms into a sustained rally.