Ethereum price prediction: Can ETH break $4,600 and target $5K?

- Ethereum price prediction analysts note ETH is holding between $4,000 and $4,400, with lower volatility following September’s fluctuations.

- The major resistance zone is $4,600; a break might send momentum to $4,800-$5,000.

- Institutional ETF inflows and staking activity continue to drive long-term demand.

- Analysts predict possible gains above $5,200 if supply tightening from staking ETFs occurs.

- If ETH fails to retain $4,200 support, the price could fall below $4,000.

- The short-term view ranges from neutral to cautiously bullish, depending on ETH’s ability to retake resistance.

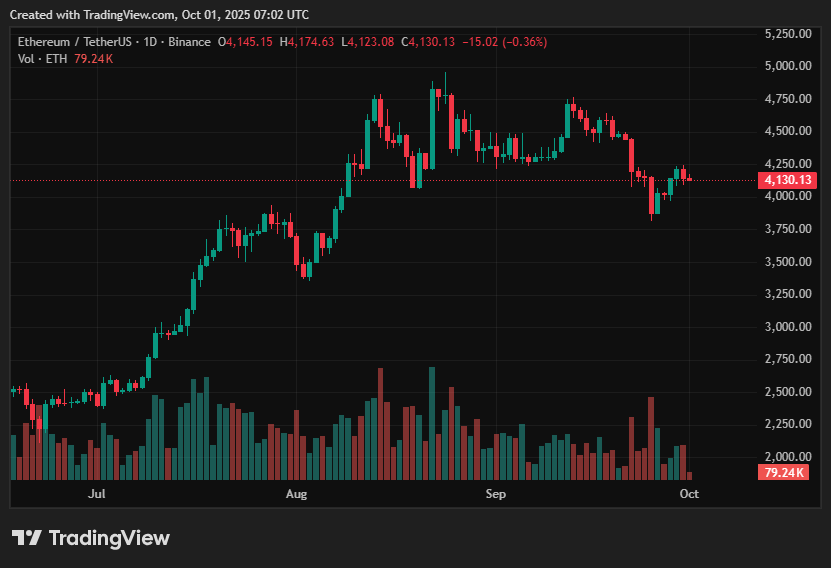

Ethereum price prediction is in sharp focus as the coin trades near $4,140, holding steady after a turbulent September. The $4,600 zone is shaping up as a crucial resistance level for bulls, while the $4,000–$4,200 range remains an important cushion of support.

Traders are discussing whether Ethereum’s current steadiness provides a foundation for another upward push, or if the lack of momentum could lead to additional downside pressure. Institutional ETF flows and consistent staking activity remain closely watched as potential catalysts.

Table of Contents

- Ethereum price prediction analysis

- Upside outlook for Ethereum price

- Downside risks for ETH price

- Ethereum price prediction based on current levels

Ethereum price prediction analysis

Ethereum has entered a consolidation phase between $4,000 and $4,400, indicating a period of lower volatility than the rapid intraday changes observed last week.

Lighter volumes indicate a brief pause in market activity as traders await stronger signals. Despite this, underlying network activity remains strong, with DeFi protocols continuing to secure significant liquidity, bolstering Ethereum’s foundations.

Institutional flows have also played a stabilizing role. Spot ETH ETFs have seen inflows on numerous important days, indicating a gradual but consistent build-up in long-term demand.

While speculative impetus has slowed, increased participation from funds and continuous staking activity are helping Ethereum (ETH) avoid deeper retracements, keeping price movement constructive within its current range.

Upside outlook for Ethereum price

A solid advance above $4,400-$4,500 would likely start Ethereum on a path to higher objectives, initially around $4,800-$5,000. This level has served as resistance in recent weeks, and regaining it could result in short covering in derivatives markets, accelerating upward momentum.

Traders see ETF inflows as a catalyst that might propel Ethereum into its next bullish leg. From a broader Ethereum coin forecast, analysts note that momentum could extend into Q4, with some calling for a push beyond $5,200.

The expectation is that if staking elements are integrated into ETF products, available supply would shrink further, potentially drawing more institutional allocations and fueling a longer-term rally.

Downside risks for ETH price

The greatest danger is Ethereum’s inability to defend its $4,200 support zone. Derivatives heatmaps reveal thick liquidation clusters in this range, implying that a sudden drop could intensify selling pressure toward $4,000. Such a scenario is most likely caused by low liquidity and the unwinding of leveraged long bets.

Macroeconomic conditions add another layer of uncertainty. Political developments, shifting interest rate projections, or sudden ETF redemption waves could stall momentum and leave ETH vulnerable. Even with solid fundamentals, a risk-off backdrop could quickly cap upside moves.

Ethereum price prediction based on current levels

Ethereum’s short-term direction is mainly dependent on whether it can maintain a price over $4,400-$4,500. A confirmed breach above this resistance area would support a bullish forecast of $4,800-$5,000, with a probability of reaching $5,200 if institutional flows stay supportive.

Traders believe this scenario is increasingly plausible if ETF inflows continue at their current rate. Conversely, a decisive drop below $4,200 would shift sentiment bearish, opening the door to a slide below $4,000. Such a move would likely trigger liquidations and dampen near-term confidence.

For now, the Ethereum outlook remains neutral to cautiously bullish, with the balance of expectation resting on its ability to reclaim resistance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CARV In-Depth Analysis: Cashie 2.0 Integrates x402, Transforming Social Capital into On-Chain Value

It is no longer just a tool, but a protocol.

Trump Takes Control of the Federal Reserve: The Impact on Bitcoin in the Coming Months

The U.S. financial system is undergoing its most significant transformation in a century.

Castle Island Ventures partner: I don’t regret spending eight years in the cryptocurrency industry

Move forward with pragmatic optimism.

Undercurrents Surge: Crypto Whales Spark Another Wave of Accumulation