Key Notes

- Metaplanet became the fourth-largest corporate Bitcoin treasury globally, following the latest BTC purchases.

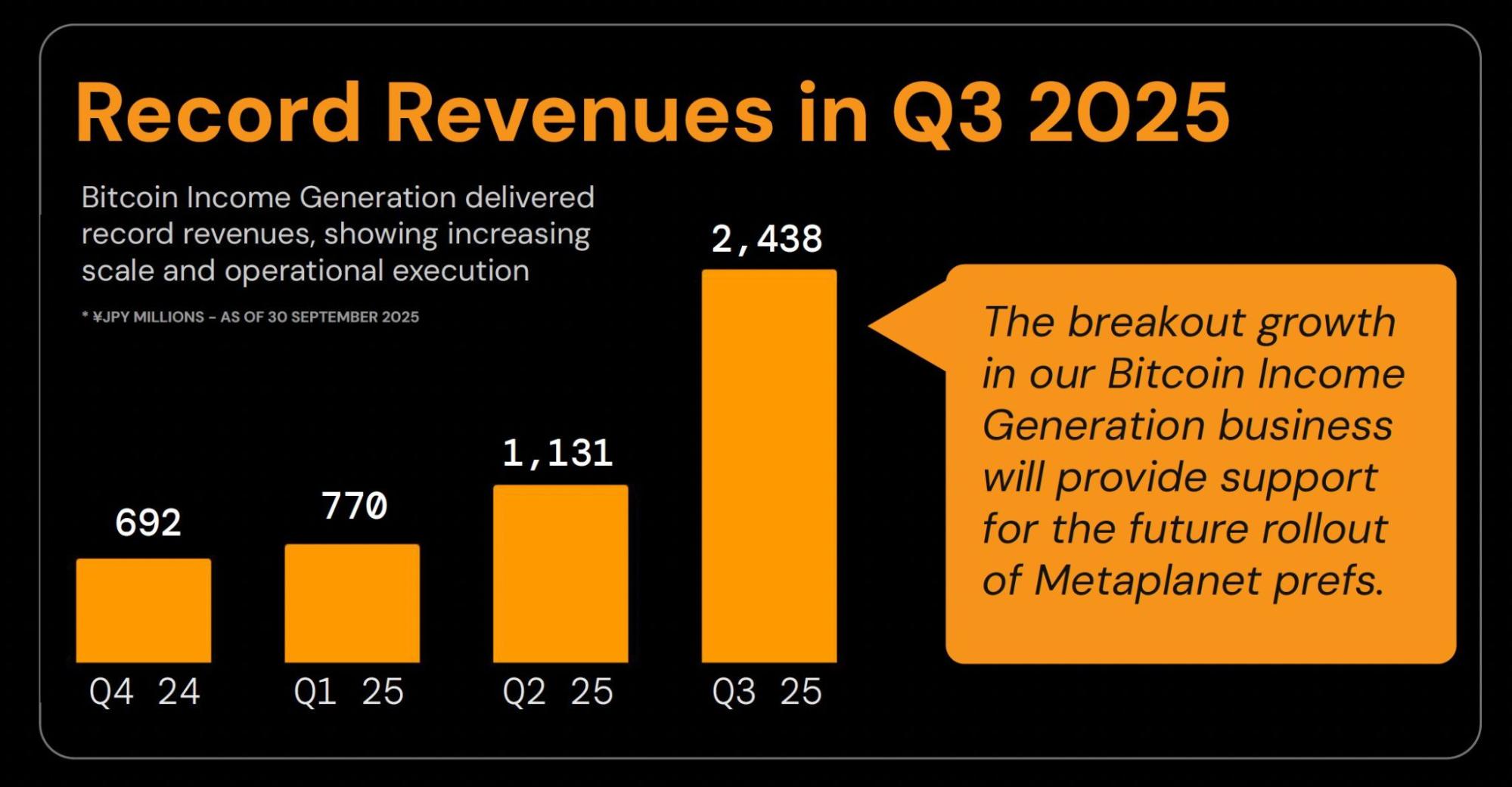

- Metaplanet’s Bitcoin Income Generation segment reported 2.438 JPY billion in Q3 revenue, up 115.7% from Q2.

- Despite strong operational results, the stock fell over 10% to 516 JPY, while institutions like Capital Group continue to increase holdings.

Asia’s largest corporate Bitcoin BTC $117 559 24h volatility: 3.9% Market cap: $2.34 T Vol. 24h: $65.18 B holder, Metaplanet, extended its lead with the purchase of another 5,268 BTC on Oct. 1. The Japanese firm purchased the latest BTC stash at $116,870 per Bitcoin, for an investment of $615 million. Despite this, the stock price has reacted negatively and corrected by over 10% on the Tokyo Stock Exchange.

Metaplanet Becomes Fourth-Largest Bitcoin Treasury Firm

As of October 1, 2025, Metaplanet holds a total of 30,823 BTC, purchased for roughly $3.33 billion at an average cost of $107,912 per Bitcoin. The company’s CEO, Simon Gerovich, declared that they are now the fourth-largest Bitcoin Treasury firm globally, thereby putting them in a dominant spot.

🪜Metaplanet is now the 4th largest publicly-traded Bitcoin treasury company in the world pic.twitter.com/kg8quw2JYR

— Simon Gerovich (@gerovich) October 1, 2025

More importantly, the Japanese firm has disclosed the results of the Bitcoin Income Generation Strategy. During the third quarter of 2025, Metaplanet’s Bitcoin Income Generation segment reported quarterly revenue of 2.438 JPY billion, which marks a 115.7% increase from Q2.

Following the strong Q3 performance, the Japanese firm revised its full-year 2025 consolidated guidance. As a result, it expects a revenue of 6.8 JPY billion, along with an operating profit of 4.7 JPY billion. The updated forecast reflects a 100% increase in revenue and an 88% rise in operating profit compared to previous projections.

CEO Simon Gerovich noted that the Q3 results demonstrate operational scalability. Besides, it also reinforces the company’s financial position ahead of its planned Metaplanet preferred share issuance, supporting the broader Bitcoin Treasury strategy.

Metaplanet Bitcoin Income Generation Revenue | Source: Metaplanet

Metaplanet Stock Crashes 10%

Despite the strong Q3 performance, Metaplanet stock price has come under selling pressure and has corrected 10.26% today, slipping all the way to 516 JPY. Over the last month, the stock has corrected by 37% leading to bearish sentiment among traders.

However, institutions have continued to purchase despite the price drop. Capital Group has recently become the largest shareholder of Metaplanet, taking a massive 11.45%.

Benchmark Equity Research has reaffirmed its “Buy” rating on Metaplanet, citing the Japanese Bitcoin treasury firm’s continued crypto accumulation despite recent stock price weakness. In a research note last week, analyst Mark Palmer set a price target of 2,400 Japanese yen for Metaplanet by the end of 2026.

next