Key Notes

- Lawmakers face midnight deadline on $1.7 trillion spending bill with prediction markets showing 87% shutdown probability.

- Bitcoin short traders deployed $1.4 billion in leverage at $115k as markets brace for potential US government funding crisis.

- BTC trades in rising wedge pattern near $113,871 with critical resistance at $115k determining next directional move.

US VP J.D Vance hints at first US Government Shutdown in 7 years at an Oval office press-briefing on Sept. 30, sparking fresh risk signals across global markets.

According to Reuters , the lawmakers remain deadlocked on a $1.7 trillion “discretionary” spending for key agency operations.

The shutdown could cut off US government funding to key federal projects starting on Oct. 1, if Republican Party and Democrats lawmakers fail to reach a timely agreement on the spending bill, or an extension before midnight. This is expected to have considerable economic impact, with critical bureaucratic services placed on hold as government offices close down, while non-essential workers may suffer redundancy.

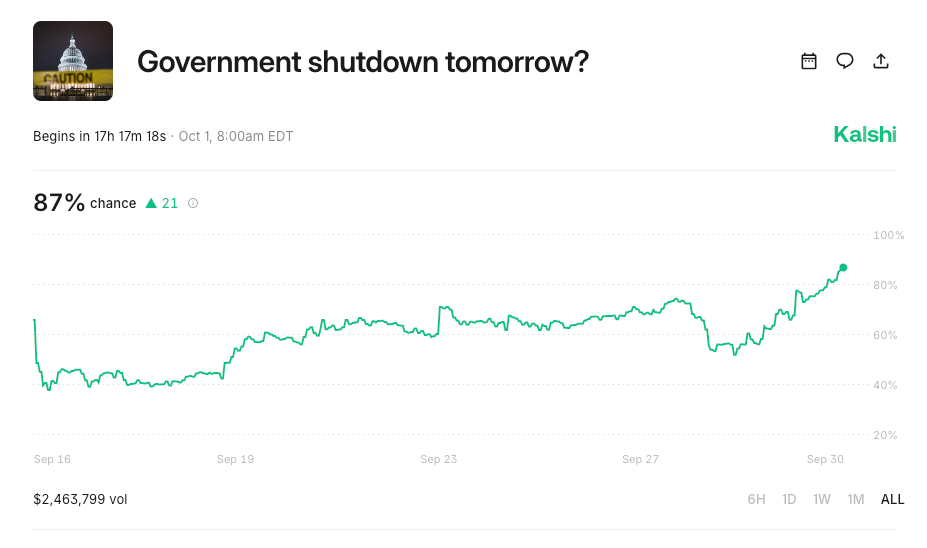

Prediction markets show 87% Chance of US Government Shutdown | Source: Kalshi, Sept 30

Real-time data from predictions market platform Kalshi shows 87% expectations of a shutdown, with total wager approaching $2.5 million as of this report.

Instant impact was seen in key markets with Gold ( XAU ) price moving up 0.6% to $3,843 and the tech-heavy S&P 500 rising 0.1%. Meanwhile with the Dow Jones Industrial Average ( DJI ) down 0.022% reflecting active capital rotations as investors react.

President Donald Trump has threatened irreversible job cuts for federal workers according to BBC News , amplifying uncertainty across key markets. While Bitcoin BTC $117 559 24h volatility: 3.9% Market cap: $2.34 T Vol. 24h: $65.18 B price consolidates near weekly-time frame peaks around $114,000, exposure to the US financial markets could see traders maintain a cautious stance.

How Will Bitcoin Price React to the US Government Shut Down?

Before rebounding to $114,200 on Sept. 30, Bitcoin price initially retraced under $113,500 with bears promptly deploying $1.4 billion as markets braced for impact of the imminent US government shutdown talks.

BTC has often rallied on safe-haven bets during periods of testy political crisis. However Bitcoin’s volatile price action and derivatives trading metrics seen on Sept. 30 signals bearish expectations from cross-exposure to US markets.

Since the last Government shutdown on Dec. 22, 2018, cryptocurrencies have become increasingly entangled with US financial markets and political landscape.

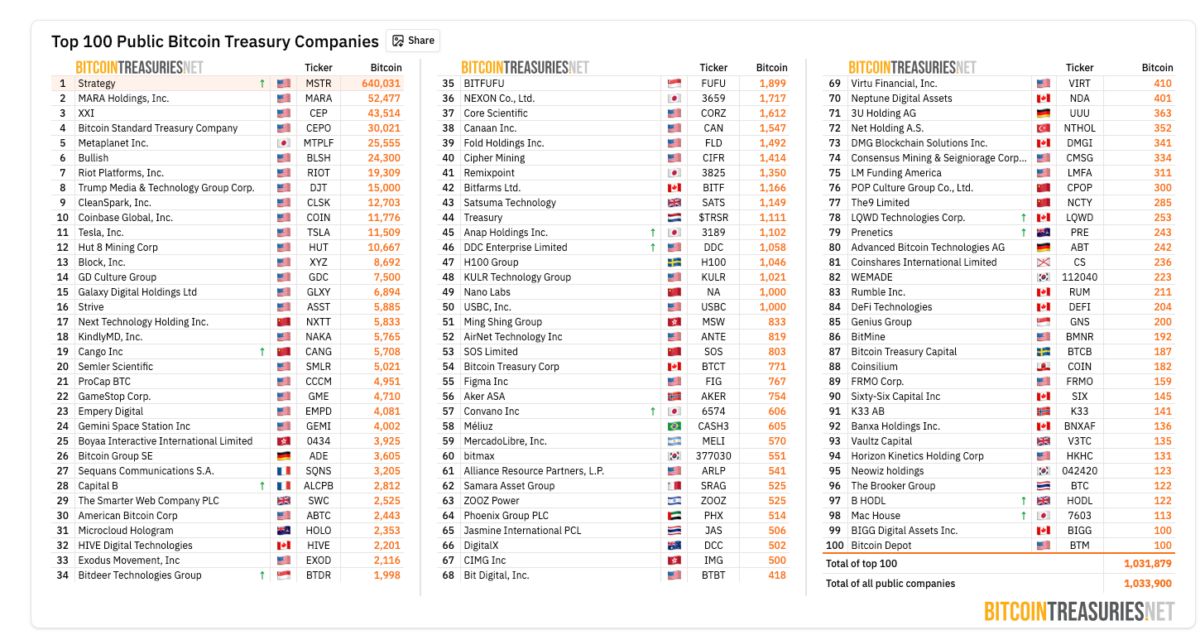

Top 100 Publicly US-listed Firms Holding Bitcoin, as of Sept. 30, 2025 | Source: BitcoinTreasuries

Crypto-native firms like Coinbase and Robinhood have been included in the S&P 500 boosted by a positive shift in US crypto regulations under the current Trump regime that took over in January 2025.

More so, BitcoinTreasuries lists over 100 public corporations in the US carrying a cumulative 1,031,879 BTC on the balance sheet, including world largest asset manager Blackrock which currently holds nearly $100 billion across its active ETF offerings for BTC and ETH.

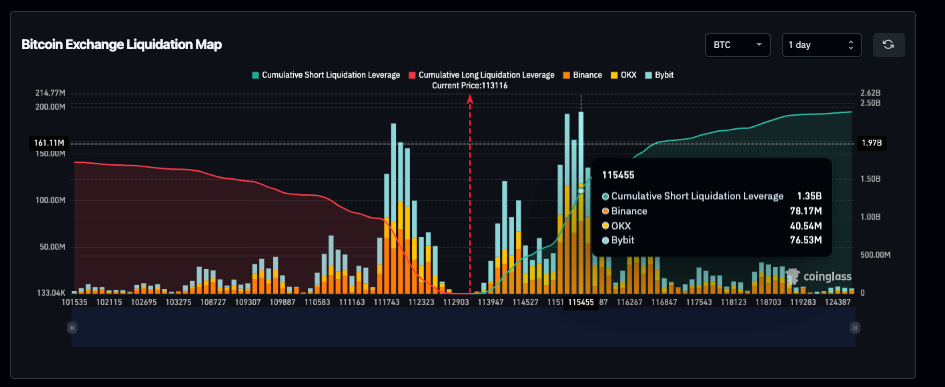

Bitcoin short traders deploy $1.4 billion of $2.4 billion total leverage at $115.3k | Source: Coinglass

Coinglass liquidation map data captures the BTC short traders’ reaction to the US government shutdown reports. As depicted below, active BTC SHORT positions rose to $2.4 billion with longs limited to $1.73 billion over the last 24 hours, reflecting dominant bearish expectations.

A closer look at the chart shows the BTC short traders clustered $1.4 billion in leverage around the $115,000 price level, accounting for 58% of the total active positions.

As the US Government shutdown remains unconfirmed, the looming short leverage cluster at $115,000 could limit Bitcoin rebound prospects as traders weigh their options.

Bitcoin Price Forecast: Will BTC Reclaim $115K or Succumb to Correction Signals Ahead?

Bitcoin price trades inside a rising wedge formation on the weekly chart, a structure often preceding sharp directional moves. At current levels near $113,871, BTC is pressing the mid-range, with bulls and bears evenly matched.

On the upside, rising Price-to-Volume ratio (PVT) levels around 725,550 BTC support an optimistic Bitcoin price outlook, suggesting long-term capital inflows still remain intact. If shutdown fears fuel safe-haven demand as seen in Gold entering overbought territories, Bitcoin bulls could capitalize to trigger a breakout above the Rising wedge’s upper boundary near $120,000.

Bitcoin (BTC) Technical Price Analysis | Source: TradingView

Conversely, the MACD line at 4,861 trending below the signal at 5,859 signals fading momentum, while histogram weakness reflects building downside pressure. A breakdown below wedge support at $105,000 would confirm bearish divergence, potentially accelerating losses toward $95,000.

With the largest leverage cluster currently at $115,000, this level remains critical to Bitcoin’s next move. A rejection there could confirm bearish dominance, while a decisive close above it in the coming days, may trigger a short covering frenzy, potentially driving BTC price to $120,000.

Best Wallet项目解析

随着比特币交易者权衡美国政府关门带来的不利因素,投资者开始关注诸如Best Wallet (BEST)这类早期阶段的项目,以寻求上升动力。

Best Wallet (BEST)是一个多链存储解决方案,具备机构级安全性,旨在推动110亿美元非托管钱包领域的变革。

Best Wallet (BEST)