Before pressing the short button, take a look at this OpenEden rating brief.

OpenEden is not a speculative project, but an infrastructure aimed at connecting traditional finance and DeFi.

OpenEden is not a speculative project, but an infrastructure aimed at connecting traditional finance and DeFi.

Written by: Stacy Muur

Translated by: AididiaoJP, Foresight News

OpenEden is positioning itself as the regulated RWA tokenization gold standard, linking institutional-grade finance with DeFi-native composability.

With a total value locked (TVL) exceeding $517 million, a Moody's "A" rating, an S&P "AA+" rating, and partnerships with BNY Mellon and Binance, it has already solved the regulatory-innovation paradox that most RWA projects have failed to address.

Some brief RWA market background:

- Total tokenized RWA market size to reach $1.2 trillion by 2025 (up from $300 billion in 2024)

- Expected compound annual growth rate of 80-100% by 2025

- Market size potential to exceed $2 trillion by the end of 2025

- Tokenized Treasuries: $150 billion market size (up from $1 billion in 2023)

Therefore, OpenEden's potential market includes:

- Treasuries: $26 trillion global market

- Stablecoins: Over $17 billion yield-seeking market

- Total DeFi TVL: Over $100 billion seeking RWA exposure

- Institutional RWA demand: Rapidly growing

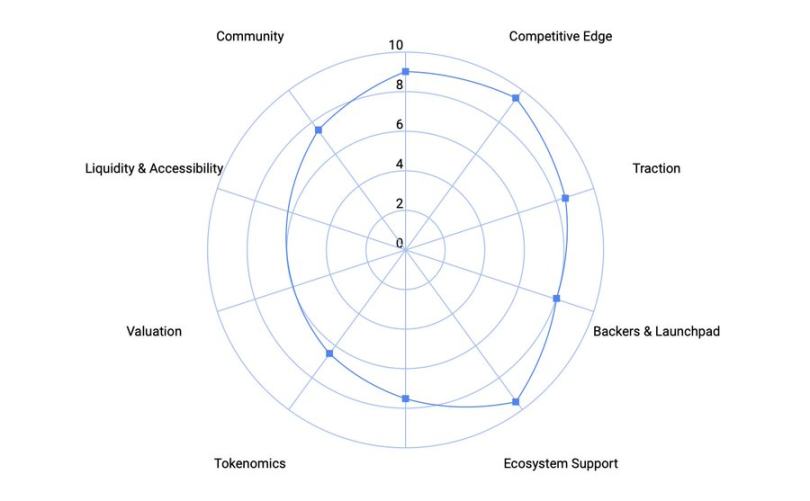

This analysis of OpenEden's investment potential uses the Muur Score, my personal framework for evaluating protocols based on impact-weighted parameters.

Part 1: Product Evaluation

Product Status Score: 9/10

- Stage: Mainnet live since 2022, with multiple functional products (TBILL, USDO, cUSDO).

- Metrics: Total TVL across products exceeds $517 million, with verified integrations in DeFi.

- Maturity: Zero major security incidents in 3 years, audited infrastructure, stable yield delivery.

Why 9/10? OpenEden is already operating at scale with strong adoption. While it hasn't reached the billion-dollar dominance of Ondo, its proven mainnet traction justifies a near-top score.

Competitive Advantage Score: 9.5/10

- Unique Innovation: The first tokenized treasury fund to receive a Moody's "A" rating and an S&P "AA+" rating.

- Trilemma Solved: Regulation + yield + DeFi composability, usually impossible to achieve together, but OpenEden delivers all three.

- Moat: Institutional custody and investment management (BNY Mellon), regulatory first-mover advantage, and multi-chain deployment.

Why 9.5/10? Clear first-mover advantage in regulated RWA, deep TradFi relationships, and robust DeFi integration. Fast followers are unlikely to replicate quickly.

Market Attractiveness Score: 8.5/10

- Total TVL: TBILL ($260 million) and USDO ($257 million) totaling $517 million.

- Growth: TBILL YoY growth +135%; USDO surging to new highs.

- Adoption: Binance and Ceffu accept cUSDO as off-exchange collateral; Pendle vaults attract high APY demand.

- Multi-chain operation: Ethereum, Ripple, Polygon, etc.

Why 8.5/10? Explosive growth, institutional adoption, and sustained usage. TVL not yet #1 compared to Ondo, but momentum is strong.

Backer Score: 8/10

Backers: YZi Labs, with strategic support from BNY Mellon and Binance.

Why 8/10? Institutional-grade partners, but no top crypto-native VCs (like Paradigm/a16z) disclosed. YZi Labs has been investing heavily recently, but not all investments have yielded strong retail returns.

Ecological Support Score: 9.5/10

- DeFi Integrations: Pendle, Curve, Morpho, Euler, Balancer, Spectra.

- TradFi Partners: BNY Mellon (custody and investment management), Moody's and S&P (ratings), Binance (collateral acceptance).

- Yield: Live products and vaults generating returns.

Why 9.5/10? Few RWA projects demonstrate such deep TradFi and DeFi synergy.

Tokenomics Evaluation

Valuation Score: N/A

Fully diluted valuation undisclosed, score deferred to a later stage.

Tokenomics (35%) Score: 6.5/10

- Unknowns: Allocation ratios, vesting periods, unlock schedules.

- Positives: Community activities (Bills events) and token incentives (OpenSeason) suggest fair launch dynamics; institutional conservatism may ensure fairness.

Why 6.5/10? Limited economic model data; a cautious mid-low score until disclosures are made.

Utility (30%) Score: 7.5/10

- Expected utility: Governance, fee sharing from TBILL/USDO, staking, ecosystem incentives.

- Strength: Real revenue capture based on fees.

- Weakness: Regulatory restrictions may limit utility breadth.

Liquidity & Accessibility (10%) N/A

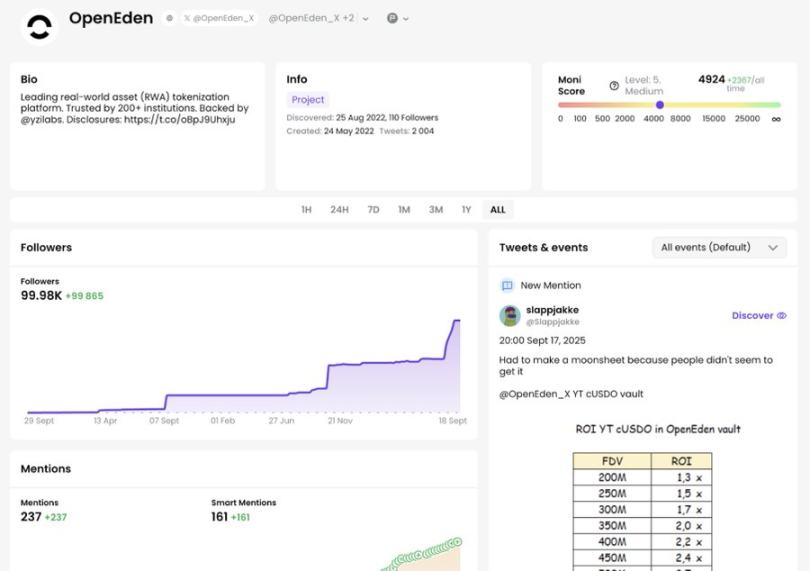

Community & Market Sentiment

Score: 7.5/10

Strong performance among institutional and DeFi-native users; weaker in retail or viral appeal. Events like OpenSeason are boosting engagement.

Market Background

- Narrative Heat: RWA is one of the hottest narratives for 2025. (Final score +0.5)

- Market Sentiment: The market is in the "greed" zone, and altcoin season has arrived. (Final score +0.5)

- Competition: Fierce competition for retail mindshare, especially in the RWA category. (Final score -0.5)

Adjustment: Overall +0.5

OpenEden Final Score: 8.27

- Product: 8.85/10

- Tokenomics: 6.96/10

- Community: 7.5/10

- Market Adjustment: +0.5

Risk Assessment

Bullish Scenario (55% probability):

- The RWA market experiences sustained exponential growth, and OpenEden captures a significant market share.

- Regulatory advantage evolves into an insurmountable competitive moat.

- Institutional adoption accelerates through strategic partnerships with BNY Mellon and Binance.

- EDEN token appreciates due to increased fee revenue.

Base Scenario (20% probability):

- Adoption remains limited to specific institutional verticals.

- Moderate growth observed, but token appreciation is limited.

- Regulatory barriers hinder innovation.

Bearish Scenario (25% probability):

- Traditional financial institutions develop competing solutions.

- Regulatory changes favor larger, incumbent entities.

- Value generated from DeFi integrations falls short of expectations.

- Competition emerges from better-funded or more aggressive market participants.

Key Risks to Monitor:

- Regulatory changes impacting RWA tokenization.

- Competition from traditional finance (e.g., BlackRock, JPMorgan entering the market).

- Risks associated with DeFi protocol integrations.

- The current interest rate environment affecting treasury yields.

Specific Red Flags:

- TVL concentrated among a few large depositors.

- Regulatory compliance costs negatively impacting profitability.

- Token utility limited due to regulatory restrictions.

- Competition from protocol tokens offering superior yields.

Conclusion

OpenEden is positioned for the institutional-grade future of RWA tokenization, offering a fully regulated platform, deeply integrated with DeFi, and backed by partnerships with traditional financial entities.

The investment case for OpenEden is strong due to:

- Proven product-market fit: evidenced by over $517 million in TVL.

- Regulatory moat: a significant barrier to entry for competitors, nearly impossible to replicate.

- Institutional partnerships: providing sustainable competitive advantage.

- DeFi composability: enabling yield optimization and broader adoption.

OpenEden is not a speculative project, but an infrastructure investment aimed at connecting traditional finance and DeFi.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Starting this Thursday, the United States will fill in missing employment data and release a new batch of economic data

The United States will fill in missing employment data and release new economic data. The Coinbase CEO is looking forward to progress in crypto regulatory legislation. Market participants predict the market is nearing a bottom. Phantom has launched a professional trading platform. Trump hints that the candidate for Federal Reserve Chair has been decided. Summary generated by Mars AI This summary was generated by the Mars AI model, which is still being iteratively updated for accuracy and completeness.

Countdown to a comeback! The yen may become the best-performing currency next year, with gold and the US dollar close behind

A Bank of America survey shows that more than 30% of global fund managers are bullish on the yen's performance next year, with undervalued valuations and potential central bank intervention possibly paving the way for its rebound.

Gemini 3 arrives late at night: surpasses GPT 5.1, the era of Google large models has arrived

Google has defined it as an “important step towards AGI” and emphasized that it is currently the world’s most advanced agent in terms of multimodal understanding and depth of interaction.

Trending news

MoreBitget Daily Digest (Nov 19) | SEC Removes Special Section on Digital Assets; Bitcoin Drops Below $90,000 with Over 170,000 Traders Liquidated; Solana ETF Launches Today

Mars Morning News | Starting this Thursday, the United States will fill in missing employment data and release a new batch of economic data