This Altcoin Crumbled The Last Time Washington Shut Down

Ripple’s XRP faces renewed pressure as another U.S. shutdown unfolds. With past declines during shutdowns and bearish market signals, the token risks slipping further unless buying interest revives.

Ripple’s XRP finds itself in a critical situation as the US government commences another shutdown period.

The altcoin’s value plunged sharply during the last two shutdowns, falling 12.8% and 12.45%, respectively, raising concerns among traders about the token’s performance during this current shutdown period.

History Points To Highlights XRP’s Vulnerability During Shutdowns

Based on CoinGecko’s historical data, XRP experienced notable declines during past shutdowns. In 2018, during the brief three-day shutdown from January 20 to 22, XRP’s price plunged from about $1.56 to $1.36, falling by 12.8%.

Similarly, during the 35-day shutdown from December 22, 2018, to January 25, 2019, the longest in US history, the token’s price fell from approximately $0.3623 to $0.3172, logging a 12.45% drop.

The current shutdown comes at a time when broader crypto market sentiment is already weak. XRP has been trading largely sideways over the past week, its price performance muted by falling demand.

This lack of momentum leaves the token vulnerable to further downside should the shutdown drag on.

In addition, six firms—including Grayscale and 21Shares—have filed for spot XRP exchange-traded funds (ETFs). Many of these applications face imminent deadlines next week.

Any slowdown in regulatory processing caused by the shutdown could push back approval timelines, further dampening investor sentiment and potentially triggering renewed selling pressure.

XRP’s Bearish Indicators Hint at History Repeating Itself

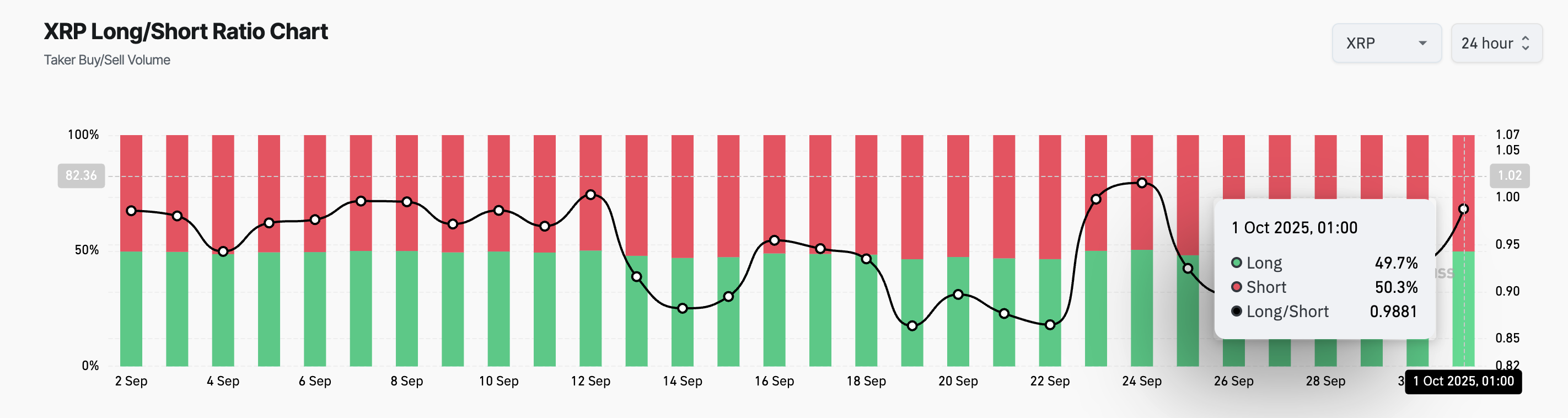

Beyond the macro headwinds, XRP’s derivatives market data support this bearish outlook. At press time, its long/short ratio is below one at 0.98.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

XRP Long/Short Ratio. Source:

XRP Long/Short Ratio. Source:

The long/short ratio measures the proportion of long bets to short ones in an asset’s futures market. A ratio above one signals more long positions than short ones. This indicates a bullish sentiment, as most traders expect the asset’s value to rise.

Conversely, as with XRP, a ratio below means there are more short than long positions in the market. This shows that the overriding bias towards the altcoin is negative, putting its price at risk of declines.

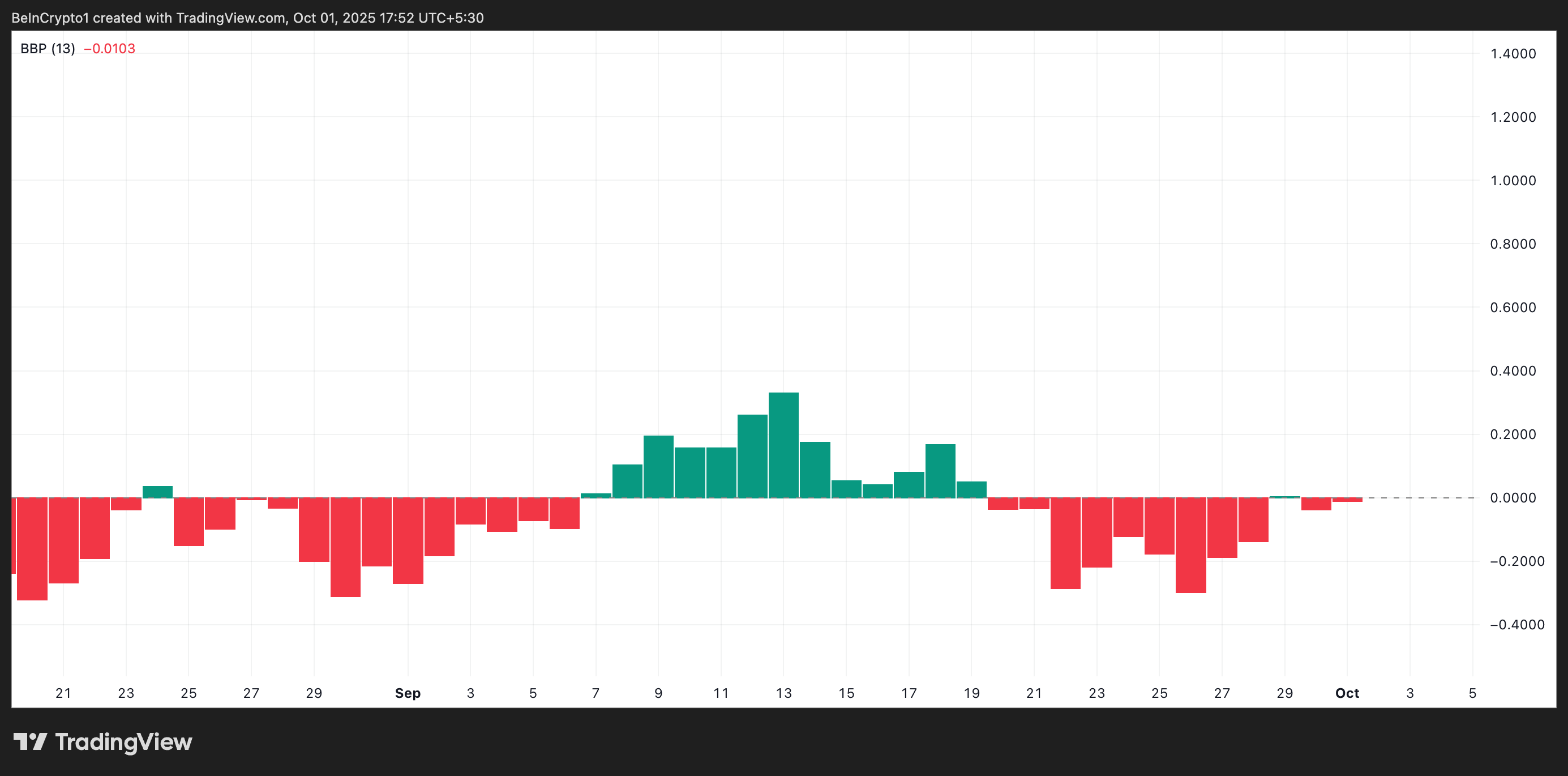

Furthermore, on the daily chart, XRP’s Elder-Ray Index continues to show persistent negative readings, indicating weakening bullish momentum. At press time, this momentum indicator is at -0.0103.

XRP Elder-Ray Index. Source:

XRP Elder-Ray Index. Source:

The Elder-Ray Index indicator measures the strength of bulls and bears in the market by comparing buying pressure (Bull Power) and selling pressure (Bear Power).

When the value is positive, the market is experiencing more buying pressure than selling, suggesting a potential uptrend.

On the other hand, when its value is negative like this, the bears have the upper hand, and token distribution is strong.

XRP Could Slip to $2.57—Or Breakout Toward $3.28

Without renewed buying interest, XRP could see additional price pressure in the coming sessions. In this scenario, it could breach its immediate support at $2.7845 and tumble toward $2.5777.

XRP Price Analysis. Source:

XRP Price Analysis. Source:

On the flip side, if demand returns to the market, it could break above the price wall at $2.99 and climb to $3.28.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Alert! Yen rate hike may trigger short-term selling pressure on Bitcoin, but the mid- to long-term narrative remains stronger

The article analyzes the contrast between expectations of a Bank of Japan rate hike and the market's bearish stance on the yen. It explores the indirect impact mechanism of yen policy on bitcoin and predicts bitcoin's trends under different scenarios. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still in an iterative update phase.

The most crucial year! The market is deeply manipulated, and this is the real way whales make money.

Social Sentiment Turns Bearish For XRP