Bitget exec sees ‘no logical reason’ for an altcoin season this cycle

The crypto markets are unlikely to see an altcoin season where “everything will go up,” as many traders are now focused on narrower trends or are just focusing solely on Bitcoin, according to Bitget operating chief Vugar Usi Zade.

“I don’t think there will be an altseason,” Usi Zade told Cointelegraph at the Token2049 conference in Singapore on Wednesday.

“The whole idea that ‘this is altseason [...] and everything will go up because it’s altseason,’ we won’t see that, and I’m very firm in that.”

“I don’t think we will see that huge pump, unfortunately, because there’s no logical reason behind it,” he added.

“There haven’t been any technological advancements. We haven’t seen any big things coming out of projects. Why would the price go up? Just because now it is the time? It’s not.”

Historically, altcoins — crypto tokens other than Bitcoin (BTC) — have rallied alongside Bitcoin. Altcoin season refers to the period when altcoins surpass Bitcoin due to their larger risk-to-reward ratios.

Crypto “seasons” over as Bitcoin decouples

Usi Zade said the crypto market is “moving very much away from seasons,” with shorter, more frequent cycles as the crypto market no longer trades in tandem with Bitcoin.

“Bitcoin is its own rally; its impact is almost zero on the rest of the market,” he added. “Bitcoin decoupled not only from the stock market, but it also decoupled from altcoins.”

“We’ve seen so many instances that Bitcoin is the only one in the green, and then the entire market is red. Money is not flowing from Bitcoin down to the alts.”

It’s likely that crypto rallies, or seasons, will start to be based around popular narratives, with only those tokens involved in the sector that’s trending seeing gains, Usi Zade said.

“Today, we talk about RWA [real world assets], probably there will be a portfolio of RWAs going up, but that doesn’t extend to anything else,” he said.

Market attitude change needed for sustainable altcoins

Usi Zade said that crypto investors think in short cycles, making it “almost impossible” for projects to sustain themselves in the long term, as the market expects them to be profitable within a matter of months.

“It took Amazon more than 10 years to become profitable, and now we want a crypto venture to do that in eight months,” he said. “That is the biggest problem, the way the entire market is built.”

He said traditional businesses often see their initial investors sell to other venture firms when exiting, which helps keep companies flush with capital. However, with crypto, it “happens the other way around” with tokens immediately available to retail investors.

“The token is a separate product. You need to work with the traders and make sure that you are traded and your price doesn’t go down because when your price reaches virtually zero, your product, or your project, is dead, and there’s almost no way to bring it back,” Usi Zade said.

Bitcoin is becoming the only recommendation

Usi Zade said that many in crypto are now recommending newcomers to only hold Bitcoin and are shirking the widely promoted portfolio allocation of 70% Bitcoin and 30% Ether (ETH).

“Now, no one tells you Bitcoin and Ethereum anymore,” he said. “Everyone will tell you just Bitcoin.”

He added that Ether’s price is “much more stable” compared to Bitcoin, which has continued to rally to new highs for nearly a year, leaving investors with “no motivation” to buy ETH.

Bitcoin and Ether’s market dominance have remained relatively stable over the past year. Bitcoin currently maintains a 58% market share, down from a 12-month peak of 65%, while ETH’s market share is 12% gaining from multi-year lows of 7.3% in April, per CoinMarketCap

Trade Secrets: Bitcoin to see ‘one more big thrust’ to $150K, ETH pressure builds

Additional reporting by Ciaran Lyons.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana News Update: Major Institutions Invest Billions While Solana Boosts Its Scarcity Approach

- Solana developers propose reducing future SOL emissions by 22M tokens to accelerate disinflation, targeting 1.5% terminal inflation twice as fast. - Institutional adoption grows via staking-enabled ETFs like VanEck's and Bitwise's BSOL , creating dual-income streams through exposure and yield. - Despite $424M in BSOL assets, Solana's price fell below $140 support, with derivatives data signaling short-term selling pressure and crowded long positions. - Coinbase's Vector acquisition enhances Solana's inst

Bitcoin Latest Updates: Macroeconomic Factors and Earnings Challenges Drive 44% DeFi Downturn

- Market analysts predict a 44% correction in DeFi and crypto sectors due to macroeconomic risks, Fed policy uncertainty, and weak corporate earnings. - HIVE Digital faces scrutiny over Bitcoin holdings reduction and shareholder dilution, while Hyster-Yale reports Q3 losses amid industry margin pressures. - Data center infrastructure emerges as a growth outlier with $11.1B backlog and $320B 2030 market projection, though labor shortages and permitting delays persist. - Goldman Sachs adjusts energy sector o

Ethereum Updates Today: Institutional Confidence Faces Challenges Amid Ethereum's Price Fluctuations and Upcoming Upgrades

- Galaxy Digital's 7,098 ETH withdrawal from Binance raises concerns over Ethereum's institutional activity and market stability amid macroeconomic pressures. - ETH faces $993M long liquidation risk below $2,600 and $1.07B short liquidation risk above $2,900, highlighting leveraged position fragility. - Institutional staking inflows remain steady despite declining ETH futures open interest (-7% weekly) and reduced ETF net inflows ($10M vs. $65M in October). - Upcoming Dencun upgrade (EIP-4844) aims to redu

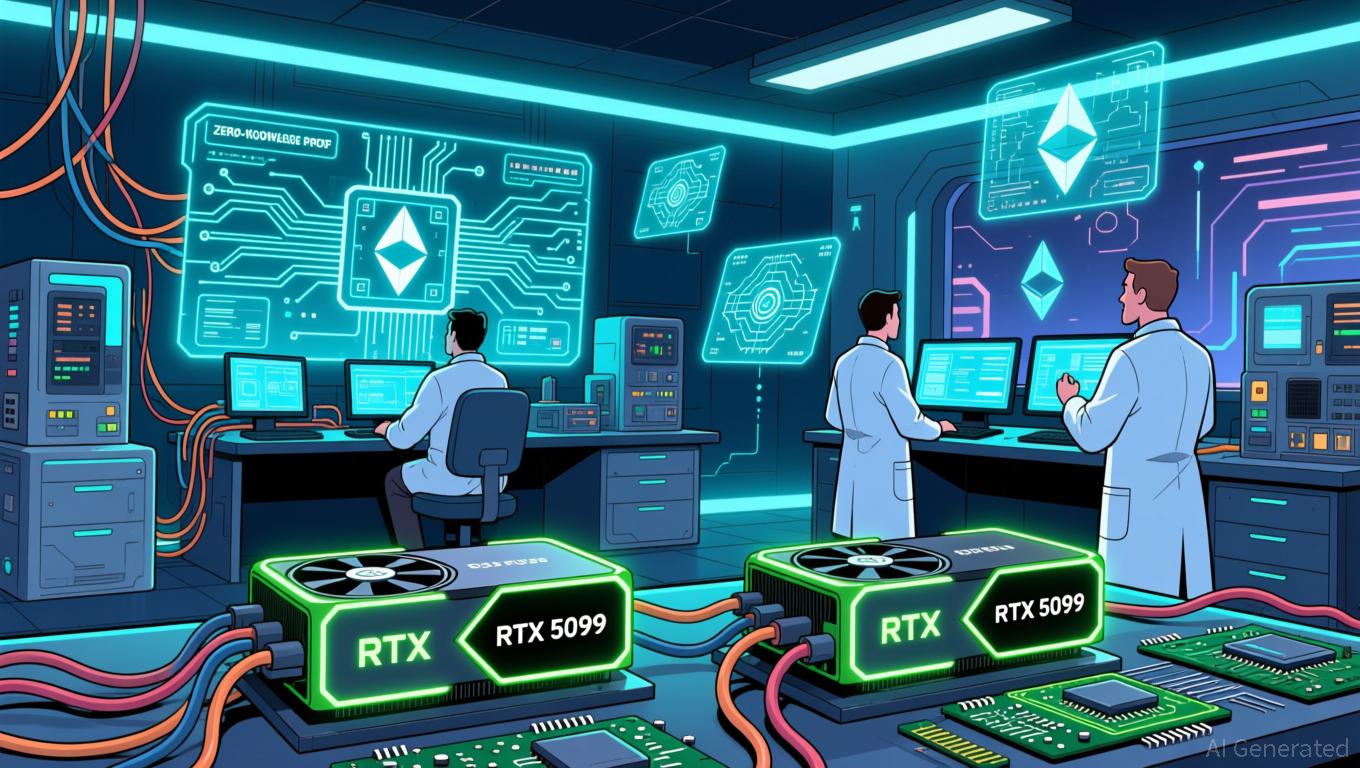

Ethereum Updates: Consumer Graphics Cards Drive Cost-Effective and Decentralized Ethereum Scaling

- zkSync's Airbender prover achieved L1 block proofs using two RTX 5090 GPUs, praised by Vitalik Buterin as a "huge milestone" for Ethereum's scalability. - The breakthrough enables "gigagas L1" expansion, potentially reducing fees and enabling near-zero L2 costs through consumer-grade hardware accessibility. - Succinct's SP1 Hypercube demonstrated 99.7% real-time L1 proving under 12 seconds with 16 RTX 5090s, advancing ZK tech alongside zkSync's progress. - Buterin cautioned against over-optimism, noting