Metaplanet Bitcoin Revenue Jumps 115.7% as Stock Plunges 67.5% in Q3

Tokyo-based Metaplanet reported record Bitcoin revenue growth in Q3 2025 and exceeded its 30,000 BTC accumulation goal. Yet, despite becoming the fourth-largest public Bitcoin holder, the company’s stock sank 67.5%, exposing a gap between operational success and market confidence.

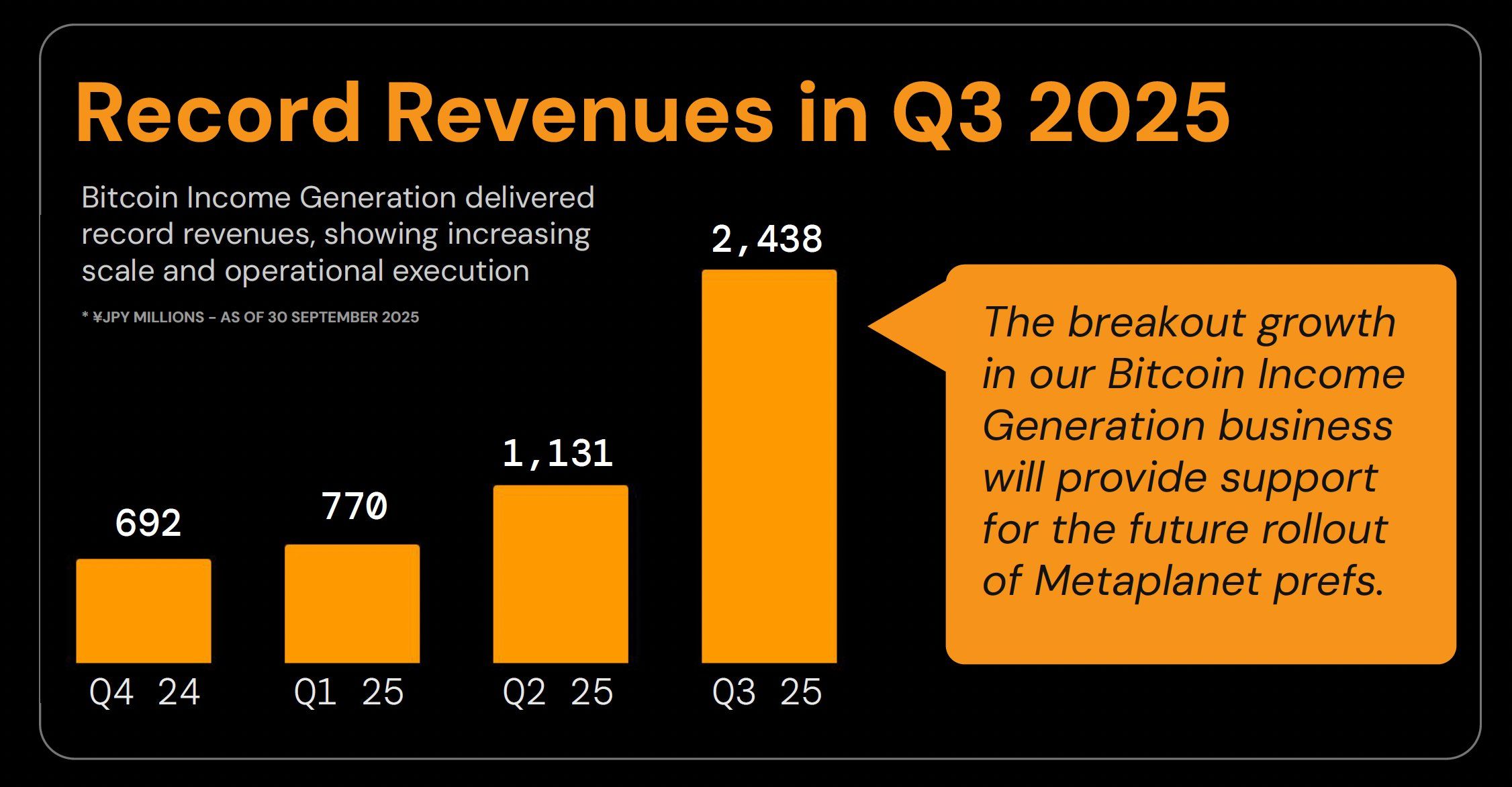

Tokyo-based Metaplanet reported record Bitcoin (BTC) Income Generation revenues in its third-quarter results for fiscal year 2025, with revenue surging 115.7% compared to the previous quarter.

Furthermore, the company revealed it has already exceeded its annual BTC accumulation target. Given this performance, Metaplanet also raised its full-year revenue and operating profit forecasts.

Metaplanet Q3 Bitcoin Revenue Jumps 115.7%, Doubles Full-Year Forecast

CEO Simon Gerovich revealed that in Q3 the firm pulled in ¥2.438 billion ($16.56 million) from its Bitcoin Income Generation segment. This was more than double the ¥1.131 billion (7.69 million) recorded in Q2. Furthermore, the firm’s revenue has a notable 216.6% increase.

Metaplanet’s Bitcoin Revenue. Source:

X/Simon Gerovich

Metaplanet’s Bitcoin Revenue. Source:

X/Simon Gerovich

On the back of these results, the Tokyo-based firm doubled its full-year revenue forecast to ¥6.8 billion, up from ¥3.4 billion previously projected. It also raised its operating profit guidance to ¥4.7 billion from ¥2.5 billion.

The revisions represent a 100% increase in expected revenue and an 88% jump in projected profit compared to earlier estimates. This signals growing confidence in the company’s core strategy of positioning Bitcoin at the center of its financial model.

“Q3 results demonstrate operational scalability and strengthen the financial foundation for our planned Metaplanet preferred share issuance, which supports our broader Bitcoin Treasury strategy,” Gerovich wrote.

Besides the revenue milestones, in Q3, Metaplanet also completed its target of accumulating 30,000 Bitcoins by 2025. As of September 30, the company held 30,823 Bitcoins.

The latest purchase of 5,268 BTC for approximately $615.67 million pushed the firm’s holdings past the target. Furthermore, the stack positions Metaplanet as the fourth-largest publicly listed Bitcoin holder globally.

🪜Metaplanet is now the 4th largest publicly-traded Bitcoin treasury company in the world pic.twitter.com/kg8quw2JYR

— Simon Gerovich (@gerovich) October 1, 2025

Now, it only trails behind (Micro) Strategy, Tesla, and XXI, according to industry tracker BitcoinTreasuries. Moreover, Metaplanet’s Bitcoin treasury represents over 0.1% of the cryptocurrency’s total supply.

The company’s year-to-date Bitcoin yield now stands at 497.1%, with an overall average acquisition cost of $107,912 per Bitcoin across its holdings.

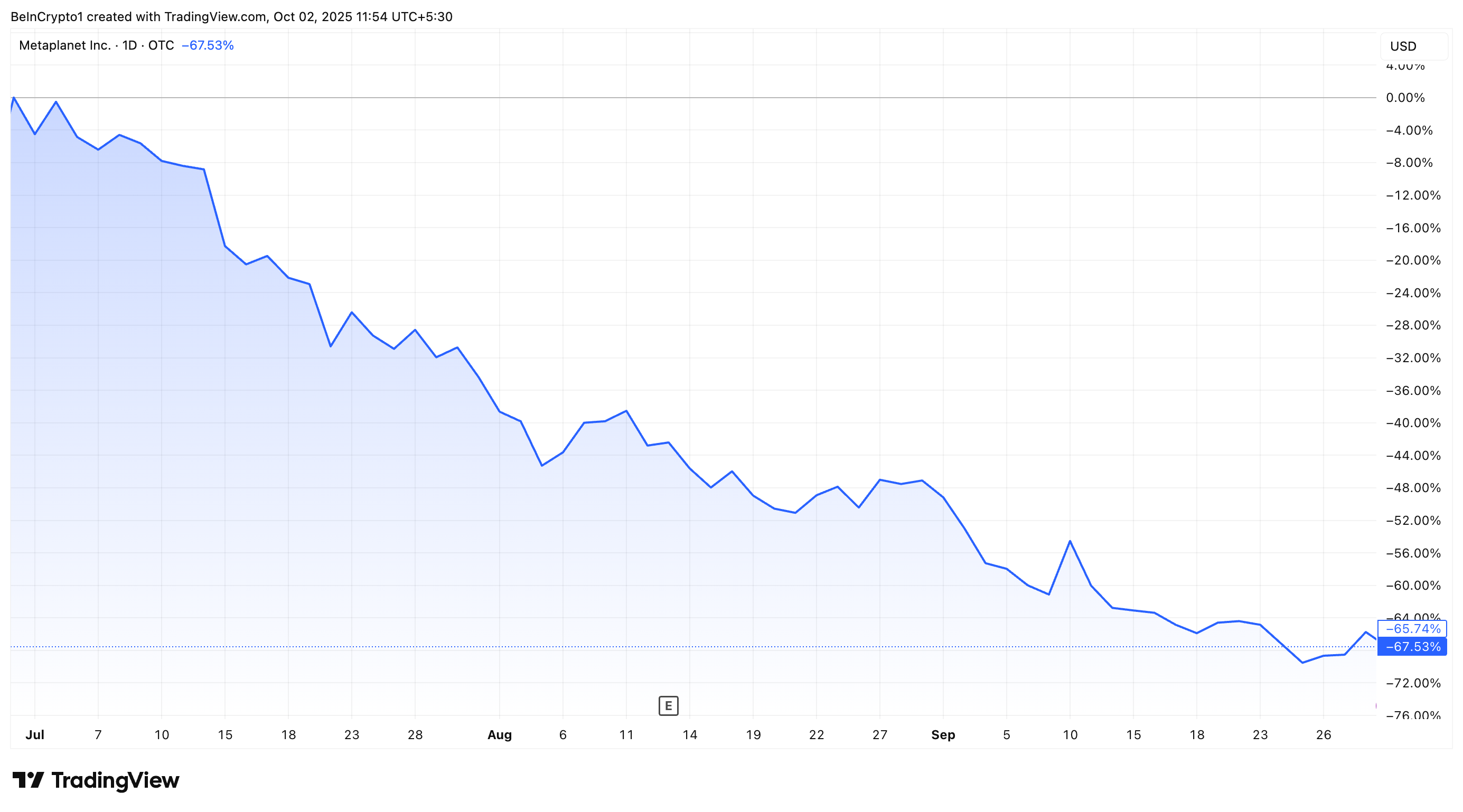

Despite operational success in Q3, the stock performance revealed a completely different picture. Market data revealed that stock prices dipped 67.5% between July and September.

Metaplanet Stock Performance In Q3. Source:

TradingView.

Metaplanet Stock Performance In Q3. Source:

TradingView.

In contrast, Coinglass data showed that Bitcoin itself closed Q3 with a 6.31% gain. The sharp sell-off underlines the challenge Metaplanet faces in aligning its operational achievements with investor confidence, even as it cements its role as one of the world’s largest corporate Bitcoin holders.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.