Zcash rallied after a high-profile endorsement and technical upgrades, jumping from about $53 to $154 in one week as traders bought into the financial privacy narrative. ZEC’s surge was driven by Naval Ravikant’s endorsement, futures market froth, and a planned NU7 upgrade promising quantum-proof features.

-

ZEC surged 62% in one day and doubled for the week

-

Catalysts: Naval Ravikant endorsement, privacy narrative, NU7 upgrade

-

Warning signs: CryptoQuant “overheating” and ~$21M Exchange Netflow

Zcash rally: ZEC price doubled after Naval Ravikant’s endorsement; monitor futures and exchange flows for possible pullback. Read how traders are reacting.

Why did Zcash rally this week?

Zcash rally accelerated after investor Naval Ravikant publicly described ZEC as “insurance against Bitcoin,” rekindling the financial privacy narrative. The endorsement, combined with anticipation around the NU7 upgrade and heavy futures activity, pushed ZEC from roughly $53 to a three-year high above $150.

How large was the price move and where did it peak?

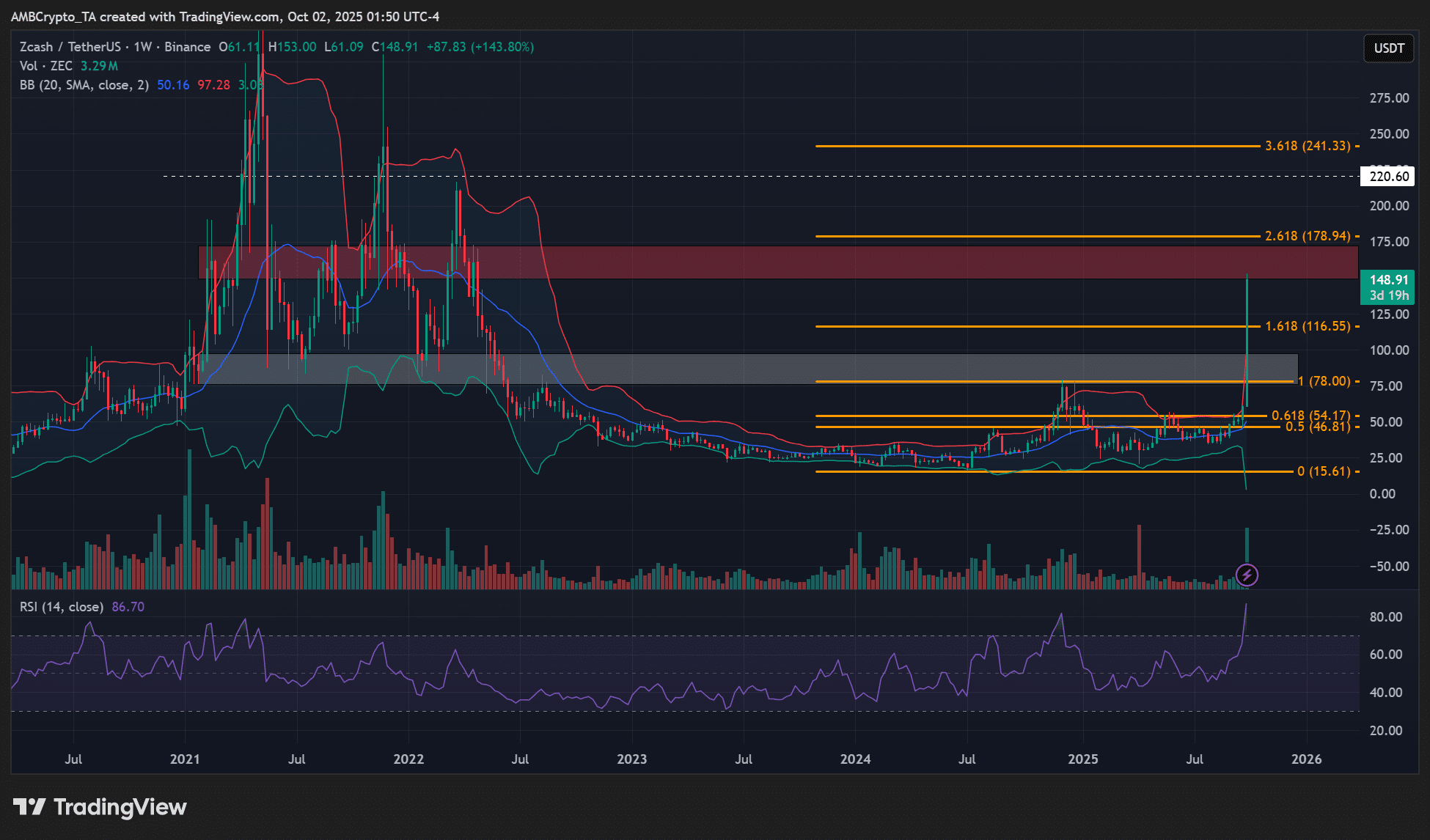

On 1 October ZEC jumped ~62% intraday and extended gains to more than double for the week. The price moved from about $53 to a three-year high near $154.4 on major exchanges, according to TradingView price data.

Source: ZEC/USDT, TradingView

Who amplified the move and what did they say?

Renowned investor Naval Ravikant publicly endorsed ZEC on social media, saying: “Bitcoin is insurance against fiat. ZCash is insurance against Bitcoin.” That quote triggered renewed retail and institutional interest in privacy-focused coins.

Source: X (public posts)

Will the uptrend continue?

ZEC price momentum can persist if the financial privacy narrative and technical upgrades maintain traction. However, on-chain metrics show elevated futures activity and exchange flows consistent with late-stage rallies, which raises the risk of a short-term correction.

Is Zcash’s pullback likely?

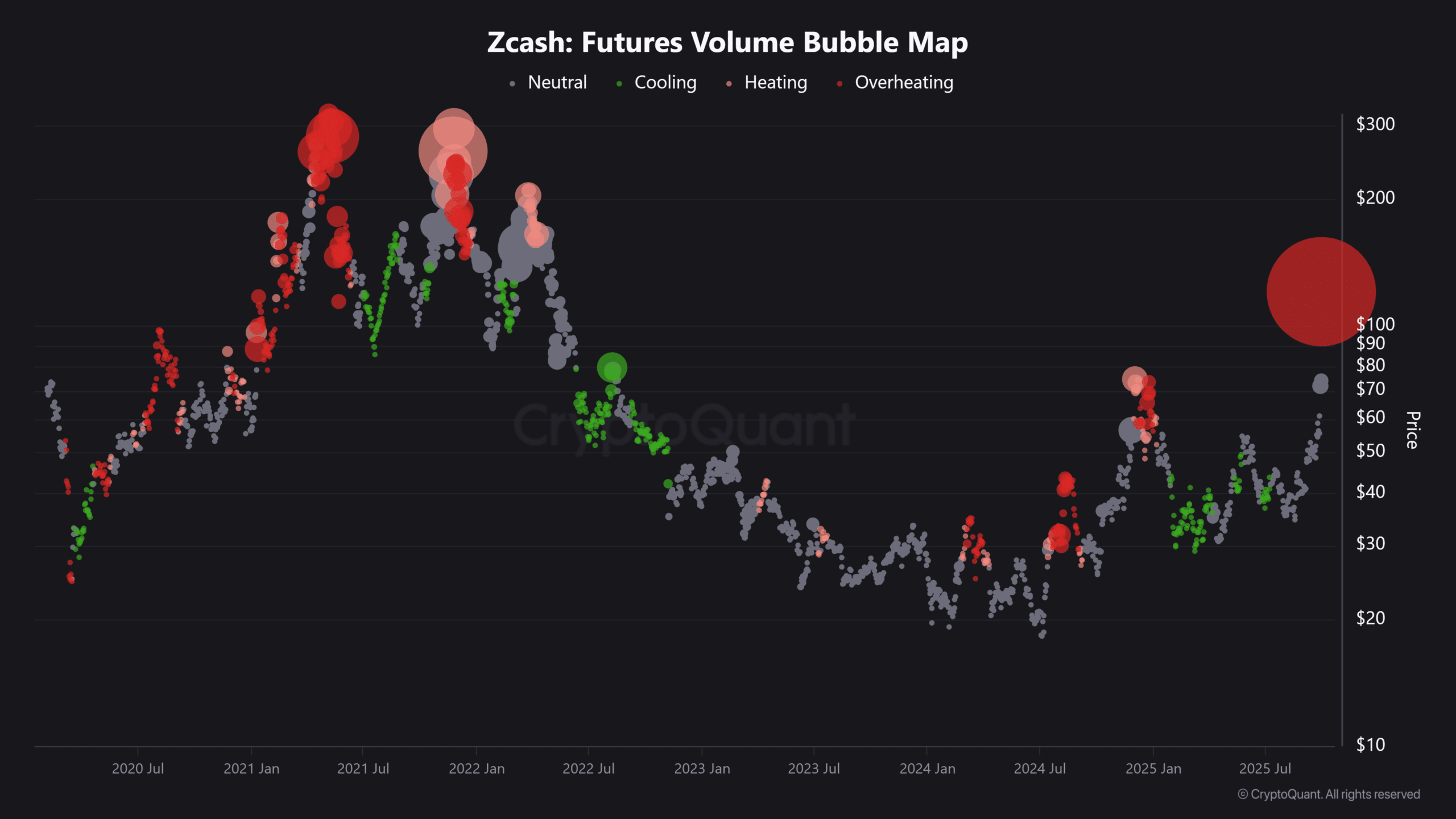

CryptoQuant’s Futures Volume Bubble Map flagged ZEC in an “overheating” phase, historically associated with local tops. Similar readings preceded local highs in 2024. Combined with heavy exchange outflows, the data point to a meaningful chance of a near-term pullback or consolidation.

Source: CryptoQuant

What do exchange flows and futures data indicate?

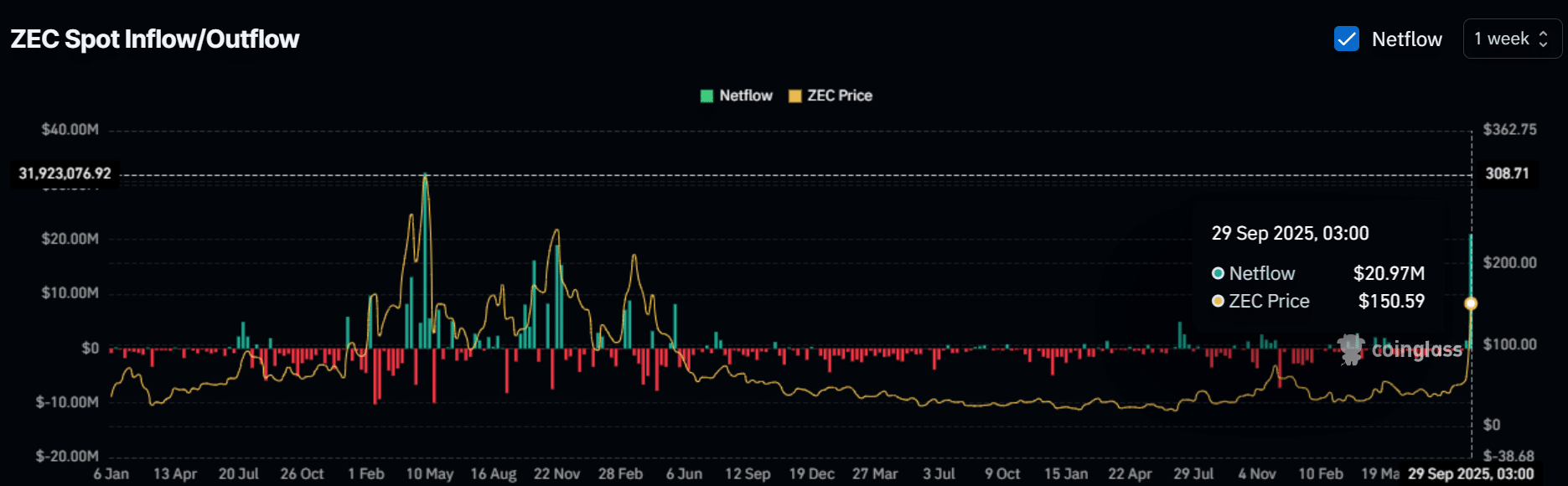

CoinGlass data recorded roughly $21 million in Exchange Netflow this week, signaling more selling than accumulation. Historically, weekly netflows in the $20–$30M range have coincided with local and cycle tops for similar assets.

Source: CoinGlass

How should traders and investors respond?

Short-term traders should monitor futures funding, Open Interest, and Exchange Netflow for signs of liquidation pressure. Long-term investors focused on privacy technology may view a pullback toward ~$100 as a potential buying opportunity if fundamentals and the upgrade roadmap hold.

Frequently Asked Questions

What triggered Zcash’s rapid price increase?

The immediate trigger was Naval Ravikant’s endorsement and renewed attention to financial privacy, combined with positive sentiment around the upcoming NU7 upgrade and elevated futures activity.

How risky is buying ZEC after the surge?

Buying at peak levels carries elevated risk; on-chain indicators like CryptoQuant’s overheating signal and ~$21M weekly Exchange Netflow suggest the possibility of a correction or consolidation.

What is NU7 and why does it matter?

NU7 is a planned Zcash network upgrade intended to add quantum-resistant signatures and speed improvements. Technical upgrades can strengthen long-term fundamentals but do not guarantee immediate price appreciation.

Key Takeaways

- Rapid rally: ZEC more than doubled after a high-profile endorsement and upgrade anticipation.

- On-chain warning signs: CryptoQuant overheating and ~$21M Exchange Netflow signal possible pullback.

- Trading plan: Short-term caution advised; a pullback to ~ $100 may present a buying opportunity for long-term privacy proponents.

Conclusion

The Zcash rally was driven by a renewed financial privacy narrative, a public endorsement from Naval Ravikant, and optimism about the NU7 upgrade. While momentum could continue, on-chain and futures metrics point to elevated risk of a short-term pullback. Monitor exchange flows and funding rates for clearer signals.