Lighter Launches Public Mainnet With ZK-Powered Perp DEX on Ethereum L2

Lighter has launched its public mainnet after eight months in private beta, entering the competitive perpetual decentralized exchange (perp DEX) sector. The company announced the rollout on October 2. Its platform enables low-cost, low-latency perpetuals trading with custom zero-knowledge (ZK) circuits. These cryptographic systems validate transactions without exposing underlying data. They allow verifiable matching and

Lighter has launched its public mainnet after eight months in private beta, entering the competitive perpetual decentralized exchange (perp DEX) sector.

The company announced the rollout on October 2. Its platform enables low-cost, low-latency perpetuals trading with custom zero-knowledge (ZK) circuits. These cryptographic systems validate transactions without exposing underlying data. They allow verifiable matching and liquidations.

Public Launch After Beta

Built as an Ethereum layer 2 (L2), Lighter combines high-frequency performance with onchain transparency. The project published audit reports showing that its smart contracts and ZK infrastructure underwent external review. According to the team, this design balances scalability and security while keeping custody in user control.

The Lighter public mainnet is live after 8 months of private beta! Trade perpetuals with low costs and low latency on Ethereum L2 with custom ZK circuits for verifiable matching and liquidations. Experience onchain trading at the performance grade of high frequency finance.

— Lighter (@Lighter_xyz) October 1, 2025

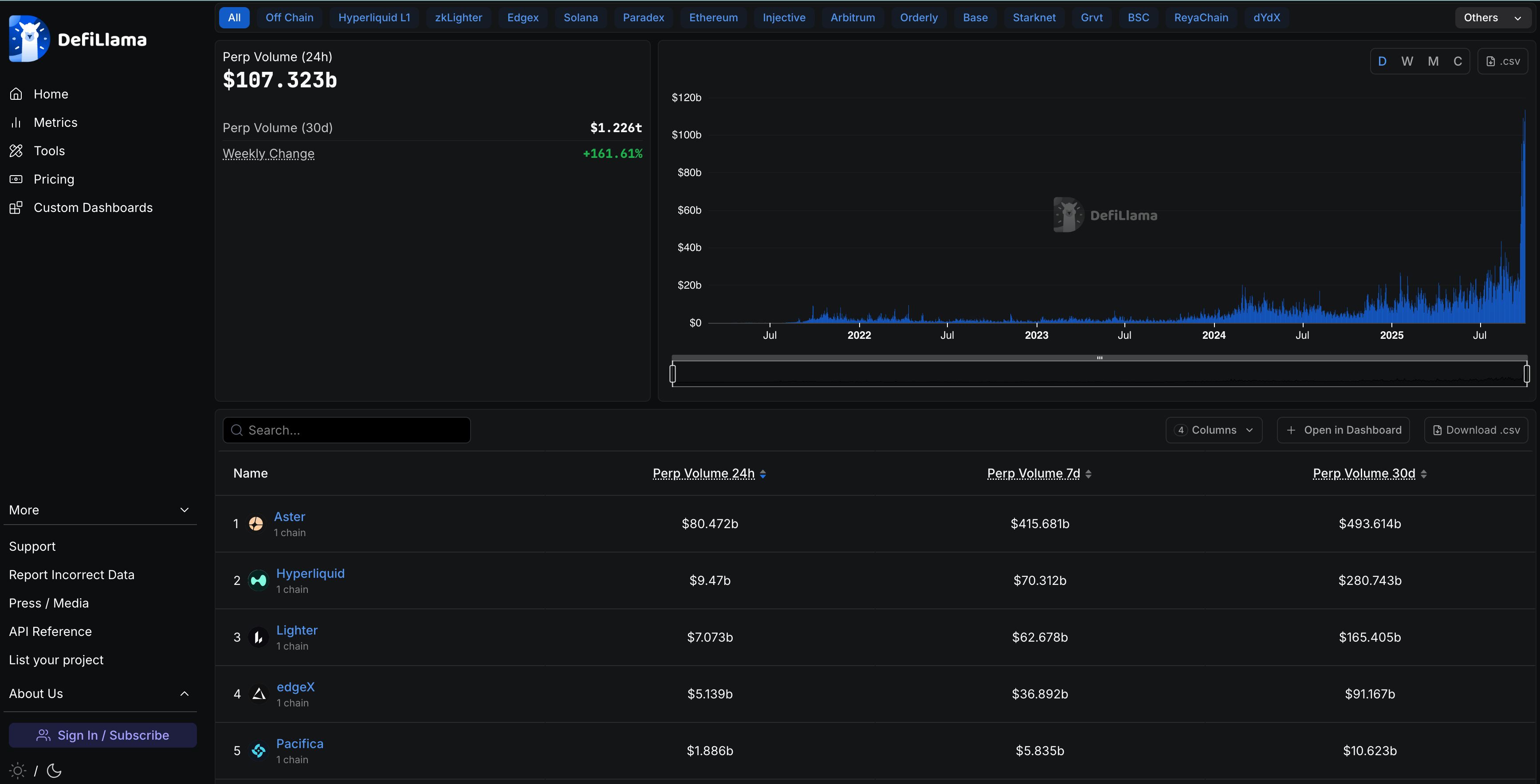

According to DefiLlama, monthly trading volume on perpetual DEXs surpassed $1 trillion for the first time in September. It reached $1.143 trillion, nearly a 50% increase from the prior month.

Source: DefiLlama

Source: DefiLlama

Several protocols, including Hyperliquid, Aster, and Lighter, each recorded more than $100 billion in 30-day volume. This shows that decentralized derivatives are becoming central to on-chain liquidity.

User Growth, Incentives, and Market Risks

Lighter closed its first points season and began a second, set to run through late 2025. Deposit caps and referral requirements have been lifted. An invite-based rewards program continues. Accounts have expanded to 188,000, with 50,000 daily active users compared with just 100 during early beta.

Retail traders face no fees. API-driven high-frequency firms now pay charges. The protocol also introduced rules to curb wash trading and Sybil attacks.

Robinhood CEO Vlad Tenev called Lighter a step forward for decentralized infrastructure. BitMEX founder Arthur Hayes framed it as an experiment in on-chain high-frequency finance. Supporters argue these features show maturity. Analysts at Gate contend that liquidation transparency and margin efficiency remain weaker than centralized standards.

Decentralized perpetuals processed more than $2.6 trillion in 2025. The same analysis flagged ongoing transparency concerns. Another report observed that daily trading volumes above $100 billion fueled systemic risk debates. A separate study highlighted how airdrop incentives, including Lighter’s, are influencing user behavior.

Bitwise’s Max Shannon previously told BeInCrypto that the addressable market is already enormous and could expand quickly if DEXs keep gaining share from centralized exchanges.

“CEXs processed about $16 trillion over the past year. Because leverage and trading churn boost turnover, perp DEX volumes can scale faster than spot. If market share rises from 30% to 50%, annual DEX volumes could reach $20 trillion within five years. At 75% share, they could reach $30 trillion. These assumptions match recent trends and are reinforced by favorable regulation, stablecoin and exchange IPOs, and growing institutional adoption,” he said.

Gate analysts also identified five persistent risks in the sector. These include liquidity mirages, hidden costs, and inefficient margin systems. Whether Lighter becomes a pillar of DeFi liquidity or faces headwinds may depend less on cryptographic design than on how regulators and traders balance speed with trust.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Macroeconomic structural contradictions are deepening, but is it still a good time for risk assets?

In the short term, risk assets are viewed bullishly due to AI capital expenditures and affluent consumer spending supporting earnings. However, in the long term, caution is advised regarding structural risks brought by sovereign debt, demographic crises, and geopolitical restructuring.

a16z predicts four major trends will be announced first in 2026

AI is driving a new round of structural upgrades in infrastructure, enterprise software, health ecosystems, and virtual worlds.

Bitcoin FOMO trickles back at $94K, but Fed could spoil the party

Beyond Cryptocurrency: How Tokenized Assets Are Quietly Reshaping Market Dynamics

Tokenization is rapidly becoming a key driving force in the evolution of financial infrastructure, with an impact that may go beyond short-term fluctuations, reaching the deeper logic of market structure, liquidity, and global capital flows.