Key Notes

- Treasury managers accumulated 3.4 million ETH worth $14.6 billion during Q3, favoring yield-bearing assets over Bitcoin.

- Ethereum's market cap reached $522 billion, closing the gap with Bitcoin's $2.3 trillion valuation by capturing 10% share.

- Technical indicators show bullish momentum with resistance at $4,500 and potential upside targets toward $4,750 in October.

Ethereum ETH $4 391 24h volatility: 2.0% Market cap: $530.04 B Vol. 24h: $39.89 B price closed trading at $4,150 on Sept. 30, before advancing another 5% to $4,320. Historical trading patterns show ETH has now outperformed Bitcoin BTC $119 065 24h volatility: 2.0% Market cap: $2.37 T Vol. 24h: $65.71 B for the second consecutive month, driven by investor demand for yield-bearing assets.

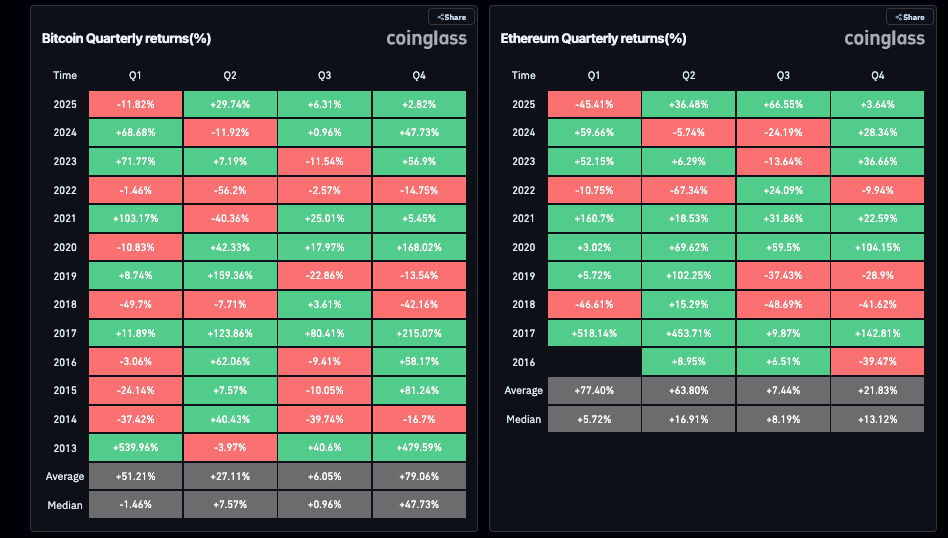

Ethereum (+66.8%) Outperforms Bitcoin (+6.3%) in Q3 2025 | Source: Coinglass

According to Coinglass data , Ethereum surged 66.8% in Q3 2025, building on a 36.5% rally in Q2. By contrast, Bitcoin delivered only 6.3% in Q3, closing around $114,000 on Sept. 30, despite broader macroeconomic optimism and institutional flows.

The disparity in ETH and BTC price movements signals investors appear willing to accept greater volatility in exchange for yield income and higher upside potential on long-term holdings.

$14.6B Treasury Inflows Propelled Ethereum Price Above BTC in Q3

In terms of key value drivers, Ethereum has witnessed strong fundamentals from network updates, treasury inflows and heightened speculative demand.

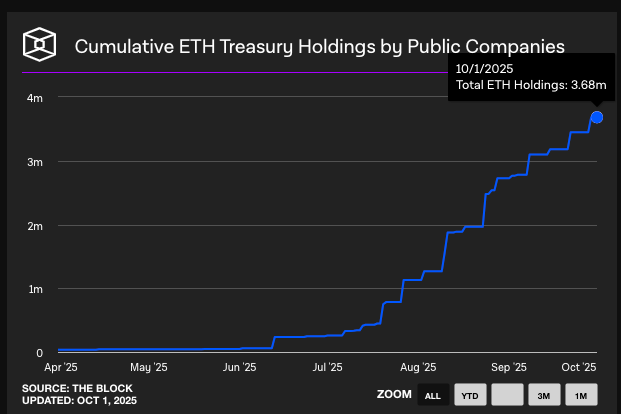

Ethereum treasury inflows remained steady in Q3, propelling ETH momentum ahead of BTC. According to data from TheBlock , Ethereum treasury firms held cumulative balances of 3.68 million ETH as of Oct. 1, having opened with only 257,830 ETH as of July 1.

Ethereum Cumulative Treasury Inflows as of Oct. 1, 2025 | Source: TheBlock

This represents a quarterly net accumulation of 3.4 million ETH, equivalent to $14.6 billion at $4,300 per coin.

With ETH offering yield on locked assets, treasury managers have increasingly allocated funds to Ethereum over BTC. If this preference persists, Ethereum’s $522 billion market cap could continue closing the gap on Bitcoin’s $2.3 trillion valuation after encroaching 10% market share in September.

Moreover, following the leadership shuffle in March 2025, Ethereum Foundation researchers concluded an inquiry into critical challenges within the ecosystem. The team published findings in the Project Mirror report on Sept. 29, further strengthening long-term outlook.

0/ Earlier this year the EF commissioned Project Mirror: a deep dive into perceptions of Ethereum.

The goal was to understand how different audiences view Ethereum, identifying challenges and strengths, and reflect those back to the ecosystem so that we can learn from them.

— Ethereum Foundation (@ethereumfndn) September 29, 2025

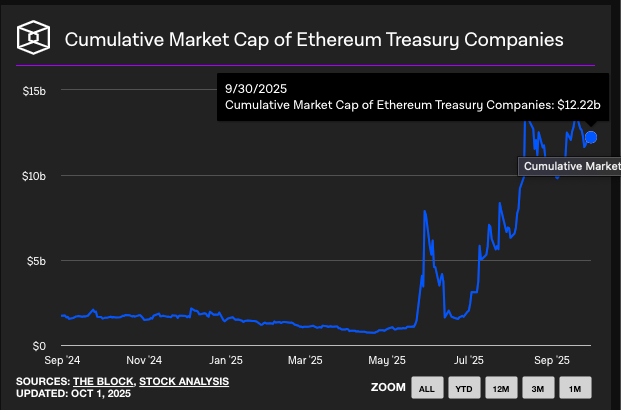

Led by Bitmine (BMNR), the cumulative market cap of the active Ethereum treasury firms rose from $1.6 billion in mid-July to $12.2 billion at press time.

Ethereum Treasury Firms’s Cumulative Market Cap | Source: TheBlock

Such high unrealized gains could attract new entrants, while existing Ethereum treasury firms now sit in stronger financial position to fund future purchases. This places ETH price in line for more gains in October as markets anticipate more rate cuts following the latest US jobs data readings on Oct. 1 .

Ethereum Price Forecast: What’s Next For ETH in October?

Ethereum price held at $4,318 on Oct. 1, adding 5% uptick, after outperforming Bitcoin with a strong 66.8% rally in Q3. The weekly chart below highlights key Ethereum price targets to watch as traders weigh whether momentum can extend toward new highs.

The MACD crossover remains firmly bullish at 501.88, trending above the red signal line at 440.26. Also, the Price Volume Trend (PVT) at 14.04M signals consistent ETH accumulation despite recent volatility, reflecting the $14.6 billion treasury inflows in Q3.

Ethereum (ETH) Technical Price Analysis | Source: TradingView

On the upside, Ethereum price faces resistance at the $4,500 order block zone, marking the upper wedge line. A clean breakout above this level could accelerate gains toward $4,750.

On the downside, immediate support rests at $4,050, coinciding with the lower wedge of the higher order block. A break below this level could trigger a slide toward $3,800, where the last major demand cluster provided relief. Failure there risks a sharper retracement to $3,600, erasing a significant portion of the 66.8% Q3 gains.

Snorter Bot (SNORT)最新动态

作为以太坊在第三季度实现66.8%强劲涨幅后,Snorter Bot(SNORT)逐渐获得市场关注。该基于Telegram的加密货币交易助手融合了热门迷因币的活力与实用的链上交易工具,旨在简化用户的代币管理体验。

Snorter Bot追求操作简便,允许用户直接在Telegram内发现、抢购、交易数字币。其首发将落地Solana网络,依托其高效结算与低手续费优势,同时团队已规划拓展至以太坊与BNB链。项目代币总量上限为5亿枚,致力于为加密散户和迷因币爱好者提供高速去中心化交易体验。

项目最新进展快照

代币价格: $0.1065

已募集资金: $4.211 million

代币简写: $SNORT

支持网络: Solana