Uptober rally builds as on-chain data confirm crypto market strength

The crypto market is rallying after a turbulent week that erased billions from the total market cap and left traders on edge.

- The crypto market kicked off October on a strong note, lifting total value to $4.17 trillion.

- Bitcoin is up $118,000 on the day with a 4% gain, while Ethereum rose 6% to $4,400.

- Other altcoins rallied as well, with the likes of Zcash and Zora posting stronger double-digit gains.

- Analysts believe the bull cycle is still underway, with room for more upside in Uptober.

The uptrend comes as the crypto market stages a broad rebound, with several coins climbing back from recent lows.

Bitcoin ( BTC ) is leading the rebound, surging past $118,000 and gaining roughly 4% in the past 24 hours. Ether ( ETH ) is also back in focus, jumping over 6% to briefly touch $4,400 after sinking to $3,900 during the latest market pullback.

Other major altcoins like Solana ( SOL ) and Binance Coin ( BNB ) rose as well, with SOL climbing 7% to $225, and BNB trading near $1,040. Some smaller-cap altcoins posted even stronger double-digit gains, with Zcash ( ZCASH ) jumping 73% and Zora ( ZORA ) surging nearly 33%.

This rebound is fueled by both price action and renewed sentiment. The total crypto market capitalization is up 4.6% to $4.17 trillion on the day, turning the broader mood from caution to confidence. The ongoing rally comes as anticipation for “Uptober” picks up among traders and market participants, with hopes high for the momentum to hold and push prices to new highs.

On-chain data back Uptober crypto market rally

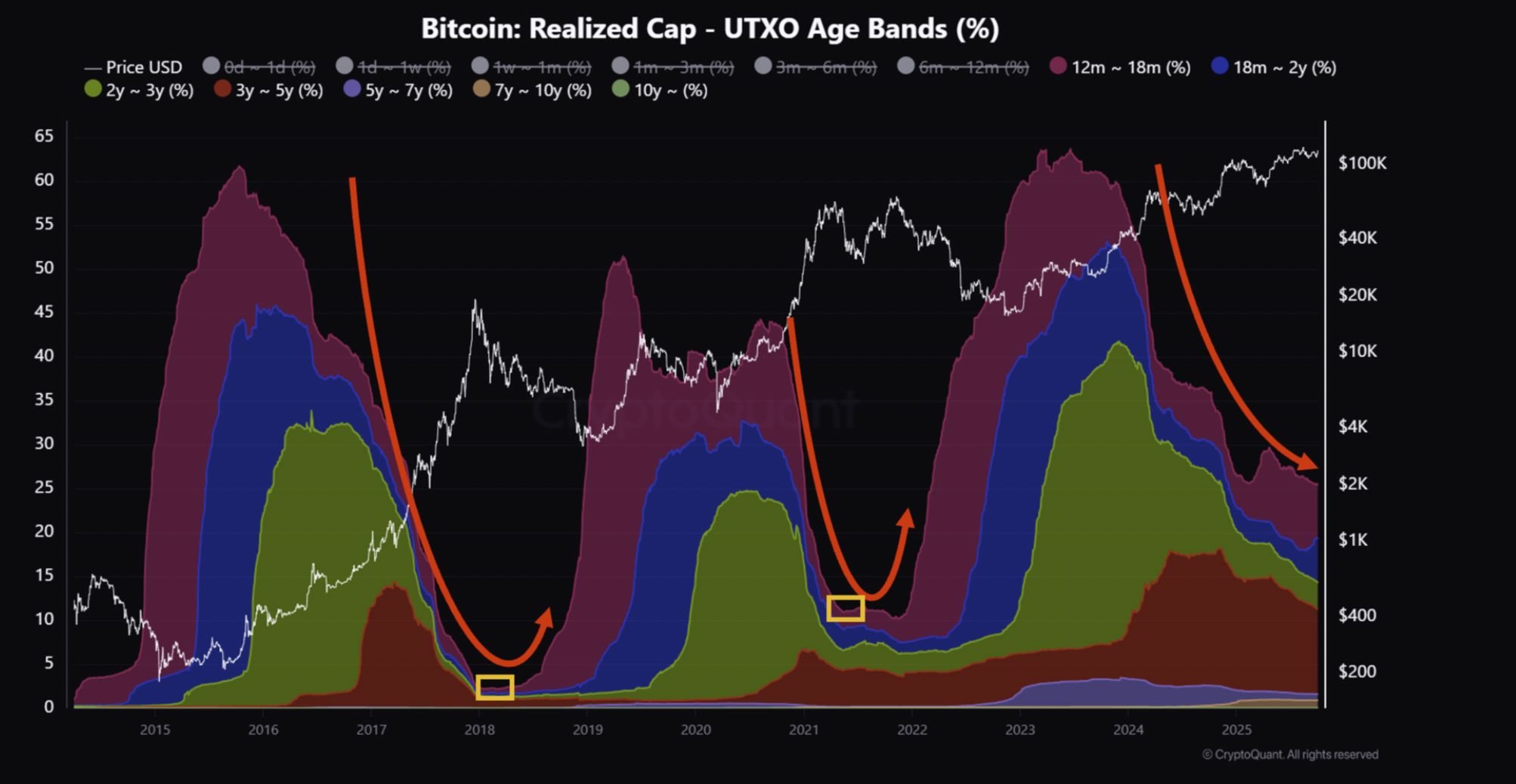

Supporting the outlook, a new CryptoQuant analysis suggests that the crypto market rally may still have room to run. Per the report , the current bull cycle is “slow but still in progress,” with long-term Bitcoin holders gradually reducing their positions but not yet signaling a market top.

Historically, the late stage of a bull run has been marked by a sharp drop in the share of BTC held for more than a year, as early investors sell into strength and new capital flows into the market. That shift has typically signaled the beginning of a transition from bullish momentum to the early stages of a bear cycle.

At present, the share of Bitcoin held long-term is declining at a much slower pace. This suggests the cycle is maturing but has not yet reached its peak.

Bitcoin Realized Cap chart | Source: CryptoQuant

Bitcoin Realized Cap chart | Source: CryptoQuant

“The current market is progressing slowly within the bull cycle, but there are no signs of an imminent end,” the report noted, adding that a stronger upward move could still be ahead.

Price action and on-chain trends together point to a market with more room to grow. While volatility is likely to persist, signals suggest October’s rally is supported by long-term strength rather than short-term speculation.

If history holds, this month could again prove to be a major one for Bitcoin and altcoins, with the potential to push the market toward new highs in the weeks ahead.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DeFi Faces a Trust Challenge: Balancer Recovers $8 Million Following $128 Million Hack

- Balancer proposes $8M repayment plan after $128M exploit, returning funds to liquidity providers via pro-rata in-kind distribution. - Whitehat actors receive 10% bounties in rescued tokens; non-socialized model ensures pool-specific funds go only to affected LPs. - Exploit exposed systemic risks in DeFi's composable pools, with attackers exploiting rounding errors despite 11 prior audits by four firms. - Governance vote will finalize distribution framework, with claim interface enabling 90-180 day token

AI-driven SaaS Revolution: PetVivo Reduces Expenses by 50-90%, C3.ai Collaborates with Microsoft

- PetVivo.ai cuts veterinary client acquisition costs by 50-90% using AI agents, achieving $42.53 per client vs. $80-$400 industry norms. - C3.ai's Microsoft partnership boosts stock 35% as Azure integration enables enterprise AI scalability through unified data operations. - AI-driven SaaS models like PetVivo's $3/lead platform and C3.ai's 19-27% revenue growth highlight AI's disruptive potential in traditional industries. - Both companies face challenges scaling beta results and converting pilots to long

Ethereum News Today: "Turbulence or Trust? $15 Billion in Crypto Options Set Market Dynamics Against Institutional Hopefulness"

- Bitcoin and Ethereum face $15B options expiry on October 31, 2025, risking amplified volatility amid sharp price declines. - Institutional confidence grows as Bitcoin/ETH ETFs see $217.5M inflows, contrasting crypto's 33-45% drawdowns vs. stable tech stocks. - Tom Lee's firm BMNR boosts ETH holdings to 2.9% of supply, betting on $5,500 mid-2025 and $60K+ 2030 targets. - Deribit data shows Bitcoin's bullish positioning (put-call ratio 0.54) vs. Ethereum's balanced approach, with max pain levels at $100K a

VIPBitget VIP Weekly Research Insights

This year's market has been driven primarily by the growth of DATs, ETFs, and stablecoins. Strong institutional inflows indicate that mainstream U.S. capital is now entering the crypto market. However, after the October 11 black swan event, the market underwent a significant correction due to deleveraging. Even so, several indicators now suggest that a bottom may be forming. Our recommended assets are BTC, ETH, SOL, XRP, and DOGE.