Crypto Trader Says One Indicator Pointing to $139,000 Bitcoin Next, Outlines Path Forward for XRP, Solana and Chainlink

Cryptocurrency analyst and trader Ali Martinez says one indicator is signaling Bitcoin ( BTC ) will soon reach new all-time highs.

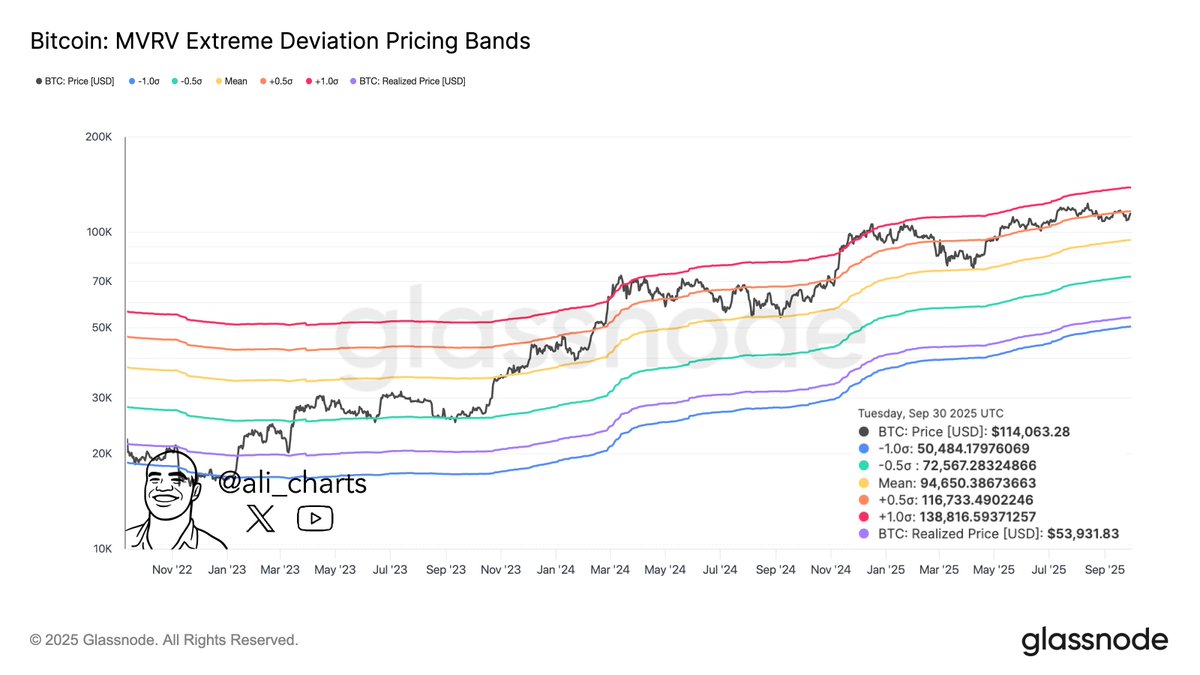

Martinez tells his 158,600 followers on X that Bitcoin may increase more than 16% from its current value based on the MVRV (Market Value to Realized Value) Extreme Deviation Pricing Bands.

The MVRV Extreme Deviation Pricing Bands are used in on-chain analysis to identify potential market tops and bottoms.

“Bitcoin breaking past $117,000 points to $139,000 next, according to the Pricing Bands.”

Source: Ali Martinez/X

Source: Ali Martinez/X

Bitcoin is trading for $119,252 at time of writing, up 1.5% in the last 24 hours.

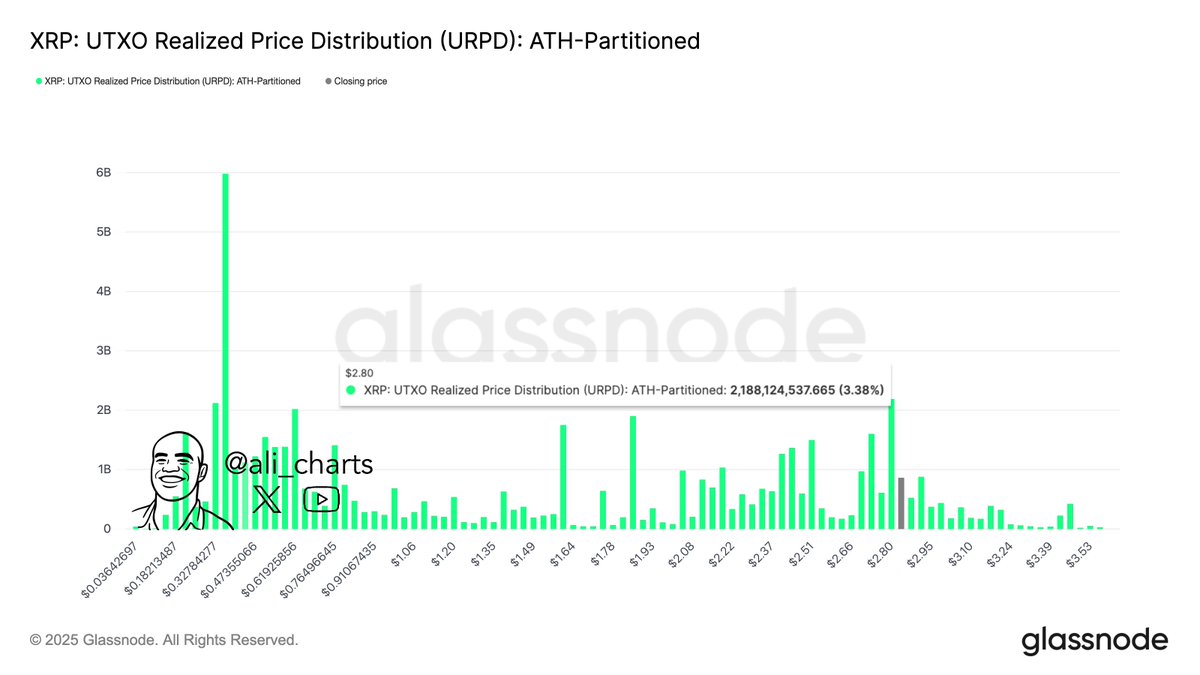

Next up, the analyst says that payments token XRP is looking bullish based on the Unspent Transaction Output (UTXO) Realized Price Distribution indicator, which shows the specific prices at which the current supply last moved.

“XRP held $2.80 as support. As long as it does, there are no major supply walls to block a rebound.”

Source: Ali Martinez/X

Source: Ali Martinez/X

XRP is trading for $2.98 at time of writing, up 1.1% on the day.

Moving on to Ethereum ( ETH ) rival Solana, the analyst says that SOL may increase by 60% from its current value after holding the $205 level as support.

“With the bullish retest complete, Solana could now be ready for $320-$360.”

Source: Ali Martinez/X

Source: Ali Martinez/X

SOL is trading for $225 at time of writing, up 2.7% on the day.

Lastly, the analyst says that decentralized oracle Chainlink ( LINK ) is on the verge of a massive breakout after retesting a key Fibonacci retracement level at around $20.

“$47 could be next for Chainlink!”

Source: Ali Martinez/X

Source: Ali Martinez/X

LINK is trading for $22.24 at time of writing, down marginally in the last 24 hours.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Growing Optimism Faces ETF Withdrawals: The Delicate Balance of Crypto Stability

- Crypto markets show fragile stabilization as Fear & Greed Index rises to 20, but Bitcoin remains 30% below October peaks amid $3.5B ETF outflows. - Stablecoin market cap drops $4.6B and on-chain volumes fall below $25B/day, weakening Bitcoin's liquidity absorption capacity. - Select altcoins like Kaspa (22%) and Ethena (16%) gain traction while BlackRock's IBIT returns $3.2B profits, signaling mixed institutional confidence. - Technical indicators suggest tentative support at $100,937 for Bitcoin, but So

BCH Rises 0.09% as Momentum Fuels Outperformance

- BCH rose 0.09% in 24 hours but fell 4.22% in seven days, yet gained 22.72% annually. - It outperformed its Zacks Banks - Foreign sector with 0.66% weekly gains vs. -2.46% industry decline. - Earnings estimates rose twice in two months, boosting consensus from $2.54 to $2.56. - With a Zacks Rank #2 (Buy) and Momentum Score B, BCH shows strong momentum potential. - Annual 63.46% gains and positive revisions solidify its position as a top momentum stock.

DOGE drops 1.36% as Bitwise ETF debuts

- Bitwise launched the first Dogecoin ETF (BWOW) on NYSE, offering institutional-grade exposure to the memecoin. - DOGE fell 1.36% in 24 hours but rose 7.34% weekly, reflecting mixed short-term market sentiment. - The ETF aligns with growing institutional adoption and regulatory momentum for altcoins, despite a 52.35% annual decline. - Similar products like Bonk’s ETP and Ethereum upgrades highlight maturing crypto infrastructure and investor demand.

ZEC Falls 4.01% After Grayscale Submits Zcash ETF Conversion Application

- Zcash (ZEC) fell 4.01% in 24 hours as Grayscale files to convert its Zcash Trust into an ETF. - The ETF conversion aims to boost institutional exposure and regulated market access for ZEC. - ZEC shows 16.26% monthly gain and 736.04% annual rise despite recent 17.89% weekly drop. - Analysts highlight ETF approval could stabilize ZEC’s price and attract diversified investors. - The SEC’s decision on the ETF remains pending, shaping market perceptions and ZEC’s adoption trajectory.