Expect a Strong Move Up for One BNB Chain Ecosystem Altcoin, According to Economist Alex Krüger

A popular economist believes that one altcoin project supported by the BNB Chain ecosystem is setting the stage for a massive breakout.

In a new X post to his 215,200 followers, Alex Krüger says that Plasma ( XPL ) is likely to have an explosive move to the upside once the token forms a local bottom.

Plasma is a proof-of-stake (PoS) layer-1 project optimized for large-scale stablecoin payments and compatible with Ethereum ( ETH ).

“Seeing widespread FUD (fear, uncertainty and doubt) around Plasma following its two-day ~40% price correction. Dump is driven by profit taking from unlocked participants who are/were up about 20x-30x in under four months, in size.

Abnormally high funding can be indicative of spot selling. Expect a strong move up as soon as indiscriminate spot selling subsides, whenever that may be.”

Source: Alex Krüger/X

Source: Alex Krüger/X

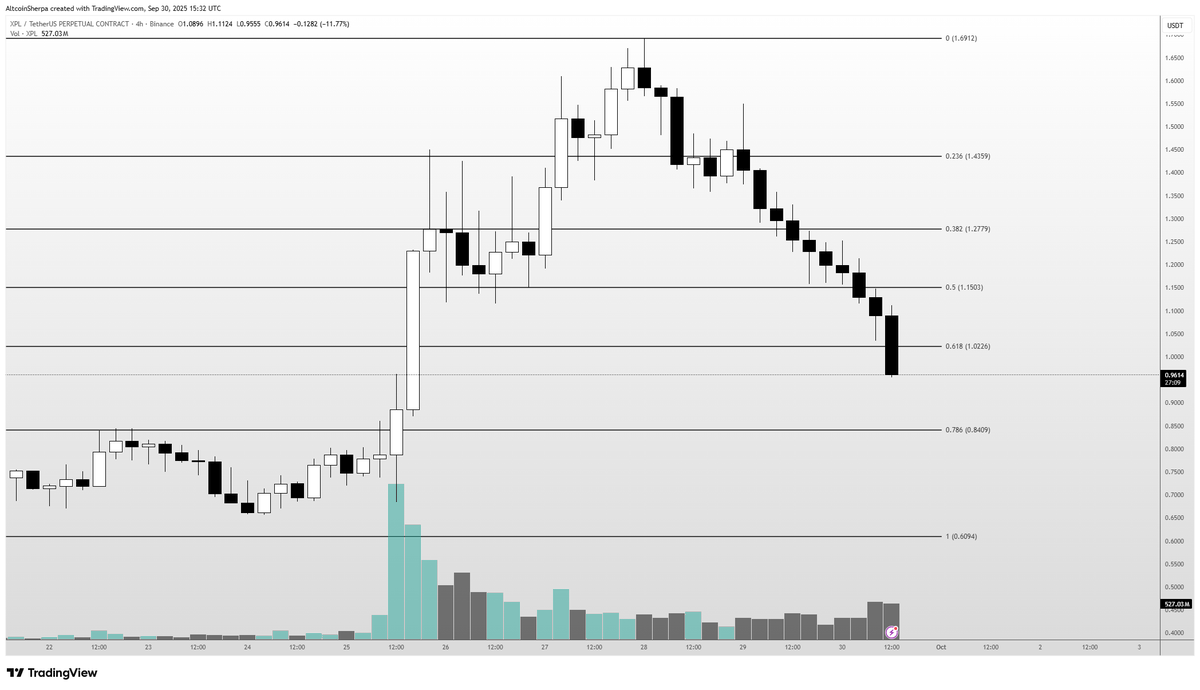

Popular analyst Altcoin Sherpa is also predicting an XPL bounce, but warns the altcoin may still have a deeper correction.

“This XPL chart is a sight to behold. Literally not one green four-hour candle and just vicious selling across the board. Seems like 90% of CT (crypto Twitter) is down on this coin, myself included.

My entry is around $1.15-$1.20 or so and I’m definitely feeling the pain. I keep thinking bounce is coming but I don’t know when/where/how it happens. I’ve already cut my perps position and just in spot at this point.”

Source: Altcoin Sherpa/X

Source: Altcoin Sherpa/X

XPL is trading for $0.95 at time of writing, down 8.2% in the last 24 hours.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Unlocking Potential: The Impact of Targeted Grants and Public-Private Partnerships on Transforming Medium-Sized Real Estate Markets in the U.S.

- U.S. mid-sized cities leverage infrastructure investment and PPPs to drive commercial real estate growth, outpacing large cities in value creation. - Federal programs like IIJA enable upgrades in transportation and broadband, reducing business costs while boosting property values in Tampa and Grand Rapids. - PPPs in cities like Montgomery County combine affordable housing incentives with CRE development, balancing equity and economic resilience through data-driven strategies. - Market projections show $2

Modern Monetary Theory and the Transformation of International Markets: Inflation Trends, Asset Movements, and Currency Shifts in 2025

- Modern Monetary Theory (MMT) reshapes fiscal-monetary coordination, linking government spending to inflation and resource constraints in post-pandemic economies. - Central banks face challenges anchoring inflation expectations as CPI lags asset market pressures, risking self-fulfilling inflationary spirals amid eroding public trust. - Currency valuations shift with fiscal stimulus (e.g., euro's 2025 rebound) and U.S. dollar uncertainty, compounded by gold reserve diversification and rising bond yields. -

Grasping the COAI Price Decline: Key Factors and What It Means for Investors

- COAI Index, a crypto AI benchmark, fell 88% in 2025 due to governance failures, regulatory ambiguity, and market panic. - C3.ai's $116M loss, founder resignation, and lawsuits exposed systemic governance risks in AI crypto firms. - Regulatory "gray zone" over AI tokens and conflicting agency rules deterred institutional investment in the sector. - Volatile COAI prices ($44.9 to $2-3) and suspicious trading patterns highlighted sector-wide trust erosion. - Investors now prioritize governance transparency

The Importance of Industrial Property in Webster, NY, in Light of $9.8 Million Infrastructure Investment

- Webster , NY, transformed a 300-acre brownfield into the NEAT industrial hub via $9.8M FAST NY funding, boosting economic growth and real estate value. - Infrastructure upgrades (roads, utilities) reduced industrial vacancy rates to 2%, attracting high-capacity industries like semiconductor manufacturing and food processing. - A $650M fairlife® dairy facility will create 250 jobs by 2025, while rezoning expanded 1,400 acres of contiguous industrial land with mixed-use development. - Residential property