Small Image "Rejuvenation"? NFTStrategy "Perpetual Motion Machine" Attracts $200 Million

Against the backdrop of a long absence of breakout hits in the NFT market, a new ecosystem called NFTStrategy has unexpectedly drawn attention. In just a few days, its token's total market cap surpassed $210 million, with daily trading volume reaching $10.7 million, becoming a new model for the integration of NFT and DeFi.

TokenWorks’ “Perpetual Motion Machine” Model: NFT + Automated Trading + Token Burn

NFTStrategy, launched by the team TokenWorks, is dubbed “a perpetual motion machine that every NFT collection can own.”

Its core logic is a closed-loop model of trading fees → buying NFTs → reselling NFTs → buyback and burning of tokens, so that every transaction injects momentum into the ecosystem.

Specifically:

-

Each NFTStrategy token (such as PUNKSTR, PUDGYSTR) corresponds to a well-known NFT collection (such as CryptoPunks, Pudgy Penguins).

-

Every token transaction charges a 10% fee: 8% is used to accumulate ETH for automatically purchasing NFTs from the corresponding collection, 1% rewards creators, and 1% is allocated to the team or supporters.

-

When the ETH in the pool is sufficient, the system automatically buys NFTs at the floor price and lists them for sale at 1.2 times the purchase price.

-

After the NFT is sold, the ETH obtained is used to buy back and burn NFTStrategy tokens, achieving supply contraction and price support.

According to TokenWorks, this mechanism will form a “perpetual loop”—a self-reinforcing system driven by trading activity that can theoretically continue indefinitely.

Why did it explode so quickly?

Simply put, NFTStrategy’s rapid rise is the result of multiple forces working together.

The most crucial is, of course, the flywheel model mentioned above by TokenWorks.

In addition, the NFT market has started to recover, with NFT trading volume in July surging to $530 million.

TokenWorks seized the window on September 20 and launched five major projects in one go, including $APESTR for BAYC, $PUDGYSTR for Pudgy Penguins, and $BIRBSTR for Moonbirds.

These established NFT collections come with their own traffic, and their communities respond enthusiastically. The trading of new tokens also feeds back into the burning and appreciation of $PNKSTR, and cross-project linkage has revitalized the community.

On September 30, TokenWorks simultaneously launched eight NFTStrategy tokens on OpenSea and set up a 20 ETH reward pool distributed across each asset to incentivize trading. OpenSea’s rapid listing essentially allows novice users to enter the market with one click. ETH also rose 2.4% that day, providing additional momentum to the market.

The community has also been actively “calling the shots.”

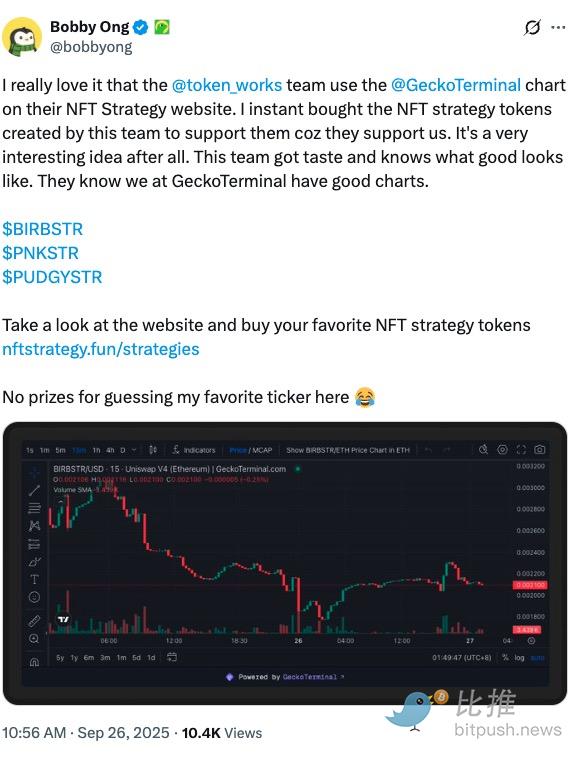

CoinGecko co-founder and CEO Bobby Ong tweeted his appreciation for the NFTStrategy project. Bobby Ong said he has been an entrepreneur in the crypto space since 2013, and he believes the token.works team “has great taste” and understands the importance of quality products. Bobby Ong said he immediately bought some tokens.

The results are indeed impressive. NFTStrategy started from scratch and, in just a few weeks, surpassed Autoglyphs in market cap, with the ecosystem’s total value soaring toward $200 million.

As of October 2, NFTStrategy’s ecosystem market cap has firmly stood at $213 million, surging 73.1% in 24 hours. The leading token $PNKSTR surged 22.7% in a single day, with a market cap of $161 million and trading volume exceeding $9.7 million. Other projects: $PUDGYSTR skyrocketed 65.9% to a market cap of $13.4 million, and $APESTR was even more aggressive, jumping 74.3% to $12.2 million. Even the more stable $BIRBSTR contributed $4.55 million in 24-hour trading volume.

The chart below shows the latest performance of each token (data from CoinGecko, October 2):

Ranking

Token Name

Price (USD)

24h Change

24h Trading Volume (USD)

Market Cap (USD)

| 1 | PunkStrategy ($PNKSTR) | 0.1652 | +22.7% | 9,734,693 | 160,647,555 |

| 2 | PudgyStrategy ($PUDGYSTR) | 0.01343 | +65.9% | 1,700,556 | 13,496,888 |

| 3 | ApeStrategy ($APESTR) | 0.01219 | +74.3% | 1,283,530 | 12,248,029 |

| 4 | BirbStrategy ($BIRBSTR) | 0.01121 | +2.4% | 4,552,644 | 10,625,621 |

| 5 | DickStrategy | 0.005550 | +0.6% | 578,975 | 5,417,041 |

| 6 | MeebitStrategy | 0.005103 | +14.0% | 586,247 | 4,870,318 |

| 7 | SquiggleStrategy | 0.004543 | +19.8% | 629,694 | 4,499,045 |

| 8 | ToadzStrategy | 0.003965 | +25.3% | 708,925 | 3,873,615 |

Potential Concerns

However, NFTStrategy’s “perpetual motion machine” model is not without flaws.

-

Over-reliance on trading volume: The system depends on the continuous accumulation of trading fees. Once trading cools down, the pool will be unable to continue buybacks or NFT purchases, and the loop will be broken.

-

Price bubble risk: Token price increases are mainly driven by market sentiment rather than intrinsic asset returns, making it easy to form a “self-reinforcing” bubble.

-

Mechanism loopholes and attack risks: The complex logic of smart contracts increases the potential attack surface, and hackers could exploit the buy/sell logic or trigger conditions for arbitrage.

-

The NFT market itself is unstable: If the overall market floor price declines, the accumulated NFT assets may depreciate, triggering systemic risk.

In short, whether it will become the next successful innovation or just another round of high-risk speculative bubble remains to be seen. As one investor said in the community:

“This is not just the second spring for NFTs, but another attempt to find a reason for NFTs to exist.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Legislation Booms Globally, Why Is China Taking the Opposite Approach? An Article to Understand the Real National Strategic Choices

Amid the global surge in stablecoin legislation, China has chosen to firmly curb stablecoins and other virtual currencies, while accelerating the development of the digital yuan to safeguard national security and monetary sovereignty. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Liquidity migration begins! Japan becomes the Fed's "reservoir," 120 billions in carry trade returns set to ignite the December crypto market

The Federal Reserve has stopped quantitative tightening and may cut interest rates, while the Bank of Japan plans to raise rates, changing the global liquidity landscape and impacting carry trades and asset pricing. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.

Weekly Hot Picks: Bank of Japan Sends Strongest Rate Hike Signal! Is the Copper Market Entering a Supercycle Rehearsal?

The leading candidate for Federal Reserve Chair is being questioned for potentially "accommodative rate cuts." Copper prices have reached a historic high, and a five-hour meeting between the United States and Russia ended without results. Expectations for a Japanese interest rate hike in December have surged, and Moore Threads' stock soared more than fivefold on its first day... What market moves did you miss this week?

Monad Practical Guide: Welcome to a New Architecture and High-Performance Development Ecosystem

This article will introduce some resources to help you better understand Monad and start developing.