Token Deflation Experiment: Apple-Style Gamble by Hyperliquid and Pump.fun

The author, Prathik Desai, points out that two major "revenue engines" in the crypto industry—perpetual contract exchange Hyperliquid and meme coin issuance platform Pump.fun—are adopting a large-scale token buyback strategy similar to Apple's massive stock repurchase approach. They are using almost all of their revenues at an astonishing pace to buy back their own tokens, aiming to transform crypto tokens into financial products with "shareholder equity proxy" attributes.

Original Author: Prathik Desai

Translated by: Saoirse, Foresight News

Seven years ago, Apple completed a financial feat whose impact even surpassed that of its most outstanding products. In April 2017, Apple opened its $5 billion “Apple Park” campus in Cupertino, California. A year later, in May 2018, the company announced a $100 billion stock buyback plan—an amount 20 times what it invested in its 360-acre “spaceship” headquarters. This sent a core message to the world: besides the iPhone, Apple had another “product” just as important (if not more so).

This was the largest stock buyback plan in the world at the time, and part of Apple’s decade-long buyback spree—during which Apple spent over $725 billion buying back its own shares. Six years later, in May 2024, the iPhone maker broke the record again, announcing a $110 billion buyback plan. This move proved that Apple not only knows how to create scarcity with hardware, but is equally adept at doing so with its stock.

Now, the cryptocurrency industry is adopting similar strategies—only faster and on a larger scale.

The industry’s two major “revenue engines”—perpetual futures exchange Hyperliquid and meme coin issuance platform Pump.fun—are using almost every cent of their fee income to buy back their own tokens.

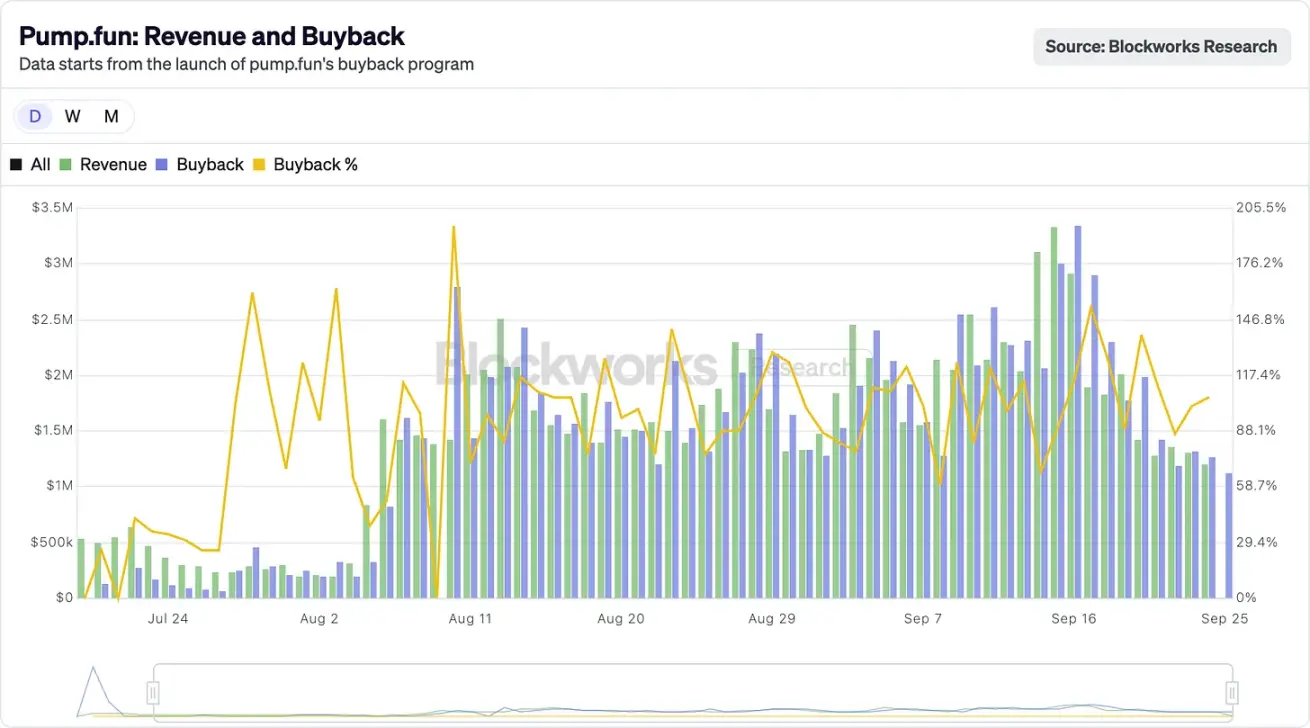

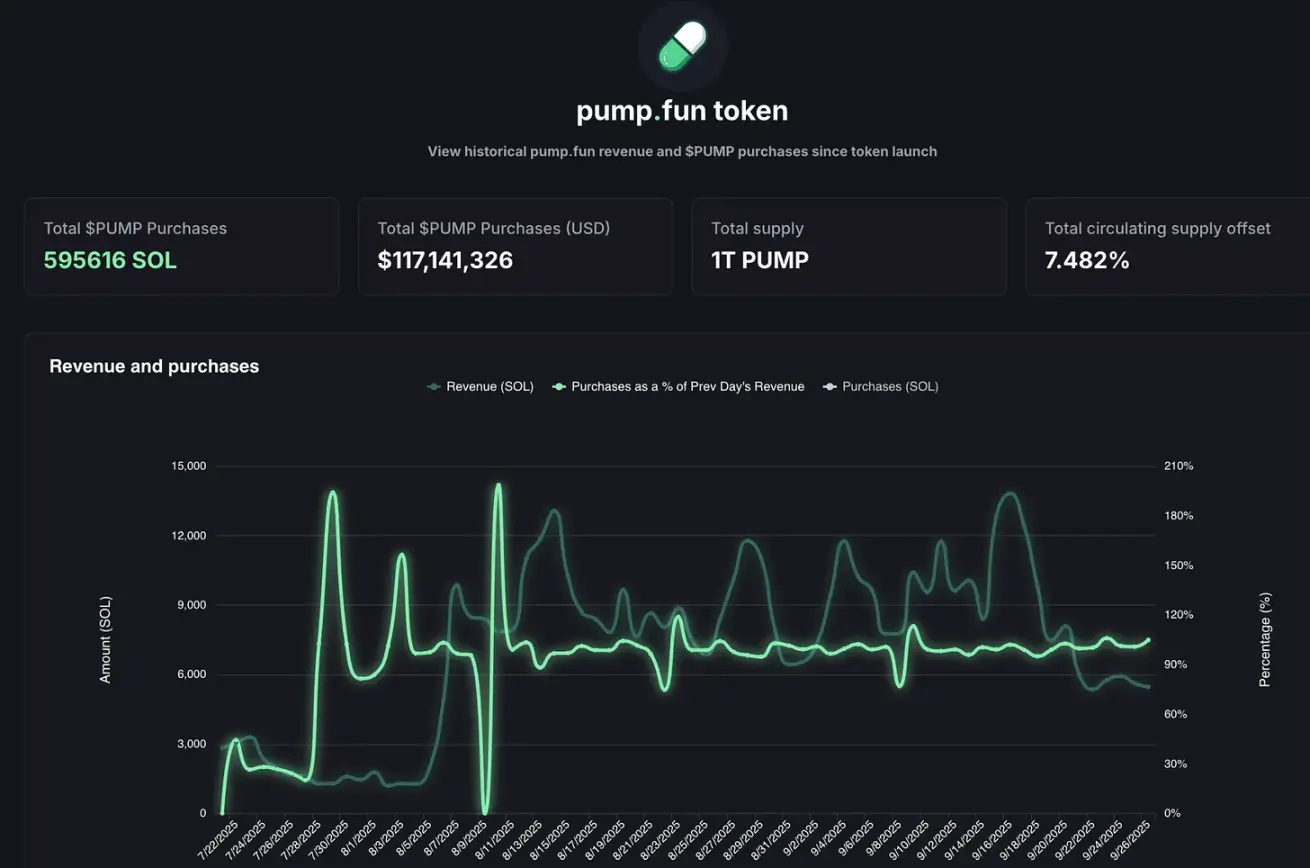

In August 2025, Hyperliquid set a record with $106 million in fee income, over 90% of which was used to buy back HYPE tokens on the open market. Meanwhile, Pump.fun’s daily income briefly surpassed Hyperliquid—in one day in September 2025, the platform earned $3.38 million. Where did this income go? The answer: 100% was used to buy back PUMP tokens. In fact, this buyback model has been ongoing for more than two months.

@BlockworksResearch

This operation is gradually giving crypto tokens the attribute of “shareholder equity proxies”—which is rare in the crypto space, where tokens are often dumped on investors at the first opportunity.

The logic behind this is that crypto projects are trying to replicate the long-term success path of Wall Street’s “dividend aristocrats” (such as Apple, Procter & Gamble, Coca-Cola): these companies spend heavily to reward shareholders through stable cash dividends or stock buybacks. For example, Apple’s stock buybacks in 2024 reached $104 billion, about 3%-4% of its market cap at the time; while Hyperliquid’s “circulating supply offset ratio” achieved through buybacks reached as high as 9%.

Even by traditional stock market standards, such numbers are astonishing; in the crypto world, they are unprecedented.

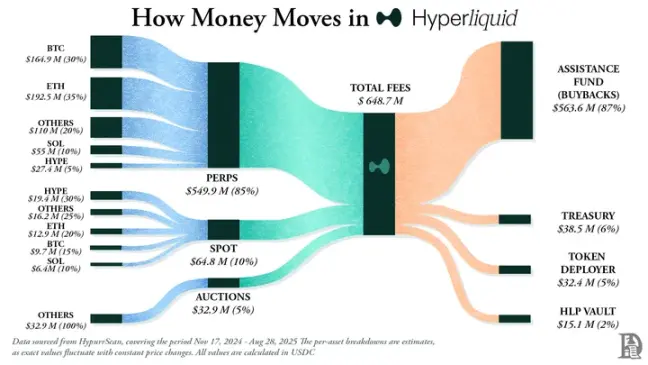

Hyperliquid’s positioning is very clear: it has built a decentralized perpetual futures exchange that offers the smooth experience of a centralized exchange (like Binance), but operates entirely on-chain. The platform supports zero gas fees, high-leverage trading, and is a Layer 1 focused on perpetual contracts. By mid-2025, its monthly trading volume had surpassed $400 billion, accounting for about 70% of the DeFi perpetual contract market.

What truly sets Hyperliquid apart is how it uses its funds.

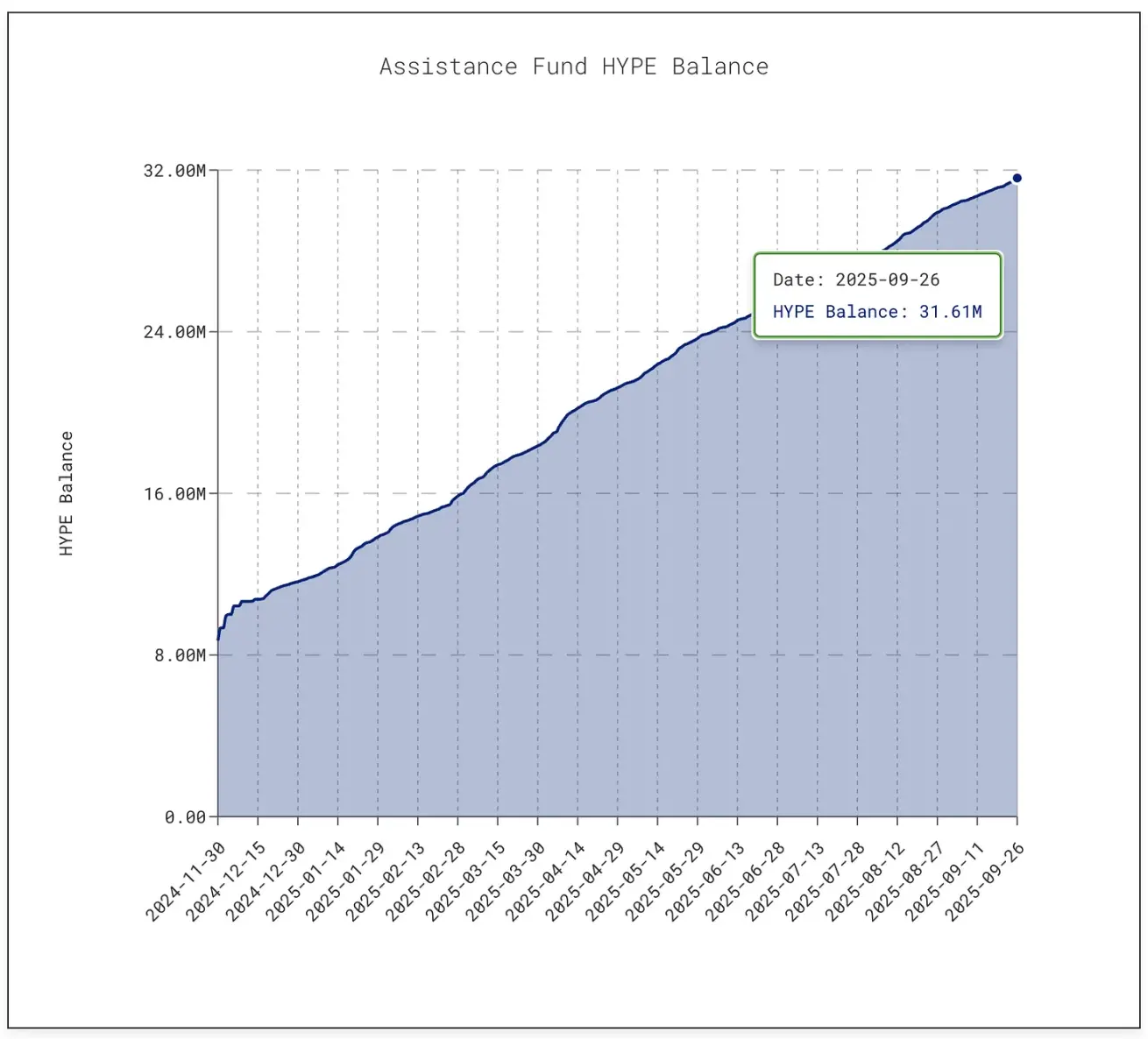

The platform allocates over 90% of its daily fee income to an “aid fund,” which is then used directly to buy HYPE tokens on the open market.

@decentralised.co

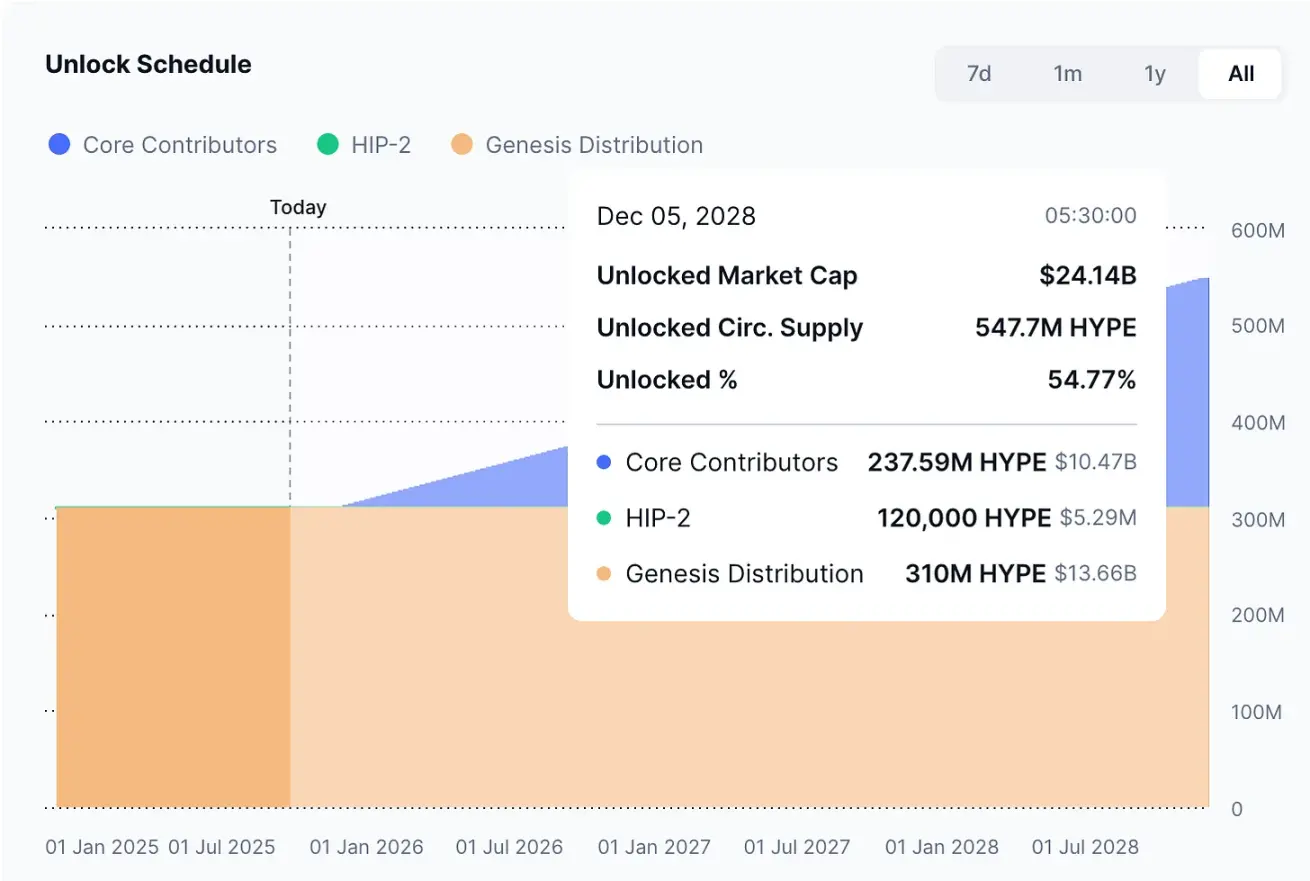

As of this writing, the fund has accumulated over 31.61 million HYPE tokens, worth about $1.4 billion—a tenfold increase from 3 million tokens in January 2025.

@asxn.xyz

This buyback frenzy has reduced HYPE’s circulating supply by about 9%, pushing the token’s price to a peak of $60 in mid-September 2025.

Meanwhile, Pump.fun’s buybacks have reduced PUMP token circulation by about 7.5%.

@pump.fun

This platform, with extremely low fees, has turned the “meme coin craze” into a sustainable business model: anyone can issue tokens and set up “bonding curves” on the platform, letting market hype ferment freely. What started as a “joke tool” has now become a “factory” for speculative assets.

But risks also exist.

Pump.fun’s income is highly cyclical—because its revenue is directly tied to the popularity of meme coin issuance. In July 2025, the platform’s income dropped to $17.11 million, the lowest since April 2024, and buyback volume shrank accordingly; by August, monthly income rebounded to over $41.05 million.

However, “sustainability” remains an unresolved issue. When the “meme season” cools down (as it has in the past and inevitably will again), token buybacks will also shrink. More seriously, the platform is facing a lawsuit worth $5.5 billion, with plaintiffs accusing its business of being “akin to illegal gambling.”

Currently, the core support for Hyperliquid and Pump.fun is their willingness to “return profits to the community.”

Apple has, in some years, returned nearly 90% of its profits to shareholders through buybacks and dividends, but these decisions are mostly “batch announcements” at intervals; Hyperliquid and Pump.fun, on the other hand, return almost 100% of their income to token holders on a daily, ongoing basis.

Of course, there are still fundamental differences: cash dividends are “realized returns”—taxable but highly stable; buybacks are at most a “price support tool”—once income declines, or token unlocks far exceed buybacks, the effect of buybacks disappears. Hyperliquid is facing an imminent “unlock shock,” while Pump.fun must deal with the risk of “meme coin hype shifting.” Compared to Johnson & Johnson’s “63 years of continuous dividend increases” or Apple’s long-term stable buyback strategy, these two crypto platforms’ operations are more like “walking a tightrope.”

But perhaps, this is already remarkable in the crypto industry.

Cryptocurrency is still in its maturation phase and has not yet formed a stable business model, but it has already demonstrated astonishing “development speed.” The buyback strategy happens to have the elements to accelerate the industry: flexibility, tax efficiency, deflationary attributes—all highly compatible with the “speculation-driven” crypto market. So far, this strategy has turned two completely different projects into the industry’s top “revenue machines.”

Whether this model can be sustained long-term remains to be seen. But it is clear that it has, for the first time, allowed crypto tokens to shed the label of “casino chips” and become more like “company stocks that can generate returns for holders”—with a speed of return that might even put pressure on Apple.

I believe there is a deeper lesson here: Apple realized, long before crypto existed, that it was selling not just iPhones, but also its own stock. Since 2012, Apple has spent nearly $1 trillion on buybacks (more than the GDP of most countries), reducing its share float by over 40%.

Today, Apple’s market cap remains above $3.8 trillion, partly because it treats its stock as a “product that needs to be marketed, refined, and kept scarce.” Apple does not need to raise funds by issuing new shares—its balance sheet is flush with cash, so the stock itself becomes a “product,” and shareholders become “customers.”

This logic is gradually permeating the crypto space.

The success of Hyperliquid and Pump.fun lies in: they do not reinvest or hoard the cash generated by their business, but convert it into “purchasing power that boosts demand for their own tokens.”

This also changes investors’ perception of crypto assets.

iPhone sales are certainly important, but investors bullish on Apple know the stock has another “engine”: scarcity. Now, for HYPE and PUMP tokens, traders are forming a similar perception—these assets, in their eyes, come with a clear commitment: every transaction or expenditure based on the token has over a 95% chance of being converted into “market buyback and burn.”

But Apple’s case also reveals another side: the strength of buybacks always depends on the strength of underlying cash flow. What happens if income declines? When iPhone and MacBook sales slow, Apple’s strong balance sheet allows it to fulfill buyback commitments by issuing debt; but Hyperliquid and Pump.fun have no such “buffer”—once trading volume shrinks, buybacks will stall. More importantly, Apple can turn to dividends, services, or new products to weather crises, while these crypto protocols currently have no “backup plan.”

For cryptocurrencies, there is also the risk of “token dilution.”

Apple does not have to worry about “200 million new shares flooding the market overnight,” but Hyperliquid faces this issue: starting in November 2025, nearly $12 billion worth of HYPE tokens will be unlocked for insiders, far exceeding daily buyback volumes.

@coinmarketcap

Apple can autonomously control its share float, but crypto protocols are bound by token unlock schedules “set in stone” years ago.

Even so, investors still see the value and are eager to participate. Apple’s strategy is obvious, especially to those familiar with its decades-long development—by turning stock into a “financial product,” Apple has fostered shareholder loyalty. Now, Hyperliquid and Pump.fun are trying to replicate this path in crypto, only at a faster pace, with greater momentum, and higher risk.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Legislation Booms Globally, Why Is China Taking the Opposite Approach? An Article to Understand the Real National Strategic Choices

Amid the global surge in stablecoin legislation, China has chosen to firmly curb stablecoins and other virtual currencies, while accelerating the development of the digital yuan to safeguard national security and monetary sovereignty. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Liquidity migration begins! Japan becomes the Fed's "reservoir," 120 billions in carry trade returns set to ignite the December crypto market

The Federal Reserve has stopped quantitative tightening and may cut interest rates, while the Bank of Japan plans to raise rates, changing the global liquidity landscape and impacting carry trades and asset pricing. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.

Weekly Hot Picks: Bank of Japan Sends Strongest Rate Hike Signal! Is the Copper Market Entering a Supercycle Rehearsal?

The leading candidate for Federal Reserve Chair is being questioned for potentially "accommodative rate cuts." Copper prices have reached a historic high, and a five-hour meeting between the United States and Russia ended without results. Expectations for a Japanese interest rate hike in December have surged, and Moore Threads' stock soared more than fivefold on its first day... What market moves did you miss this week?

Monad Practical Guide: Welcome to a New Architecture and High-Performance Development Ecosystem

This article will introduce some resources to help you better understand Monad and start developing.