Privacy Coins Quietly Outperform Bitcoin and Ethereum With 71.6% Gains in 2025

While Bitcoin and Ethereum dominated headlines, privacy coins quietly became 2025’s best performers, with Zcash recording major gains.

In a year dominated by headlines about Bitcoin’s (BTC) record highs, Ethereum’s (ETH) rally, meme coins, layer-2 solutions, and more, privacy coins have quietly emerged as the cryptocurrency sector’s top performers.

Despite minimal media attention and subdued public interest, the privacy coin market has outpaced every other sector. The growth has been further propelled by the recent bullish rally in leading privacy tokens.

Privacy Coins Emerge as 2025’s Best-Performing Crypto Sector

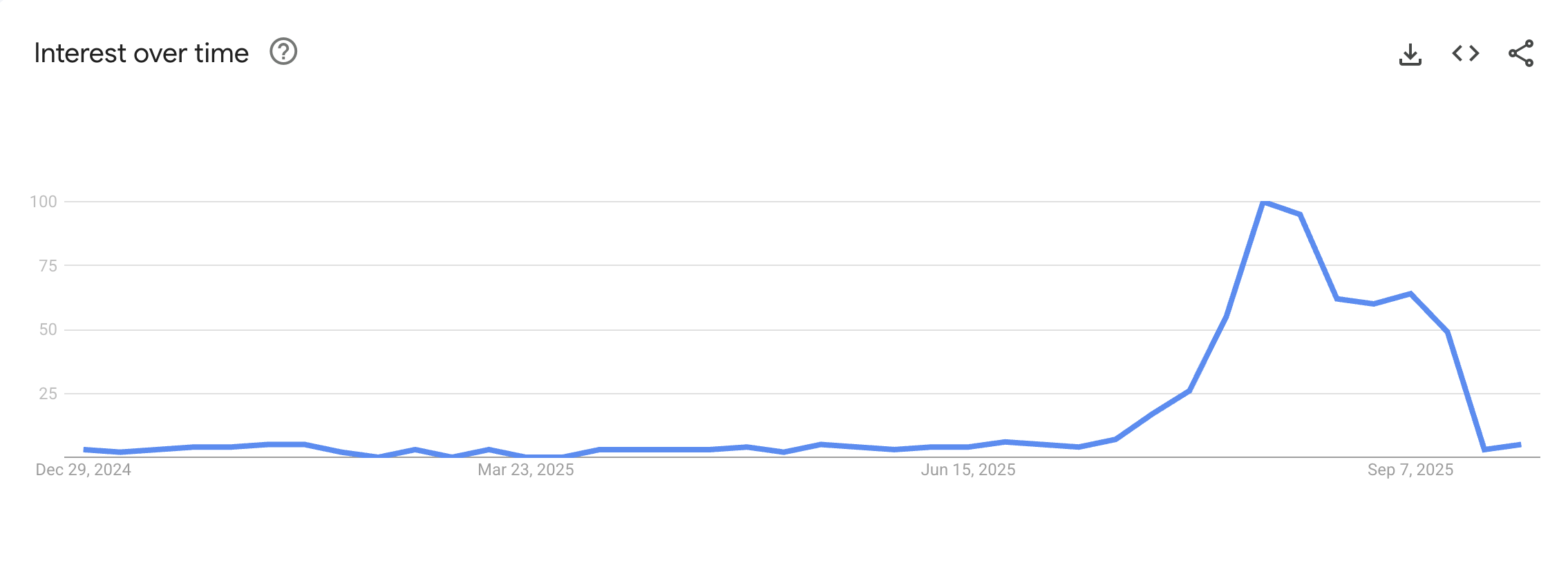

Google Trends data indicated that search interest for the term ‘privacy coin’ remained low through the first half of 2025, only beginning to accelerate in August and reaching a peak. However, this was short-lived as public curiosity faded again and interest dropped.

Search Interest in The Term ‘Privacy Coin.’ Source:

Google Trends

Search Interest in The Term ‘Privacy Coin.’ Source:

Google Trends

In addition, when compared to searches for terms like ‘crypto’ or ‘altcoin,’ interest remained completely flat. This showed a lack of retail interest in the sector.

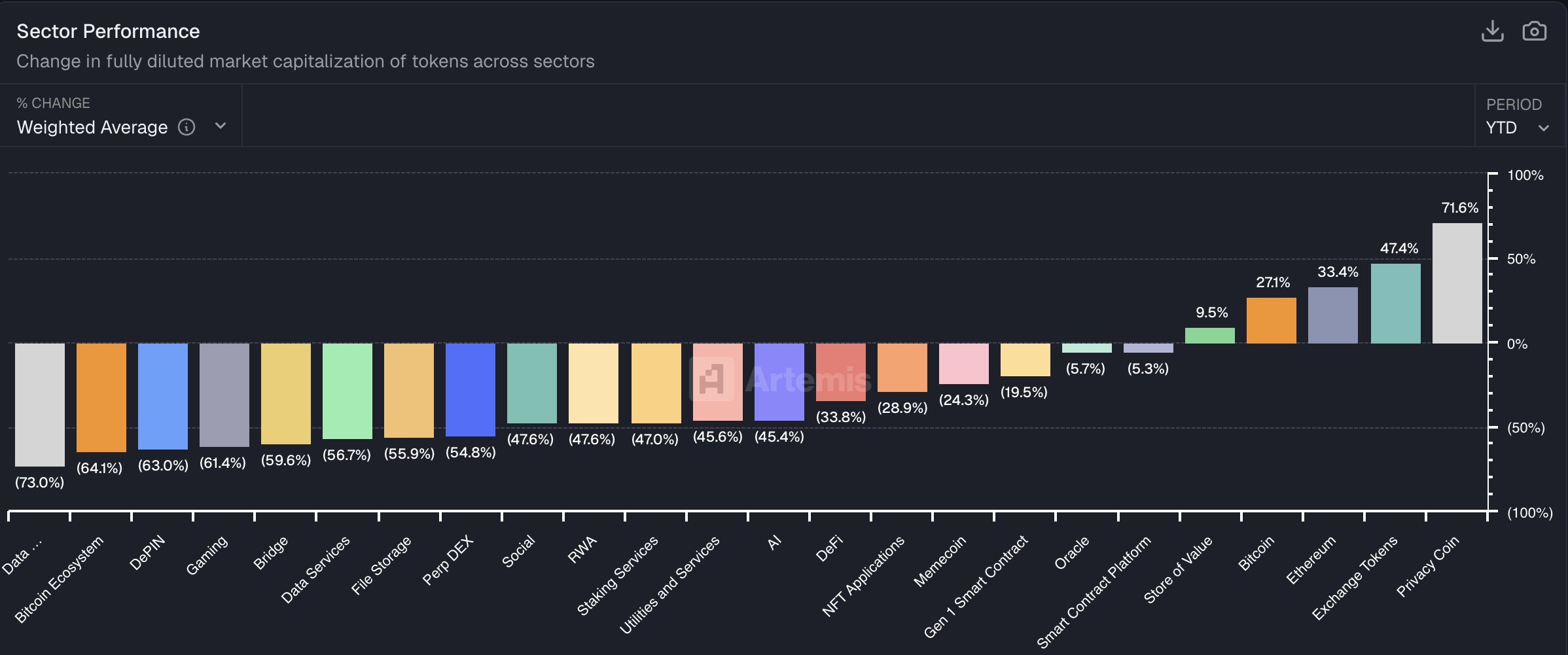

Despite this, privacy-focused cryptocurrencies have continued to grow. According to the latest data from Artemis, the sector has risen 71.6% in 2025, the highest uptick among all crypto sectors.

Privacy Coins Performance. Source:

Artemis

Privacy Coins Performance. Source:

Artemis

In comparison, Bitcoin has seen a 27.1% increase. Additionally, Ethereum, exchange tokens, and store-of-value assets have appreciated 33.4%, 47.4%, and 9.5%, respectively. Meanwhile, the rest of the sectors have all seen losses.

Zcash Leads Privacy Coin Rally in 2025

That being said, retail interest is not entirely absent from privacy coins. The latest rallies in leading tokens show that momentum has intensified recently.

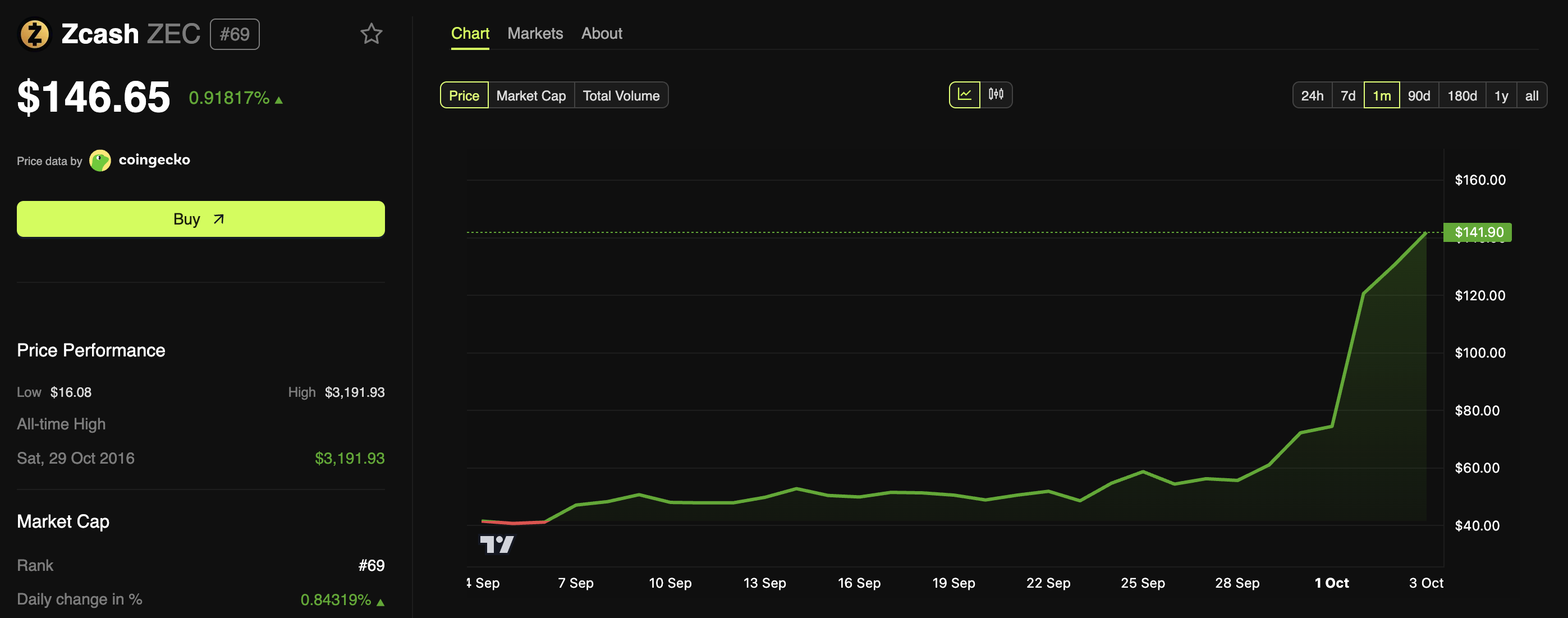

For instance, Zcash (ZEC) has been the standout, surging over 150% in the past week. BeInCrypto recently reported that the altcoin reached a three-year high, with a 247% monthly return.

Bitcoin is insurance against fiat.ZCash is insurance against Bitcoin.

— Naval (@naval) October 1, 2025

The catalyst was Grayscale’s launch of a Zcash Trust, enabling accredited investors to gain exposure without direct token handling and boosting demand. At the time of writing, the privacy coin traded at $146.65, up 0.918% over the past day.

Zcash (ZEC) Price Performance. Source:

BeInCrypto Markets

Zcash (ZEC) Price Performance. Source:

BeInCrypto Markets

Meanwhile, Monero (XMR), the sector’s leader with a market cap of approximately $6.1 billion, has also performed strongly. Over the past week, the coin has gained nearly 14%, less than ZEC but still outperforming the broader crypto market’s gains.

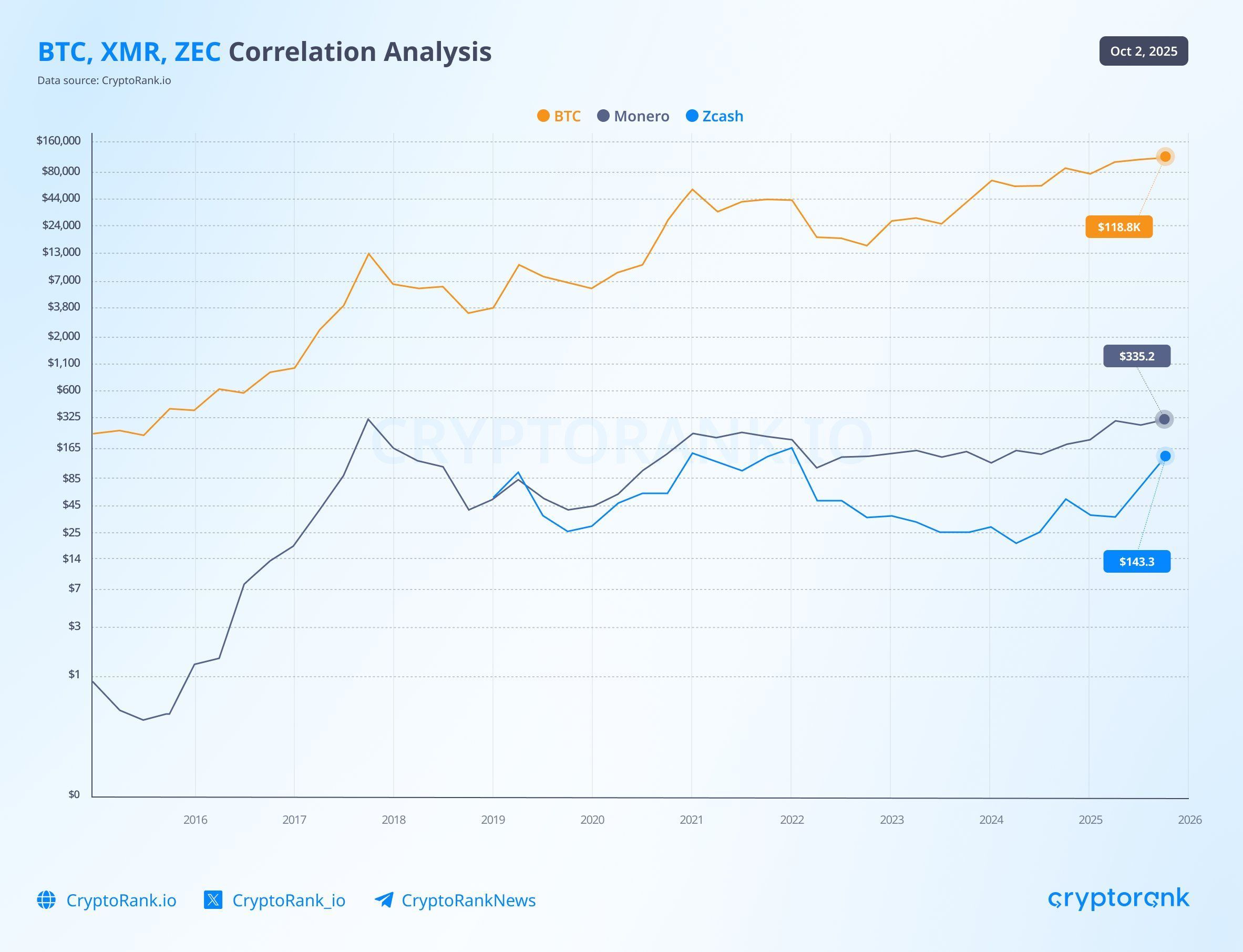

CryptoRank pointed to a mix of factors behind the recent upswing in privacy coins. One explanation is capital rotation, typically seen in crypto markets.

Another is the theory that privacy tokens often see stronger runs closer to the later stages of a market cycle. At the same time, tightening regulations and accelerating adoption have renewed attention on privacy as a potential growth theme.

“Privacy coins don’t just pump at cycle tops. Data shows they grow across different stages – XMR & ZEC moving in sync with BTC prove it,” CryptoRank added.

XMR, ZEC, and BTC Correlation. Source:

X/CryptoRank_io

XMR, ZEC, and BTC Correlation. Source:

X/CryptoRank_io

Thus, with momentum building, privacy tokens are positioning themselves as a core narrative in the ongoing bull market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoins Top $300B, But Bots Dominate Trading

The US September non-farm payroll report was not released as planned, the first time in 12 years

Standard Chartered predicts Bitcoin to reach new all-time high as soon as next week

MARA now holds 52,850 Bitcoin worth over $6 billion