XRP Bears Tested As Whales Pour In $1.5 Billion — Here’s How Price Could React

The XRP price has gained steadily in recent weeks, but a bearish channel still caps rallies. Whale inflows and bullish signals now test if $3.10 can flip the structure.

XRP price has shown solid gains recently, rising about 10% over the past week and nearly 7% in the past month. Since September 26, it has edged higher to around $3.02 at press time. But despite the move up, the coin has not managed a breakout rally.

A bearish channel that began in early August has capped every attempt higher. Now, billions in whale inflows combined with short-term accumulation could finally test the limits of this bearish stretch.

XRP Sees Heavy Whale Support As Short-Term Wallets Pile In

Large investors — whales holding between 100 million and 1 billion XRP — have added significantly to their balances in recent days. Their holdings grew from 8.95 billion coins on September 30 to 9.46 billion on October 3. That’s an increase of 510 million XRP, worth about $1.54 billion at current XRP prices.

Even after slight profit-taking from the October 2 peak of 9.49 billion, these wallets remain near record highs, showing strong conviction.

XRP Whale Accumulation:

XRP Whale Accumulation:

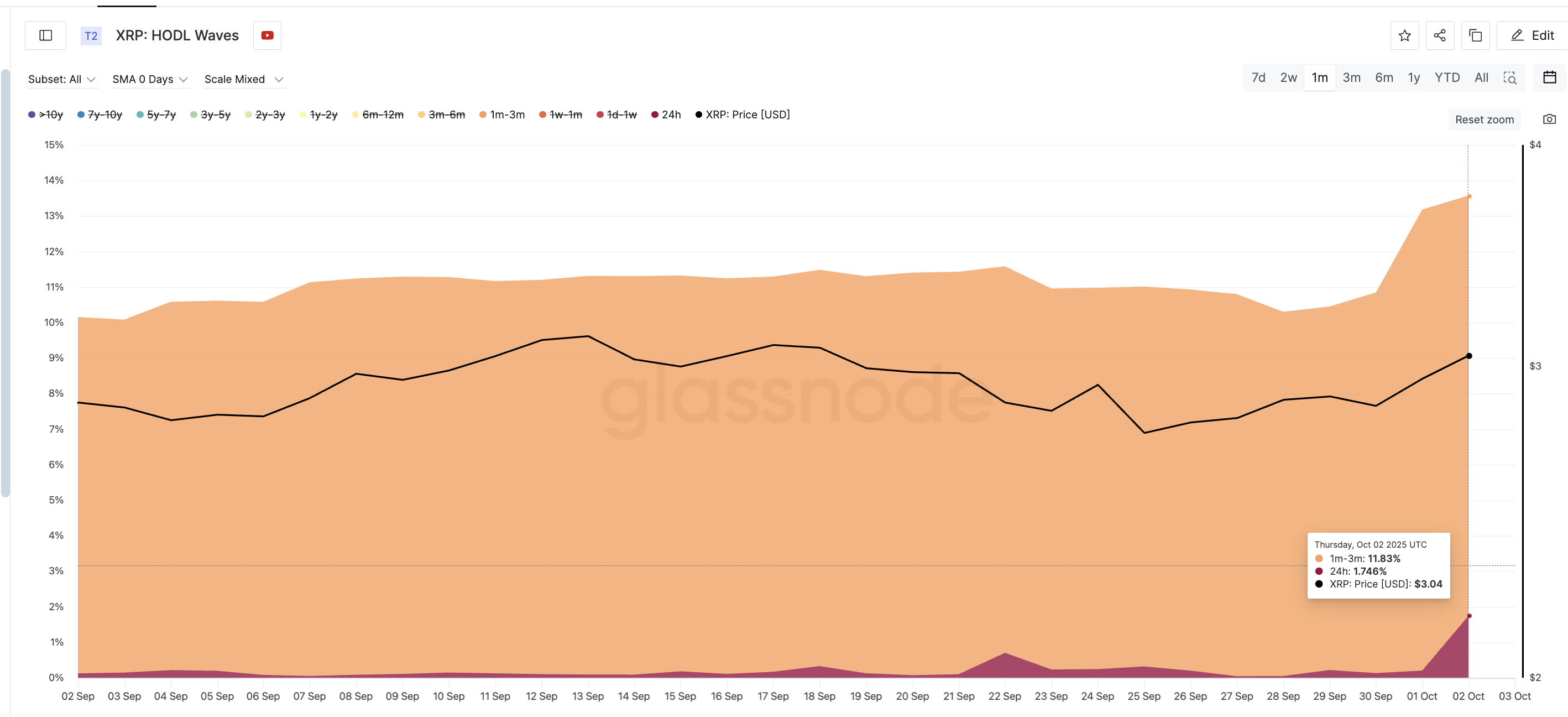

At the same time, smaller but active groups of traders are also accumulating. XRP’s HODL waves, which track how long coins are held before moving, show sharp increases in shorter-term cohorts. The one-month to three-month group rose from holding 10% of supply in early September to 11.83% by October 2.

Even more striking, the 24-hour cohort spiked from just 0.12% on September 2 to 1.74% a month later.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Key XRP Cohorts Adding To Their Stash:

Key XRP Cohorts Adding To Their Stash:

These additions are not part of the $1.54 billion whale tally, but they underline a broader trend: both whales and short-term holders are building positions at the same time. Together, they add meaningful buying pressure as XRP approaches a crucial level on the chart.

Multi-Week Bearish Channel Traces XRP Price Breakout Test

Despite the accumulation, the XRP price has been locked inside a descending channel since early August. Each rally attempt has failed at the channel’s upper boundary, including one on October 2 that could not hold.

This explains why the XRP price, even with weekly and monthly gains, has remained stuck under bearish pressure for nearly two months.

XRP Price Analysis:

XRP Price Analysis:

Now, the inflows are pressing at a critical moment. For the first time since September 20, the bull-bear power indicator shows bulls taking the lead, with the last two sessions favoring buyers. This tool compares price to a moving average to show which side — bulls or bears — has momentum.

Price is hovering just below $3.10, the key resistance line. A close above both the upper trendline and $3.10 would end the channel’s grip. That wouldn’t make XRP instantly bullish, but it would remove the bearish structure that has capped rallies since August.

If bulls succeed, the next upside targets lie at $3.18 and $3.35. On the downside, failure to hold $3.00 risks a slide toward $2.94 and $2.78.

At this point, the XRP price reflects a clash of signals. The structure remains bearish, but whales have injected $1.5 billion, and short-term wallets are piling in. If $3.10 breaks, the bearish stretch could finally give way.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Monad Practical Guide: Welcome to a New Architecture and High-Performance Development Ecosystem

This article will introduce some resources to help you better understand Monad and start developing.

Alphabet’s TPUs Emerge as a Potential $900 Billion Chip Business

Ethereum Loses 25% of Validators After Fusaka: The Network Nears a Critical Failure

US Stablecoin Rules Are Splitting Global Liquidity, CertiK Warns