Over $4 Billion Bitcoin and Ethereum Options Expire as BTC Reclaims $120,000

Over $4.3B in Bitcoin and Ethereum options expire today as BTC reclaims $120K. Traders brace for volatility, with max pain levels in focus.

Bitcoin (BTC) has surged past the $120,000 mark for the first time in weeks, but the rally faces an immediate stress test. Today, Friday, October 3, more than $4.3 billion in Bitcoin and Ethereum options are expiring.

The event adds another layer of uncertainty to already volatile crypto markets marked by sharp reversals and collapsing volatility.

Over $4 Billion Bitcoin and Ethereum Options Expire Today: What Traders Should Expect

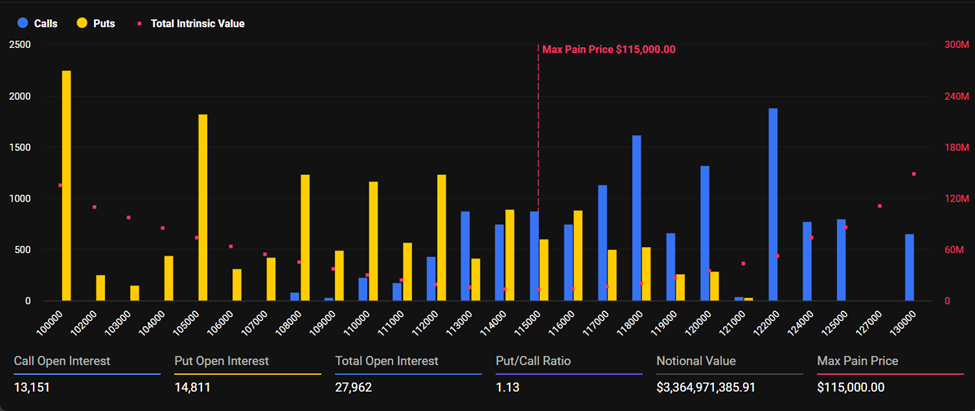

According to data from Deribit, Bitcoin leads with option contracts worth $3.36 billion set to expire. The max pain point, representing the level at which the most options expire worthless and dealers experience the most loss, is $115,000.

The total open interest (OI) for these expiring Bitcoin options is 27,962 contracts and a put-to-call ratio (PCR) of 1.13.

This PCR suggests a slightly bearish lean, with more puts (Sale options) than calls (Purchase contracts) in play.

Bitcoin Expiring Options. Source:

Bitcoin Expiring Options. Source:

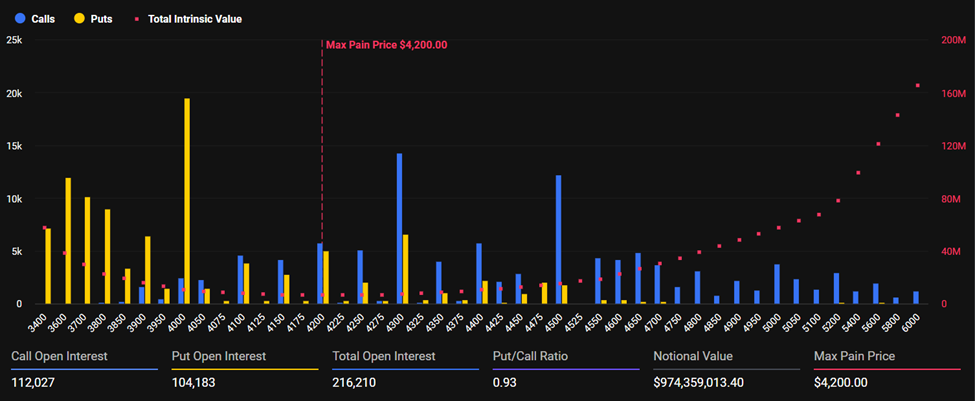

For Ethereum, the figures are more modest but still significant. At 8:00 UTC on Deribit, $974.3 million in Ethereum options will expire today, with 216,210 contracts outstanding.

The max pain level, $4,200, is aligned with the notional value of $974.3 million, and the PCR of 0.93 indicates a more neutral sentiment than Bitcoin.

Ethereum Expiring Options. Source:

Ethereum Expiring Options. Source:

Traders often pay close attention to the max pain level, the strike price at which most options contracts expire worthless. This level is concerning as it can act as a gravitational pull on price action leading into expiries.

With Bitcoin currently trading well above that level, $120,124 as of this writing, bullish traders may be in a stronger position. However, market makers and option sellers could seek to balance exposure, potentially pulling the price toward the $115,000 strike price.

Notably, this week’s expiring options are significantly lower than last week’s. The marginal difference comes as last week’s options expiry, when a record $21 billion in contracts went bust, was for the month.

Traders Struggle in Extreme Chop As Ethereum Volatility Collapses

The broader market context adds to the tension. Analysts at Greeks.live, an options analytics platform, described the current trading environment as an extreme, choppy price action that is difficult to trade profitably.

According to the analysts, traders are frequently caught off-guard by intraday swings, with 3% price moves occurring suddenly and without clear direction.

This means many active traders may be left with breakeven or losing positions despite high activity, as the market whipsaws between bullish and bearish setups.

One particularly painful dynamic has been short-dated options. Greeks.live noted that short calls, down 80% in the morning, were suddenly moving against traders by the afternoon earlier in the week. This type of volatility whipsaw has left many struggling to manage risk effectively.

“Options trading struggles – volatility whipsaw,” they wrote.

Meanwhile, Ethereum’s options market is seeing a different pattern altogether. Analysts point out that ETH volatility has collapsed significantly. Much of the activity has shifted away from Ethereum as Bitcoin dominance in the options market grows.

In response, multiple traders have been selling ETH puts and BTC 120,000 calls for October 10 expirations, positioning for continued sideways action in the Ethereum price.

This strategy allows them to collect premiums while betting neither asset will stage a significant breakout in the short term.

While bulls laud Bitcoin’s return to the $120,000 threshold as a sign of renewed momentum, the looming expiry could trigger forced rebalancing and inject new volatility. The rally may face a temporary stall if price action drifts closer to max pain levels.

Ethereum, on the other hand, remains in a more fragile position. With volatility drained and traders rotating into Bitcoin, ETH risks being sidelined unless a fresh catalyst emerges.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Markets Face a Rollercoaster: What Happened in the Past 24 Hours?

In Brief Bitcoin price dropped by 2.4%, influencing overall crypto market sentiment. The top 10 cryptocurrencies saw a general decline over the past 24 hours. Market seeks stability amid cautious investor behavior and potential short-term volatility.