BlackRock buys over $600 million of these two cryptocurrencies

Crypto exchange-traded funds (ETFs) are continuing their positive streak this week, recording consistent green daily inflows since September 26.

As usual, BlackRock is dominating the landscape, having seen approximately $446 million in Bitcoin (BTC) and $177 million in Ethereum (ETH) inflows, or around $623 million in total, on Thursday, October 2, according to data retrieved by Finbold from SoSoValue.

With the fresh capital, the world’s largest fund now has nearly $111.5 billion in the two assets, Bitcoin accounting for 84% of its overall holdings and Ethereum for about 14%.

Daily volumes are likewise strong, with $4.25 billion traded in the last 24 hours, as the total Bitcoin ETF market capitalization hovers at some $161 billion.

Institutional appetite for BTC and ETH grows

U.S. spot Bitcoin ETFs are regaining momentum after a brief cooldown in late September, with renewed capital signaling renewed investor confidence at the start of “Uptober.”

In addition to BlackRock, Fidelity and ARK also posted some gains, the former recording $89.62 million and the latter $45.18 million in inflows on the same day, bringing the total cumulative net inflow to $59.07 billion.

Ethereum ETFs were also strong, as Fidelity and Bitwise saw $60.71 million and $46.47 million added, respectively. What’s more, only two of the nine products, Franklin and Invesco, recorded no positive net changes.

Big-money investors remain drawn to ETFs for their regulated structure, so the surge in ETF demand highlights the crypto’s accelerating appeal, as even long-known skeptics are starting to rethink their positions.

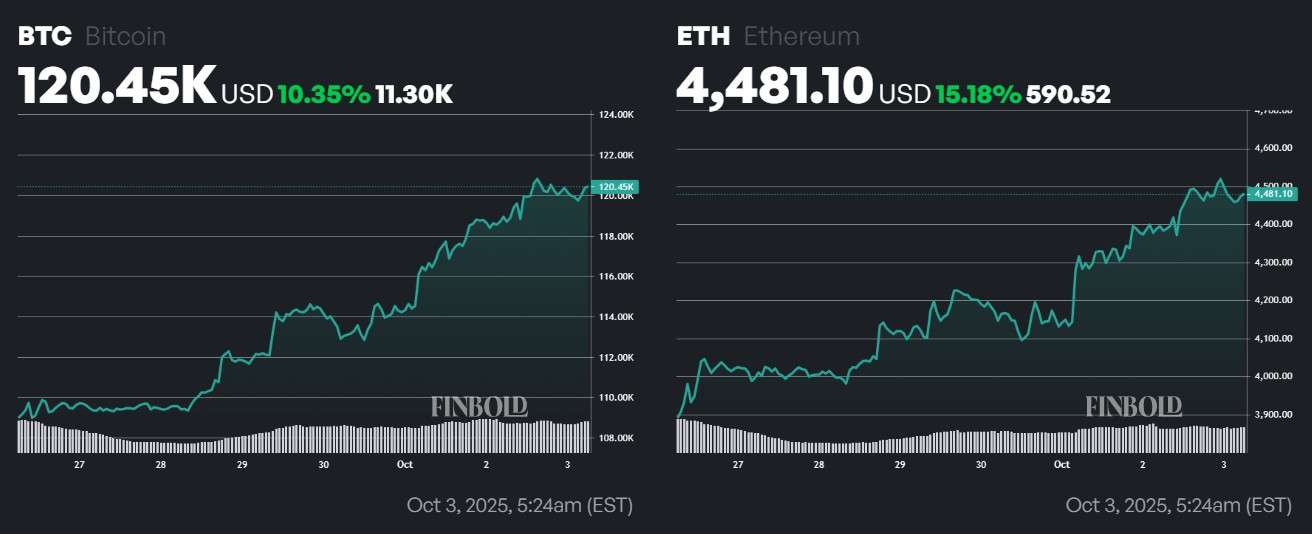

Bitcoin continues to trade over $120,450 at the time of writing, up over 10% this week, while Ethereum is holding steady at around $4,481, having gained more than 15% over the same period.

Both assets thus appear bullish, with analysts at Citigroup raising their year-end targets for Bitcoin at $132,000 and Ethereum at $4,500 on October 2.

Featured image via Shutterstock

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Why is the short seller who made $580,000 now more optimistic about ETH?

The truth behind Bitcoin's overnight 9% surge: Is December the turning point for the crypto market?

Bitcoin strongly rebounded by 6.8% on December 3 to $92,000, while Ethereum surged 8% to break through $3,000, with mid- and small-cap tokens seeing even larger gains. The market rally was driven by multiple factors, including expectations of a Federal Reserve rate cut, Ethereum’s technical upgrades, and policy shifts. Summary generated by Mars AI. This summary was produced by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative updates.

Even BlackRock can't hold on? BTC ETF sees $3.5 billion outflow in a single month as institutions quietly "deleveraging"

The article analyzes the reasons behind cryptocurrency ETF outflows in November 2025 and their impact on issuers' revenues, comparing the historical performance of BTC and ETH ETFs as well as the current market situation. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its generated content are still being iteratively updated.