Crypto hack losses in Q3 2025 fell to $509 million, a 36.6% drop from Q2, as attackers shifted from smart-contract exploits to wallet-focused and operational breaches—while September saw a record 16 million-dollar incidents, driven largely by exchange and DeFi compromises.

-

Q3 2025 total losses: $509 million (down 36.6% from Q2)

-

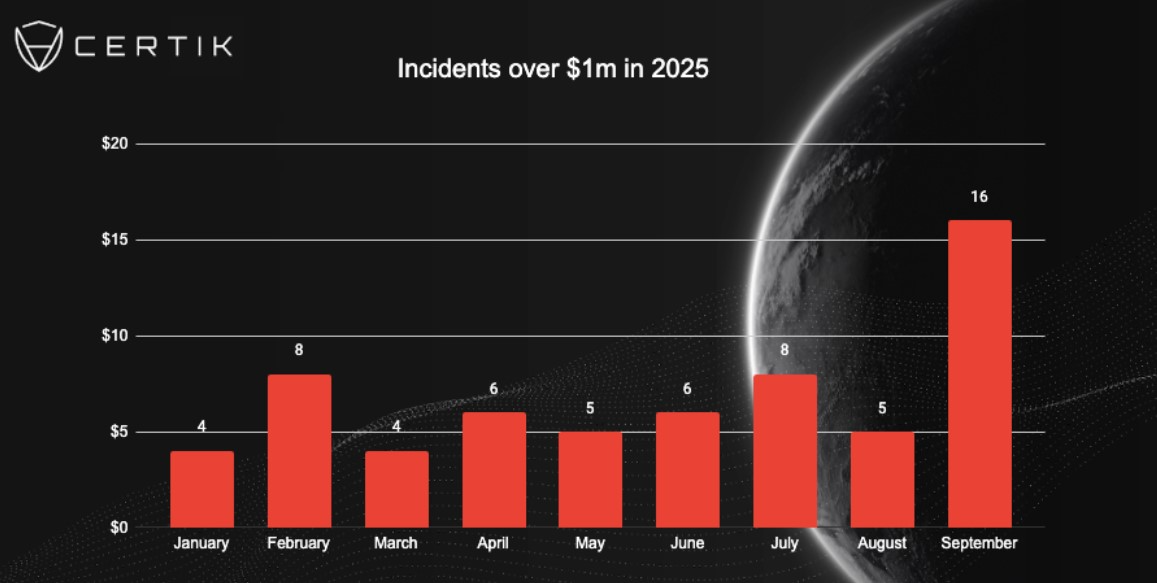

September recorded 16 incidents over $1M, the highest monthly total on record.

-

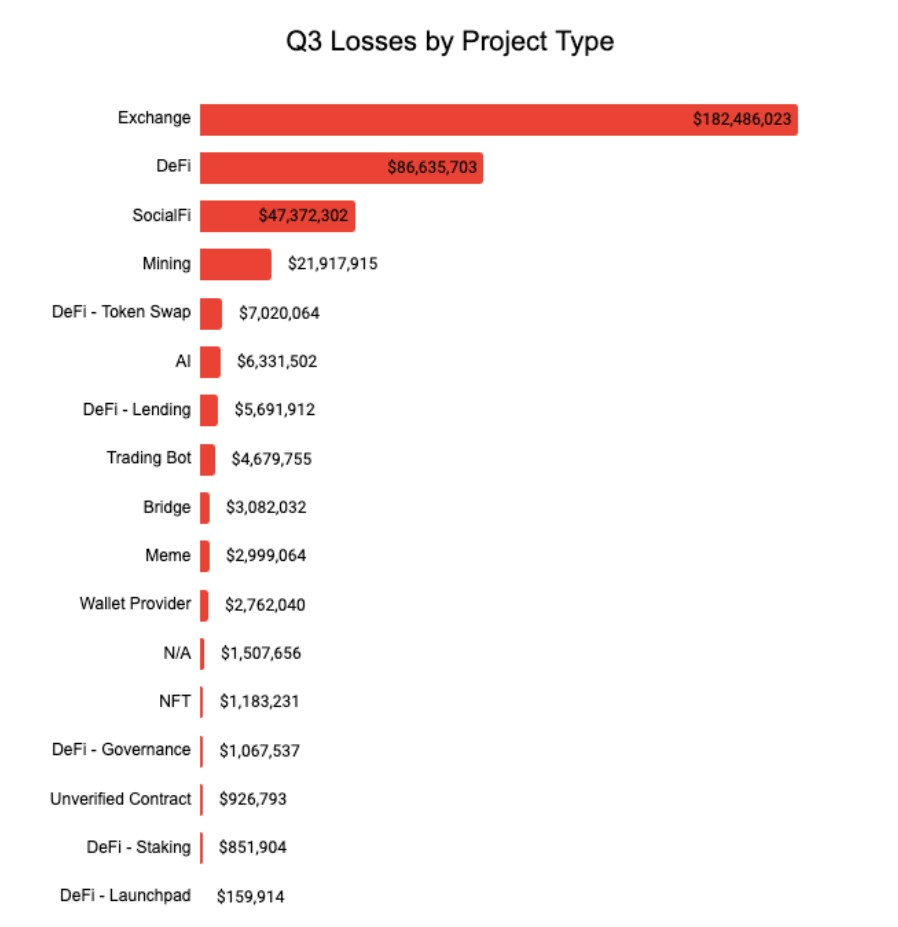

Centralized exchanges led losses ($182M); DeFi accounted for $86M with mid-sized exploits predominant.

Crypto hack losses Q3 2025: $509M total, down 36.6% vs Q2 — read analysis and protective steps. Learn what changed and how to respond.

Crypto hack losses dropped 37% in Q3 to $509 million, but September saw a record surge in million-dollar incidents, led by exchange and DeFi exploits.

Total funds lost to crypto hacks and exploits fell by nearly 37% in the third quarter of 2025, even as malicious actors shifted their approach from smart contract attacks to wallet-focused compromises and operational breaches.

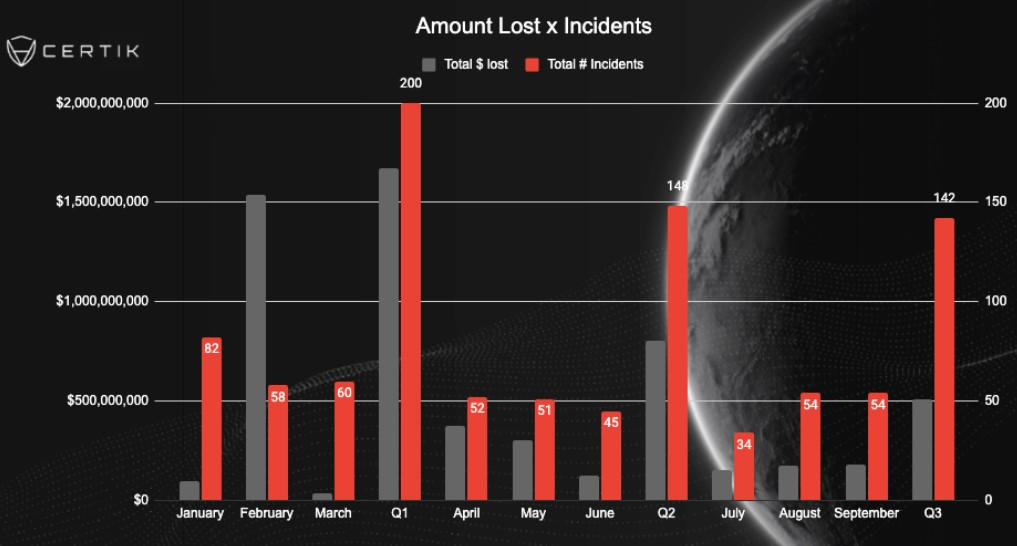

According to data shared by blockchain security firm CertiK, losses dropped from around $803 million in Q2 to $509 million in Q3, a 36.6% decline. Compared to Q1, when hackers stole nearly $1.7 billion, Q3’s losses declined by over 70%.

Total amount lost and total amount of security incidents in 2025. Source: CertiK

Total amount lost and total amount of security incidents in 2025. Source: CertiK

What caused crypto hack losses to fall in Q3 2025?

Reduced code-exploit losses and stronger audit practices were primary factors. CertiK reported code-vulnerability losses fell from $272 million in Q2 to $78 million in Q3, indicating improvement in code hardening and vulnerability remediation across projects.

How did attacker tactics shift in Q3?

Attackers moved from large-scale smart-contract drains to wallet-focused compromises and operational breaches. Phishing and social engineering increasingly targeted multisig setups and hot wallets, yielding mid-sized but frequent payouts.

Why did September record a spike in million-dollar incidents?

September recorded 16 incidents exceeding $1 million—the highest monthly total on record—driven by concentrated attacks on exchanges and DeFi projects and a rise in targeted operational compromises.

Security incidents with over $1 million in losses in 2025. Source: CertiK

Security incidents with over $1 million in losses in 2025. Source: CertiK

Which sectors were targeted most in Q3 2025?

Centralized exchanges led losses with $182 million stolen in Q3. DeFi projects were the second-largest target at $86 million, with mid-sized exploits such as the GMX v1 DEX hack (≈$40M) notable for later partial restitution via a $5M bounty.

Losses by project type in Q3 2025. Source: CertiK

Losses by project type in Q3 2025. Source: CertiK

Are new chains a heightened risk?

Yes. Security firms flagged new ecosystems such as Hyperliquid for recent incidents (HyperVault exploit, HyperDrive rug pull). Emerging chains often have immature security operations, making them attractive to opportunistic attackers.

How should platforms and users respond to evolving threats?

Security experts recommend doubling down on operational security: strengthen multisig controls, enforce strict key management, increase phishing resistance, and require third-party audits before mainnet launches.

Expert perspective

Hacken CEO Yevheniia Broshevan indicated that state-linked groups—particularly from North Korea—remain a top threat, and that roughly half of stolen funds this quarter were linked to such operations. She urged centralized platforms and users in emerging ecosystems to intensify operational security and due diligence.

Frequently Asked Questions

How much did crypto hack losses change in Q3 2025?

Q3 2025 losses totaled $509 million, a 36.6% decline from Q2’s $803 million, driven by fewer code-exploit incidents and improved code hardening across many projects.

Which attack types fell the most in Q3?

Code-vulnerability losses fell sharply from $272 million in Q2 to $78 million in Q3, suggesting audits and patching reduced the incidence of smart-contract drains.

What immediate steps can users take to reduce risk?

Users should enable hardware wallets, avoid reusing keys, verify multisig signers, and exercise caution on new chains and projects with limited security history.

Key Takeaways

- Losses declined: Q3 total losses were $509M, down 36.6% from Q2.

- Attack pattern shift: From smart-contract exploits to wallet and operational breaches.

- High-value incidents rose in September: 16 million-dollar-plus events, highest monthly total recorded.

- Exchanges remain a primary target: Centralized exchanges accounted for $182M in losses.

- Action required: Platforms and users must prioritize operational security and due diligence, especially on new chains.

Conclusion

The Q3 2025 decline in crypto hack losses to $509 million shows progress in code security but also highlights how attackers adapt—targeting wallets, multisig and operational vectors. Continued industry focus on operational defenses, audits and user hygiene is critical to reduce future losses.