CAKE’s surge is driven by PancakeSwap’s new fee‑earning limit orders, which boosted retail and whale accumulation and lifted trading volume and market cap. This combination of reward-bearing orders and concentrated buying pushed CAKE higher while profit‑taking created a short-term retracement.

-

Fee-earning limit orders launched — traders earn 0.1% on executed orders

-

Retail and whale accumulation produced a positive buy-sell delta and large net inflows

-

Price reaction: +28.55% intraday high, volume +528% to $410M, market cap ~$1.2B

CAKE price surge driven by fee-earning limit orders — see key metrics and next steps for traders. Read latest analysis and trade implications.

Why is CAKE up today?

CAKE is up due to PancakeSwap’s launch of fee‑earning limit orders, which encouraged both retail and whale buying and led to a sharp rise in volume and market cap. The incentive (0.1% trading fee reward on executed orders) amplified demand and produced a multi‑day positive buy‑sell delta.

How did fee‑earning limit orders change trader behavior?

The new feature rewards users with a 0.1% trading fee when a limit order executes. This links passive income to execution, encouraging market participants to place more limit orders and accumulate CAKE. Exchanges and on‑chain data providers — Coinalyze, CryptoQuant, Nansen, CoinGlass, TradingView — reported higher order sizes, inflows and positive netflow after the launch.

What do on‑chain metrics show?

Front‑line metrics show the rally was broad‑based: CAKE hit a 2025 high of $3.46 (+28.55%) before retracing to $3.22 at press time. Volume rose 528% to $410 million and market cap reached roughly $1.2 billion, indicating fresh capital entering the token.

| Intraday high (2025) | $3.46 | +28.55% |

| Price (press time) | $3.22 | — |

| 24h Volume | $410M | +528% |

| Market Cap | $1.2B | Yearly high |

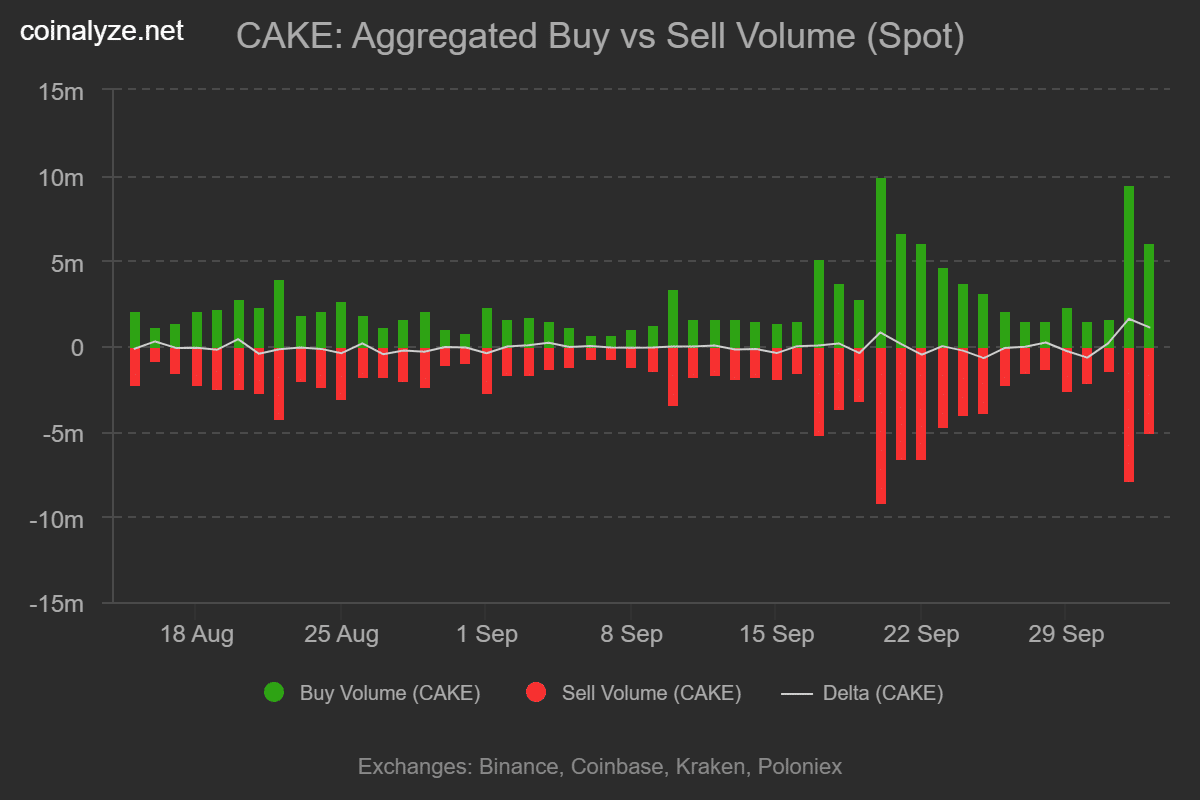

How much retail buying occurred?

Retail flows registered a positive Buy‑Sell Delta for three straight days. Coinalyze data cited cumulative buy volume of ~17 million CAKE versus 14 million in sell volume, resulting in a +3 million token delta — a clear short‑term buying bias from smaller traders.

Source: Coinalyze (plain text)

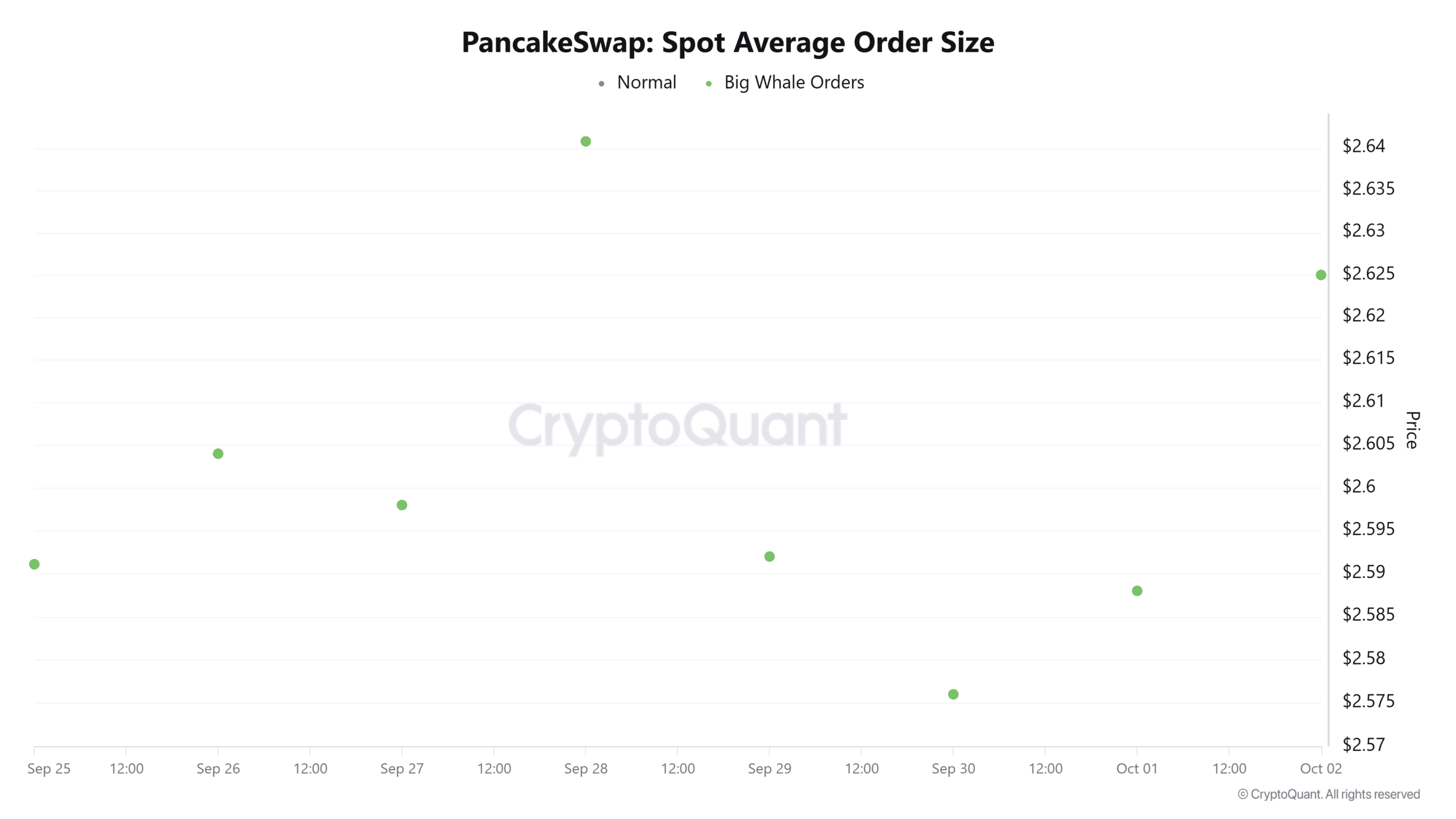

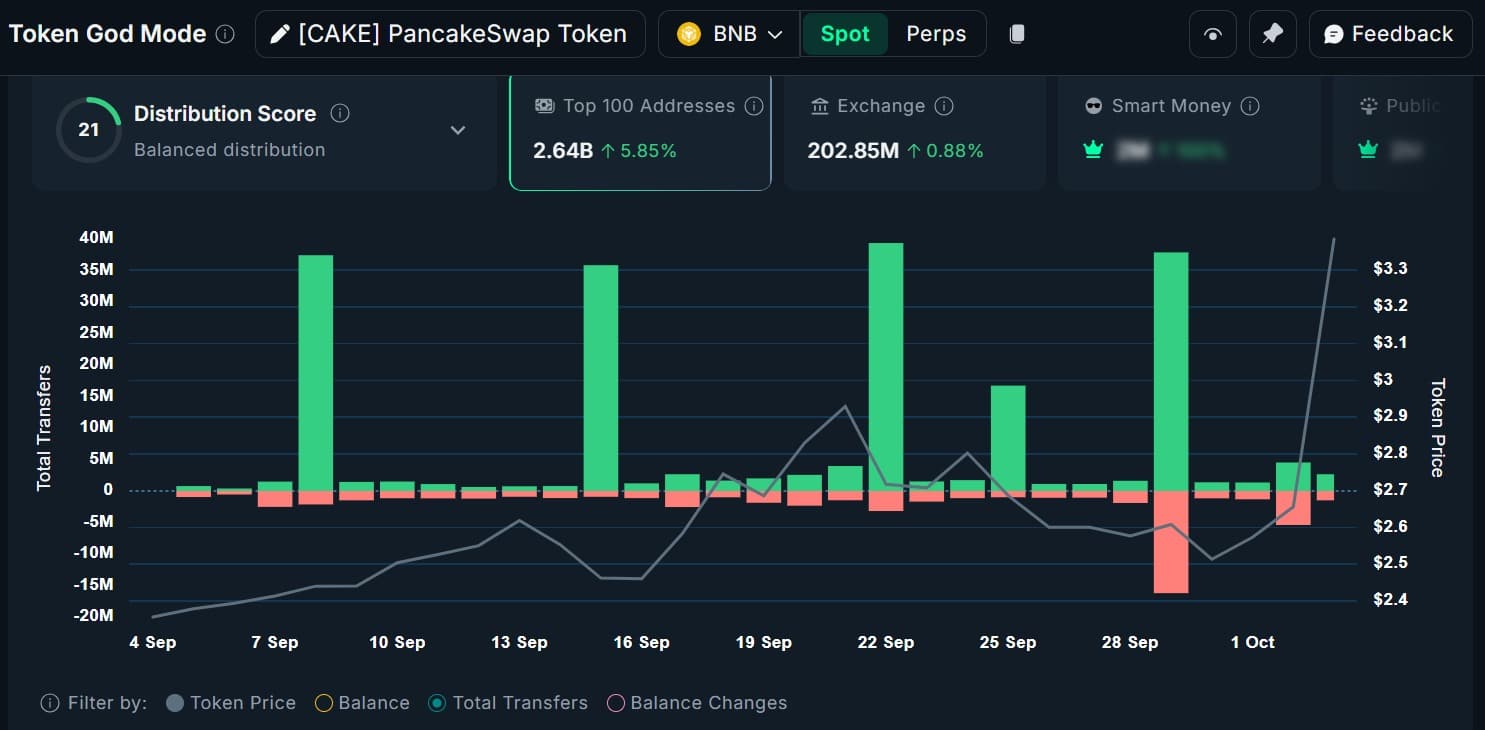

What about whale activity?

Whales also accumulated. CryptoQuant showed average order size increased, with Big Whale Orders dominating seven consecutive days. Nansen measured net inflows from large holders on four of five days; in the latest 24‑hour window, large holders added 7.6 million CAKE (+5.8%), lifting holdings to ~2.64 billion tokens.

Source: CryptoQuant (plain text)

Source: Nansen (plain text)

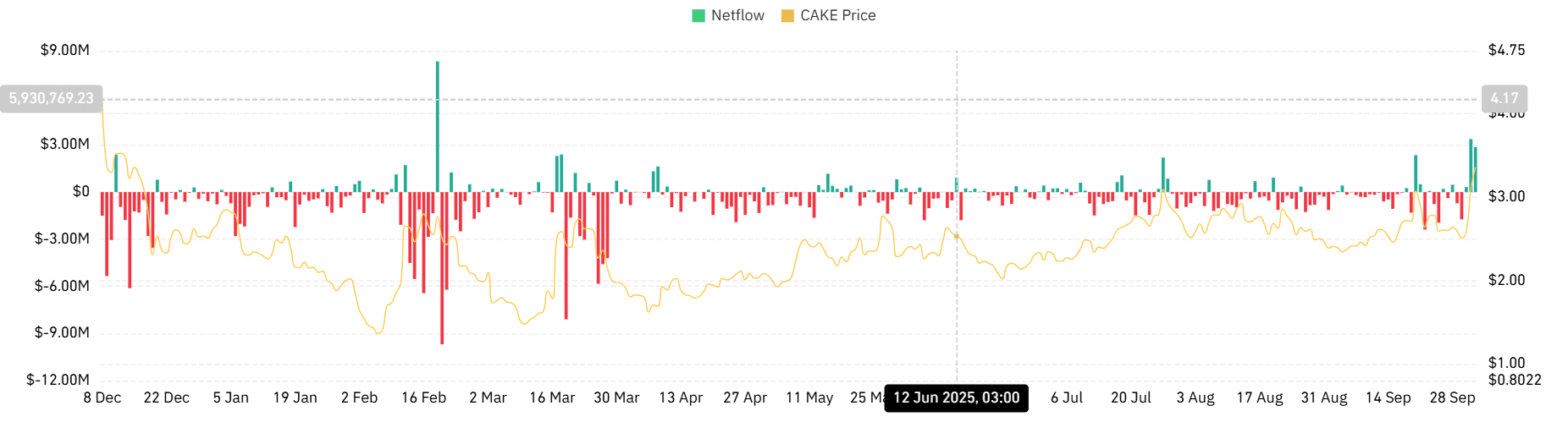

Are profit takers affecting price?

Yes — profit‑taking rose as prices climbed. CoinGlass recorded positive Spot Netflow for three days, with netflow at ~$2.89M (down from $3.38M the previous day), indicating some sellers are locking gains even as inflows persist.

Source: CoinGlass (plain text)

Can CAKE hold momentum?

Momentum indicators suggest a bullish tilt but room for consolidation. TradingView shows RSI at ~69 and Stochastic RSI near 59, consistent with buyer presence but approaching overbought thresholds. If accumulation from whales and retail continues, CAKE could test ~$4. If profit‑taking dominates, a pullback toward ~$3 is likely.

Source: TradingView (plain text)

Frequently Asked Questions

What triggered the recent CAKE price rally?

PancakeSwap’s rollout of fee‑earning limit orders, offering a 0.1% execution fee reward, triggered increased limit order placement and accumulation among retail traders and whales, elevating volume and price.

How long could this bullish phase last?

Duration depends on continued accumulation vs profit‑taking. If whales and retail keep buying, CAKE may test $4. If selling pressure increases, short‑term correction to ~$3 is plausible.

Key Takeaways

- Product change drove demand: Fee‑earning limit orders created a direct incentive to hold and place limit orders.

- On‑chain flows confirm accumulation: Positive buy‑sell delta, whale inflows, and volume spikes signal real demand.

- Watch indicators and netflow: RSI, Stochastic RSI and Spot Netflow will indicate whether momentum sustains or profit‑taking accelerates.

Conclusion

CAKE’s recent rally was largely technical and incentive‑driven: PancakeSwap’s fee‑earning limit orders catalyzed retail and whale accumulation, lifting volume and market cap. Traders should monitor on‑chain inflows, momentum indicators and netflow to gauge whether CAKE will press toward $4 or retrace to $3. COINOTAG will monitor and update as data evolves.