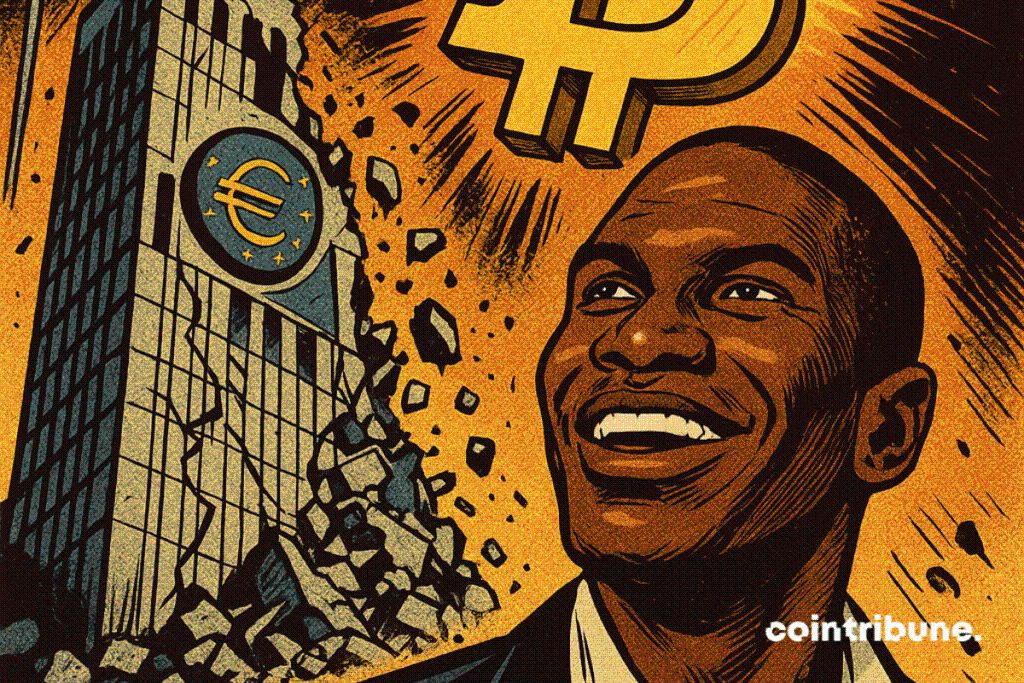

Arthur Hayes Predicts European Central Banks Will Drive Bitcoin Higher

Arthur Hayes puts another coin in the machine. This time, his target is not the Fed but the eurozone. And his message is clear: if the ECB falters, Bitcoin benefits.

In brief

- Arthur Hayes believes that financial instability in Europe strengthens Bitcoin’s appeal as a rare asset.

- French debt and the ECB dilemmas could accelerate the euro’s dilution.

- For Hayes, these tensions create a structural catalyst in favor of Bitcoin, beyond classic market cycles.

Why monetary policy could become an unexpected catalyst

Hayes proposes a simple mechanism. When a central bank faces a crisis of confidence, it buys time with the printing press. Not for pleasure. Out of necessity. In this context, the euro dilutes. The rare asset mechanically gains attractiveness.

This reasoning is not theoretical. Episodes of monetary stress create arbitrages . Investors sell what depreciates in real terms. They seek refuge in assets with limited supply. Gold has played this role for decades. Bitcoin increasingly takes this role during liquidity shocks.

Above all, transmission is rapid. Unconventional policies, asset purchases, promises of “whatever it takes” support: all this feeds the scarcity premium. With each monetary turn, the narrative “hard asset vs. paper money” strengthens. Hayes only extrapolates this dynamic to the European case.

France, debt and systemic risk

The stumbling block, according to Hayes, is France. A key economy, heavy debt, permanent financing needs. A rise in risk premiums on French debt would put the ECB in a dilemma. Let the market act, or monetize. In both cases, confidence in the euro would be tested.

If the ECB chooses to print, the euro depreciates. If it refuses, the risk of fragmentation resurfaces. Capital protects itself. For him, the outcome is the same: balance sheets swell, the currency dilutes, and Bitcoin gains a structural advantage.

This debate goes beyond France. It touches the architecture of the eurozone: a single currency, multiple budgets, a central bank with a delicate mandate. With each peripheral crisis, the ECB is forced to choose between financial stability and orthodoxy. This institutional ambiguity is, in itself, latent volatility and a narrative fuel for bitcoin.

What this implies for bitcoin and the market

During shock phases, Bitcoin may fall with risky assets. But if the policy response is easing, the trajectory often reverses. Liquidity returns. Preference for rare assets resumes. This second wind is what Hayes’ analysis targets.

Monetary cycles do not change over a weekend. They announce themselves, are contested, then imposed. For a crypto investor, this implies patient management: clear thesis, measured size, cash ready to be deployed when the macro narrative shifts. Staggered entries remain here a discipline more than an opinion.

An hypothesis is not a fact. The ECB may surprise. French fiscal policy may pivot. Markets may reassess risk without panic. In this scenario, BTC grows less through “crisis” than “adoption”: infrastructure, regulated products, institutional flows. One does not exclude the other. But confusing catalyst and certainty remains the best way to get burned.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Decoding VitaDAO: A Paradigm Revolution in Decentralized Science

Mars Morning News | ETH returns to $3,000, extreme fear sentiment has passed

The Federal Reserve's Beige Book shows little change in U.S. economic activity, with increasing divergence in the consumer market. JPMorgan predicts a Fed rate cut in December. Nasdaq has applied to increase the position limit for BlackRock's Bitcoin ETF options. ETH has returned to $3,000, signaling a recovery in market sentiment. Hyperliquid has sparked controversy due to a token symbol change. Binance faces a $1 billion terrorism-related lawsuit. Securitize has received EU approval to operate a tokenization trading system. The Tether CEO responded to S&P's credit rating downgrade. Large Bitcoin holders are increasing deposits to exchanges. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

The central bank sets a major tone on stablecoins for the first time—where will the market go next?

The People's Bank of China held a meeting to crack down on virtual currency trading and speculation, clearly defining stablecoins as a form of virtual currency with risks of illegal financial activities, and emphasized the continued prohibition of all virtual currency-related businesses.