Bitcoin is retesting its $124k all-time high on heavy spot institutional inflows, rising long-term holder conviction, and elevated open interest; these factors reduce the likelihood of a July-style leverage flush and set a clearer path for price discovery.

-

BTC near $124k with strong institutional spot demand

-

Open Interest hit a fresh $90B ATH and short-term holders moved significant supply to exchanges.

-

Bitcoin Dominance holds ~59% and long-term holding rates have increased, limiting alt rotation.

Bitcoin retest $124k: BTC nears ATH on heavy spot inflows and rising LTH conviction — read analysis and next steps.

What is driving Bitcoin’s retest of $124k?

Bitcoin retest $124k is being driven by large institutional spot inflows, rising long-term holder accumulation, and elevated derivatives open interest. These dynamics have boosted bid-side liquidity and reduced the altcoin rotation that previously amplified leverage flushes.

How significant are derivatives and open interest for BTC price action?

Open Interest (OI) recently set a new $90 billion all-time high, a 7% rise from the prior peak. High OI increases liquidation risk but paired with strong spot flows, it signals greater participation rather than purely speculative excess. Source: CryptoQuant (data reported as on-chain and derivatives metrics).

BTC is trading roughly 1.3% below the prior $124k ATH as the market evaluates whether available bids can absorb potential long liquidation events. Historically, similar OI peaks preceded short-term volatility when leveraged positions were overexposed.

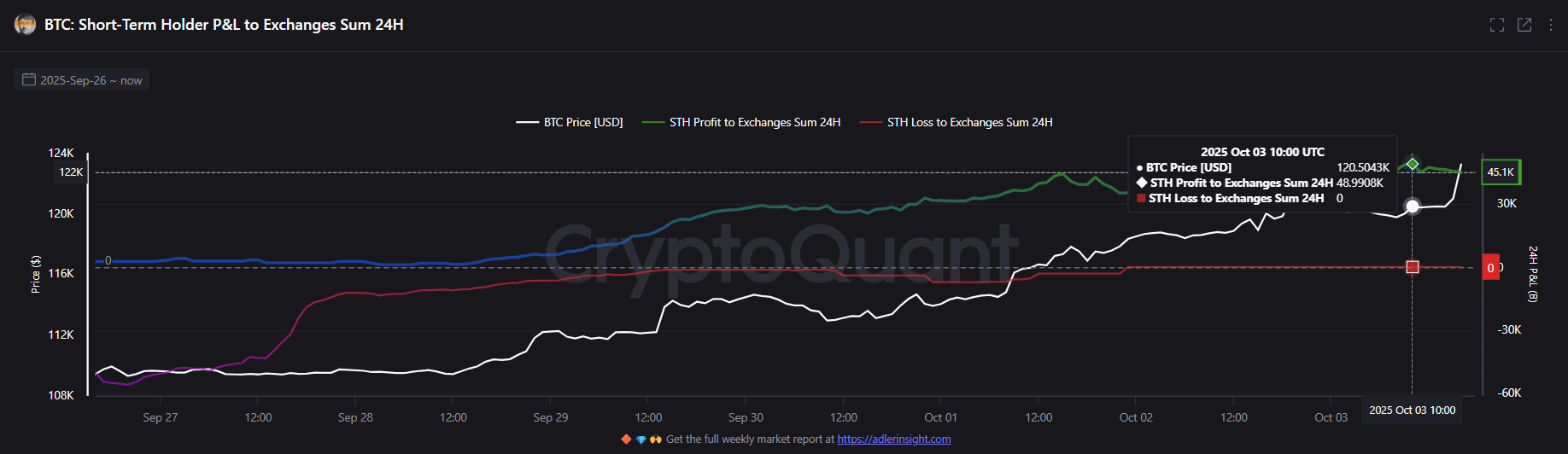

Why are short-term holder flows important for the current setup?

Short-term holder (STH) activity is a key liquidity signal. In the current window, 46k BTC flowed from STHs to exchanges, representing the largest 24-hour STH-to-exchange spike on record. That movement shows weak hands are being shaken out as prices approach resistance, reducing the pool of immediately liquid supply.

At the same time, STH on-chain cost bases flipped above $111k and realized profit rates rose, indicating many recent participants are now in profit and may be less motivated to sell on minor pullbacks.

Image of STH dynamics:

Source: CryptoQuant

How do ETF flows and Bitcoin Dominance affect breakout odds?

ETF spot inflows continue to underpin BTC bids. On October 3rd, ETFs recorded an inflow of $985 million, reinforcing a structural bid beneath price. Simultaneously, Bitcoin Dominance (BTC.D) is holding near 59%, which limits capital rotation into altcoins and concentrates demand back into BTC.

When BTC.D remains elevated, altcoin performance underperforms and speculative rotation is restricted, lowering the probability of a broad market derisking that previously triggered deeper corrections.

When could a leverage flush still occur?

A leverage flush becomes more likely if open interest collapses rapidly while spot flows dry up and BTC.D falls sharply as capital rotates into alts. Monitoring OI trends, ETF net flows, and exchange inflows from STHs provides the earliest warning signs of renewed downside pressure.

How to assess whether a BTC breakout will hold (HowTo)

Frequently Asked Questions

Will Bitcoin see a repeat of the July leverage flush?

Unlikely in the immediate term: rising long-term holder conviction, steady Bitcoin Dominance, and continued spot ETF inflows reduce the probability of a July-style leverage flush. Watch OI and ETF flows for sudden change.

How much Open Interest is currently in the market?

Open Interest recently hit roughly $90 billion, about a 7% increase from the prior peak. High OI heightens liquidation risk but, combined with spot demand, indicates increased participation rather than pure leverage excess.

What on-chain sources support this view?

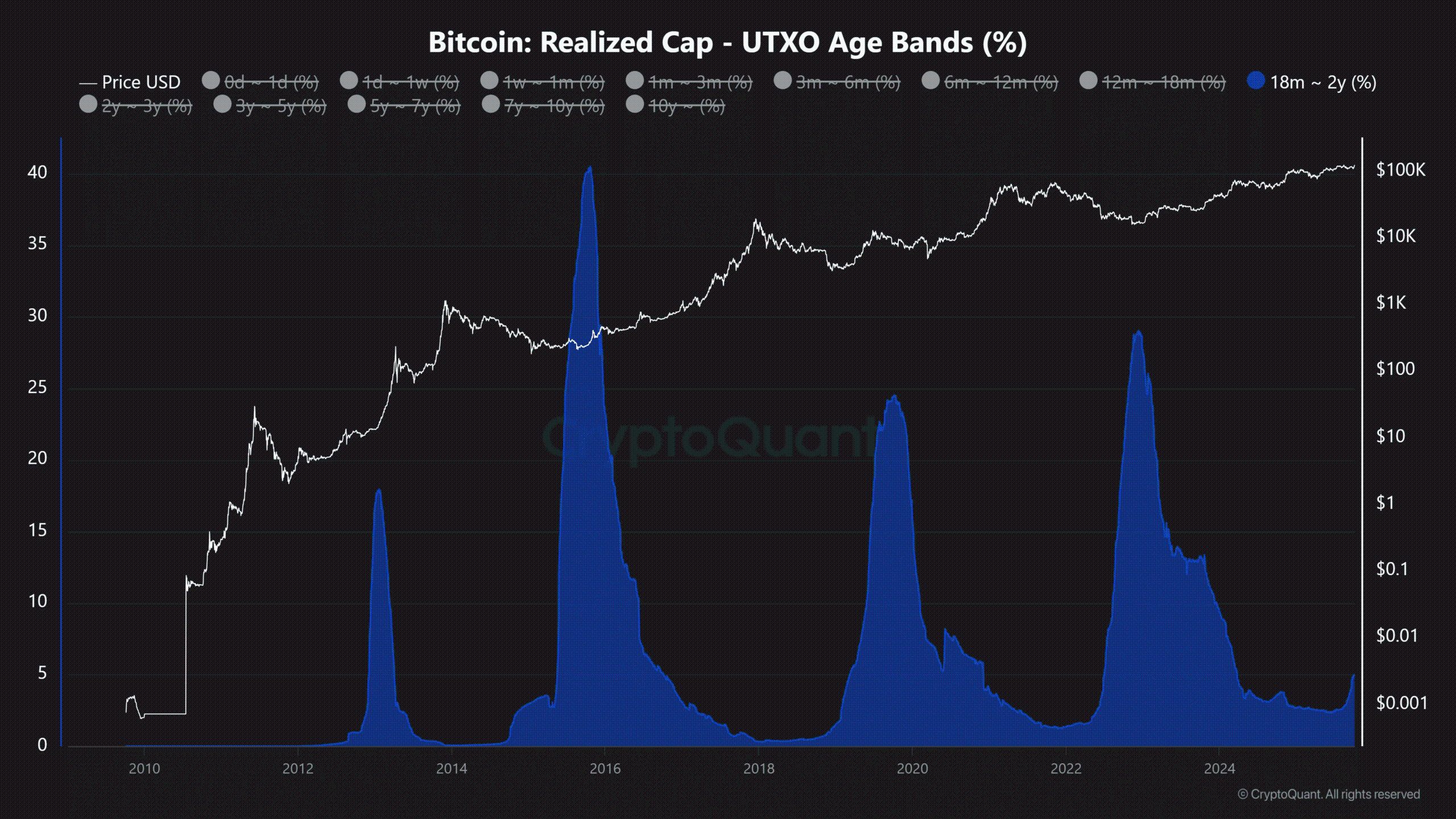

On-chain indicators referenced include STH exchange flows, STH NUPL, BTC.D, and UTXO age-band shifts. Data reported by CryptoQuant and other on-chain analytics providers informs these observations (sources cited as plain text).

Key Takeaways

- Institutional spot inflows: Large ETF and spot purchases are sustaining bids beneath BTC near $124k.

- On-chain diverging signals: Elevated OI and STH exchange flows are countered by rising LTH accumulation and strong BTC.D.

- Watch indicators: Monitor OI trends, ETF net flows, and STH-to-exchange spikes for early warnings of deleveraging.

Image — UTXO age bands and realized cap:

Source: CryptoQuant

Conclusion

Bitcoin’s retest of $124k is supported by substantial spot inflows, growing long-term holder conviction, and concentrated market dominance. While open interest remains high and derivative risk exists, the balance of on-chain signals currently favors a controlled retest rather than a repeat of July’s leverage flush. Continue monitoring OI, ETF flows, and STH exchange activity for timely risk assessment.