Blockchain network revenue fell 16% month-over-month in September as reduced crypto volatility lowered demand for high-priority transactions, driving network fees down across major chains such as Ethereum, Solana and Tron.

-

Network revenue fell 16% MoM in September

-

Ethereum fees down 6%, Solana down 11%, Tron fees dropped 37% after a governance fee cut.

-

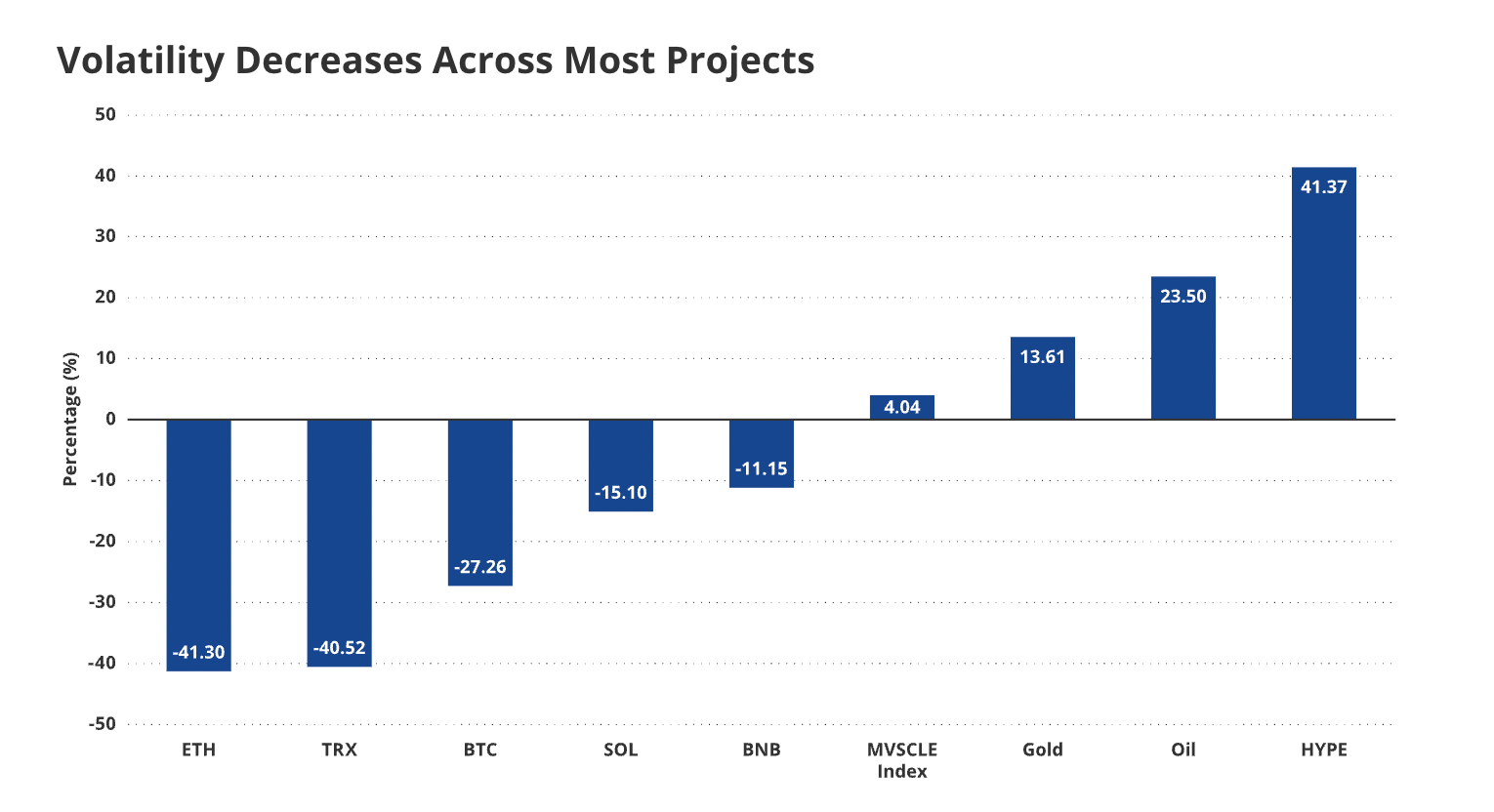

Volatility fell sharply: ETH -40%, SOL -16%, BTC -26% — reducing arbitrage-driven fee demand.

Blockchain network revenue fell 16% in September due to lower crypto volatility; read the full analysis, data, and investor takeaways. Learn how fees and fundamentals changed.

Asset manager VanEck attributed the broad decline in blockchain network revenue in September to lower volatility in the crypto markets.

What caused the decline in blockchain network revenue in September?

Blockchain network revenue declined 16% month-over-month in September primarily because lower crypto volatility reduced traders’ need to pay priority fees, decreasing total fees across major networks. VanEck’s analysis cites reduced arbitrage and fewer high-priority transactions as the main drivers.

VanEck reported that overall network revenues across the blockchain ecosystem dropped by 16% month-over-month in September, linked to diminished volatility and lower transaction fee demand.

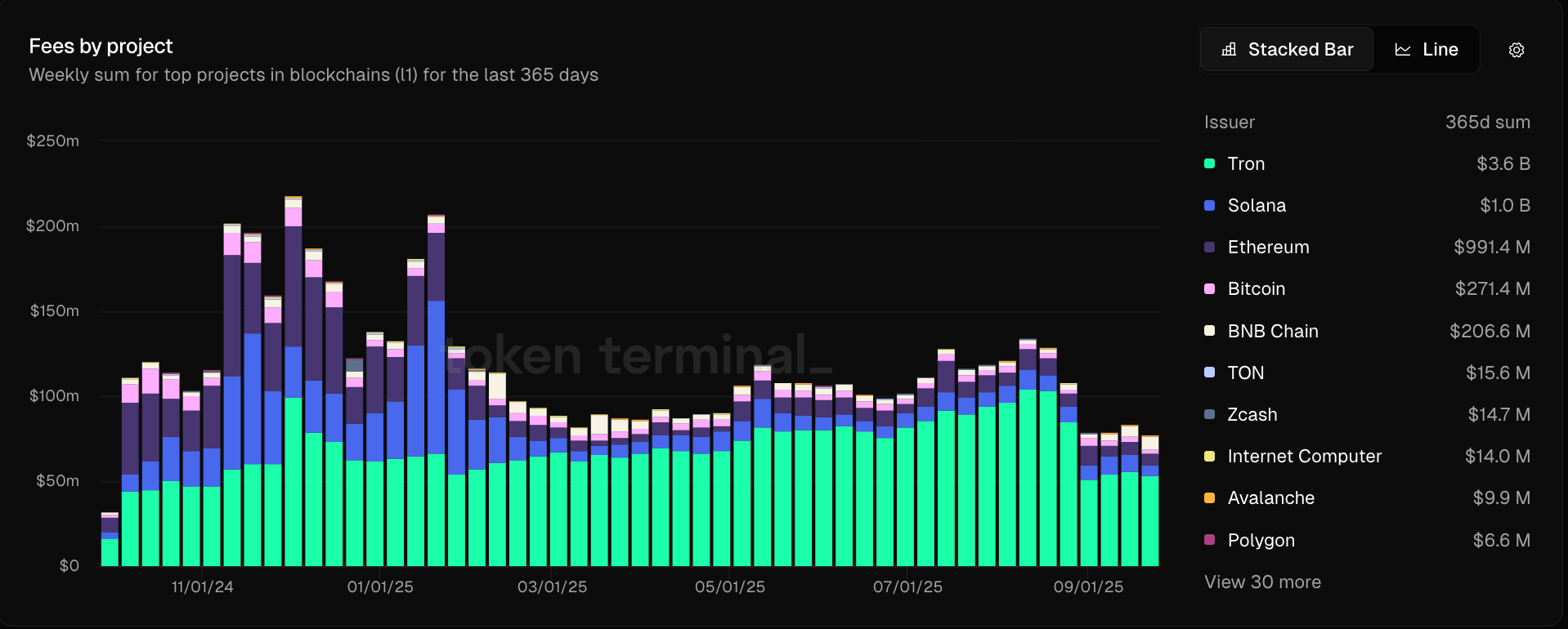

Ethereum network revenue fell by 6% and Solana’s by 11%. The Tron network recorded a 37% reduction in fees, which VanEck attributes to a governance proposal that halved gas fees in August.

Most cryptocurrencies experienced reduced volatility in September. Source: VanEck

How did volatility changes affect crypto network fees?

Reduced volatility curtailed arbitrage and time-sensitive trading that typically pushes users to pay higher fees for faster settlement. Ether (ETH) volatility dropped about 40% in September, SOL volatility fell 16%, and BTC volatility declined 26%, according to VanEck’s figures.

Lower volatility means fewer rapid price moves and thus fewer priority transactions, translating directly into lower network revenue and smaller fee pools for validators and miners.

Why did Tron lead revenue metrics despite lower fees?

Tron remains the top revenue-generating crypto ecosystem, producing roughly $3.6 billion over the last year, according to Token Terminal data cited in market reporting. This leadership stems largely from stablecoin activity — 51% of circulating Tether USDt supply is issued on the Tron network.

A comparison of crypto network fees over the last year. Source: Token Terminal

By comparison, Ethereum generated about $1 billion in annual revenue despite ETH reaching all-time highs in August and a market capitalization near $539 billion — roughly 16x TRX’s market cap of about $32 billion.

Stablecoins continue to expand: the stablecoin market cap crossed $292 billion in October 2025, per RWA.XYZ data, reinforcing Tron’s role in settlement and recurring fee generation.

How should investors interpret network revenue and fees?

Network revenues and fees are a core metric for assessing blockchain economic activity and protocol health. Monitor fees as a short-term gauge of transaction demand and revenue as a longer-term indicator of platform monetization and product fit.

Analysts track fundamentals such as active addresses, transaction value, and fee revenue to evaluate project trajectories and ecosystem resilience.

Frequently Asked Questions

How large was the month-over-month revenue decline in September?

The blockchain ecosystem saw a 16% month-over-month decline in network revenue in September, driven largely by reduced volatility and lower priority-fee transactions.

Did any networks buck the trend in September?

Tron continued to lead annual revenue generation despite a 37% monthly fee drop, thanks to heavy stablecoin settlement activity and prior fee-structure changes.

What role did governance changes play in fee reductions?

On Tron, a governance proposal reduced gas fees by over 50% in August, contributing to a 37% drop in network fees in September as reflected in revenue data.

Key Takeaways

- Revenue decline: A 16% MoM drop in September shows fees are sensitive to volatility and governance changes.

- Network leaders: Tron leads annual revenue ($3.6B) due to stablecoin settlement dominance; Ethereum earned ~$1B.

- Investor action: Monitor volatility, fee policy changes, and stablecoin flows to assess short- and long-term revenue trends.

Conclusion

September’s 16% fall in blockchain network revenue reflects lower crypto volatility and targeted protocol changes that cut fees. Investors should combine fee analytics with on-chain activity and stablecoin trends to evaluate ecosystem health. Review network fundamentals regularly to inform allocation and risk decisions.