Bitunix Analyst: Gaza Ceasefire Negotiations Shift to Comprehensive Agreement, Geopolitical Risks Ease in the Short Term, Supporting Stabilization of Safe-Haven Sentiment

BlockBeats News, October 6 — Hamas and the Israeli negotiation delegation have both arrived in Egypt to begin ceasefire agreement talks. U.S. President Trump emphasized that negotiations are "progressing rapidly," but Hamas still refuses to disarm, and Israeli airstrikes have not ceased. Unlike previous phased agreements, this round of negotiations adopts a "one-time comprehensive plan" aimed at avoiding a return to deadlock.

On the macro level, the market interprets the Middle East conflict as possibly cooling down, with capital continuing to flow into risk assets. U.S. stock index futures and the crypto market are rebounding in tandem, and the shekel has reached a three-year high against the U.S. dollar, indicating that regional safe-haven pressure has temporarily eased.

Bitunix analyst's view: If geopolitical tensions ease further, market focus will shift back to the Federal Reserve's policy pace and liquidity environment, and overall risk appetite is expected to continue. BTC is fluctuating near its historical high, with short-term support at $121,000 and resistance in the $126,000 range. If risk-off sentiment continues to subside, prices may test this resistance area. However, caution is still needed regarding short-term volatility caused by unexpected variables.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Federal Reserve Governor Milan once again calls for a significant rate cut in December

International Business Settlement: Acquired approximately 247 bitcoins between October 17 and November 7

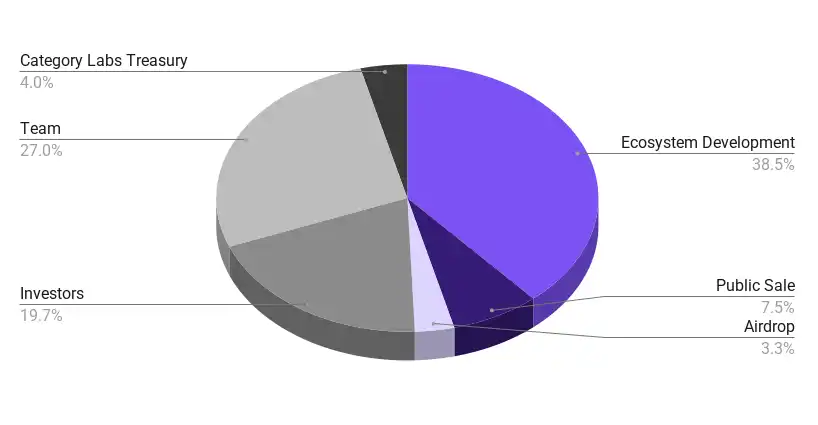

Monad announces tokenomics: total supply of 100 billions tokens, 3% to be distributed via airdrop

Trending news

MoreOverview of Monad Tokenomics: 49.4% of the total supply will be unlocked on the first day of mainnet launch, with 10.8% entering circulation through public sale and airdrop, and 38.5% managed by the Monad Foundation.

Federal Reserve Governor Milan once again calls for a significant rate cut in December