Glassnode Co-Founders Say Bitcoin Flashing Major Momentum Signal, Detail Timeline for Bull Market Top

The co-founders of the analytics firm Glassnode say the bull market top for Bitcoin ( BTC ) is in sight.

Jan Happel and Yann Alleman, who go by the pseudonym Negentropic, tell their 63,900 followers on X that traders shorting Bitcoin right now will likely absorb losses.

According to the Glassnode co-founders, BTC is flashing signals witnessed exactly a year ago that drove Bitcoin to breach $100,000 for the first time ever.

“Our major momentum signal is in and accelerating deployment.

Last time this happened was October 2024, things about to heat up.

Bottom Confirmation with aggregated impulse.

BTC Trend and reversal confirmation with systematic strategies.

ETH systematic signals will be next, once BTC goes over all-time highs (ATHs).

If you are shorting this move, you are out of your mind.”

While the pair is bullish on Bitcoin and altcoins, they warn that the end of crypto’s bullish phase is on the horizon.

“There is a good chance BTC tops out in 4-5 weeks, and alts in 6-8 weeks.”

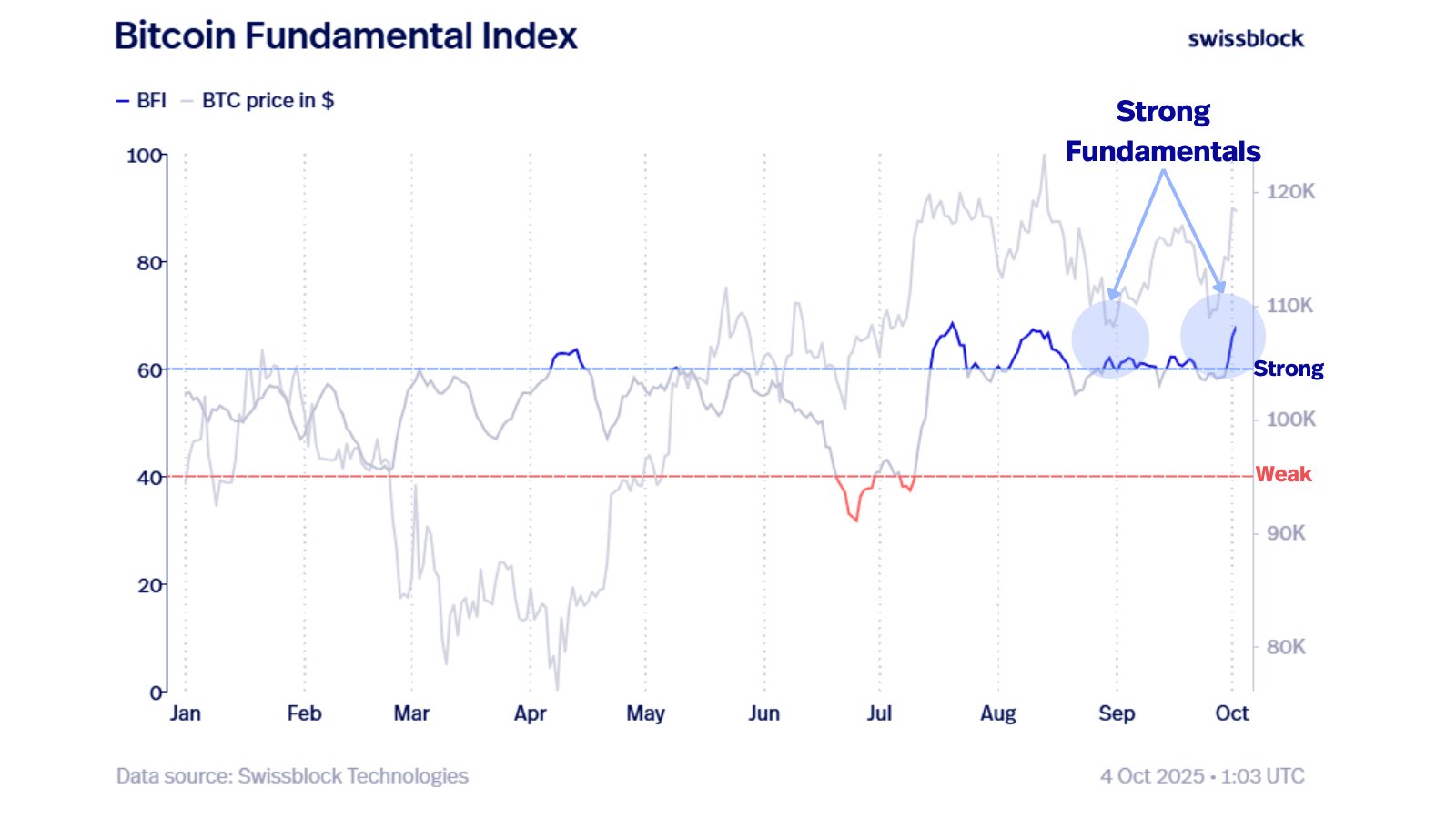

Meanwhile, analytics firm Swissblock says strong fundamentals are carrying BTC to new all-time high levels.

“Now, with Bitcoin trending into the ATH zone, it’s clear: fundamentals were the launchpad. Liquidity and network growth built the base, turning a bearish setup into the foundation of the current bullish trend. The lesson: when price and sentiment diverge from fundamentals, it often marks structural inflection points.”

Source: Swissblock/X

Source: Swissblock/X

At time of writing, Bitcoin is trading at $124,144, very close to its all-time high of $125,782.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Mining Faces Energy Cost Challenges as Tether Withdraws from Uruguay

- Tether halts Uruguay Bitcoin mining due to rising energy costs and unresolved tariff disputes, ending a $500M project with 30 layoffs. - Unpaid $5M electricity bills forced power cuts in July 2025, accelerating the project's collapse despite initial renewable energy ambitions. - The exit highlights Latin America's regulatory challenges for crypto mining, prompting Tether to shift operations to Paraguay and El Salvador. - Analysts note energy economics now dominate mining strategies, with firms prioritizi

DOGE Holds $0.1499 Support, Reviving Long-Term Bullish Structure and $1 Projection

Dogecoin Holds $0.144 Support as Price Climbs to $0.1484 in Tight Reversal Range

SOL Trades Near Resistance While Heatmap Highlights Major $145 Liquidation Band