Bitcoin Hits New $126,000 Record While Retail Engagement Sleeps

Bitcoin’s record-breaking rally to $126,000 signals a new era led by institutions, not retail traders. Analysts now question whether this shift has permanently rewritten the rules of crypto market behavior.

Bitcoin reached a new all-time high, breaking $126,000 despite an apparent lack of engagement from retail traders. Corporate inflows overwhelmed a huge volume in short positions, creating an unusual situation.

If institutional investors really are directing the valuation of BTC, it might invalidate years of data on crypto price cycles. The future may be harder to predict than ever before.

Bitcoin’s Unusual All-Time High

Bitcoin hit an all-time high yesterday, but this apparently hasn’t slowed the train down one bit. Throughout 17 years of price data, new heights typically recede somewhat, with records manifesting as brief spikes on an upward trend.

Profit-taking and other hedging activities often cause this, pulling prices back despite fierce enthusiasm.

Today, however, has been a little different. BTC did recede a little after yesterday’s all-time high, but investment continued, causing massive liquidations among short positions.

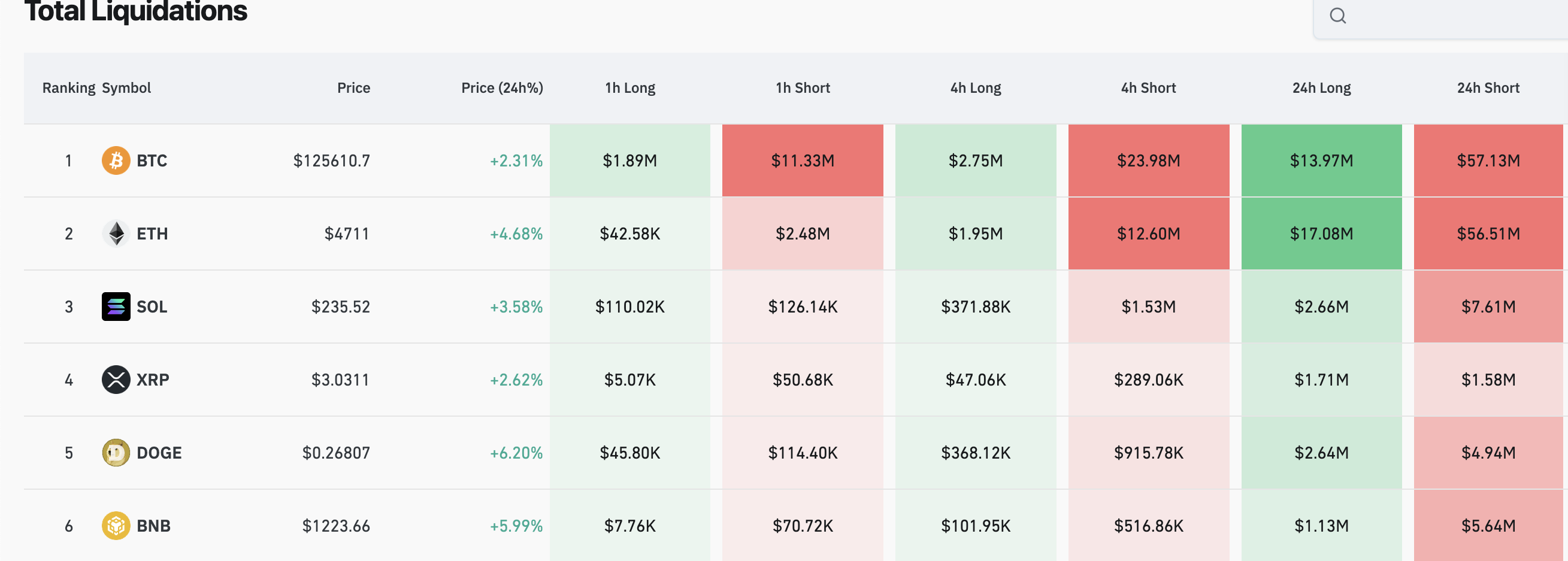

Ethereum is also flirting with a new record price level, but Bitcoin’s rise to $126,000 is causing the biggest impact:

Bitcoin and Altcoin Liquidations. Source:

Bitcoin and Altcoin Liquidations. Source:

Although this should ostensibly be bullish, Bitcoin’s newest all-time high is causing a little consternation among analysts. Some experts have feared that corporate inflows are powering this growth, representing a broader narrative shift from expectation of future gains to monetary panic.

Today’s new data seems to further corroborate these concerns. Bitcoin ETF investment is flourishing, and digital asset treasuries reported $1.3 billion in acquisitions last week.

This impressive figure doesn’t even include MicroStrategy or Metaplanet. Meanwhile, how is retail sentiment reacting to Bitcoin’s new all-time high?

A New Price Cycle?

These pieces of information, especially when paired with the liquidation data, could present a concerning sign. “Concern” might be an overstatement; it’s hard to be outright bearish when Bitcoin hits an all-time high.

Still, today’s market raises an interesting question: how can we predict future price moves in these unprecedented circumstances?

Ever since the SEC approved BTC ETFs in 2024, analysts have been wondering if institutional inflows will permanently break well-established price dynamics.

Bitcoin hit two all-time highs in two days without much retail participation, which seems like an aberration if ever there was one. Where do we go from here?

If the rules really have changed forever, we’ll need to independently verify each time-tested industry truism to see if it still applies in 2025. Is Bitcoin actually a good inflation or recession hedge?

Can we continue trusting that crypto winters will always end, even if it takes multiple years? Your guess might be as good as mine.

That sort of chaos could be very unsettling and have deleterious impacts on investor confidence. Hopefully, we’ll get some answers soon.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates Today: BitMine's Pursuit of Ethereum 'Alchemy': 3% Ownership Targeting 5% Milestone

- BitMine acquires 3.63M ETH (3% supply), advancing its "Alchemy of 5%" goal to control 5% of Ethereum's network. - Aggressive buying positions BitMine as second-largest crypto treasury globally, with staking via MAVAN stabilizing its balance sheet. - Upcoming Fusako upgrade (Dec 3) aims to boost staking efficiency, but market remains fragile with $3,000 resistance and $2,850 support critical. - Institutional caution grows as Ethereum ETFs see $500M outflows, while analysts question BitMine's $2,840 averag

INJ at $6.30: Holding Firm in a Downtrend or Poised for a Bullish Breakout

DeFi Faces a Trust Challenge: Balancer Recovers $8 Million Following $128 Million Hack

- Balancer proposes $8M repayment plan after $128M exploit, returning funds to liquidity providers via pro-rata in-kind distribution. - Whitehat actors receive 10% bounties in rescued tokens; non-socialized model ensures pool-specific funds go only to affected LPs. - Exploit exposed systemic risks in DeFi's composable pools, with attackers exploiting rounding errors despite 11 prior audits by four firms. - Governance vote will finalize distribution framework, with claim interface enabling 90-180 day token

AI-driven SaaS Revolution: PetVivo Reduces Expenses by 50-90%, C3.ai Collaborates with Microsoft

- PetVivo.ai cuts veterinary client acquisition costs by 50-90% using AI agents, achieving $42.53 per client vs. $80-$400 industry norms. - C3.ai's Microsoft partnership boosts stock 35% as Azure integration enables enterprise AI scalability through unified data operations. - AI-driven SaaS models like PetVivo's $3/lead platform and C3.ai's 19-27% revenue growth highlight AI's disruptive potential in traditional industries. - Both companies face challenges scaling beta results and converting pilots to long