Plume Wins SEC Green Light for Tokenized Securities Push

The US Securities and Exchange Commission (SEC) formally approved Plume (PLUME) as a registered transfer agent for tokenized securities on October 6, marking a major milestone in the shift toward regulated blockchain markets. The announcement sparked a sharp market rally, with PLUME’s price jumping 31% before settling at $0.12. Analysts say the decision highlights a

The US Securities and Exchange Commission (SEC) formally approved Plume (PLUME) as a registered transfer agent for tokenized securities on October 6, marking a major milestone in the shift toward regulated blockchain markets.

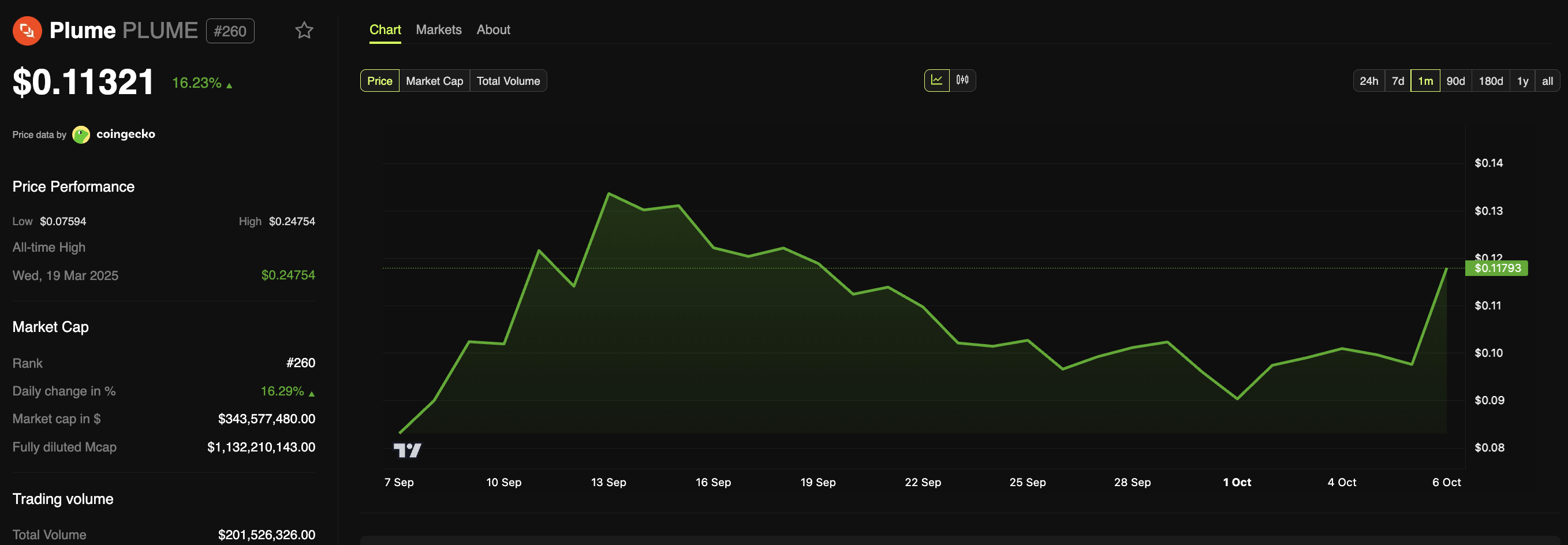

The announcement sparked a sharp market rally, with PLUME’s price jumping 31% before settling at $0.12. Analysts say the decision highlights a growing effort to merge blockchain innovation with US financial oversight.

Plume Secures Key SEC Approval

As a transfer agent, Plume can now handle shareholder records, trades, and dividend payments directly on-chain. The registration connects its infrastructure with the SEC and the Depository Trust & Clearing Corporation (DTCC), integrating compliance into the digital asset ecosystem.

Plume Price Performance. Source:

Plume

Plume Price Performance. Source:

Plume

Transfer agents have long been vital to maintaining shareholder data and processing ownership changes. Plume’s blockchain-native system automates these duties and offers real-time audit visibility.

“Regulated on-chain reporting is no longer theoretical — it’s operational,” said Plume co-founder Chris Yin. “We built this framework to integrate digital and traditional finance without friction.”

The company said it has already onboarded over 200,000 real-world asset holders and facilitated more than $62 million in tokenized assets through its Nest platform within three months.

The registration, it added, represents a foundation for aligning blockchain infrastructure with US securities law.

Regulatory Shift Could Reshape Token Markets

The SEC’s approval underscores a broader regulatory turn toward treating blockchain as viable market infrastructure. It follows joint SEC–CFTC discussions and the CFTC’s $15 billion tokenized collateral pilot launched last month.

Observers say Plume’s achievement could push other tokenization firms to seek similar recognition, speeding up institutional entry into digital securities. The SEC’s nod may also assure custodians and broker-dealers that blockchain processes can function safely under federal frameworks.

Economists say integrating blockchain into official settlement systems could cut processing times by up to 70%, lower operational costs, and improve transparency across asset lifecycles. It could also open routes for tokenized funds, ETFs, and private credit vehicles to meet compliance faster.

Plume CEO Chris Yin stressed that regulatory alignment is essential for scaling real-world assets, saying, “Compliance and transparency are not limitations—they’re the foundation of institutional adoption,” in a post on X this February.

Plume is for the people. I've said it before and I'll say it again — almost all RWA projects are TradFi ppl trying to do Trad things onchainNot us. We are focused on building a new financial system that allows everybody — from the largest financial institutions to…

— Chris Yin February 5, 2025

The approval also places the US alongside Europe and Asia, where regulators have advanced tokenized securities rules. With global tokenized assets topping $30 billion — a 700% rise since early 2023 — analysts say regulated transfer agents like Plume could bridge issuers, asset managers, and investors in a fully compliant on-chain ecosystem.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.