Why Dogecoin’s Rally May Falter Amid Bearish Divergence and Dropping Whale Demand

Dogecoin’s recent gains may not hold for long. Despite a steady climb, weakening inflows and falling whale demand point to a potential correction unless new buyers step in.

Leading meme asset Dogecoin (DOGE) has seen a steady price rise over the past two weeks, trading within an ascending parallel channel on the daily chart. Currently priced at $0.2605, the coin’s value has climbed 17% in the past 14 days, extending optimism across the meme coin market.

However, there’s a catch. A key momentum indicator has formed a bearish divergence, signaling that DOGE’s rally may lack organic support and could be due for a correction. Meanwhile, large holders, known as whales, appear to be slowing down their accumulation, further dampening the bullish outlook.

DOGE Price Strength Faces Test

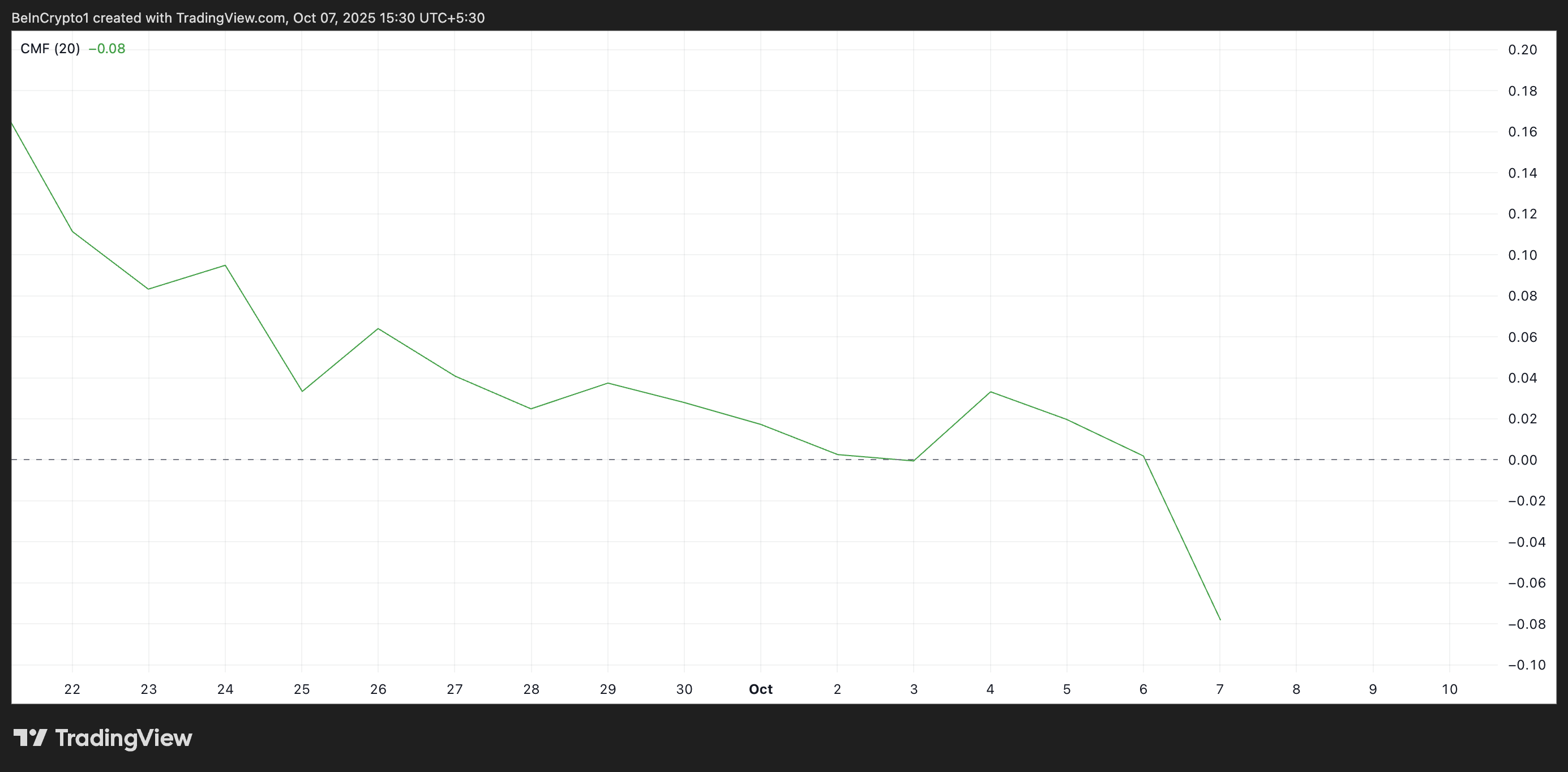

While DOGE has posted double-digit gains in the past two weeks, its Chaikin Money Flow (CMF), a key indicator that tracks capital inflows and outflows, has declined, forming a bearish divergence. This momentum indicator is below the zero line at -0.08 at press time.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

DOGE CMF. Source:

TradingView

DOGE CMF. Source:

TradingView

A bearish divergence occurs when an asset’s price continues to climb while its CMF indicator trends downward. This means that less capital flows into the asset despite the price growth.

Such divergences typically precede pullbacks, suggesting that DOGE’s short-term momentum could weaken if buying activity does not recover.

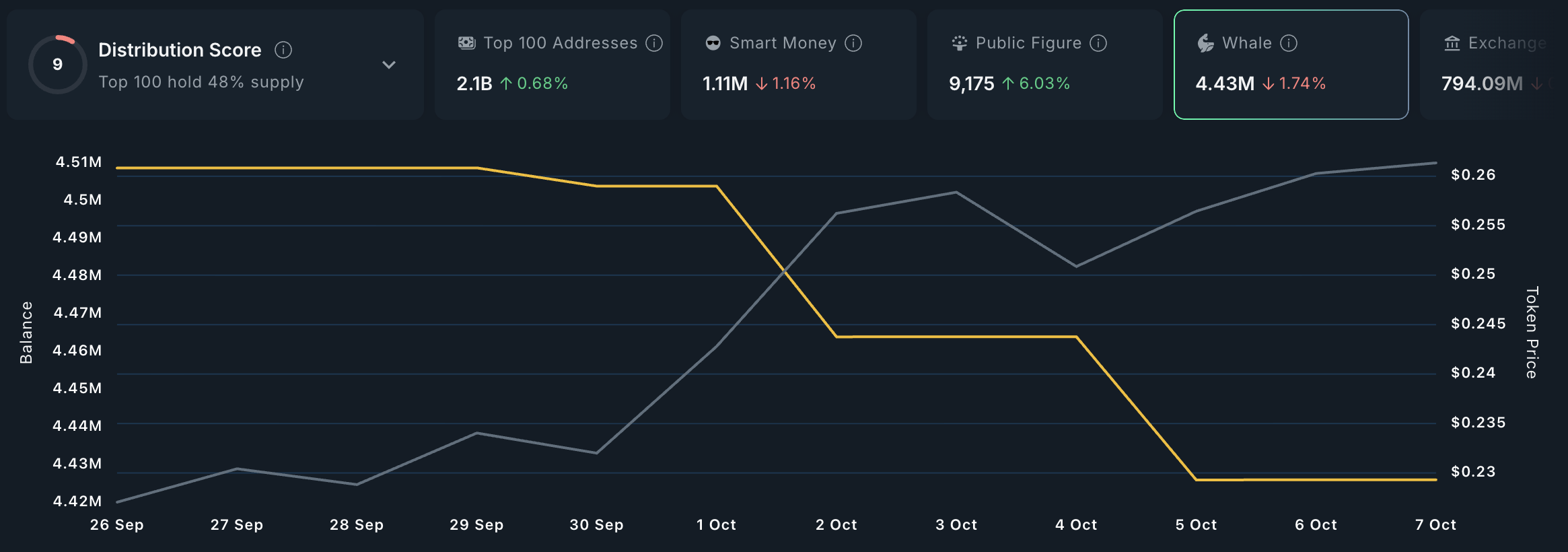

In addition, on-chain data has revealed a drop in whale activity. According to Nansen data, large investors holding DOGE coins worth more than $1 million have reduced their supply by 1% in the past two weeks. At press time, this cohort of DOGE investors holds 4.43 million DOGE.

Dogecoin Whale Activity. Source:

Nansen

Dogecoin Whale Activity. Source:

Nansen

Whales play a crucial role in sustaining market momentum. When their demand declines during a rally, it often reflects a lack of conviction behind the price move. This could be a red flag for traders banking on continued upside.

Can New Demand Save the Meme Coin?

If buying pressure continues to wane, DOGE could face a short-term correction toward the lower boundary of its ascending parallel channel, potentially testing $0.2574 as near-term support. If this price floor gives way, the meme coin’s price could experience a deeper decline toward $0.2018.

Dogecoin Price Analysis. Source:

TradingView

Dogecoin Price Analysis. Source:

TradingView

On the other hand, if new demand enters the market, the coin could break above the upper line of its current channel, which forms resistance at $0.2797. If successful, DOGE price could reach for $0.2980.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Perhaps as soon as next week, the term "RMP" will sweep across the entire market and be regarded as the "new generation QE".

The Federal Reserve has stopped its balance sheet reduction, marking the end of the "quantitative tightening" era. The much-watched RMP (Reserve Management Purchases) could initiate a new round of balance sheet expansion, potentially injecting a net increase of $20 billion in liquidity each month.

Enemies reconciled? CZ and former employees join forces to launch prediction platform predict.fun

Dingaling, who was previously criticized by CZ due to the failure of boop.fun and the "front-running" controversy, has now reconciled with CZ and jointly launched a new prediction platform, predict.fun.

Why is it said that prediction markets are really not gambling platforms?

The fundamental difference between prediction markets and gambling lies not in gameplay, but in mechanisms, participants, purposes, and regulatory logic—the capital is betting on the next generation of "event derivatives markets," not simply rebranded gambling.

2025 Crypto Prediction Mega Review: What Nailed It and What Noped It?

Has a year passed already? Have those predictions from back then all come true?