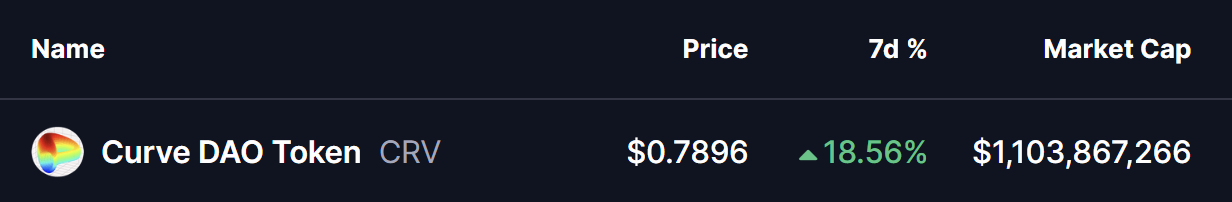

As per its historical October trend, the cryptocurrency market is showing strong upside momentum, with Bitcoin (BTC) and Ethereum (ETH) surging over 10% and 13% respectively in the past week. Riding this market-wide strength, several major altcoins are beginning to display bullish setups — and Curve DAO Token (CRV) is one of the most notable among them.

CRV has climbed by an impressive 18% over the past week, and more importantly, its latest technical structure suggests that a potential bullish breakout could be on the horizon.

Source: Coinmarketcap

Source: Coinmarketcap

Broadening Wedge Setup in Play

CRV’s daily chart reveals a large ascending broadening wedge pattern — a structure that often reflects volatility and market indecision. While such formations can sometimes lean bearish, they are also known for generating sharp upside rallies before any potential correction occurs.

Interestingly, CRV’s current setup closely mirrors a previous fractal formation observed in mid-2025. Back then, the token broke out of a falling wedge pattern after reclaiming both the 50-day and 100-day moving averages, leading to a powerful 86% rally that took its price to test the upper resistance line of the wedge.

Curve DAO Token (CRV) Daily Chart/Coinsprobe (Source: Tradingview)

Curve DAO Token (CRV) Daily Chart/Coinsprobe (Source: Tradingview)

Now, history seems to be repeating itself. CRV has once again formed a similar falling wedge pattern and is currently hovering near the upper resistance and the 100-day moving average ($0.8019) — the same technical area where the last breakout began.

Adding further confidence, the RSI indicator has broken out of its downward trendline, hinting at strengthening bullish momentum.

What to Watch Next?

If this fractal setup unfolds similarly to the last one, a confirmed breakout above the 100-day moving average and the wedge resistance could spark a strong upward rally. The potential upside target lies around the $1.60 level, aligning with the upper boundary of the broadening wedge.

However, traders should keep in mind that fractals serve as historical reflections of price behavior — not guarantees. Still, the striking resemblance between the current and past patterns makes CRV one of the most intriguing altcoins to watch this month.

If history rhymes once again, early holders could find themselves well-positioned for a significant upside move.