Bitcoin Drops Below $124,000 Amid Market Downturn

- Main event, market impact, potential funding changes.

- Bitcoin drops, affecting broader market.

- Possible implications for funding and investments.

Bitcoin dropped below $124,000, decreasing by 0.80% amid a broader market decline impacting cryptocurrencies like Ethereum and Solana. The drop reflects historical volatility, with major players often sharing insights, although official statements from Bitcoin’s decentralized network remain absent.

Points Cover In This Article:

ToggleBitcoin’s value has dropped below $124,000, decreasing by 0.80% in a day, amid a broader cryptocurrency market downturn affecting Ethereum and Solana.

Bitcoin’s Price Decline

Bitcoin’s price decline to below $124,000 reflects a volatile market trend impacting major cryptocurrencies. Ethereum and Solana have also suffered price drops, suggesting a widespread market downturn rather than isolated events.

Market Players and Reactions

Key players include institutional and long-term investors, yet no central authority or founder’s response, given Bitcoin’s decentralized nature. Absent official statements, market insights often come from cryptocurrency leaders like CZ Binance, though none directly address this event.

**CZ Binance, CEO of Binance**, – “The current market trends reinforce the need for caution among investors, especially in a volatile market like crypto.”

Market reactions include potential funding challenges for projects tied to Bitcoin’s value. Broader implications are seen with Ethereum and Solana’s price decreases. This ongoing volatility affects market capitalization and trader sentiment.

Past Market Trends

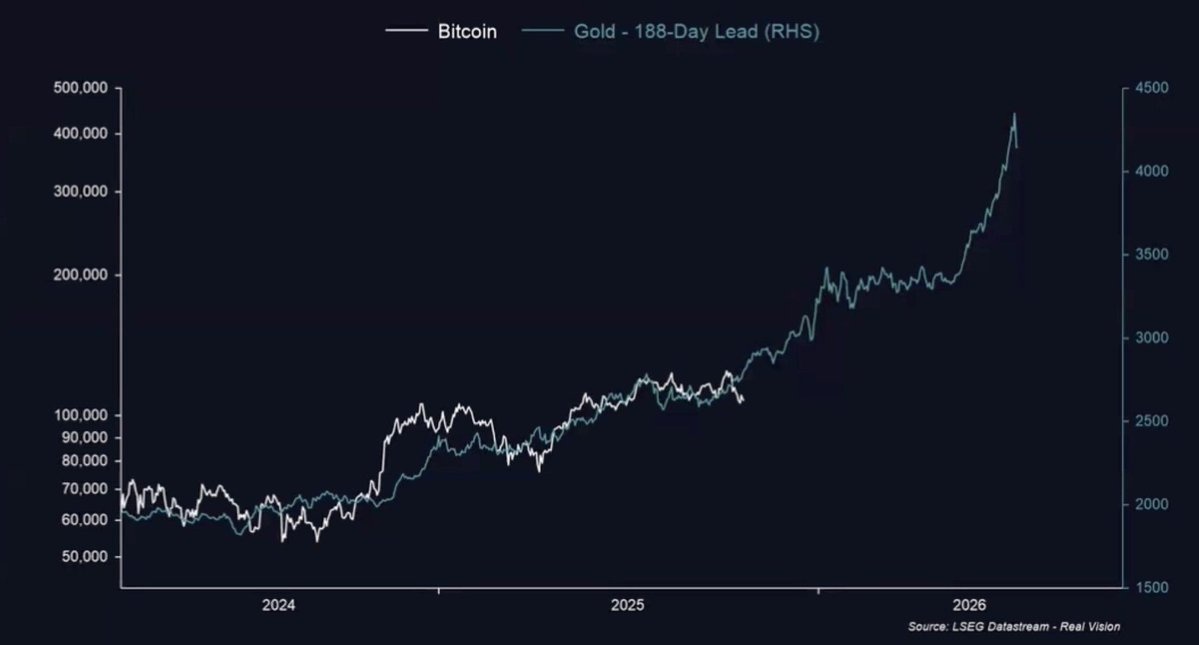

Past events show Bitcoin’s volatile history with periodic price corrections. Current changes align with this pattern, demonstrating the market’s susceptibility to frequent fluctuations within its cycle. Community discourse reflects mixed sentiments as market uncertainty persists.

Potential outcomes include continued market impact on investments and liquidity, subject to regulatory discussions. Analysts frequently debate cryptocurrency trends and project valuations based on historical data and market dynamics. Financial implications remain a central focus for investors navigating these turbulent times.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Polymarket Will Launch Token and Airdrop After U.S. Relaunch, CMO Says

Bitcoin Updates: Gold's Downturn Sparks Shift to Altcoins While Bitcoin Remains Stuck in Crucial Range

- Ethereum forms bullish "triple bottom" pattern near $3,800, signaling potential breakout above $4,000 as large holders accumulate. - Bitcoin stalls in $107k–$111.5k range amid gold's 6.3% single-day crash, triggering capital rotation into crypto risk assets. - Altcoin Season Index at 24 favors Bitcoin despite $1.46T market cap threshold seen as critical for broader crypto breakout. - Digitap ($TAP) emerges as rotation beneficiary with hybrid crypto/fiat infrastructure as market fear/greed index hits 29-y

Polymarket's token giveaway connects the world of cryptocurrency with conventional finance

- Polymarket launches POLY token and airdrop, backed by $2B ICE investment valuing it $9B-$15B. - Airdrop rewards 1.35M users based on trading volume, with top traders receiving largest shares. - U.S. relaunch delayed until 2025 to ensure compliance, following CFTC-regulated QCX acquisition. - Platform aims to bridge crypto and traditional finance through tokenization and institutional data integration. - Regulatory restrictions in 15+ countries persist, but partnerships target mainstream financial adoptio