The S&P Digital Markets 50 Index is a new hybrid benchmark that combines 15 major cryptocurrencies and 35 crypto-exposed public companies, enabling on‑ and off‑chain investment access via tokenized products and traditional exchange vehicles for diversified exposure and improved global liquidity.

-

S&P Digital Markets 50 Index mixes crypto and equities for diversified exposure.

-

The tokenized version will be available on‑chain via Dinari and off‑chain through traditional markets.

-

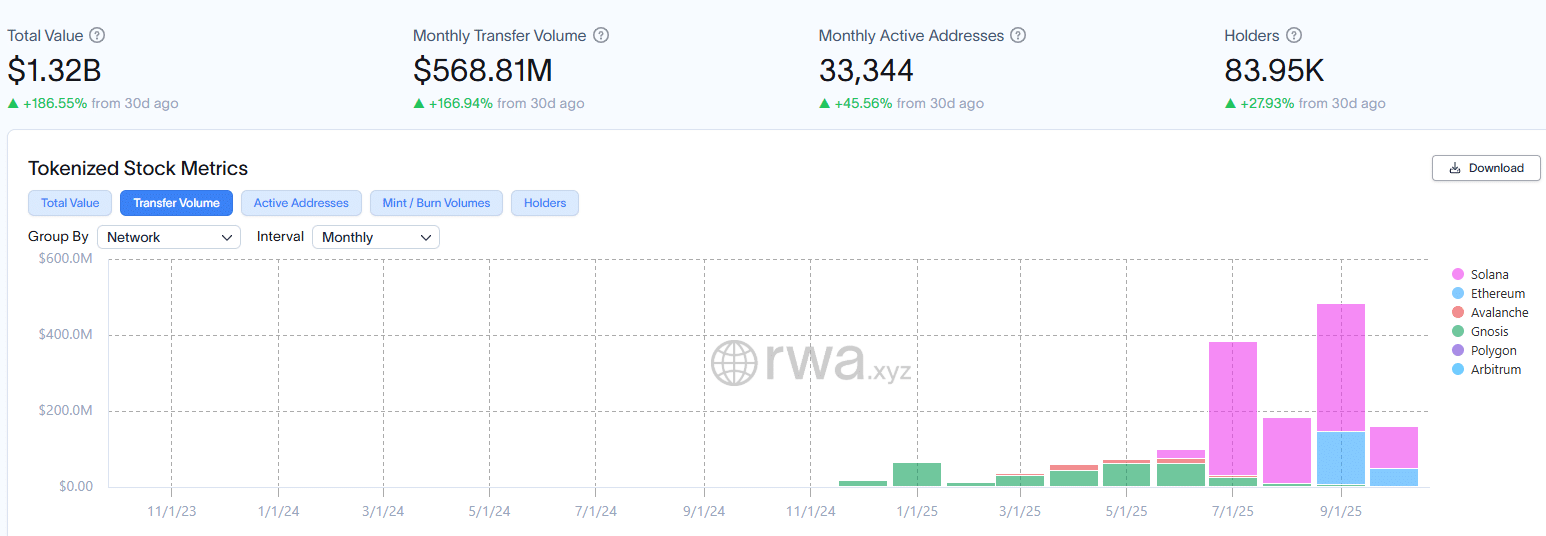

Tokenized stocks sector value exceeded $1B and monthly transfer volume nearly doubled to ~$600M.

S&P Digital Markets 50 Index combining crypto and equities — learn how tokenized stocks and ETFs expand access. Read the full analysis and key takeaways.

What is the S&P Digital Markets 50 Index?

The S&P Digital Markets 50 Index is a diversified benchmark tracking 15 cryptocurrencies and 35 publicly traded firms with material crypto exposure. It is designed to be investable both via traditional, off‑chain exchange vehicles and via a tokenized on‑chain product, broadening investor access to combined crypto and equity exposure.

How will tokenized stocks and ETFs provide investor access?

Tokenized stocks and ETFs use blockchain rails to represent traditional securities or indices as transferable tokens. The collaboration between S&P Global and Dinari enables an on‑chain token that mirrors the index while off‑chain versions trade on regulated venues. This hybrid approach increases global access, reduces settlement friction, and supports 24/7 transferability.

Frequently Asked Questions

How big is the tokenized stocks and ETFs sector?

The tokenized stocks and ETFs sector has surpassed $1 billion in total value, with monthly transfer volumes rising sharply. Recent data shows transfer volumes nearly doubled month‑over‑month to approximately $600 million, highlighting rapid growth in on‑chain trading activity.

Why is Solana leading tokenized equities growth?

Solana’s throughput and low fees make it attractive for tokenized equity issuance and transfers. Market participants favor blockchains that support high transfer volume and low settlement costs, which has contributed to Solana’s clear dominance in this subsector.

Key Takeaways

- S&P Digital Markets 50 Index: Blends 15 cryptocurrencies and 35 crypto‑exposed firms for diversified exposure.

- Dual access model: Available off‑chain via traditional markets and on‑chain as a token through Dinari.

- Market momentum: Tokenized equities surpassed $1B in value; monthly transfer volumes hit ~ $600M, led by Solana.

Conclusion

The launch of the S&P Digital Markets 50 Index marks a notable step in mainstreaming tokenized securities by combining established benchmarks with blockchain distribution. As tokenized stocks and ETFs scale, investors will gain new tools for diversification. Follow regulatory developments and liquidity metrics before allocating; COINOTAG will monitor updates and provide ongoing coverage. Published: 2025-10-08 | Updated: 2025-10-08

Source: RWA.xyz. Commentary includes statements from S&P Global Chief Product Officer Cameron Drinkwater and Dinari Chief Business Officer Anna Wroblewska, cited as industry sources for product context and market impact. Other referenced industry products and indices are cited as plain text (Nasdaq, Coinbase, Market Vector).

meta-description: S&P Digital Markets 50 Index combining crypto and equities — learn how tokenized stocks and ETFs expand access. Read the full analysis and key takeaways.