NEAR Intents Activity Spikes as Zcash’s Zashi Wallet Taps It for Private Swaps

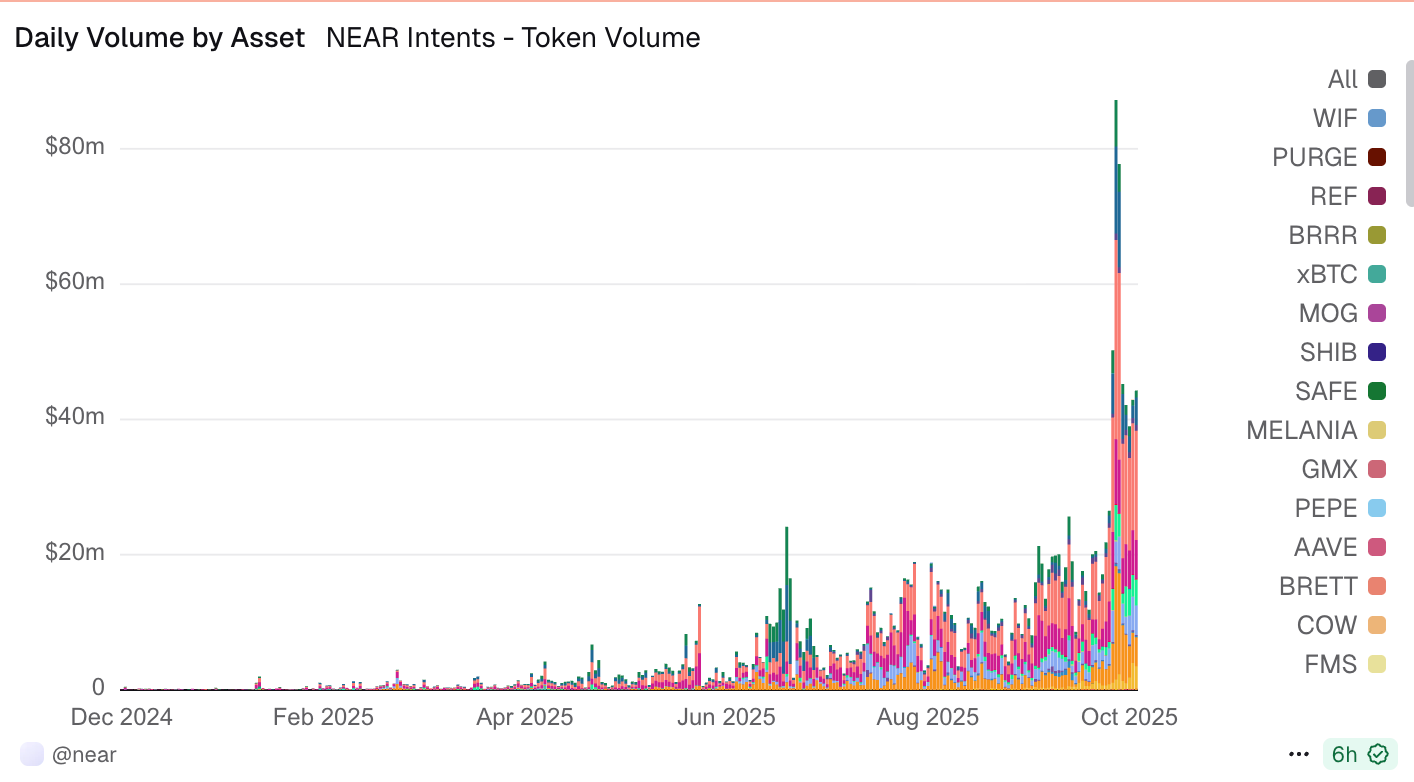

Activity on NEAR’s intent-based system has picked up sharply in recent weeks, with transaction volumes nearly doubling month-on-month and user counts climbing past 120,000, according to Dune data.

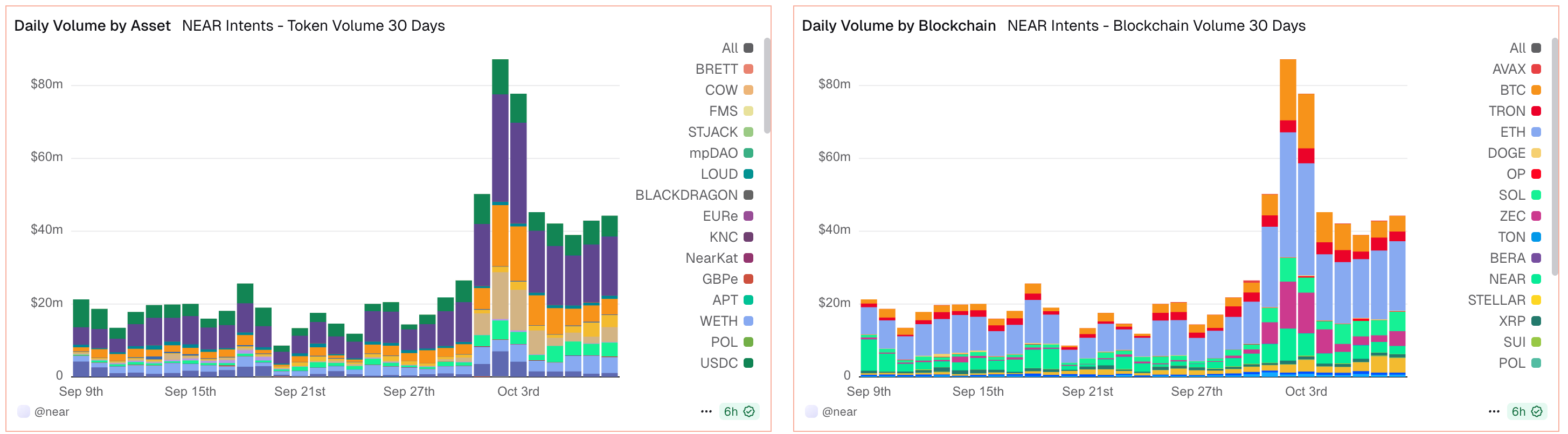

Nearly $800 million in swaps and payments have flowed through NEAR Intents in the past 30 days, lifting cumulative totals to about $1.8 billion since the product went live earlier this year.

The jump is tied to how Intents changes the user experience. Instead of bridging assets manually or confirming multiple steps across chains, a user states an outcome — “swap USDC on Ethereum for NEAR on Solana,” for example — and the protocol handles routing in the background.

Data shows both asset and chain coverage widening. USDC, WETH and newer ecosystem tokens have climbed into the top slots by volume, while Ethereum, Solana and Zcash dominate on the blockchain side. Unique active users hit 113,000 over the past week, suggesting stickier flows rather than one-off incentive spikes.

Orders are bundled and matched by relayers, reducing failures and compressing gas costs. That structure is starting to pull traders who want cross-chain execution without the mess of juggling multiple wallets or waiting for bridges to settle.

The privacy angle is giving this wave its edge. Zashi, the mobile wallet released by the Electric Coin Company for Zcash, now runs two live features on NEAR Intents after launching earlier in October.

Zashi Swaps let users convert BTC, SOL, USDC and other supported assets directly into ZEC inside the app, where they can then be shielded. CrossPay allows someone to spend shielded ZEC and have the recipient receive funds in their chosen crypto on any NEAR-supported chain.

That link matters because Zcash, after years in the background, has quadrupled in price in the past month and is back in market conversation. Furthermore, Zashi’s on-ramp and off-ramp to NEAR Intents creates a cleaner user experience for everyday participants and makes private ZEC actually usable.

The Zashi–Intents loop sets a template for other privacy wallets to mimic, where intents do the heavy lifting in the background while the user-facing applications handle client user demand.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Coinpedia Digest: This Week’s Crypto News Highlights | 29th November, 2025

QNT Price Breaks Falling Wedge: Can the Bullish Structure Push Toward $150?

Digital dollar hoards gold, Tether's vault is astonishing!

The Crypto Bloodbath Stalls: Is a Bottom In?