Crypto bloodbath sees $19B in leveraged positions erased

Key Takeaways

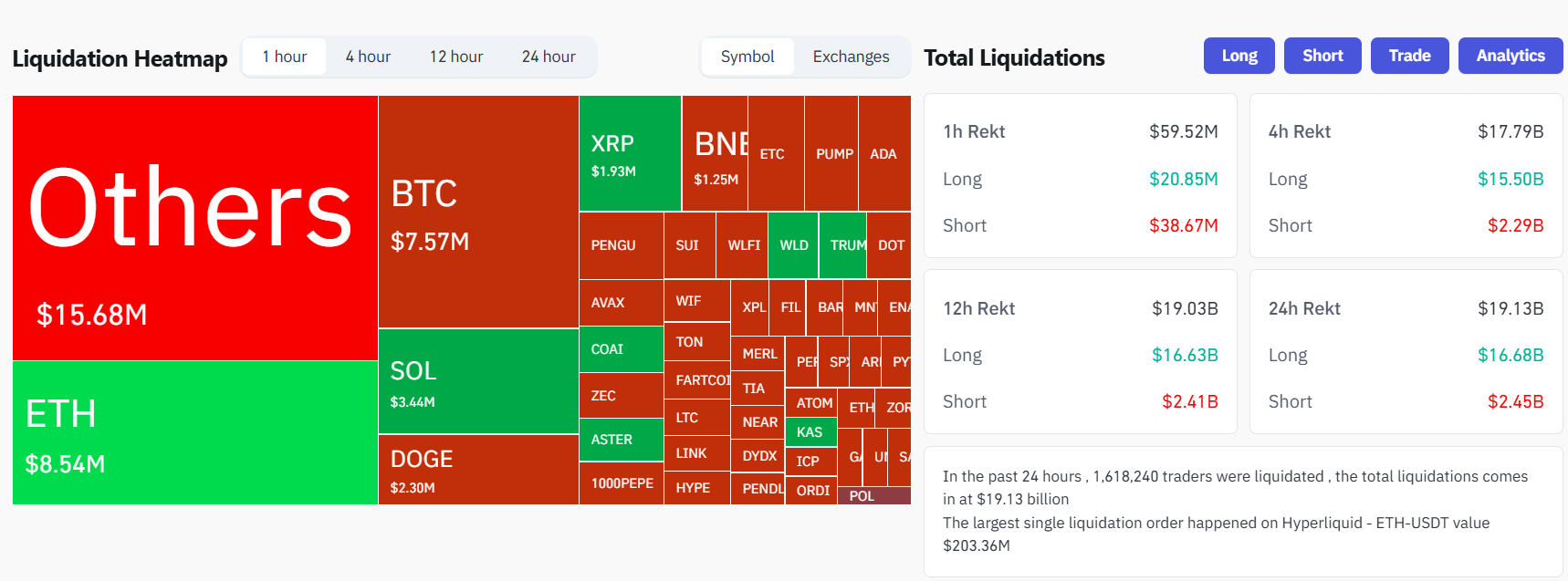

- Over $19 billion in leveraged crypto positions were liquidated in 24 hours, marking the largest single-day wipeout in digital asset history.

- Bitcoin and Ethereum long positions were hardest hit, with over 1.6 million traders affected across major exchanges.

Roughly $19 billion in leveraged crypto positions were liquidated following a brutal sell-off that sent Bitcoin tumbling to $102,000. It was the largest single-day wipeout ever recorded in digital asset markets, according to CoinGlass data .

Most of the liquidations came from long positions, which totaled $16.6 billion in losses, compared to $2.4 billion for shorts.

Over 1.6 million crypto traders were liquidated across major exchanges, with Bitcoin and Ethereum long positions severely impacted during Friday’s US trading sessions.

The liquidation cascade was triggered after President Donald Trump proposed a massive tariff increase on Chinese imports, followed shortly by an announcement of a 100% tariff on Chinese goods in response to China’s planned export restrictions on rare earth minerals.

Bitcoin plunged from above $122,000 to around $102,000 on the news. Ethereum dropped below $3,500, while smaller-cap altcoins saw double-digit losses amid evaporating liquidity.

At the time of writing, Bitcoin traded above $113,000 after recovering from earlier lows but remained below its daily high of $122,500, according to CoinGecko data.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Decentralized Finance (DeFi) and the Emergence of DASH Aster DEX

- DASH Aster DEX combines AMM and CEX features, reducing slippage by 40% and attracting $1.399B TVL by Q3 2025. - Cross-chain interoperability and yield-bearing collateral address liquidity gaps, while dual-mode trading caters to both retail and institutional users. - Privacy tools like ZKPs and decentralized governance mitigate regulatory risks, though challenges persist under MiCA and CLARITY Act frameworks. - With 70% perpetual derivatives market share and Aster Chain's 2026 launch, it aims to redefine

Empowering Crypto Traders: How FlipsideAI Simplifies Technical Analysis with Natural Language

Exploring the Opportunities and Challenges of Decentralized Exchanges After Regulatory Changes

- Global DeFi regulation (GENIUS Act, MiCA, FATF) forces platforms to balance compliance with decentralization, reshaping innovation and investment viability. - Aster DEX (19.3% DEX market share) integrates AI surveillance, MiCA-compliant tools, and 1:1 stablecoin reserves to align with 2025 regulatory benchmarks. - The platform bridges TradFi and DeFi via Aster Chain (Q1 2026), offering institutional-grade privacy features and tokenized real-world assets to attract traditional investors. - Proactive compl

ZK Technology's 2025 Price Increase: An In-Depth Analysis of On-Chain Integration and Protocol Enhancements

- ZK technology surged 170% in Q3 2025 due to protocol upgrades and institutional adoption. - ZKsync's 15,000 TPS Atlas upgrade and StarkNet's $150M TVL validated scalability breakthroughs. - Goldman Sachs , Nike , and 35+ institutions adopted ZK for confidential transactions and NFT authentication. - ZKP market reached $1.5B in 2025, projected to hit $7.59B by 2033 at 22.1% CAGR. - 230% developer growth and $3.3B TVL across ZK Rollups signal maturing blockchain infrastructure.