Bitcoin, Ethereum Rebound as Trump Contains China Chaos to the Weekend

Trump’s measured China comments fueled a swift Bitcoin and Ethereum rebound after Friday’s market chaos, hinting at a deliberate de-escalation that steadied investor sentiment before Wall Street’s open.

The Trump-China drama may have been perfectly timed because Donald Trump struck a calm, almost rehearsed tone after Friday’s sudden market crash, before TradFi markets open on Monday.

Crypto is often caught holding the ball as President Trump’s market-moving announcements tend to come on Friday, almost sparing stocks from the carnage.

Trump Calms China Fears, Fuels Bitcoin and Ethereum Recovery

Global markets could be steady by Monday morning, and crypto, which absorbed the shock over the weekend, is already leading the rebound.

Bitcoin was approaching the $115,000 mark, while Ethereum reclaimed $4,100, following Trump’s comments on Truth Social, which eased China fears. Investors interpreted his remarks as deliberate de-escalation after a politically charged sell-off.

“Don’t worry about China, it will all be fine! Highly respected President Xi just had a bad moment… The USA wants to help China, not hurt it,” Trump noted.

The timing raised familiar eyebrows. The plunge came late Friday, just as Wall Street shut for the weekend, leaving only 24/7 crypto markets to process the fallout.

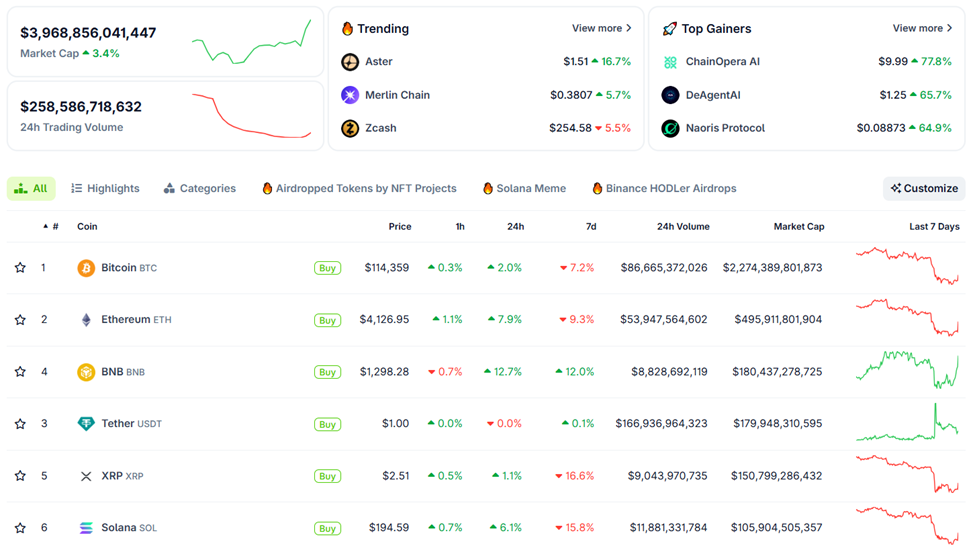

Indeed, markets are already on a rebound, with Bitcoin trading for $114,359 as of this writing, while Ethereum has already reclaimed the $4,100 mark. Notably, Ethereum is up by over 20% from its Friday low.

Crypto Markets on the Rebound. Source:

Crypto Markets on the Rebound. Source:

Sentiment is already flipping, and equities could open Monday largely unscathed. Many traders now suspect that Trump prefers weekend volatility, allowing crypto markets to bleed privately before the S&P 500 can react.

The White House also pointed to Trump’s softer stance, with reports indicating that Vice President JD Vance revealed his boss’s willingness to be a reasonable negotiator with China.

Similarly, White House officials reportedly suggested that markets would “calm down this week.” With crypto markets showing strength, traders may read this as a green light for risk assets.

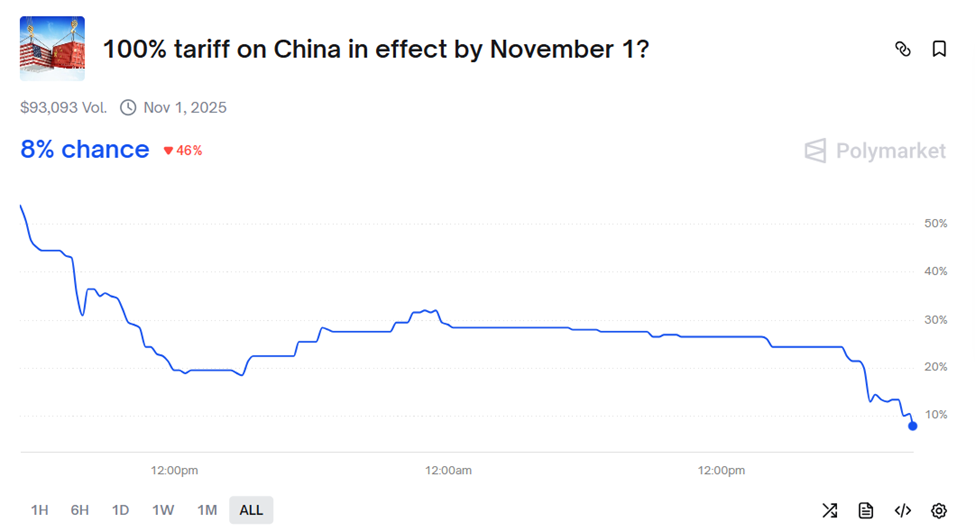

100% Tariff on China in Effect by November 1?

On whether Trump will impose a 100% tariff on China by November 1, Polymarket bettors see a measly 8% chance. This marks a significant drawdown from minutes before Trump’s announcement on Truth Social, where the odds stood at 26%.

Trump China 100% Tariffs by November 1. Source:

Trump China 100% Tariffs by November 1. Source:

The change points to de-escalation, implying most participants see Trump’s rhetoric as bluff, not brinkmanship.

Still, for crypto investors, the pattern feels intentional. Crypto trades nonstop, making it the first asset class to price in sudden political shocks, and the easiest to shake out leveraged players before calmer Monday headlines appear.

“Liquidating everyone just to push prices to new ATHs would be pretty frustrating… and honestly, it seems likely,” Crypto Rover quipped.

In the same tone, Helius Labs CEO, Mert, said the crypto markets are an oracle for Trump’s social media mood.

Whether orchestrated or coincidental, the weekend whiplash reflects how deeply political theater now intersects with digital assets. Trump crashes the market on Friday, calms it by Sunday, and the S&P may never even flinch, only Bitcoin does.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Major Institutions Wager on Bitcoin’s Long-Term Potential as Expectations of Fed Rate Cuts Drive Surge to $93K

- Bitcoin surged to $93,000 on Nov 25, 2025, driven by 85% odds of a Fed 25-basis-point rate cut in December. - XRP rose 11% and Ethereum hit $2,900 as improved liquidity and macro sentiment fueled crypto optimism ahead of the Fed's Dec 10 meeting. - Institutional demand grew with Texas and Harvard investing in Bitcoin ETFs, while Abu Dhabi tripled its ETF holdings to $517.6 million. - Risks persist: ETF outflows, leveraged fund liquidations, and regulatory uncertainties offset gains, with derivatives posi

Ethereum Updates Today: MegaETH's $1 Billion Funding Failure Highlights Blockchain Scaling Challenges

- MegaETH canceled its $1B fundraising after technical failures caused unintended deposits and operational chaos during the pre-deposit phase. - KYC system errors and premature execution of a multisig transaction led to $500M in deposits, forcing the team to freeze the raise and abandon expansion plans. - Critics highlighted preventable engineering flaws, with 259 duplicate addresses raising concerns about bot activity and unfair allocation practices. - Despite backing from Vitalik Buterin and Joe Lubin, t

Ethereum News Update: Canton’s Privacy-Centric Approach Attracts Institutions Away from Public Blockchains

- Canton Network's tokenomics strategy prioritizes institutional adoption by avoiding ICOs and focusing on privacy and interoperability. - Its "need-to-know" privacy model enables regulated access to transaction data, aligning with KYC/AML frameworks while maintaining confidentiality. - Institutional backing, including $135M funding and Goldman Sachs integration, highlights Canton's appeal for enterprise blockchain solutions. - Canton's RWA TVL ($96 per $1 cap) outperforms Ethereum ($0.03), emphasizing its

Hyperliquid News Today: SEC Approval Ignites Triple Crypto Rally: ETFs, Cross-Chain Bridges, and Retail Frenzy

- Institutional investors are accelerating crypto adoption via Avalanche-based ETFs, with Bitwise’s 0.34% fee BAVA ETF offering staking yields and cost advantages over competitors. - Avail’s Nexus Mainnet bridges Ethereum and Solana ecosystems, streamlining cross-chain liquidity and reducing fragmentation through a unified network. - Retail hype drives Apeing’s presale as a potential 100x opportunity, leveraging meme coin dynamics and FOMO to attract speculative traders. - SEC’s evolving regulations and in