Key Market Intelligence for October 13: How Much Did You Miss?

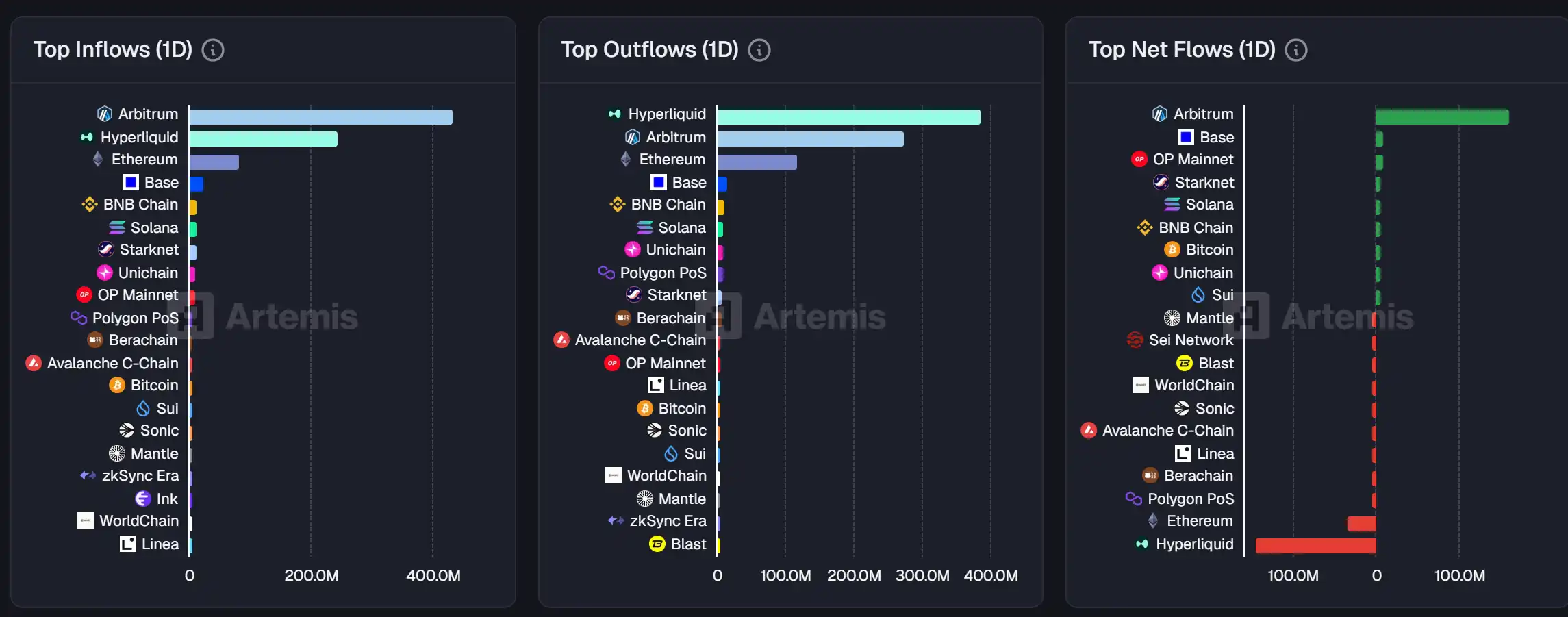

1. On-chain funds: Today, $160.0M flowed into Arbitrum; $143.4M flowed out of Hyperliquid. 2. Top gainers and losers: $SKYAI, $PETSNA. 3. Top news: BNB continues to surge, breaking through $1,375, with a 24-hour increase expanding to 17.2%.

Selected News

1. BNB continues to surge, breaking through $1,375, with a 24-hour increase expanding to 17.2%.

2. Binance Alpha will exclusively launch Lab (LAB) TGE on October 14.

3. Monad will open its airdrop claim portal tomorrow.

4. ZeroBase releases ZBT tokenomics: 8% for airdrop, total supply of 1 billion tokens.

5. Prediction market Opinion Labs, supported by YZi Labs, is about to launch its mainnet.

Trending Topics

[BNB]

BNB has received significant attention on Twitter due to its strong performance and resilience amid market volatility. Core discussions focus on its robust ecosystem—thanks to community support and strategic actions taken by Binance and its affiliates to protect users. The infrastructure of BNB Chain and the launch of new projects such as Aster have also fueled its growth. In addition, comparisons with previous market cycles indicate further upside potential, with BNB being regarded as a safe and promising investment. Overall market sentiment towards BNB is positive, with most users expressing confidence in its future prospects.

[MONAD]

Today's discussions about MONAD mainly revolve around its mainnet launch and airdrop event scheduled for October 14. The community is both excited and cautious, with users being reminded to watch out for scams. The development of the ecosystem has sparked widespread interest, with over $100 million in funding already raised by teams building on MONAD. The airdrop is a hot topic, with market speculation about its impact on prices and the potential benefits for MONAD card holders. Additionally, discussions highlight the platform’s Ethereum Virtual Machine (EVM) compatibility and its potential for high-speed, low-fee transactions. Overall market sentiment is positive, with most people optimistic about MONAD’s future.

[ENA]

Today's discussions about ENA mainly focus on the recent crypto market crash and its impact on Ethena’s stablecoin USDe. Despite initial concerns about depegging, subsequent clarifications showed that the issue was specific to the Binance platform, stemming from its internal pricing flaw rather than a failure in USDe’s mechanism. Ethena’s stabilization mechanism performed strongly, maintaining its peg to the US dollar on major trading platforms such as Curve. This incident highlighted the importance of robust oracle systems and market infrastructure, with Ethena being praised for its resilience and transparency during the crisis. Discussions also touched on the broader impact on decentralized finance (DeFi) and the need for improved risk management strategies.

[POLYMARKET]

Polymarket received significant attention today, mainly because Tom Brady mentioned the platform on national television, sparking widespread discussion. The platform is recognized for its cultural relevance and intuitive user experience, and is being compared to other prediction markets such as Kalshi. In addition, the recent $2 billion investment in Polymarket by the New York Stock Exchange (NYSE) has elevated its industry status, making its founder a billionaire. The platform’s role in accurately predicting events (such as Nobel Peace Prize winners) was also highlighted, demonstrating its potential to replace traditional experts in multiple fields.

[TAO]

TAO became the biggest winner in crypto discussions due to Grayscale filing a Form 10 for its Bittensor Trust, signaling potential access for institutional investors and paving the way for its exchange-traded fund (ETF) approval. This news drove a sharp rebound in TAO’s price, with many tweets emphasizing its resilience and further growth potential. Discussions focused on bullish sentiment for TAO, its recovery from recent declines, and the upcoming halving event in 2026—which could further boost its value.

Selected Articles

1. "How to Farm So Many Prediction Markets?"

Following the announcement by Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, on October 7 that it plans to invest $2 billion in prediction market platform Polymarket at a valuation of about $9 billion, just three days later, another prediction market giant, Kalshi, also announced a $300 million funding round, reaching a valuation of $5 billion. Meanwhile, Polymarket founder Shayne Coplan has previously retweeted or liked posts hinting at the platform possibly launching a token. This time, he listed a series of mainstream crypto asset symbols followed by the $POLY ticker on social media, which in some ways is a clear signal of a token issuance. This series of news has triggered FOMO among community members. As the news spreads, the prediction market sector has once again become a hot topic of discussion.

2. "Black Swan Operator? Who Is the Mysterious Whale Garrett Jin?"

Discussions about the black swan crash event on October 11 continue, with the community raising questions about the identity of the whale who precisely opened over $1.1 billion in short positions in advance. On-chain detective analysis suggests that the address likely belongs to former BitForex CEO Garrett Jin. At noon today, Garrett Jin posted three consecutive updates on his personal X account, responding to market rumors for the first time, clarifying that he has no connection with the Trump family or "Little Trump," and emphasizing that his previous trades were not insider trading and that the funds used did not belong to him personally, but to his clients.

On-chain Data

On-chain capital flows for October 13

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Can the 40 billion bitcoin taken away by Qian Zhimin be returned to China?

Our core demand is very clear—to return the assets to their rightful owners, that is, to return them to the Chinese victims.

Bitcoin Surges but Stumbles: Will Crypto Market Recover?

In Brief Bitcoin fails to maintain its position above $93,000 and faces heavy selling pressure. Altcoins experience sharp declines, with some showing mixed performance trends. Shifts in U.S. spot Bitcoin ETF flows highlight cautious investor behavior.

Qubic and Solana: A Technical Breakthrough by Studio Avicenne