3 Altcoins Crypto Whales Are Buying as Market Recovers From Black Friday Crash

The crypto market is stabilizing after the Black Friday crash, and big money is making its move. Three altcoins crypto whales are buying — DOGE, SNX, and ASTER — are seeing strong accumulation, rising smart money signals, and breakout-ready chart patterns pointing to early recovery momentum.

Two days after the Black Friday crypto crash, market sentiment is beginning to stabilize, and crypto whales are already making their move. On-chain data reveals that several altcoins are seeing renewed accumulation, as large holders strategically rebuild positions while prices remain at post-crash lows.

Three of these coins are backed by sizable whale inflows, product launch excitement, and improving technical setups. Some also see parallel smart money infusion, while others seek a breakout of key patterns (or higher targets), signaling early signs of strength.

Dogecoin (DOGE)

Dogecoin (DOGE) has become one of the first altcoins crypto whales are buying after the Black Friday crash. Earlier, mega whales holding over 1 billion DOGE were among the first to react, adding heavily during the selloff.

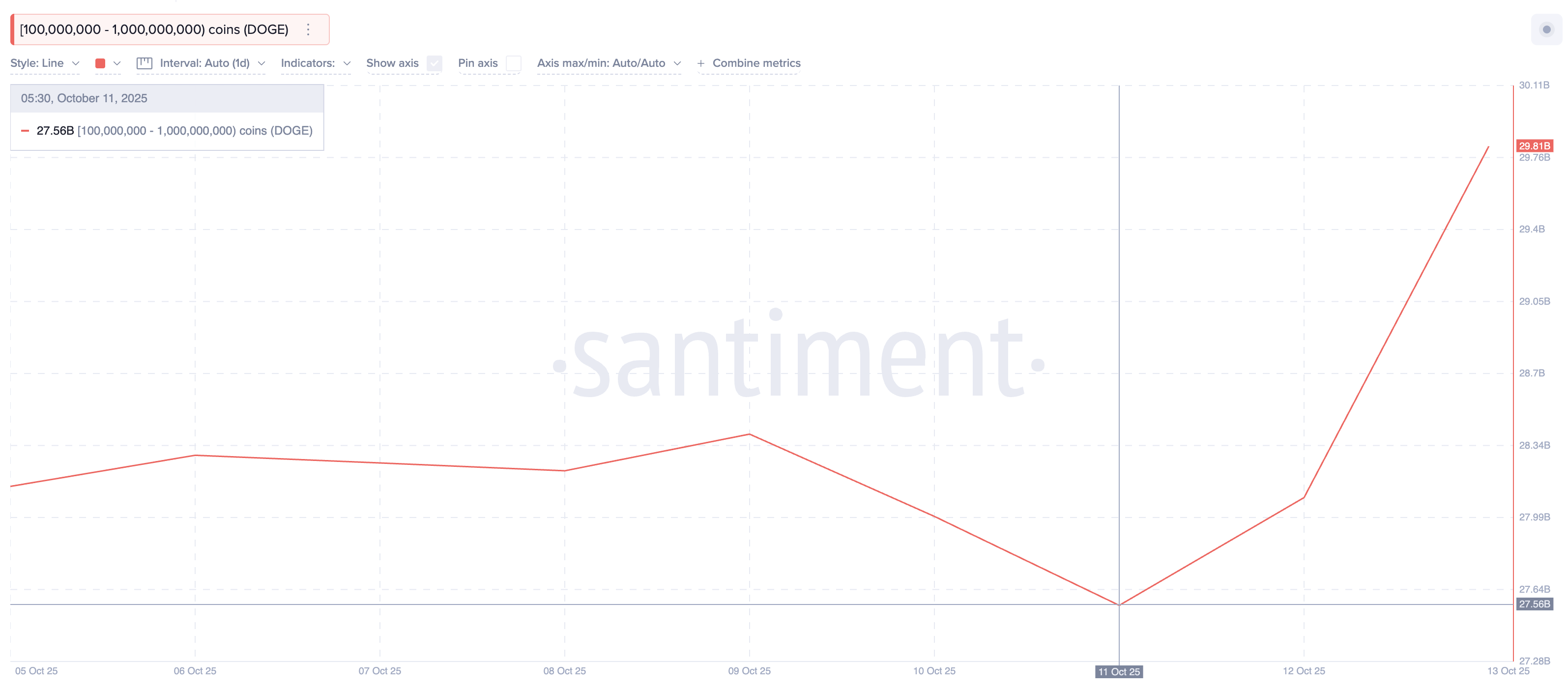

Now, the momentum has shifted to mid-tier whales holding between 100 million and 1 billion DOGE.

These whales increased their balances from 27.56 billion to 29.81 billion DOGE since October 11. That’s a net gain of about 2.25 billion DOGE, worth roughly $475 million at current Dogecoin prices.

Dogecoin Whales In Action:

Santiment

Dogecoin Whales In Action:

Santiment

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This second wave of accumulation shows renewed confidence in the rebound, suggesting that large holders are positioning for a potential continuation of the recovery.

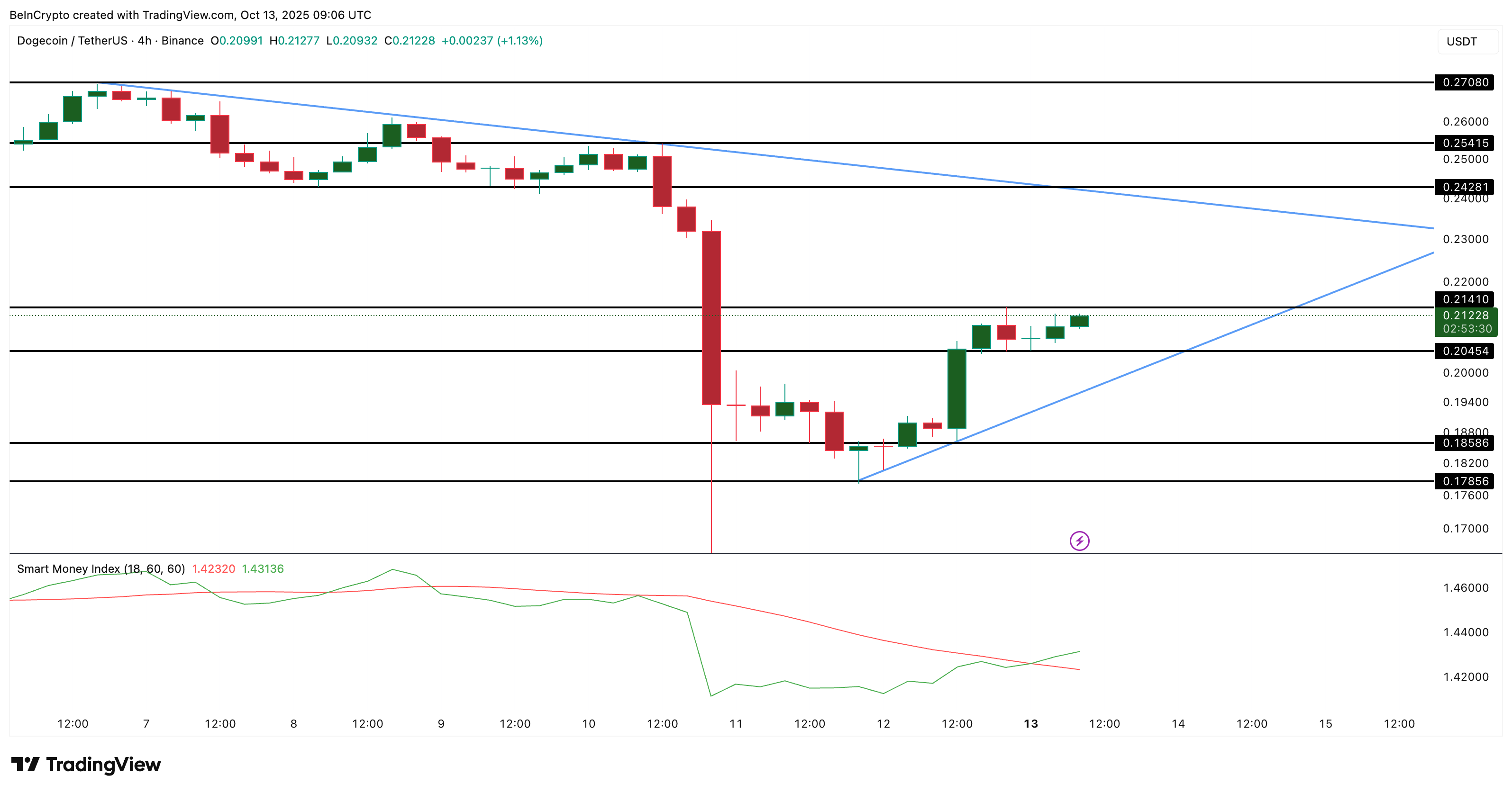

On the 4-hour chart, used to spot early trend shifts, the DOGE price trades just under a key resistance at $0.214, forming a symmetrical triangle pattern. A 4-hour candle breakout above $0.214 could confirm a short-term uptrend toward $0.242, $0.254, and $0.270.

However, dropping below $0.205 may delay this move and expose DOGE to $0.185 and $0.178.

Dogecoin Price Analysis:

TradingView

Dogecoin Price Analysis:

TradingView

Adding conviction to this setup, the Smart Money Index (SMI), which tracks activity from experienced investors versus retail, has started turning higher. This uptick suggests that seasoned traders are aligning with whales.

Synthetix (SNX)

Synthetix (SNX) has been one of the strongest rebounders after the Black Friday crash, surging over 80% in 24 hours and hitting a 10-month high. The rally has been fueled by renewed excitement around its upcoming perpetual DEX on Ethereum.

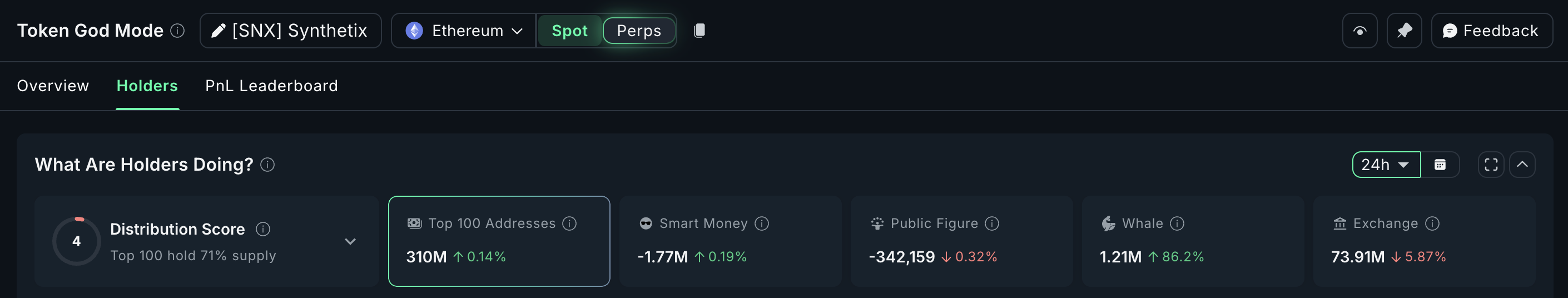

However, behind that price action, on-chain data shows that whales are playing an even bigger role in driving the move.

Whale wallets holding large amounts of SNX have increased their positions by 86.2% in just one day. This cohort now controls about 1.21 million SNX. That means they’ve added roughly 560,000 SNX, worth nearly $1.23 million at an average price of $2.20.

Synthetix Holders:

Nansen

Synthetix Holders:

Nansen

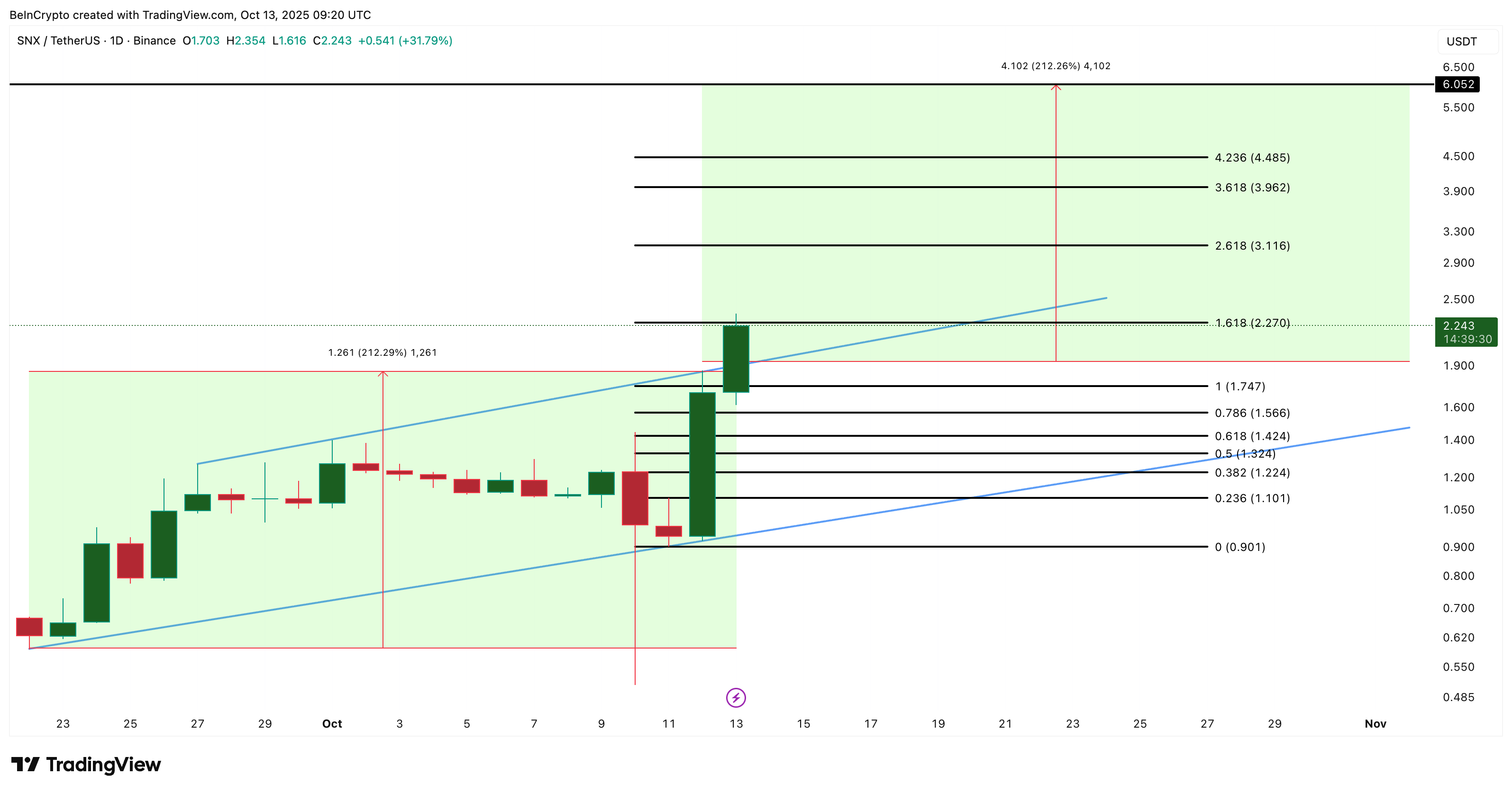

From a technical angle, SNX has broken out of an ascending channel on the daily chart, a bullish pattern that signals continuation when confirmed.

The breakout projects a potential 212% upside from the breakout point, which translates to an extended target near $6.0. For now, the first resistance is near $2.27, followed by $3.11 and $3.96. A breakout above $4.48 would validate the larger move.

On the downside, key supports lie at $1.74, $1.56, and $1.10. A dip under the last level ($1.10) would flip the SNX price structure bearish.

SNX Price Analysis:

TradingView

SNX Price Analysis:

TradingView

If whale accumulation continues at this pace, it could support SNX in holding above its immediate support zone and extending toward higher targets, especially as the DEX launch nears and broader market sentiment stabilizes.

Aster (ASTER)

Aster (ASTER), a fast-growing perpetual DEX project built on BNB Chain, has quickly gained attention after its explosive debut and cross-chain trading model. The project allows users to trade with yield-bearing collateral, a feature that has drawn whales and smart money in after the Black Friday market crash.

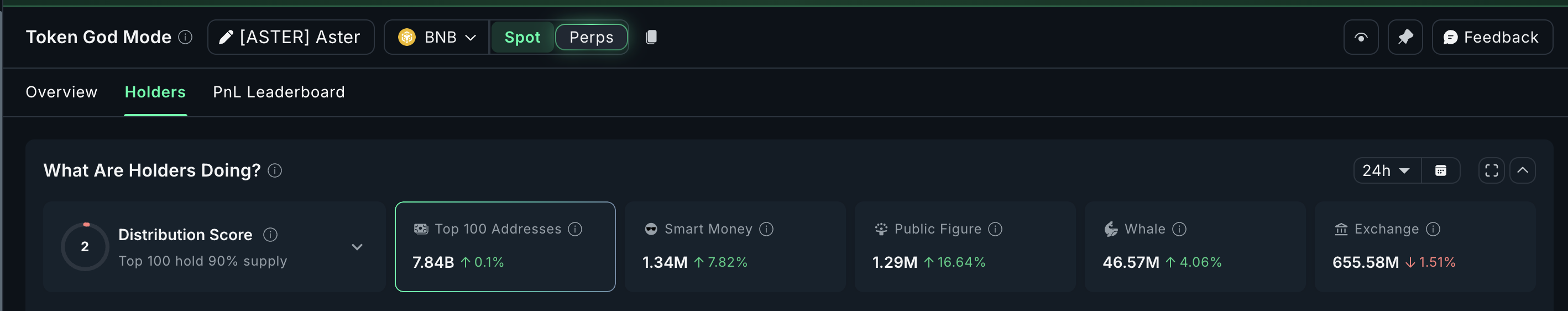

Whales have increased their holdings by 4.06% over the past 24 hours, now sitting on 46.57 million ASTER. That means they’ve added roughly 1.82 million ASTER, worth about $2.7 million at an average price of $1.50.

This steady build-up aligns with a similar pattern seen among smart money and public figure wallets, which have grown their holdings by 7.82% and 16.64%, respectively.

Aster Holders:

Nansen

Aster Holders:

Nansen

Such synchronized accumulation across key investor segments suggests growing confidence that ASTER’s rebound is more than a short-term bounce.

On the technical side, Aster’s 4-hour chart shows the token trading inside a bullish pennant, a pattern that often precedes continuation. For the bullish setup to confirm, the 4-hour price must break above $1.75 (upper trendline breakout). That could be followed by a move past $1.88, which would open the door to $2.10 and $2.20.

ASTER Price Analysis:

TradingView

ASTER Price Analysis:

TradingView

On the downside, losing $1.43, a key support level, could push the token lower to $1.27 or $1.15.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto: Fundraising Explodes by +150% in One Year

Bitcoin Drops $8B In Open Interest : Capitulation Phase ?

Coinpedia Digest: This Week’s Crypto News Highlights | 29th November, 2025