OpenSea Users Urged to Link EVM Wallets Before SEA Airdrop Deadline

OpenSea's SEA airdrop farmers face a critical deadline to link their EVM wallets with significant risks for those who delay.

OpenSea users must link Ethereum Virtual Machine (EVM) wallets by October 15 or risk missing out on NFT and SEA token rewards as the Treasure Chests program ends.

This critical deadline is part of OpenSea’s strategy to re-engage its community and build excitement for the upcoming SEA token launch. Many in the NFT ecosystem see this as a pivotal opportunity for OpenSea’s comeback.

Why Users Must Act Before the Deadline

To receive the largest rewards, OpenSea users must connect an EVM-compatible wallet by October 15. Failure to do so will result in missing nearly all major new incentives.

Only limited rewards remain for users logged in via Solana or Web2 accounts. Most token and NFT drops, including the $SEA token, are tied to EVM chains.

OpenSea has increased its reminders as the deadline approaches. Official messaging leaves no room for doubt: users without an EVM wallet connection will not access EVM rewards.

“We know degens don’t read. So here’s your reminder: connect an EVM wallet to your OpenSea rewards profile. Most rewards are on EVM chains. No EVM wallet? No EVM prizes,” the marketplace articulated.

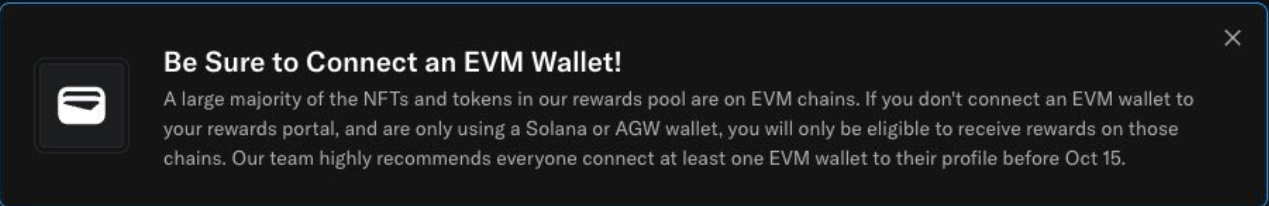

Meanwhile, those using only Web2 or Solana logins see in-app alerts urging them to add an EVM address before time runs out. These notifications clarify that airdrop allocations heavily favor EVM chains.

OpenSea’s in-app notification tells users to link EVM wallets to access almost all NFT and token rewards. Source:

OpenSea on X

OpenSea’s in-app notification tells users to link EVM wallets to access almost all NFT and token rewards. Source:

OpenSea on X

Treasure Chests Program Ends, Raising the Stakes

October 15 also marks the end of the Treasure Chests program, adding urgency for users. Each chest, especially in the Solar tier, affects the number of SEA tokens awarded at the token generation event (TGE).

The chest level at the cutoff sets airdrop rewards; Solar chests may offer the greatest gains, but still pose risk if their contents disappoint.

Community excitement is high, as some NFT veterans explain the appeal and risk of the highest chests.

“I’m at Solar (the last chest). Thus, no matter how you see this, in my opinion, yes, it’s still a gamble, but the risk-reward chances are just too nice to pass up. I’m betting on OS actually doing well, a big fat drop, and the potential of opening a good NFT,” wrote Cape, an NFT and airdrops farmer.

As the chests program ends and SEA launches, users could break even or see gains or losses, depending on OpenSea’s relaunch outcome.

Impact on OpenSea and the NFT Ecosystem

The SEA airdrop and rush to link EVM wallets form OpenSea’s biggest push since its earlier days as a leading NFT marketplace. The campaign aims to boost participation and help OpenSea keep pace with rivals like Magic Eden, introducing their own rewards and tokens.

With the token event drawing near, the NFT community is weighing the risks and rewards of holding Solar chests or opting for lower tiers.

OpenSea’s approach emphasizes rewarding active users, signaling new standards for marketplace incentives. However, users who delay wallet linking may miss these opportunities, potentially for months or even forever.

October 15 is the decisive moment. After the deadline, OpenSea’s success with the $SEA token will depend on user participation, how rewards are distributed, and whether the platform can reclaim its place as a market leader.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Five charts to help you understand: Where does the market go after each policy storm?

After this regulatory crackdown, is it a harbinger of an impending downturn, or the beginning of a new cycle where all negative news has been fully priced in? Let’s examine the trajectory after the storm through five key policy milestones.

Mars Morning News | The crypto market rebounds across the board, Bitcoin rises above $94,500; The "CLARITY Act" draft is expected to be released this week

The crypto market has fully rebounded, with bitcoin surpassing $94,500 and US crypto-related stocks rising across the board. The US Congress is advancing the CLARITY Act to regulate cryptocurrencies. The SEC chairman stated that many ICOs are not securities transactions. Whales are holding a large number of profitable ETH long positions. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model is still being iteratively updated.

Federal Reserve’s Major Shift: From QT to RMP, How Will the Market Transform by 2026?

The article discusses the background, mechanism, and impact on financial markets of the Federal Reserve's introduction of the Reserve Management Purchases (RMP) strategy after ending Quantitative Tightening (QT) in 2025. RMP is regarded as a technical operation aimed at maintaining liquidity in the financial system, but the market interprets it as a covert easing policy. The article analyzes RMP's potential effects on risk assets, the regulatory framework, and fiscal policy, and provides strategic recommendations for institutional investors. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative improvement.

Rate Hike in Japan: Will Bitcoin Resist Better Than Expected?