A16Z's core competency is Pump and Dump.

VC stands for Venture Capital, where media is power.

Original Article Title: "Original Source:

Today's top VCs are essentially media companies.

a16z is the best proof of this.

In 2009, a16z founder Marc Andreessen provided a positioning from the very beginning—a media company that profits through investment.

At that time, this positioning was very radical. But today in 2025, it has been proven to be the most accurate prediction of the future of the VC industry.

Because attention is scarcer than fiat currency.

Fiat currency can be printed in excess, but each person only has a dozen hours of wakefulness every day. Having attention alone can only do a traffic business, and internet celebrities promoting products is based on this logic.

However, when attention is combined with trust, it becomes influence. Influence is the truly scarce asset that can be monetized.

Monetizing influence, there are only two completely legitimate places globally. One is the cryptocurrency world, and the other is the primary market.

When Justin Sun hypes in the cryptocurrency world, he faces widespread criticism. When a16z does similar things in the primary market, they are revered as a model.

So, how did a16z do it?

01 Power

The core capability of a16z can be summed up in two words—Power.

Marc Andreessen himself explained it clearly: "We have always believed that what you want from VCs is power; you need the ability to gain public attention."

What does this power specifically refer to?

It is the ability for startup companies to directly shape industry agendas, influence public perception, and attract other capital to follow suit. And the carrier of this ability is content.

Marc himself is a top-tier content creator.

From 2011's "Why Software Is Eating the World," to 2020's "It's Time to Build," and to 2023's "Why AI Will Save the World" and "The Techno-Optimist Manifesto," Marc's almost every article sparks industry-wide discussions.

His pace of publishing long-form articles in the past two years has been about every 8 months, with each piece being a meticulously crafted product.

The influence of these articles comes from two points.

First, Marc's precise capture of the prevailing sentiment of the times. "It's Time to Build" struck a chord of powerlessness that pervaded the entire Western world in the early days of the pandemic.

Second, his ability to elevate business issues to the level of nation and civilization. "The Little Tech Agenda" directly equated supporting small tech companies with defending American technological hegemony. Marc packaged VC's business interests as America's national interests.

a16z has also established a professional and sizable content team.

According to information on the a16z website, they have a full-time content director, podcast hosts, and a video production team. Chris Dixon is responsible for content output in the cryptocurrency field, Connie Chan focuses on the Chinese market and the mobile internet, Katherine Boyle leads the "American Dynamism" column series, and Sriram Krishnan hosts podcasts and is involved in Web3 narrative creation.

a16z's content output is industrialized and systematic. They have their own podcast series, YouTube channel, and special reports. The mission of this team is to translate a16z's investment themes into shareable narratives and reach policymakers, LPs, entrepreneurs, and other VCs through various channels.

With content capability, a16z has the core competency of both "calling the shots + boosting the market."

Calling the Shots: Through Marc's articles and the systematic output of the content team, a grand narrative is put forward (such as Web3 Matters, AI Will Save the World), defining it as a trend of the times.

Boosting the Market: When the narrative is gaining traction, immediately invest billions or tens of billions of real money in this race, pushing up the valuations of star projects by 10 times, 100 times, thus solidifying the narrative. When other VCs see a16z entering the game, they will follow suit, further driving up the valuation of the entire race.

This is a16z's core competency of "Narrative-Investment."

a16z has generated $25 billion in net returns for LPs

Content creates influence, and investment transforms influence into skyrocketing valuations. Manipulating the candlestick chart oneself, becoming a market maker, of course, makes exiting easier.

So, how did a16z develop its "pump" capability?

02 Pumping

a16z's grand narrative, a.k.a. pumping capability, has a replicable methodology. I summarize it as the "a16z Five-Step Narrative Method."

Strike at the heart of collective emotion, present a disruptive framework, build an us-vs-them dynamic, elevate to a civilizational level, shout out a battle cry.

Progress step by step.

Step one, strike at the heart of collective emotion.

Marc's articles never hype out of thin air, only half a step ahead of industry sentiment. Not too far ahead, nor lagging behind.

In the beginning of "It's Time to Build" (2020), he said, "Every Western institution was unprepared for the coronavirus pandemic…The virus makes obvious something that has been true for so long—our nation-state system has left us exposed and ill-prepared." At the beginning of the pandemic, the entire Western world was experiencing a sense of frustration with the failed institutions, and Marc accurately captured this emotion without regard to party affiliation.

In the beginning of "Why AI Will Save the World" (2023), he started with, "The AI era is here, and people are terrified." With a light-hearted tone, he acknowledged the public's fear of AI and then aggressively attacked AI skepticism.

Step two, present a disruptive framework.

After establishing emotional resonance, Marc immediately introduces a disruptive new framework to steer the debate to his own turf.

In "Why Software Is Eating the World" (2011), instead of debating whether "tech stocks are in a bubble," he directly redefined the issue: this is an "economic revolution where software is becoming the foundation of all industries." He turned the valuation controversy into a question of "do you understand the future."

《It's Time to Build》 does not dwell on the supply chain of masks and ventilators; it directly states: "The problem is desire. We need to want these things. The problem is inertia, the problem is will." It elevates from supply chain issues to America's national will and spirit.

Step Three, Constructing an Us vs. Them

Marc simplifies the world into two camps, forcing the reader to pick a side.

《The Little Tech Agenda》 (2024) is the clearest: "Those who support small tech, we support them. Those who oppose small tech, we oppose them." Simple political mobilization language, black and white. We are Little Tech startups, they are Big Tech giants and proponents of harmful government policies.

《Why AI Will Save the World》 (2023) goes further: we are AI builders, heroes, optimists. They are doomsayers, further subdivided into Baptists (naive but co-opted), Bootleggers (profiting under the table from regulation), even termed as the "AI risk cult."

Not only dividing into camps but also weakening the legitimacy of opponents through stigmatizing labels.

Step Four, Ascend to Civilizational Heights

Marc excels at elevating issues, turning specific topics into grand narratives concerning the nation, humanity, and civilization.

《The Little Tech Agenda》: "America's tech dominance, and the critical role of small tech startups in ensuring this dominance... A first-rate political issue equal in importance to any other issue." Supporting startups = American tech dominance = national security. VC's business interests directly equate to US national interests.

《The Techno-Optimist Manifesto》 (2023): "We believe growth is progress, we believe no growth is stagnation, and ultimately leads to death." Techno-optimism = survival, opposition = death. Elevating a business choice to a life-or-death decision.

Step Five, Scream the Battle Cry

Marc condenses complex arguments into brief, powerful, easily communicable slogans. The title is the slogan, repeated throughout the text, with a final call to action.

The titles all have distinct characteristics:

- Strong Proposition (Manifesto/Agenda, etc., a worldview declaration);

- Call to Action (It's Time to Build, imperative sentence, rallying emotion);

- Grand Vocabulary (World/Future, emphasizing direction rather than detail);

- Minimal Adjectives (Adjectives show lack of courage, the simpler, the more powerful);

For example, in "It's Time to Build," the title is a slogan repeated throughout the text. "Why AI Will Save the World" concludes with an escalation: "We win, they lose."

The ending of "The Little Tech Agenda" is even more grandiose:

"The glory of a Second American Century is within our reach.

Let's grasp it."

(The glory of a Second American Century is within our reach. Let's grasp it.)

a16z's website also has style; at a glance, you can tell the bro really believes in the New Rome

Marc knows his positioning; he is aware that his articles should be for B2B communication, not for C2C traffic. The target readers are policymakers, other VCs and LPs, entrepreneurs and engineers, media, and opinion leaders.

This determines that his titles must be concise, grand, and powerful enough for those who don't have time to read the entire article to remember the core points and share them.

This is the basic method of a16z's callouts. It provides an emotional foundation for subsequent bullish behavior, invoking industry FOMO; moral legitimacy, where investment is righteousness; political stature, where investment is safeguarding civilization; and rallying ability, It's Time to Build.

Now, let's see how a16z transforms these narratives into tangible returns.

03 Pumping

a16z's callouts are just the beginning. What truly closes the loop on this playbook is the investment that immediately follows the narrative, pumping up the price oneself.

In 2021, a16z published an article advocating for Web3, followed by the release of the seminal piece "Why Web3 Matters" and a policy agenda. Almost simultaneously, a16z announced the establishment of the $2.2 billion cryptocurrency fund Crypto Fund III.

By 2022, this figure had grown to $4.5 billion for Crypto Fund IV.

a16z has invested in Web3 projects such as OpenSea and Dapper Labs. OpenSea's valuation skyrocketed from $1.5 billion in July 2021 to $13.3 billion in January 2022.

The logic behind this is very simple.

a16z tells the world through articles that "Web3 is the future," and then a16z tells the market with billions of dollars that "we are serious." Other VCs see a16z's moves, naturally follow suit, and enter the field. LPs, seeing a16z's judgment, also increase their allocation to Web3. The valuations of the entire sector are thus driven up.

The logic for the AI sector is exactly the same. In June 2023, Marc published "Why AI Will Save the World," refuting AI doomsday scenarios and advocating for AI accelerationism. In the same year, a16z announced an investment in Character.AI, leading a $150 million Series A round. In 2024, they continued to double down on AI infrastructure and applications.

This is how the "Narrative-Investment" flywheel operates.

Narratives create attention and expectation, and investments translate those expectations into actual valuations. The grander the narrative, the more capital follows the trend, and the more astonishing the valuation surge. As the earliest player on the scene with the largest investment volume, a16z naturally benefits the most from the skyrocketing valuations.

More importantly, a16z's playbook has gained moral legitimacy.

Marc's articles have packaged investment behaviors as a grand mission of "defending American technological dominance, advancing human progress, and combating stagnation and death." It's hard to accuse a16z of mere hype because their narrative has risen to the level of national interest and the survival of civilization.

When you have enough power, you can create your own price chart. So, the undisputed stock god of this era is undoubtedly Trump.

a16z does exactly this. They create anticipation with content, establish reality with capital, and provide the entire process with legitimacy and a sense of justice through grand narratives.

This is the epitome of monetizing influence.

04 Media

Why did a16z turn itself into a media company?

The underlying motivation goes back to Marc's deep thoughts on power and media.

Prior to 2016, Marc believed that the relationship between the tech industry and mainstream media was "healthy, normal, and productive." He recalled in a podcast that from 1993 to 2016, the media was curious about the tech industry, willing to learn, and trying to understand the ongoing transformation.

But everything changed after Trump's election in 2016.

In the spring of 2017, during Marc's media tour, he found that "it was as if someone had flipped a light switch, all media became incredibly hostile, a 100% shift, absolute hostility."

Marc believes this shift had three reasons.

The media blamed the election of Trump on tech platforms and projected political animosity onto the entire tech industry.

The traditional media's business model was destroyed by social media, leading to economic hardship and resentment towards the tech industry.

The tech industry shifted from being a tool provider to a force disrupting the entire social structure, warranting closer scrutiny.

A deeper issue is that social media is like an "X-ray machine."

An X-ray machine can see inside the human body, revealing bones and lesions without hiding anything. Social media does the same, allowing everyone to see and spread the truth in real-time, repeatedly exposing the internal flaws and inconsistencies of traditional institutions.

Marc references the theory of former CIA analyst Martin Gurri:

"Social media will completely destroy the authority of all existing institutions. It achieves this by revealing, through this X-ray effect, that these institutions are fundamentally untrustworthy."

This guy is always bashing the media on his podcasts, it really gets to me.

In this context, for VCs to gain power — the ability to influence public perception, define industry agendas, and attract capital through signaling — they can only build their own media to bypass the hostile and credibility-collapsed traditional media.

Marc repeatedly emphasized in the podcast: "We have always believed that what you want from a VC is power. You need power, which means you need to be able to truly meet with customers and have them take you seriously; you need the ability to capture public attention."

a16z's media platform is the core tool for achieving this "power" distribution.

Marc likened this strategy to a "bridge loan for branding": before a startup has a strong brand of its own, it can borrow a16z's brand to gain initial market acceptance.

So, a16z's motivation to become a media company is very clear.

In an era of distrust in traditional media, only by having the ability to produce and distribute content can one truly wield power. And power is the scarcest resource that VCs can offer to startups.

Returning to the initial question: What is the essence of VC?

The traditional answer is: VC is a capital intermediary, connecting LPs and startups, making investments to generate returns.

But a16z has provided a new answer: VC is a profit-making media company through investment.

a16z's success has proven the correctness of this answer. They have crafted a grand narrative through newsletters and video podcasts, converted that narrative into sky-high valuations in the race with billions of dollars, and built a network of power through a content team and Marc's own influence.

This tandem pump playbook has allowed a16z to achieve returns far beyond their peers in fields such as SaaS, Web3, and AI.

More importantly, a16z's playbook has gained "moral legitimacy." Marc's articles have framed investment activities as a grand mission of "defending American technological hegemony and advancing human progress."

In the crypto world, Sun Yuchen's hype is met with backlash for coin launches and price pumps. a16z's hype in the primary market, narrative→investment→valuation soar, is held as a model.

What's the difference?

One lacks a system, relies solely on hype, stops at nothing, and can only gain attention. The other has a complete methodology, is backed by real money, packages commercial interests as national interests, and continues to bring influence.

Attention is more scarce than fiat currency. Having attention alone can only be used for a traffic business, but when attention is combined with trust, it transforms into influence. And influence is the truly scarce asset that can be monetized.

a16z's success is a textbook example of monetizing influence.

In this sense, today's top VCs are essentially media companies. VC is just part of the business model; content and influence are the core assets.

VC equals media.

Influence equals power.

(Reference materials, I've actually read all the representative articles from a16z)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stellar (XLM) Price Prediction: Can Bulls Push Toward $0.30 in December?

21Shares XRP ETF Set to Launch on 1 December as ETF Demand Surges

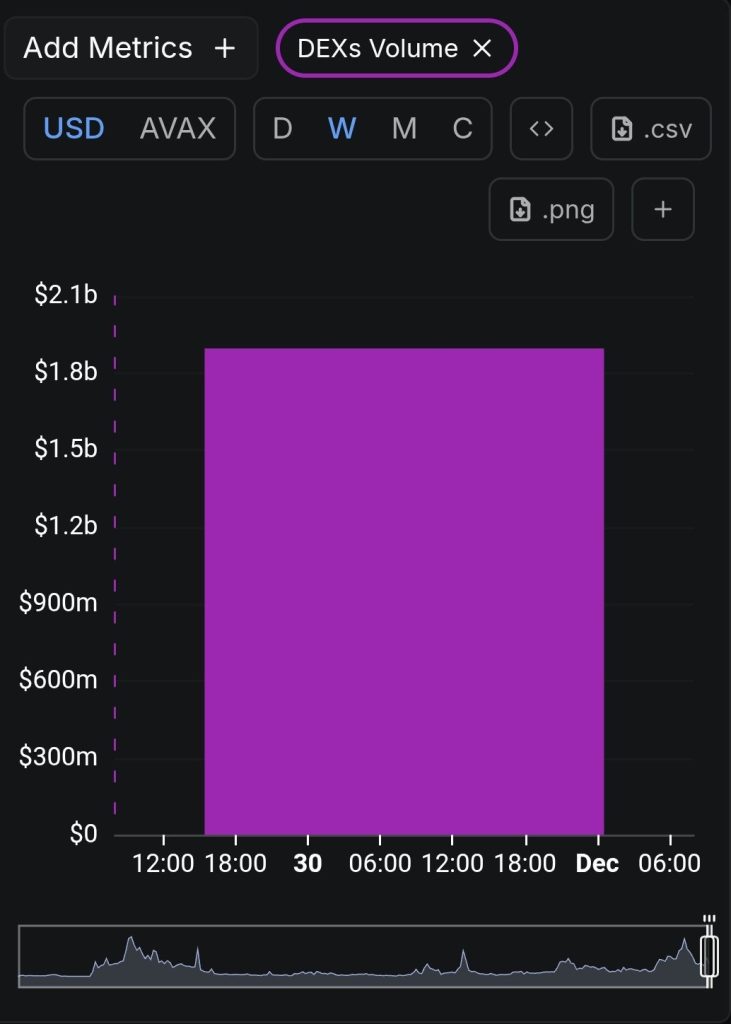

Avalanche (AVAX) Sees DEX Volume Surge as Price Rebounds From Key Support—Is a Major Breakout Near?

CZ Issues Market Warning as Crypto Exits Longest ‘Extreme Fear’ Streak