Whales short XRP, DOGE and PEPE ahead of Powell speech

As FED Chair Jerome Powell’s speech on the U.S. economic outlook looms ahead, whales are bracing themselves for a potential market crash by shorting several altcoin positions.

- Crypto whales are heavily shorting major altcoins ahead of Powell’s speech amid renewed trade tensions and market volatility on October 14 in Philadelphia.

- The crypto community is preparing for potentially hawkish signals from the Fed, prompting them to hedge against downside risks and lock in profits amid fears of an imminent crypto market crash.

On Oct. 14, Federal Reserve Chair Jerome Powell is scheduled to deliver a speech covering the state of U.S. economy and monetary policy at the National Association for Business Economics annual meeting in Philadelphia.

According to the official calendar for the Board of Governors of the Federal Reserve System, the speech is set to take place at 12:20 pm local time and will be titled “Economic Outlook and Monetary Policy.”

Powell’s upcoming speech comes at a time of growing economic volatility, with global markets still reeling from renewed trade tensions between the U.S. and China after fresh tariffs reignited talk of a potential trade war.

The crypto market has also experienced a series of sharp corrections recently. Ethereum ( ETH ) has fallen below the $4,000 mark, while Bitcoin ( BTC ) is down 2.88% over the past 24 hours.

Meanwhile, the crypto fear and greed index dropped from a Greed level of 64 at the end of last week to a Fear level of 27 this weekend, its lowest in six months.

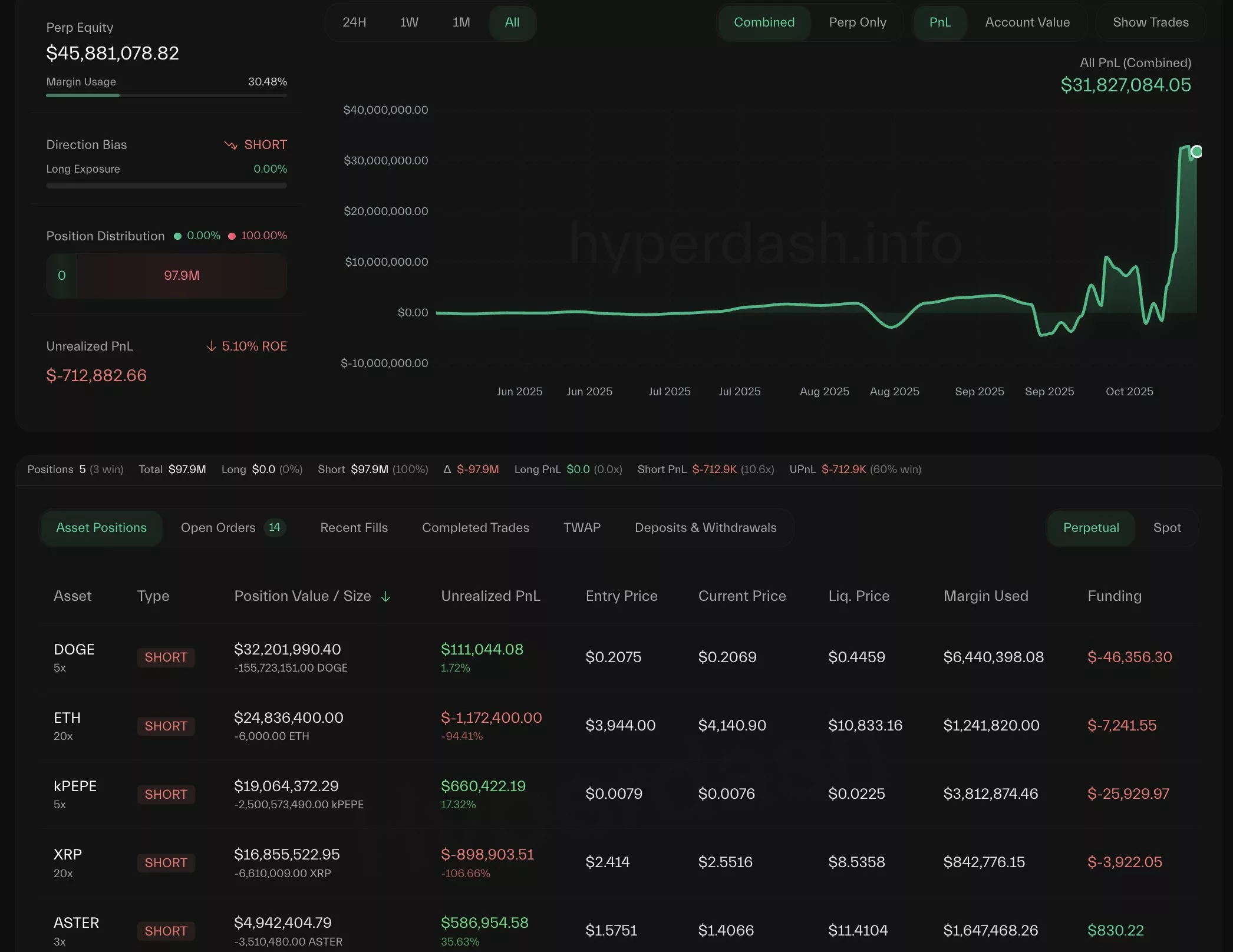

Whales have been shorting altcoin positions ahead of Jerome Powell’s speech on economic outlook | Source:

Lookonchain

Whales have been shorting altcoin positions ahead of Jerome Powell’s speech on economic outlook | Source:

Lookonchain

Traders are bracing themselves for more market volatility that is expected to accompany Powell’s speech. According to on-chain analysis platform LookOnChain , several whales on Hyperliquid ( HYPE ) are heavily deploying short positions on the market.

The first whale, 0x9eec9, with $31.8 million in profit, currently holds short positions in DOGE ( DOGE ), ETH, PEPE ( PEPE ), XRP ( XRP ) and ASTER ( ASTER ) worth around $98 million combined.

The other whale, 0x9263, has about $13.2 million in profits on-chain. The whale currently holds short positions on Solana and Bitcoin, totaling to about $84 million. Meanwhile, the Bitcoin OG whale has further increased its BTC short position to $492 million with a floating profit of $9 million.

Why are whales shorting ahead of Powell’s economic outlook speech?

More often than not, market sentiment spawned by moves made by the Fed usually have a major impact on the crypto market. From Powell’s speech today, whales could be expecting caution on monetary policy, which could signal whether the agency will delay rate cuts or maintain high rates to combat inflation.

One post by Lebanese-Australian entrepreneur and podcast host Mario Nawfal warned traders of “volatility” arising after Powell’s speech on October 14. A “hawkish” tone may serve to tighten liquidity, raise borrowing costs and put increased downward pressure on alternative asset such as metals and cryptocurrency.

As concerns of a crypto market crash begin circulating around the crypto community, many have resorted to shorting positions as a way to hedge against the potential of an imminent crash. Shorting provides traders with an opportunity to still gain profit if the market turns bearish.

With heightened uncertainty surrounding the content and implications of Powell’s speech, these whales may be locking in gains to play it safe, reducing the risk of being caught on the wrong side of the market in the event of a crash.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin 2022 bear market correlation hits 98% as ETFs add $220M

Fed rate-cut bets surge: Can Bitcoin finally break $91K to go higher?

Crypto: Fundraising Explodes by +150% in One Year