Date: Tue, Oct 14, 2025 | 11:10 AM GMT

The cryptocurrency market is once again turning lower after a short-lived recovery on Monday that pushed Ethereum (ETH) to a 24-hour high of $4,292, before slipping back to $3,975, marking a 3.50% drop.

Following this pullback, several altcoins are showing mixed technical setups — one of them being Pump.fun (PUMP), which is down over 7% today, testing a key support area that could decide whether the token rebounds or falls further.

Source: Coinmarketcap

Source: Coinmarketcap

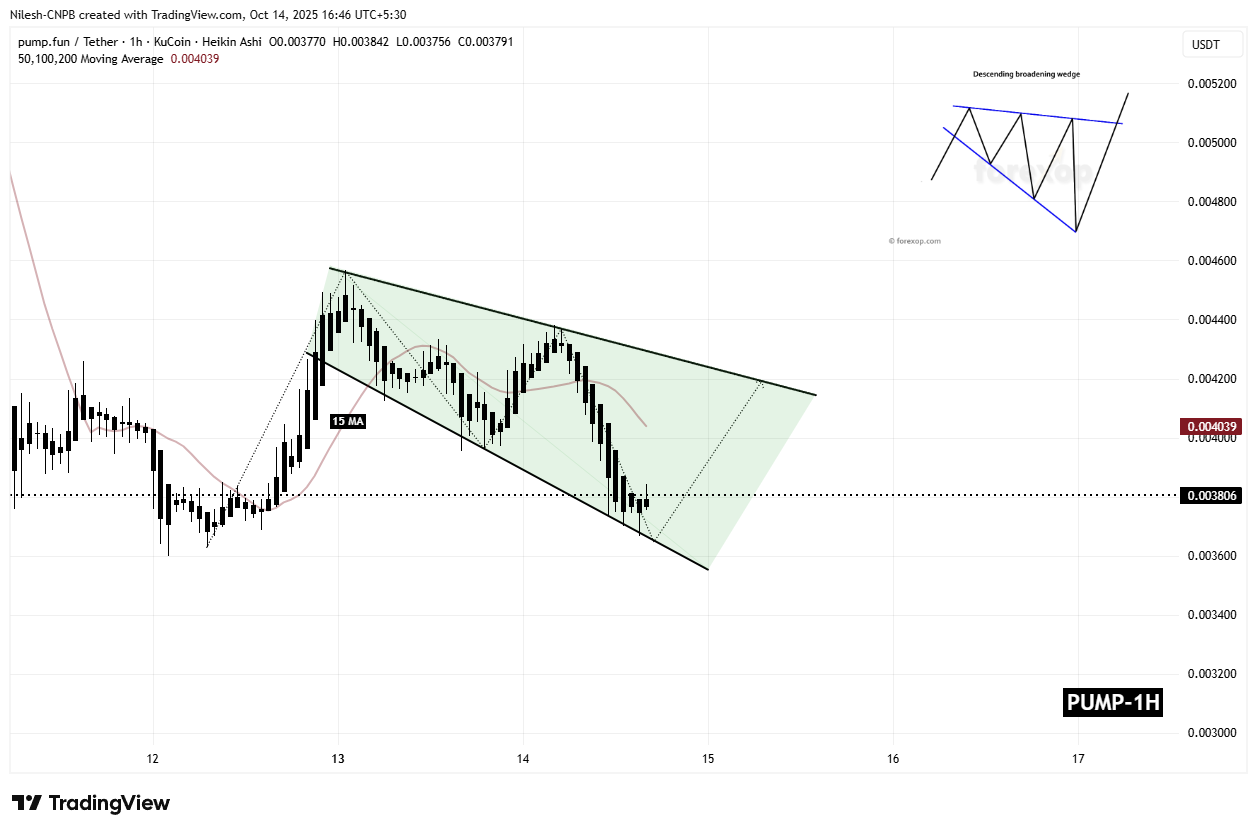

Descending Broadening Wedge in Play

On the 1-hour chart, PUMP has been consolidating within a descending broadening wedge, a bullish reversal formation that typically forms during a corrective downtrend. The pattern indicates a phase of decreasing momentum where price swings widen before a potential upside breakout.

The recent drop from the wedge’s upper resistance near $0.00483 has brought PUMP down to the lower boundary around $0.003667, where buyers appear to be stepping in. At the time of writing, PUMP trades around $0.003806, just above this support trendline.

Pump.fun (PUMP) 1H Chart/Coinsprobe (Source: Tradingview)

Pump.fun (PUMP) 1H Chart/Coinsprobe (Source: Tradingview)

This zone has acted as dynamic support multiple times in the past, making it an important level for bulls to defend if they aim to maintain the broader structure of the pattern.

What’s Next for PUMP?

If buyers can hold above the lower wedge trendline and reclaim the 15-hour moving average near $0.0040, momentum could start shifting back upward. A bounce from this level might drive PUMP toward the wedge’s upper resistance zone around $0.004195.

A breakout above this zone would confirm a bullish continuation setup, potentially setting the stage for a stronger recovery in the short term.

However, if PUMP breaks below the support trendline, it would signal a bearish breakdown, opening the door for deeper losses as sellers gain control.