AI predicts Bitcoin price for end of 2025

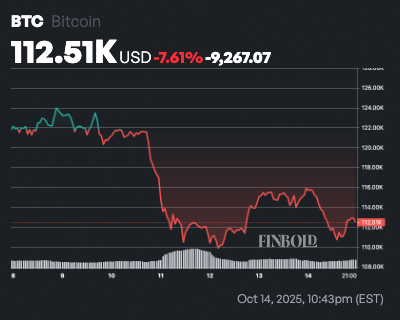

As Bitcoin (BTC) faces heightened volatility following the historic October 10 crash, an artificial intelligence tool suggests the asset could potentially reach a record high of near $200,000 by the end of 2025.

As of press time, Bitcoin was trading at $112,474, down 2.7% in the past 24 hours and over 7% for the week.

For its end-2025 outlook, Finbold turned to OpenAI’s ChatGPT, which predicts Bitcoin could trade near $195,000, supported by improving macroeconomic conditions, steady institutional inflows, and resilient on-chain activity.

The AI’s forecast is based on four key factors: monetary policy, institutional participation, blockchain health, and market sentiment.

It expects modest Federal Reserve rate cuts by late 2025 to restore liquidity and renew investor appetite for risk assets, while consistent demand from spot Bitcoin ETFs could further lift prices given the cryptocurrency’s limited supply.

On-chain data indicate a stable mid-cycle phase, reflected in strong activity from long-term holders and active wallets.

Although market sentiment remains cautious after the recent correction, ChatGPT noted that it appears to be recovering, a pattern that historically precedes new rallies once leverage resets.

Bitcoin price prediction

In coming up with the December 31 price outlook, ChatGPT’s model began with a 2024 closing price of about $95,000 and a mid-October 2025 level near $113,000.

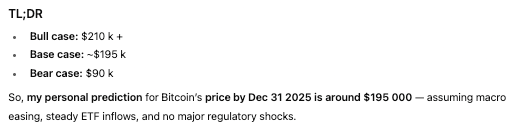

Using historical cycle data, it estimates potential gains of 60% to 110% over the following year, projecting a target range of $185,000 to $210,000 for Bitcoin by December 2025, with a base forecast of around $195,000.

The model assumes continued institutional adoption and a supportive macro environment but warns of downside risks if sentiment weakens or regulatory pressure intensifies. In a bearish scenario, Bitcoin could retreat to between $85,000 and $100,000, roughly aligning with previous cycle highs.

Overall, ChatGPT envisions Bitcoin entering 2026 at or near record levels, provided liquidity remains strong and institutional participation continues to expand.

Featured image via Shutterstock

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

An overview of two new projects in the Polkadot ecosystem and what they will bring to Polkadot Hub

HIC: Continue to bring truly valuable new projects to Polkadot in a sluggish market!

Three cases demonstrate what Revive and Polkadot Hub can achieve!

Bridging the Development Gap: How is HashKey Ushering in a New Era for Web3 in Asia?

HashKey Group, which is currently striving for a listing on the Hong Kong Stock Exchange, reveals a clear path for us through its unique business strategies and practices.