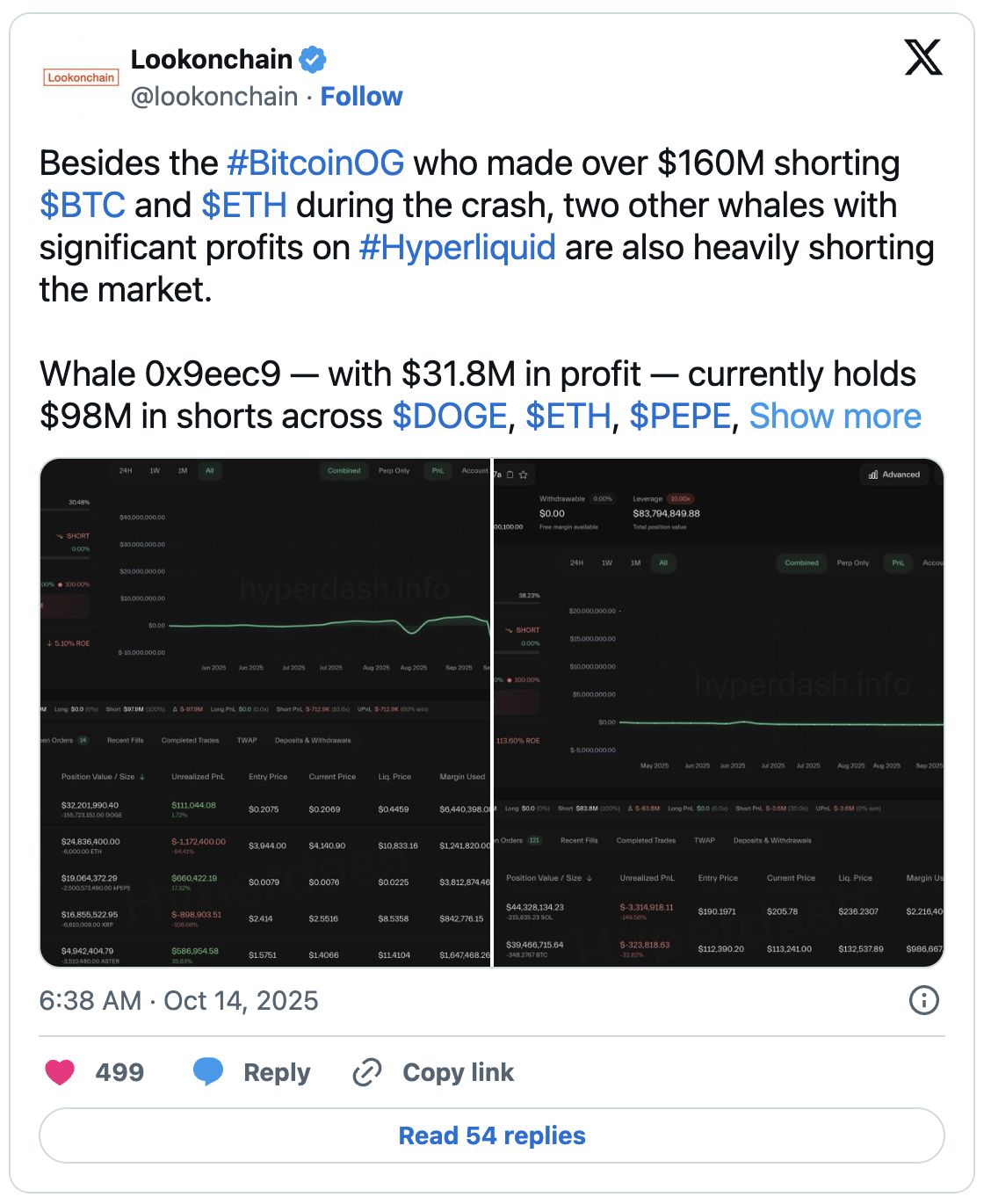

A recent report from blockchain analysis platform LookOnChain reveals a shift in strategy among prominent cryptocurrency investors, known as whales, who are adopting new short-selling approaches in altcoins other than Bitcoin $111,165 . Particularly in the realms of XRP and Ethereum (ETH) $3,951 , aggressive short positions are gaining attention. However, this trend is accompanied by heightened market volatility and macroeconomic risks, such as the speech expected from Federal Reserve Chairman Jerome Powell, which could significantly impact market balances.

Short Pressure on Altcoins: High Leverage in XRP and ETH

LookOnChain data indicates that three major crypto whales had previously grossed substantial profits during prior bear cycles. Among them, the most aggressive whale initiated a high-leverage short position on BTC and ETH over the weekend, expecting to generate an approximate $160 million in revenue with a 20x leverage. While the ETH position currently exhibits a $157,000 loss, the XRP position shows a $263,000 deficit despite only a $0.04 movement from the entry point.

In addition to targeting XRP and ETH, the same whale is reportedly applying pressure on altcoins like DOGE , PEPE, and ASTER through 3–5x leveraged positions. Meanwhile, a 20x leverage position opened on SOL has resulted in nearly a $1 million loss. This altcoin-oriented pressure strategy is heavily influenced by market uncertainty, as sentiment has quickly shifted from “greed” to “fear” over the past week, with the sentiment index dropping from 70 to 38.

Fed’s Influence: Powell’s Speech as a Market Catalyst

Market participants are now closely monitoring today’s forthcoming speech from Fed Chairman Jerome Powell. This speech is anticipated to shape expectations regarding interest rates and broader economic policies.

The sharp fluctuations seen in today’s US stock markets, such as the Dow Jones index’s decline and Nasdaq’s approximate 1.1% dip, reflect this anticipation. Such conditions suggest that liquidity in crypto markets can rapidly shift, leaving risk appetite susceptible to change.

Furthermore, comments from Philadelphia Fed President Anna Paulson have caught attention, particularly regarding the weakening labor market and potential indications of necessary interest rate cuts. This viewpoint supports investors’ cautious stances.

LookOnChain’s findings highlight the aggressive maneuvering of large players in the crypto arena, revealing the inherent risks of such strategies. Leveraged positions in liquid altcoins like XRP, ETH, and SOL can incur substantial losses with even minimal price changes. Powell’s speech could trigger sudden market direction shifts, emphasizing the need for careful risk management in these highly leveraged trades.